Blood Screening Market

Global Blood Screening Market Size, Share & Trends Analysis Report by Screening Technology (Nucleic Acid Amplification Test, Western Blotting, Enzyme-Linked Immunosorbent Assay, and PCR-RNA), By Products (Testing Instruments, and Reagents & Kits), By End-users (Blood Banks, Hospitals, and Laboratories) Forecast, 2021-2027

The global blood screening market is anticipated to grow at a CAGR of 6.9% during the forecast period. Blood screening is the process of testing blood units to ensure the safety of collected blood. The donated blood is required to be screened to check the presence of various biomarkers, infections in the blood units. The increasing prevalence of infectious diseases, as well as the need for safe blood units, is propelling the blood screening market forward. The rapid introduction of new screening technologies such as nucleic acid amplification tests, as well as increased knowledge about blood donations, are driving the market forward.

Various organizations and governments are launching campaigns to raise awareness regarding blood donation and screening before transfusion. According to the World Health Organization, nearly 108 million blood donations are received across the globe each year. About 50% of these blood donations are collected from high-income countries which is home to less than 20% of the total population. Complex legislation and high initial set-up costs for blood banks and screening tests are the main hindering factors, although advances in new screening processes such as microbiology screening, as well as increased government spending on healthcare, will open up more development opportunities.

Impact of COVID-19 Pandemic on Global Blood Screening Market

The global blood screening market is hit by the outbreak of COVID-19 since December 2019 as the emergence of healthcare was announced by WHO. Blood donations and collections were greatly decreased at the peak of the COVID-19 pandemic due to the lockdowns and limitations imposed. In several nations, it resulted in a reduction in blood and blood components, as well as a negative impact on blood system activities. The American Red Cross has now started checking all blood, platelet, and plasma donations for COVID-19 antibodies, which will tell the donor whether they've been exposed to the coronavirus. Many companies quickly developed many serological tests to detect COVID-19 antibodies as a result of the pandemic outbreak. Also, the US FDA has approved many antibody tests to detect the virus in the blood. Thus, the market will witness “V” shape recovery in near future owing to the restart of key industries in major economies.

Segmental Outlook

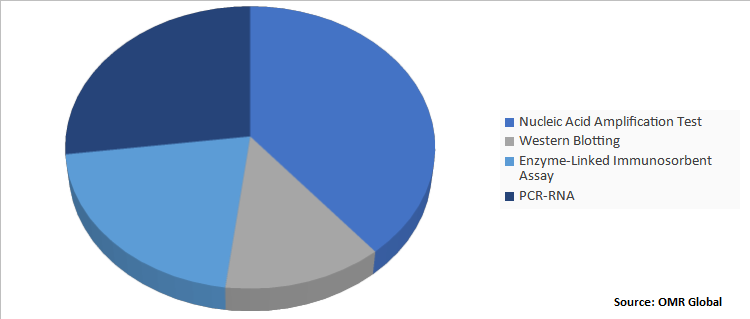

The global blood screening market is segmented based on screening technology, products, and end-users. Based on the screening technology, the market is classified into nucleic acid amplification test (NAT), western blotting, enzyme-linked immunosorbent assay, and PCR-RNA. Among screening technologies, the NAT is projected to grow at a significant CAGR due to its sensitivity to viral nucleic acid. Based on the products, the market is bifurcated into testing instruments, and reagents. Among products, reagents dominated the market due to higher accuracy and specialty in detecting the presence and type of many elements in a small sample. Apart from it, based on the end-users, the market is segmented into blood banks, hospitals, and laboratories.

Global Blood Screening Market Share by Screening Technology, 2020 (%)

Nucleic Acid Amplification Test Segment holds the significant share in the Global Blood Screening Market

Among the screening technologies for the blood screening market, the nucleic acid amplification test segment held the highest share in 2020 and is also anticipated to grow considerably during the forecast period. Tests for transcription-mediated amplification (TMA) and polymerase chain reaction (PCR) are included in NAT. The market is booming due to the rising introduction of NAT (Nucleic Acid Testing) with a positive effect on adopting cutting-edge innovations in transfusion services around the world. Apart from it, the growing number of blood donors and the adoption of NAT technology due to it is more responsive than other blood screening technologies are also fueling the growth of the market.

Regional Outlooks

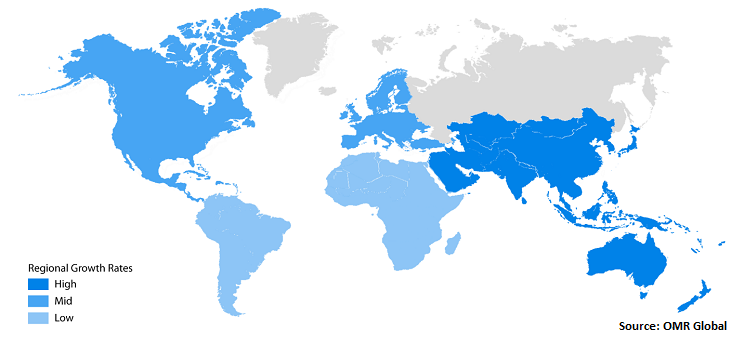

The global blood screening market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). North American region dominates the global blood screening market due to the rising prevalence of infectious diseases, and advanced healthcare technologies. The extended support of government and rapid adoption of advanced screening test such as nucleic acid amplification test is also propelling the market in the region.

