BRICS e-commerce Retail Market

BRICS e-commerce Retail Market Size, Share & Trends Analysis Report By End-User (B2C, B2B, C2C) By Products (Electronics, Fashion, Automobile, Healthcare, and Others) By Device Used (Smartphone, Tablets, and Personal Computer) Forecast, 2021-2027 Update Available - Forecast 2024-2030

BRICS e-commerce retail market is projected to have a considerable CAGR of around 13.5% during the forecast period. The e-commerce retail market in the BRICS region has been positively influenced by a variety of pivotal factors such as increasing smartphone and internet users, improving transport connectivity, and the availability of an inexpensive workforce. The increasing number of smartphone and internet users in the countries such as India, China, Brazil, and Russia created ample opportunities for the e-commerce retail market. Further, China, India, and the South African countries have the economic workforce and funding initiatives that have led to a rise in start-up businesses adopting e-commerce platforms. For instance, in February 2021, B2B sourcing and procurement platform GlobalFair has raised $2.0 million in a seed funding round led by Saama Capital and India Quotient. Moreover, the e-commerce retail market in China is propelling at a much faster rate than Japan and is expected to overtake Japan’s e-commerce retail market in the near future. South Korea’s annual average spent per online shopper was accounted for $1,364 and has an e-commerce sales share of 84% of GDP.

However, high costs for reverse logistics, lack of adequate data, logistics infrastructure, trust, regulations, cross-border customs clearance, and talent are still major concerns for the market growth. The cost incurred when the customer returns and replaces the product increases the expenditure of the company. The increasing number of returns and replacement of goods can create a major problem for any e-commerce company. China has the largest share of the e-commerce retail market among all the countries in the world followed by India. Improved infrastructure, cohesive government policies, and a growing e-commerce market boost the growth of the e-commerce retail market. The growing trend of online launching of products and exclusive sales creates scope for the e-commerce retail market.

COVID-19 Impact on BRICS e-commerce Retail Market

BRICS e-commerce retail market is positively impacted by the COVID-19 pandemic. According to the 2020 eEbit Web shoppers report, eCommerce in Brazil grew by 16% in 2019 compared to 2018, closing the year with revenue of $15.7 billion. Growth was mainly driven by the number of orders in the following categories: electronics, home & decoration, computing, and fast-moving consumer goods during the lockdown. It has been witnessed that during the first week of March of 2020, the online sales of health-related products and sanitizers have increased, due to which overall sales revenue has been grown.

Segmental Outlook

BRICS e-commerce retail market is segmented based on end-user, products, and device used. Based on end-user, the market is segmented into business-to-consumer, business-to-business, and customer-to-customer. Based on products, the BRICS e-commerce market is categorized into electronics, fashion, healthcare, automobile, beauty & personal care, and others. Whereas, based on the device used, the market is classified into smartphones, tablets, and personal computers. The smartphone segment is expected to be the fastest-growing during the forecast period. The rising prevalence of smartphone users is the factor driving the growth of the market as they are the major end-users who use e-commerce websites for shopping. According to the World Economic Forum, Internet adoption has steadily increased over the year it’s more than doubled since 2010. Additionally, between 2019 and 2020, the number of internet users in the country grew by 128 million (+23%).

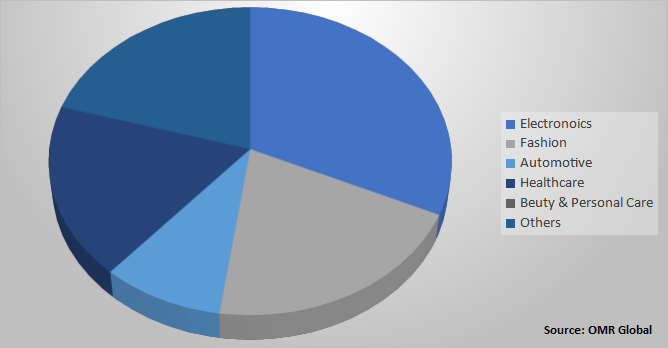

BRICS E-Commerce Retail Market Share by Products, 2020 (%)

Electronic Segment is Projected to Hold the Largest Market Share in BRICS e-commerce Retail Market

Based on products, the electronic sub-segment dominated the market in 2020, and it is projected to hold the largest market share in BRICS e-commerce retail market during the forecast period. Electronic products delivered through e-commencers retail consist of electronic goods, that include mobile phones, laptops, home audio systems, navigation products, audio products, smartwatches, and many more. The rising penetration of smartphones and the internet is the major factor driving the growth of the segment. The growing demand for quality consumer electronics products at a lower rate is enticing more business buyers in BRICS countries to shift to e-commerce retail, owing to their product sourcing needs. This led to the growth of more electronics products in the region, which further drive the segmental growth.

