1,4 Butanediol Market (BDO) Market

Global 1,4 Butanediol (BDO) Market Size, Share & Trends Analysis Report, by Technology (Butadiene Process, Davy Process, Propylene Oxide Process, and Reppe Process), by Application (Gamma-Butyrolactone, Poly Butylenes Terephthalate (PBT), Polyurethane, and Tetrahydrofuran)and by End-Users (Automotive Industry, Electrical And Electronics, Chemical Industry, Footwear Industry, and Sports Industry) Forecast Period (2022-2028)

The global 1,4 Butanediol (BDO) market is anticipated to grow at a significant CAGR of 3.9% during the forecast period. 1, 4 butanediolsare widely used in the production of (Poly Butylenes Terephthalate)PBT, which is further used in the manufacturing of automotive components. In the automotive segment, PBT allows for weight reduction, energy absorption, shock absorption for bumpers, restriction of explosion risk in fuel tanks, airbags, seat belts, door and seat assemblies, subsystems, bumpers, and exterior trim, under-bonnet components, and various other applications. Polyurethane foams can be found in the armrests, seats, and headrests of most cars, where their cushioning properties help in reducing the stress andfatigue often associated with driving. In addition, Spandex fabric derived from THF is used to manufacture door panel fabrics that adhere andstretch to the door and in the car’s seat material.Since polyurethanes are light and strong, the overall weight of cars is declined, resulting in better fuel efficiency and improved environmental performance. As per the OICA data, the global automotive production in 2021 increased by 3.0% as compared to that of 2020. The total worldwide production of automobiles reached 80,145,988 units in 2021.

Impact of COVID-19 Pandemic on Global 1,4 Butanediol (BDO) Market

In 2020, most industries suffered due to the COVID-19 pandemic. It impacted most of the companies negatively owing to the national lockdowns across the globe which stopped the transportation of humans and things. However, some of the segments such as healthcare were not impacted much but the automotive industry suffered extensively. As per the data of OICA 2020, automotive production decreased by 16.0% which had impacted the demand for the BDO. However, as the situation normalized market has shown positive growth in the production of vehicles in 2021, as per OICA.

Segmental Outlook

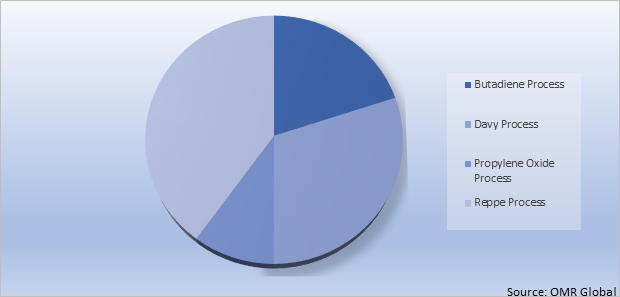

The global 1,4 Butanediol (BDO) market is segmented based on the technology, application, and end-users. Based on the technology, the market is segmented into the butadiene process, davy process, propylene oxide process, and Reppe process. Based on the application, the market is segmented into Gamma-Butyrolactone, Poly Butylenes Terephthalate (PBT), Polyurethane, and Tetrahydrofuran.Based on the end-users, the market is sub-segmented into the automotive industry, electrical, and electronics, chemical industry, footwear industry, and sports industry. The above-mentioned segments can be customized as per the requirements. Based on technology, the Reppe process is anticipating a significant hold on the market shares whilepolyurethane and electrical, and electronic are projected to show significant growth during the forecast period in the application, and end-users segments, respectively.