Global Blood Screening Market Growth, by Region 2021-2027

Asia-Pacific is projected to have a considerable growth in the global Blood Screening market

Asia-Pacific is anticipated to have a considerable market growth in the global blood screening market during the forecast period. China and India are projected to contribute significantly in the growth of the market owing to the rising healthcare infrastructure coupled with growing healthcare expenditure. The rapid development of healthcare infrastructure and awareness about blood donations are the factors that are driving the growth of the market during the forecast period. Also, the increasing investment by the market players, government initiatives, and rising awareness about transmission of diseases during its transfusion are driving the growth in the region.

Market Players Outlook

The key players of the global blood screening market include Abbott Laboratories, Becton Dickinson and Co., BioAim Scientific Inc, Bio-Rad Laboratories, Inc, Danaher Corp., Demeditec Diagnostics GmbH, F. Hoffmann-La Roche Ltd., Grifols S.A., Siemens Healthcare GmbH, Immuno-Biological Laboratories, Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2018, Ortho-Clinical Diagnostics, Inc. (OCD), a Johnson & Johnson company, has announced that it has acquired and Micro Typing Systems, Inc. (MTS), a manufacturer of blood banks serology tests for the North American market. This acquisition was done for the expansion of its geographical presence with the usage of the advanced technology of MTS.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blood screening market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Blood Screening Industry

• Recovery Scenario of Global Blood Screening Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Blood Screening Market by Screening Technology

5.1.1. Nucleic Acid Amplification Test

5.1.2. Western Blotting

5.1.3. Enzyme-Linked Immunosorbent Assay

5.1.4. PCR-RNA

5.2. Global Blood Screening Market by Products

5.2.1. Testing Instruments

5.2.2. Reagents& Kits

5.3. Global Blood Screening Market by End-Users

5.3.1. Blood Banks

5.3.2. Hospitals

5.3.3. Laboratories

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Becton, Dickinson and Co.

7.3. BioAim Scientific Inc.

7.4. bioMérieux, Inc.

7.5. Bio-Rad Laboratories, Inc.

7.6. BioVision Inc.

7.7. Boster Biological Technology

7.8. Cosmo Bio Co., Ltd.

7.9. Cusabio Technology LLC

7.10. Danaher Corp.

7.11. Demeditec Diagnostics GmbH

7.12. F. Hoffmann-La Roche Ltd.

7.13. Grifols, S.A.

7.14. Immuno-Biological Laboratories, Inc.

7.15. Innovative Research, Inc.

7.16. OriGene Technologies Inc.

7.17. Ortho-Clinical Diagnostics, Inc. (OCD)

7.18. RayBiotech, Inc.

7.19. Siemens Healthcare GmbH

7.20. Thermo Fisher Scientific Inc.

1. GLOBAL BLOOD SCREENING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TECHNOLOGY, 2020-2027 ($ MILLION)

3. GLOBAL NUCLEIC ACID AMPLIFICATION TEST IN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL WESTERN BLOTTING IN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL ENZYME-LINKED IMMUNOSORBENT ASSAY IN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL PCR-RNA IN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

8. GLOBAL TESTING INSTRUMENTS FOR BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL REAGENTS& KITS FOR BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

11. GLOBAL BLOOD SCREENING IN BLOOD BANKS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL BLOOD SCREENING IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL BLOOD SCREENING IN LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. NORTH AMERICAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TECHNOLOGY, 2020-2027 ($ MILLION)

16. NORTH AMERICAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

17. NORTH AMERICAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

18. EUROPEAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. EUROPEAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TECHNOLOGY, 2020-2027 ($ MILLION)

20. EUROPEAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

21. EUROPEAN BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TECHNOLOGY, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

26. REST OF THE WORLD BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. REST OF THE WORLD BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY SCREENING TECHNOLOGY, 2020-2027 ($ MILLION)

28. REST OF THE WORLD BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

29. REST OF THE WORLD BLOOD SCREENING MARKET RESEARCH AND ANALYSIS BY END-USERS, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL BLOOD SCREENING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL BLOOD SCREENING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL BLOOD SCREENING MARKET, 2021-2027 (%)

4. GLOBAL BLOOD SCREENING MARKET SHARE BY SCREENING TECHNOLOGY, 2020 VS 2027 (%)

5. GLOBAL BLOOD SCREENING MARKET SHARE BY PRODUCTS, 2020 VS 2027 (%)

6. GLOBAL BLOOD SCREENING MARKET SHARE BY END-USERS, 2020 VS 2027 (%)

7. GLOBAL BLOOD SCREENING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL NUCLEIC ACID AMPLIFICATION TEST IN BLOOD SCREENING MARKET SHARE BY REGION, 2020 VS 2027(%)

9. GLOBAL WESTERN BLOTTING IN BLOOD SCREENING MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL ENZYME-LINKED IMMUNOSORBENT ASSAY IN BLOOD SCREENING MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL PCR-RNA IN BLOOD SCREENING MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL TESTING INSTRUMENTS FOR BLOOD SCREENING MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL REAGENTS& KITS FOR BLOOD SCREENING MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL BLOOD SCREENING IN BLOOD BANKS MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL BLOOD SCREENING IN HOSPITALS MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL BLOOD SCREENING IN LABORATORIES MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. US BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

18. CANADA BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

19. UK BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

20. FRANCE BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

21. GERMANY BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

22. ITALY BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

23. SPAIN BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF EUROPE BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

25. INDIA BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

26. CHINA BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

27. JAPAN BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

28. SOUTH KOREA BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF ASIA-PACIFIC BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)

30. REST OF THE WORLD BLOOD SCREENING MARKET SIZE, 2020-2027 ($ MILLION)