IoT Sensor Market

IoT Sensor Market By Type, By Network Technology, By Applications - Global Industry Share, Growth, Competitive Analysis And Forecast, 2017-2022

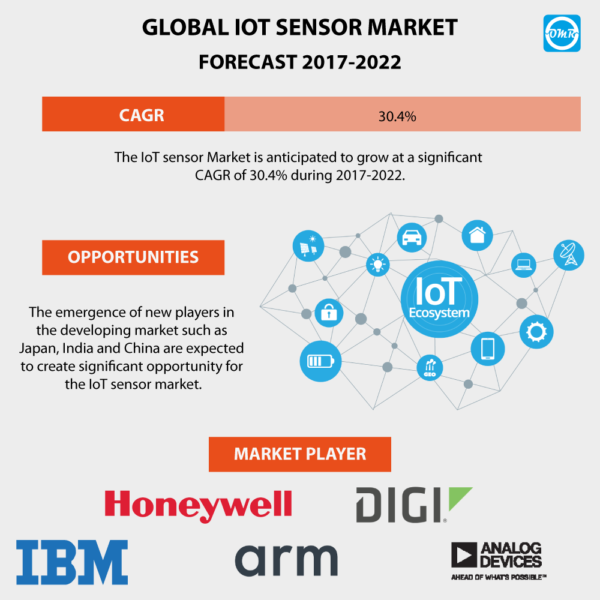

Internet of Things (IoT) is the interconnection of embedded computing like devices within the internet infrastructure. IoT is an emerging technology that is increasingly adopted across the globe. IoT related technologies like sensors, wearable, cloud, and other related platforms are much in demand. The IoT sensor market is anticipated to grow at a significant CAGR of 30.4% during 2017-2022. The major factors that are augmenting the growth of the market are the growing demand for smart devices and the wearable and development of the smarter and low prized sensor. Furthermore, rising demand for IoT sensors in various applications and miniaturization of devices are also estimated to be major factors that are fuelling the growth of the market.

IoT devices are computing devices that connect wirelessly to a network and has the ability to transmit data. These devices include thermostat, door locks, fridges, cars, pacemakers, smartphones, tablets, wearable watches and so forth. Growing demand for consumer electronics products such as smartphones, smart TV; smart home appliances are fueling the IoT sensor market. Fitbit Aria WI-Fi smart scale, Withings Smart Body analyzer, Nest Thermostat, Philip hue light bulbs, Lockitron are some IoT innovations developed in recent years to improve everyday life. All these IoT applications require IoT sensors for monitoring processes, taking measurements and collecting data. Pressure sensor, temperature sensor, humidity sensor, gyroscope, magnetometer, accelerometer and light sensors are used extensively in various applications. The market of Micro-Electro-Mechanical (MEMS) based sensors such as accelerometers, magnetometers, gyroscopes are witnessing high growth due to rising demand for smart applications such as smart city, wearables, smart grids, industrial internet and connected health in automotive, healthcare and other industrial sectors. Security and privacy issues, as well as the lack of technical skills required to expertise in IoT technology, are estimated to be the major constraints in the growth of the market.

Geography Insights

Global IoT sensor market is analyzed on the basis of the geographical regions that are contributing significantly to the growth of the market. On the basis of the geography, the market is bifurcated into North America, Europe, Asia Pacific and Rest of the World. North America held the largest share followed by Europe in the Global IoT sensor market owing to the high penetration of smart devices and the rapid adoption of new technology. The Asia Pacific is expected to be the fastest-growing region in the IoT sensors owing to the increasing demand of IoT sensors for use in smart consumer products and the medical sector. The emergence of new players in the developing market such as Japan, India, and China are expected to create significant opportunities for the IoT sensor market.

Competitive Insights

Global IoT sensor market leaders include Arm holding PLC, Analog device Inc., Broadcom limited, Digi International Inc., Ericsson, Honeywell International Inc., IBM, Infineon, InvenSense Inc. and so forth. Other notable players that account for IoT sensor market and are contributing considerably in its growth include Libelium, NXP Semiconductor N.V., Omron Corporation, Robert Bosch GMBH, Sensirion, SmartThings Inc., STMicroelectronics, TE Connectivity Ltd., Texas Instruments Incorporated, Konux Inc., Fujitsu among others. In order to survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on. For example, in 2015 NYCE Sensors, Zigbee sensor partnered with Smart things for expanding user community and rapidly the growing market for IoT. Moreover, in 2017, Bosch and IBM collaborated to bring industrial IoT capabilities to millions of devices across the globe.

