Catheters Market

Catheters Market Size, Share & Trends Analysis Report by Product Type (Cardiovascular Catheters, Urological Catheters, Intravenous catheters, Specialty Catheters, and Neurovascular Catheters), and Forecast, 2019-2025

Global Catheters market size was valued at USD 21,710 million in 2018 and projected to grow at a CAGR of 8.5% during the forecast period. Catheters define as a flexible tube injected into the body cavity to diagnose disease and make medical procedures. Catheters are made from medical grade material and serve various functions, including administration of intravenous fluids, drainage of fluid collection, angioplasty, angiography, direct measurement of blood pressure in artery or veins, and administration of oxygen. The growth of the market is attributed to the various benefits offered by catheters such as the reduced risk of infection, diagnose of diseases, and measurement of blood pressure. Catheters are widely adopted across the globe in the treatment and surgical procedures. A wide variety of catheters are available for CVD, neurovascular, urological, gastrointestinal, and ophthalmic applications. Furthermore, growing lifestyle-oriented diseases and technological advancements are anticipated to contribute significantly toward the growth of the market. Additionally, the rising demand for minimally invasive medical procedures is also predicted to boost the growth of the global catheters market.

Segmental Outlook

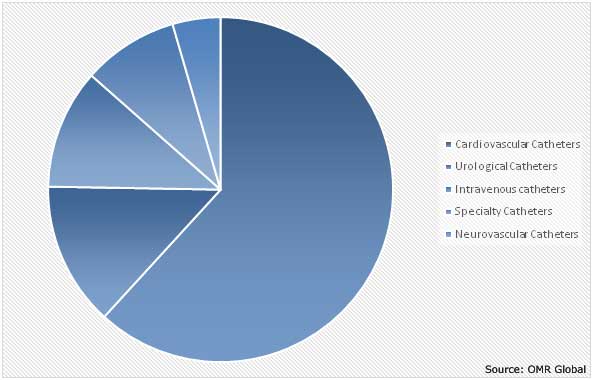

The global catheters market is segmented on the basis of product type. Based on the product type the market is further classified into cardiovascular catheters, urological catheters, intravenous catheters specialty catheters and neurovascular catheters. The cardiovascular catheters include electrophysiology catheters, percutaneous transluminal coronary angioplasty, balloon catheters, intravascular ultrasound catheters, percutaneous transluminal angioplasty catheters, guiding catheters, angiography catheters, and pulmonary artery catheters.

Global Catheters Market Share by Product Type, 2018 (%)

Global Catheters market to be driven by cardiovascular catheters

Cardiovascular catheters segment is projected to have a significant market share during the forecast period. The market is growing due to the increasing prevalence of chronic diseases such as cardiovascular diseases (CVDs) and others’ heart diseases across the globe. CVDs are among the leading chronic disease which includes diseases of heart & blood vessel circulation, heart failure, rheumatic heart disease, hypertensive heart disease, myocardial infarction, and stroke. According to WHO, in 2018, CVD accounts for 17.7 million mortality per year, which means 31% mortality across the globe. According to the American Heart Association, the CVD rate is estimated to reach 23.6 million in 2030. Cardiovascular catheterization is required to identify the presence of congenital heart defect, check narrow blockage of blood vessels, and check for problems with heart valves. Moreover, the method is used to measure the amount of oxygen in heart, the pressure inside the heart, and to evaluate and determine the need for further treatments that further increase the demand of cardiovascular catheters.

Regional Outlook

Moreover, the global Catheters market further classified based on geography including North America, Europe, Asia-Pacific and Rest of the World. Asia-Pacific is expected to witness significant growth in the catheters market in the near future due to increasing healthcare expenditures and increasing patient awareness towards the treatment of CVDs and others diseases.

Global Catheters Market Growth, by Region 2019-2025

North America has a significant share in the Catheters market

Geographically, North America is estimated to have a significant market share in the global catheters market during the forecast period. The US is the largest contributor in the market owing to the high prevalence of chronic diseases such as CVDs, high healthcare expenditure and technological development in catheters. The North American market is further sub-segmented as the US and Canada. The US contributes significantly to the market due to developed healthcare infrastructure and high adoption of catheters in the treatment of various chronic diseases in the country. Moreover, the high prevalence of CVDs and other heart related diseases in the US is contributing to the growth of the market. According to the American Heart Association (AHA) in 2017, CVD accounts for approximately 800,000 mortalities in the US that is one out of three mortalities in the country, that further raises the demand of the catheters in the country.

Market Players Outlook

The major players that contribute to the growth of the global Catheters market include Abbott Laboratories Inc., B. Braun Melsungen AG, Becton, Dickinson and Co., Boston Scientific Corp., Edwards Lifesciences Corp., Medtronic PLC, Stryker Corp., Terumo Medical Corp., Teleflex Inc., and many others. The players operating in the market adopt various strategies such as technology developent, product launch, merger and acquitions for gaining the sustainable position in the market that further propels the growth of the market. For instance, in May 2019, Medtronic PLC announced the launch of Telescope (TM) Guide Extension Catheter to Support Complex Coronary Cases. With this launch, the company enhanced its cathers portfolio and would able to increase their revenue in the cathters market.

Recent Developments

In May 2018, Abbott Laboratories Inc. got the FDA approval for Advisor HD Grid Mapping Catheter, Sensor Enabled. This catheter builds upon the company’s advanced products designed to improve performance in cardiac ablation procedures, including the EnSite Precision Cardiac Mapping System and a broad range of mapping and treatment catheters.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global catheters market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Becton, Dickinson and Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boston Scientific Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Medtronic PLC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Terumo Medical Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Catheters Market by Product Type

5.1.1. Cardiovascular Catheters

5.1.2. Urological Catheters

5.1.3. Intravenous catheters

5.1.4. Specialty Catheters

5.1.5. Neurovascular Catheters

6. Regional Analysis

6.1. North America

6.1.1. The US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories Inc.

7.2. B. Braun Melsungen AG

7.3. Becton, Dickinson and Co.

7.4. Boston Scientific Corp.

7.5. Burpee MedSystems LLC, a Seisa Medical Company

7.6. Coloplast Corp.

7.7. ConvaTec Inc.

7.8. Cure Medical, LLC

7.9. Edwards Lifesciences Corp.

7.10. Hollister Inc.

7.11. Integra LifeSciences Corp.

7.12. Intra special catheters GmbH

7.13. Koninklijke Philips N.V.,

7.14. Manfred Sauer GmbH

7.15. Medtronic, PLC

7.16. Nipro Medical Corp.

7.17. Smiths Medical Group Ltd.

7.18. Spiegelberg GmbH & Co. KG

7.19. Stryker Corp.

7.20. Teleflex Inc.

7.21. Terumo Medical Corp.

7.22. Thomas Medical, Inc.

1. GLOBAL CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL CARDIOVASCULAR CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL UROLOGICAL CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CATHETERS IN SPORTS AND FITNESS APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL INTRAVENOUS CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL SPECIALTY CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL NEUROVASCULAR CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL CATHETERS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN CATHETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

11. EUROPEAN CATHETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. EUROPEAN CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

13. ASIA-PACIFIC CATHETERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. ASIA-PACIFIC CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD CATHETERS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

1. GLOBAL CATHETERS MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL CATHETERS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

3. US CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

4. CANADA CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

5. UK CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

6. FRANCE CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

7. GERMANY CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

8. ITALY CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

9. SPAIN CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

10. ROE CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

11. INDIA CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

14. REST OF ASIA-PACIFIC CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF THE WORLD CATHETERS MARKET SIZE, 2018-2025 ($ MILLION)