Regional Outlook

BRICS e-commerce Retail market is classified into regions include Brazil, Russia, India, China, and South Korea. The e-commerce retail market in China is growing at a faster rate. Electronic globalization and digital connectivity within traditional companies is the significant factor driving the growth of the e-commerce retail in China. Alibaba, one of the key players in the B2B market in China is considered as an important platform for searching various types of products, and company in B2B sales as Alibaba has around 7 million suppliers registered on it. Additionally, supply chain financing also plays an important role in the B2B e-commerce market. Moreover, the e-commerce retail market in India is also projected to grow at a rapid pace owing to the increasing smartphone users, and the high presence of SMEs in India is the prominent factor boosting the market growth. In Brazil, cross-border e-commerce is the biggest motivator of market growth. According to the 2019 eEbit Web shoppers report, eCommerce in Brazil grew by 12% in 2018 with a revenue generation of $15 billion. In Russia, the e-Commerce market has been steadily growing and doubled in size for the past four years according to the International Trade Administration.

Market Players Outlook

The key players in the BRICS e-commerce Retail market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are Flipkart Pvt. Ltd., Amazon.Com, Inc., Alibaba Group Holding Ltd., Alphabet Inc., JD.com Inc., Homeshop18, among others. These market players adopt different marketing strategies such as mergers & acquisitions, R&D, product launches, and geographical expansions to generated more revenue and to remain competitive in the market. For instance, in June 2020, Amazon and Goldman Sachs announced a partnership to provide lines of credit up to $1.0 million to merchants selling on the Amazon platform. The credit lines vary from an annual interest rate in the range of 6.99% to 20.99%. Moreover, in April 2020, Flipkart announced new insurance protection and incentive policy for supply chain partners, including grocery shops and freelance delivery executives, to safeguard them against the impact of COVID-19.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the BRICS e-commerce Retail market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the BRICS E-Commerce Retail Industry

• Recovery Scenario of BRICS E-Commerce Retail Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. BRICS E-Commerce Retail Market, By End-User

5.1.1. Business to Consumer (B2C)

5.1.2. Business to Business (B2B)

5.1.3. Customer to Customer (C2C)

5.2. BRICS E-Commerce Retail Market, By Products

5.2.1. Electronics

5.2.2. Fashion

5.2.3. Healthcare

5.2.4. Automobile

5.2.5. Beauty and Personal Care

5.2.6. Others

5.3. BRICS e-commerce Retail Market, By Device Used

5.3.1. Smartphone

5.3.2. Tablets

5.3.3. Personal Computer

6. Regional Analysis

6.1. BRICS

6.1.1. Brazil

6.1.2. Russia

6.1.3. India

6.1.4. China

6.1.5. South Africa

7. Company Profiles

7.1. Flipkart Pvt. Ltd

7.2. Amazon.Com, Inc.

7.3. Jasper Infotech Pvt Ltd (Snapdeal)

7.4. eBay Inc.

7.5. Clues Network Pvt. Ltd.

7.6. HomeShop18

7.7. Tencent Holdings Ltd

7.8. Alibaba Group Holding Ltd.

7.9. Alphabet Inc.

7.10. JD.Com Inc.

7.11. citilink.ru

7.12. LAMODA

7.13. FedEx Corp.

7.14. DHL International GmbH

7.15. Zando

7.16. Takealot Online (Pty) Ltd.

7.17. Konga.com

7.18. Cnova N.V.

7.19. Walmart Inc.

7.20. Vipshop Holdings Ltd.

7.21. Mercado Libre, Inc

1. BRICS E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. BRICS E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

3. BRICS E-COMMERCE RETAIL BUSINESS TO CUSTOMER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. BRICS E-COMMERCE RETAIL BUSINESS TO BUSINESS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. BRICS E-COMMERCE RETAIL CUSTOMER TO CUSTOMER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. BRICS E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2020-2027 ($ MILLION)

7. BRICS E-COMMERCE RETAIL ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. BRICS E-COMMERCE RETAIL FASHION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. BRICS E-COMMERCE RETAIL HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. BRICS E-COMMERCE RETAIL AUTOMOBILE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. BRICS E-COMMERCE RETAIL BEAUTY AND PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. BRICS E-COMMERCE RETAIL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. BRICS E-COMMERCE RETAIL MARKET RESEARCH AND ANALYSIS BY DEVICE USED, 2020-2027 ($ MILLION)

14. BRICS SMARTPHONE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. BRICS TABLET MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. BRICS PERSONAL COMPUTER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON BRICS E-COMMERCE RETAIL MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON BRICS E-COMMERCE RETAIL MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF BRICS E-COMMERCE RETAIL MARKET, 2020-2027 (%)

4. BRICS E-COMMERCE RETAIL MARKET SHARE BY END USER,2020 VS 2027 (%)

5. BRICS E-COMMERCE RETAIL MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

6. BRICS E-COMMERCE RETAIL MARKET SHARE BY DEVICE USED, 2020 VS 2027 (%)

7. BRICS E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLIONS)

8. BRAZIL E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLIONS)

9. RUSSIA E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLIONS)

10. INDIA E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLIONS)

11. CHINA E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLIONS)

12. SOUTH AFRICA E-COMMERCE RETAIL MARKET SIZE 2020-2027 ($MILLIONS)