Market Segmentation

Global IoT Sensor Market is segmented on the basis of type, network technology and by the application. Based on application, the global IoT sensor market is segmented into healthcare, automotive, industrial, retail and consumer electronics. Out of all these, the consumer electronics segment is dominating the market owing to rising demand for consumer electronics such as smart TV, smartphones and smart homes. Major segments of the global IoT sensor market include:

- IoT sensor market by type

- IoT sensor market by network technology

- IoT sensor market by application

The report covers

- Comprehensive research methodology of the global IoT sensor market.

- In-depth analysis of macro and micro factors influencing the market guided by key recommendations.

- Analysis of regional regulations and other government policies impacting the global IoT sensor market.

- Insights about market determinants which are stimulating the global IoT sensor market.

- Detailed and extensive market segments with regional distribution of researched revenues.

- Extensive profiles and recent developments of market players.

1. REPORT SUMMARY

1.1. RESEARCH METHODS AND TOOLS

1.2. MARKET BREAKDOWN

1.2.1. BY SEGMENTS

1.2.2. BY GEOGRAPHY

1.2.3. BY STAKEHOLDERS

2. RESEARCH METHODS AND TOOLS

2.2. MARKET BREAKDOWN

2.2.1. BY SEGMENTS

2.2.2. BY GEOGRAPHY

2.2.3. BY STAKEHOLDERS

3. MARKET OVERVIEW AND INSIGHTS

3.1. DEFINITION

3.2. ANALYST INSIGHT & CURRENT MARKET TRENDS

3.2.1. KEY FINDINGS

3.2.2. RECOMMENDATION

3.2.3. CONCLUSION

3.3. REGULATIONS

3.3.1. UNITED STATES

3.3.2. EUROPEAN UNION

3.3.3. CHINA

3.3.4. INDIA

3.3.5. REST OF THE WORLD

3.4. PATENT ANALYSIS

4. MARKET DETERMINANT

4.1. MOTIVATORS

4.1.1. GROWING DEMAND FOR SMART DEVICES AND WEARABLE

4.1.2. DEVELOPMENT OF SMARTER AND LOW PRIZED SENSORS

4.1.3. RISING DEMAND FOR IOT SENSORS IN VARIOUS APPLICATIONS

4.1.4. MINIATURIZATION OF DEVICES

4.2. RESTRAINTS

4.2.1. SECURITY AND PRIVACY ISSUES

4.2.2. LACK OF TECHNOLOGICAL SKILLS

4.3. OPPORTUNITIES

4.3.1. RISING ADOPTION OF IOT AMONG BUSINESSES

4.3.2. TECHNOLOGICAL ADVANCEMENT

5. MARKET SEGMENTATION

5.1. IOT SENSOR MARKET BY TYPE

5.1.1. PRESSURE SENSOR

5.1.2. HUMIDITY SENSOR

5.1.3. TEMPERATURE SENSOR

5.1.4. ACCELEROMETER

5.1.5. GYROSCOPE

5.1.6. MAGNETOMETER

5.1.7. LIGHT SENSOR

5.1.8. OTHER

5.2. IOT SENSOR MARKET BY NETWORK TECHNOLOGY

5.2.1. WIRED TECHNOLOGY

5.2.2. WIRELESS TECHNOLOGY

5.3. IOT SENSOR MARKET BY APPLICATIONS

5.3.1. CONSUMER ELECTRONICS

5.3.2. HEALTHCARE

5.3.3. AUTOMOTIVE

5.3.4. INDUSTRIAL

5.3.5. RETAILS

5.3.6. OTHERS

6. COMPETITIVE LANDSCAPE

6.1. KEY STRATEGIES

6.2. KEY COMPANY ANALYSIS

7. REGIONAL ANALYSIS

7.1. NORTH AMERICA

7.1.1. UNITED STATES

7.1.2. CANADA

7.1.3. REST OF NORTH AMERICA

7.2. EUROPE

7.2.1. UNITED KINGDOM

7.2.2. FRANCE

7.2.3. GERMANY

7.2.4. ITALY

7.2.5. SPAIN

7.2.6. REST OF EUROPE

7.3. ASIA PACIFIC

7.3.1. INDIA

7.3.2. CHINA

7.3.3. JAPAN

7.4. REST OF THE WORLD

8. COMPANY PROFILES

8.1. ARM HOLDINGS PLC.

8.1.1. INTRODUCTION

8.1.2. ARM HOLDING PLC. PRODUCT PORTFOLIO

8.1.3. ARM HOLDING PLC. RECENT ACTIVITIES

8.2. ANALOG DEVICES, INC.

8.2.1. INTRODUCTION

8.2.2. ANALOG DEVICES INC. PRODUCT PORTFOLIO