Global 1,4 Butanediol (BDO) Market Share by Technology, 2021 (%)

The Reppe Process Segment Projected to Hold Significant Share in the Global 1,4 Butanediol (BDO) Market

Based on technology, the Reppe process is anticipated to hold a substantial share during the forecast period. One of the core factors that is driving the segment is its use of convenient methods to produce BDO. It is considered more economical than others, which reflects a high production rate with low cost as compared to others such as the davy process, and butadiene process. Among these methods, only the Reppe process has reached rapid development in China, far exceeding the capacity of other petrochemical feedstock methods, cause China has rich mineral resources (e.g., calcium carbide and coal) where cheaper feedstock is available for the manufacturing of BDO. There are three key steps in the production of BDO by the Reppe method (alkynylation of formaldehyde, methanol oxidation, and acetylene, and hydrogenation of 1, 4-butanediol). In recent years, Chinese enterprises have continuously optimized and explored these technologies presented from abroad and made some development in process, catalyst, equipment, environmental protection, and other related application technologies, which has promoted the technological progress of the industry

Regional Outlooks

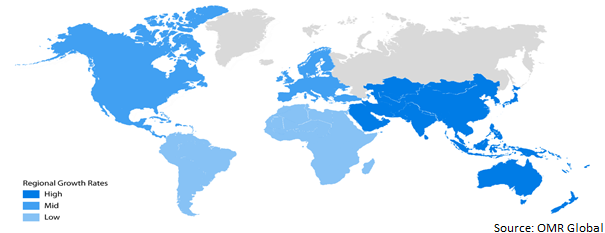

The global 1,4 Butanediol (BDO) market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Asia Pacific is anticipating holding the prominent share in the market followed by Europe, and then North America.

Global 1,4 Butanediol (BDO) Market Growth, by Region 2022-2028

The Asia-Pacific Region Estimated to Hold the Prominent Share in the Global 1,4 Butanediol (BDO) Market

Asia-Pacific region is anticipated to hold the major share in the market during the forecast period owing to the growing industries such as electronics, leather, and electronics, amongst others with rising demand for BDO. With the economical growth of emerging countries such as China, India, Japan, and others the industries are also growing exponentially in the region which requires BDO such as the automotive industry. China is the largest automotive producer across the globe and is also leading in electric vehicles. Other than EVs, electronic products such as OLED TVs, smartphones, cables, tablets, wires,earphones, etc., have the highest growth in the electronics sector. With the rise in disposable income of the middle-class population and fueling demand for electronic products has been increased in the region. As per JEITA data in Jan 2022 the total number of imports of consumer electronics amounted to $550 million.

Market Players Outlook

The major companies serving the global 1,4 Butanediol (BDO) market include Basf S.E., Dairen Chemicals Corp., Nan Ya Plastic Corp., Sinopec Yizheng Chemical Fibre Limited Liability Co., Xinjiang Tianye (Group) Co., Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, In June 2021, HELM and Cargill decided to build a bio-based intermediate manufacturing facility at Cargill’s existing biotechnology campus and corn refining operation in Eddyville, Iowa. The plant will be finalized and start operating in 2024 to meet the demanding specification of product supply-chains.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global 1,4 butanediol (BDO) market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global 1,4 Butanediol (BDO) Market

• Recovery Scenario of Global 1,4 Butanediol (BDO) Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Basf S.E.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Dairen Chemicals Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Nan Ya Plastic Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Sinopec Yizheng Chemical Fibre Limited Liability Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Xinjiang Tianye (Group) Co., Ltd.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global 1,4 Butanediol (BDO) Market by Technology