8.2.3. ANALOG DEVICES INC. RECENT ACTIVITIES

8.3. BROADCOM LIMITED

8.3.1. INTRODUCTION

8.3.2. BROADCOM LIMITED PRODUCT PORTFOLIO

8.3.3. BROADCOM LIMITED RECENT ACTIVITIES

8.4. DIGI INTERNATIONAL INC

8.4.1. INTRODUCTION

8.4.2. DIGI INTERNATIONAL INC PRODUCT PORTFOLIO

8.4.3. DIGI INTERNATIONAL INC RECENT ACTIVITIES

8.5. ERICSSON

8.5.1. INTRODUCTION

8.5.2. ERICSSON PRODUCT PORTFOLIO

8.5.3. ERICSSON RECENT ACTIVITIES

8.6. HONEYWELL INTERNATIONAL INC

8.6.1. INTRODUCTION

8.6.2. HONEYWELL INTERNATIONAL INC PRODUCT PORTFOLIO

8.6.3. HONEYWELL INTERNATIONAL INC. RECENT ACTIVITIES

8.7. IBM

8.7.1. INTRODUCTION

8.7.2. IBM PRODUCT PORTFOLIO

8.7.3. IBM RECENT ACTIVITIES

8.8. INFINEON TECHNOLOGIES

8.8.1. INTRODUCTION

8.8.2. INFINEON TECHNOLOGIES PRODUCT PORTFOLIO

8.8.3. INFINEONTECHNOLOGIES RECENT ACTIVITIES

8.9. INVENSENSE INC.

8.9.1. INTRODUCTION

8.9.2. INVENSENSE INC. PRODUCT PORTFOLIO

8.9.3. INVENSENSE INC. RECENT ACTIVITIES

8.10. LIBELIUM

8.10.1. INTRODUCTION

8.10.2. LIBELIUM PRODUCT PORTFOLIO

8.10.3. LIBELIUM RECENT ACTIVITIES

8.11. NXP SEMICONDUCTORS N.V

8.11.1. INTRODUCTION

8.11.2. NXP SEMICONDUCTOR N.V. PRODUCT PORTFOLIO

8.11.3. NXP SEMICONDUCTOR N.V. RECENT ACTIVITIES

8.12. OMRON CORPORATION

8.12.1. INTRODUCTION

8.12.2. OMRON CORPORATIONPRODUCT PORTFOLIO

8.12.3. OMRON CORPORATION RECENT ACTIVITIES

8.13. ROBERT BOSCH GMBH

8.13.1. INTRODUCTION

8.13.2. ROBERT BOSCH GMBH PRODUCT PORTFOLIO

8.13.3. ROBERT BOSCH GMBH RECENT ACTIVITIES

8.14. SENSIRION AG

8.14.1. INTRODUCTION

8.14.2. SENSIRION AG PRODUCT PORTFOLIO

8.14.3. SENSIRION AG RECENT ACTIVITIES

8.15. SMARTTHINGS, INC.

8.15.1. INTRODUCTION

8.15.2. SMARTTHINGS, INC. PRODUCT PORTFOLIO

8.15.3. SMARTTHINGS, INC. RECENT ACTIVITIES

8.16. STMICROELECTRONICS N.V.

8.16.1. INTRODUCTION

8.16.2. STMICROELECTRONICS N.V. PRODUCT PORTFOLIO

8.16.3. STMICROELECTRONICS N.V. RECENT ACTIVITIES

8.17. TE CONNECTIVITY LTD.

8.17.1. INTRODUCTION

8.17.2. TE CONNECTIVITY LTD. PRODUCT PORTFOLIO

8.17.3. TE CONNECTIVITY LTD. RECENT ACTIVITIES

8.18. TEXAS INSTRUMENTS INCORPORATED

8.18.1. INTRODUCTION

8.18.2. TEXAS INSTRUMENTS INCORPORATED PRODUCT PORTFOLIO

8.18.3. TEXAS INSTRUMENTS INCORPORATED RECENT ACTIVITIES

8.19. KONUX INC.

8.19.1. INTRODUCTION

8.19.2. KONUX INC. PRODUCT PORTFOLIO

8.19.3. KONUX INC. RECENT ACTIVITIES

8.20. FUJITSU

8.20.1. INTRODUCTION

8.20.2. FUJITSU PRODUCT PORTFOLIO

8.20.3. FUJITSU RECENT ACTIVITIES

TABLE # 1 GLOBAL IOT SENSOR MARKET RESEARCH AND ANALYSIS BY TYPE, 2015-2022 ($ MILLION)

TABLE # 2 GLOBAL PRESSURE SENSOR MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 3 GLOBAL HUMIDITY SENSOR MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 4 GLOBAL TEMPERATURE SENSOR MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 5 GLOBAL ACCELEROMETER MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 6 GLOBAL GYROSCOPE MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 7 GLOBAL MAGNETOMETER MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 8 GLOBAL LIGHT SENSOR MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 9 GLOBAL OTHER MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 10 GLOBAL IOT SENSOR MARKET RESEARCH AND ANALYSIS BY NETWORK TECHNOLOGY, 2015-2022 ($ MILLION)