4.1.1. Butadiene Process

4.1.2. Davy Process

4.1.3. Propylene Oxide Process

4.1.4. Reppe Process

4.2. Global 1,4 Butanediol (BDO) Market by Application

4.2.1. Gamma-Butyrolactone

4.2.2. Poly Butylenes Terephthalate (PBT)

4.2.3. Polyurethane

4.2.4. Tetrahydrofuran

4.3. Global 1,4 Butanediol (BDO) Market by End-Users

4.3.1. Automotive Industry

4.3.2. Electrical And Electronics

4.3.3. Chemical Industry

4.3.4. Footwear Industry

4.3.5. Sports Industry

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Ashland Inc

6.2. Bioamber Inc.

6.3. Chemtura Corporation

6.4. Chongqing Jian Feng Chemical Industry Co. Ltd.

6.5. Dow Chemicals

6.6. Exxon Mobi Chemicals

6.7. Genomatica Inc.

6.8. International Speciality Products

6.9. Invista

6.10. Lyondellbasell Industries

6.11. Metabolix

6.12. Mitsubishi Chemical Corporation

6.13. Mitsui & Co. Ltd.

6.14. Saudi International Petrochemical Company

6.15. Shanxi Sanwei Group Co. Ltd.

6.16. Shell Chemicals

6.17. Sk Global Co. Ltd

1. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

2. GLOBALBUTADIENE PROCESS IN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL DAVY PROCESS IN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL PROPYLENE OXIDE PROCESS IN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL REPPE PROCESS IN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

7. GLOBAL 1,4 BUTANEDIOL (BDO) FOR GAMMA-BUTYROLACTONE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL 1,4 BUTANEDIOL (BDO) FOR POLY BUTYLENES TEREPHTHALATE (PBT) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL 1,4 BUTANEDIOL (BDO) FOR POLYURETHANE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL 1,4 BUTANEDIOL (BDO) FOR TETRAHYDROFURAN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

12. GLOBAL 1,4 BUTANEDIOL (BDO) IN AUTOMOTIVE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL 1,4 BUTANEDIOL (BDO) IN ELECTRICAL AND ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL 1,4 BUTANEDIOL (BDO) IN CHEMICAL INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL 1,4 BUTANEDIOL (BDO) IN FOOTWEAR INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL 1,4 BUTANEDIOL (BDO) IN SPORTS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

18. NORTH AMERICAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

20. NORTH AMERICAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

21. NORTH AMERICAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

22. EUROPEAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. EUROPEAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

24. EUROPEAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

25. EUROPEAN 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

30. REST OF THE WORLD 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. REST OF THE WORLD 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

32. REST OF THE WORLD 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

33. REST OF THE WORLD 1,4 BUTANEDIOL (BDO) MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL 1,4 BUTANEDIOL (BDO) MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL 1,4 BUTANEDIOL (BDO) MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL 1,4 BUTANEDIOL (BDO) MARKET, 2022-2028 (%)

4. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

5. GLOBAL BUTADIENE PROCESS IN 1,4 BUTANEDIOL (BDO)MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL DAVY PROCESS IN 1,4 BUTANEDIOL (BDO)MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL PROPYLENE OXIDE PROCESS IN 1,4 BUTANEDIOL (BDO) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL REPPE PROCESS IN 1,4 BUTANEDIOL (BDO) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

10. GLOBAL 1,4 BUTANEDIOL (BDO) FOR GAMMA-BUTYROLACTONE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL 1,4 BUTANEDIOL (BDO) FOR POLY BUTYLENES TEREPHTHALATE (PBT) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL 1,4 BUTANEDIOL (BDO) FOR POLYURETHANE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL 1,4 BUTANEDIOL (BDO) FOR TETRAHYDROFURAN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET SHARE BY END-USERS, 2021 VS 2028 (%)

15. GLOBAL 1,4 BUTANEDIOL (BDO) IN AUTOMOTIVE INDUSTRYMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL 1,4 BUTANEDIOL (BDO) IN ELECTRICAL AND ELECTRONICS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL 1,4 BUTANEDIOL (BDO) IN CHEMICAL INDUSTRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL 1,4 BUTANEDIOL (BDO) IN FOOTWEAR INDUSTRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. GLOBAL 1,4 BUTANEDIOL (BDO) IN SPORTS INDUSTRY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. GLOBAL 1,4 BUTANEDIOL (BDO) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. US 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

22. CANADA 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

23. UK 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

24. FRANCE 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

25. GERMANY 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

26. ITALY 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

27. SPAIN 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF EUROPE 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

29. INDIA 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

30. CHINA 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

31. JAPAN 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

32. SOUTH KOREA 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

33. REST OF ASIA-PACIFIC 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)

34. REST OF THE WORLD 1,4 BUTANEDIOL (BDO) MARKET SIZE, 2021-2028 ($ MILLION)