TABLE # 11 GLOBAL WIRED TECHNOLOGY MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 12 GLOBAL WIRELESS TECHNOLOGY MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 13 GLOBAL IOT SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATIONS, 2015-2022 ($ MILLION)

TABLE # 14 GLOBAL CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 15 GLOBAL HEALTHCARE MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 16 GLOBAL AUTOMOTIVE MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 17 GLOBAL INDUSTRIAL MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 18 GLOBAL RETAILS MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 19 GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

TABLE # 20 ARM HOLDING PLC. PRODUCT PORTFOLIO

TABLE # 21 ARM HOLDING PLC. RECENT ACTIVITIES

TABLE # 22 ANALOG DEVICES INC. PRODUCT PORTFOLIO

TABLE # 23 ANALOG DEVICES INC. RECENT ACTIVITIES

TABLE # 24 BROADCOM LIMITED PRODUCT PORTFOLIO

TABLE # 25 BROADCOM LIMITED RECENT ACTIVITIES

TABLE # 26 DIGI INTERNATIONAL INC PRODUCT PORTFOLIO

TABLE # 27 DIGI INTERNATIONAL INC RECENT ACTIVITIES

TABLE # 28 ERICSSON PRODUCT PORTFOLIO

TABLE # 29 ERICSSON RECENT ACTIVITIES

TABLE # 30 HONEYWELL INTERNATIONAL INC PRODUCT PORTFOLIO

TABLE # 31 HONEYWELL INTERNATIONAL INC. RECENT ACTIVITIES

TABLE # 32 IBM PRODUCT PORTFOLIO

TABLE # 33 IBM RECENT ACTIVITIES

TABLE # 34 INFINEON TECHNOLOGIES PRODUCT PORTFOLIO

TABLE # 35 INFINEONTECHNOLOGIES RECENT ACTIVITIES

TABLE # 36 INVENSENSE INC. PRODUCT PORTFOLIO

TABLE # 37 INVENSENSE INC. RECENT ACTIVITIES

TABLE # 38 LIBELIUM PRODUCT PORTFOLIO

TABLE # 39 LIBELIUM RECENT ACTIVITIES

TABLE # 40 NXP SEMICONDUCTOR N.V. PRODUCT PORTFOLIO

TABLE # 41 NXP SEMICONDUCTOR N.V. RECENT ACTIVITIES

TABLE # 42 OMRON CORPORATIONPRODUCT PORTFOLIO

TABLE # 43 OMRON CORPORATION RECENT ACTIVITIES

TABLE # 44 ROBERT BOSCH GMBH PRODUCT PORTFOLIO

TABLE # 45 ROBERT BOSCH GMBH RECENT ACTIVITIES

TABLE # 46 SENSIRION AG PRODUCT PORTFOLIO

TABLE # 47 SENSIRION AG RECENT ACTIVITIES

TABLE # 48 SMARTTHINGS, INC. PRODUCT PORTFOLIO

TABLE # 49 SMARTTHINGS, INC. RECENT ACTIVITIES

TABLE # 50 STMICROELECTRONICS N.V. PRODUCT PORTFOLIO

TABLE # 51 STMICROELECTRONICS N.V. RECENT ACTIVITIES

TABLE # 52 TE CONNECTIVITY LTD. PRODUCT PORTFOLIO

TABLE # 53 TE CONNECTIVITY LTD. RECENT ACTIVITIES

TABLE # 54 TEXAS INSTRUMENTS INCORPORATED PRODUCT PORTFOLIO

TABLE # 55 TEXAS INSTRUMENTS INCORPORATED RECENT ACTIVITIES

TABLE # 56 KONUX INC. PRODUCT PORTFOLIO

TABLE # 57 KONUX INC. RECENT ACTIVITIES

TABLE # 58 FUJITSU PRODUCT PORTFOLIO

TABLE # 59 FUJITSU RECENT ACTIVITIES

FIGURE # 1 NORTH AMERICA MARKET RESEARCH AND ANALYSIS, 2015-2022 ($ MILLION)

FIGURE # 2 US MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 3 CANADA MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 4 EUROPEAN MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 5 UK MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 6 FRANCE MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 7 GERMANY MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 8 ITALY MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 9 SPAIN MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 10 ROE MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 11 ASIA PACIFIC MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 12 INDIA MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 13 CHINA MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 14 JAPAN MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 15 ROPAC MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)

FIGURE # 16 REST OF THE WORLD MARKET RESEARCH AND ANALYSIS, 2015-2022($ MILLION)