China Pharmaceutical Contract Manufacturing Market

China Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis Report By Manufacturing Process Type (Sterile Manufacturing, and Non-Sterile Manufacturing), By Product Type (Over-The-Counter (OTC) Drugs, Active Pharmaceutical Ingredients (API), Finished Dosage Formulation, and Others), By Route of Administration (Oral Administration, Inhaled Administration, Parenteral Administration, and Others), By Service (R&D, Manufacturing, and Non-Clinical Service) Forecast, 2021-2027 Update Available - Forecast 2024-2030

The China pharmaceutical contract manufacturing market is growing at a CAGR of around 12.1% during the forecast period. The major factor that drives the growth of the market includes the major companies in the pharmaceutical contract manufacturing market are expanding their manufacturing capacity in China. For instance, In August 2020, Bayer AG announced the submission of the regulatory application seeking the approval of vericiguat in China. Vericiguat is an investigational oral, once-daily, first-in-class soluble guanylate cyclase (sGC)-stimulator being developed to treat patients with symptomatic chronic heart failure with an ejection fraction less than 45%. Vericiguat is being jointly developed with MSD (a tradename of Merck & Co., Inc., Kenilworth, NJ, USA).

Additionally, the increasing non-communicable diseases, such as (Cardiovascular disease) CVD, and cancer, with the increasing geriatric population is also boosting the market growth. For instance, the incidence of prostate cancer has increased rapidly in China in recent years. According to the World Health Organization (WHO), in 2018, China witnessed around 4.2 million new cancer incidences and over 2.8 million cancer mortalities. Moreover, the country is also aimed to reduce cardiovascular events in patients with increased triglycerides and low-density lipoprotein (LDL) cholesterol. It shows the efforts of China contract manufacturers towards drug development, which in turn is projected to increase the China pharmaceutical contract manufacturing market. In addition, the increasing development of China pharma trades to the US pharma industry and rising demand for biosimilars is also driving the market growth. However, issues over quality control and stringent government regulations are creating a hindrance in the growth of China's pharmaceutical contract manufacturing market. Additionally, increasing advances in drug discovery & development and MAH (Marketing Authorization Holder) pilot program are expected to offer significant opportunities for market growth.

Impact of COVID-19 on China Pharmaceutical Contract Manufacturing Market

The COVID-19 pandemic has a negative impact on the pharmaceutical contract manufacturing market across the globe, including China mainly due to the changing supply chain scenario in China. As pharma companies restart full-scale operations after the COVID-19 pandemic, the demand for large-scale contract manufacturing is projected to increase considerably.

Segmental Outlook

The market is segmented based on, manufacturing process type, product type, route of administration, and service. Based on manufacturing process type, the market is segmented into sterile manufacturing and non-sterile manufacturing. Based on product type, the market is segmented into over-the-counter (OTC) drugs, active pharmaceutical ingredients (API), finished dosage formulation, and others (nutritional products and packaging). Based on route of administration, the market is segmented into oral administration, inhaled administration, parenteral administration, and others (rectal and vaginal). Based on service, the market is segmented into R&D, manufacturing, and non-clinical service such as supply chain management.

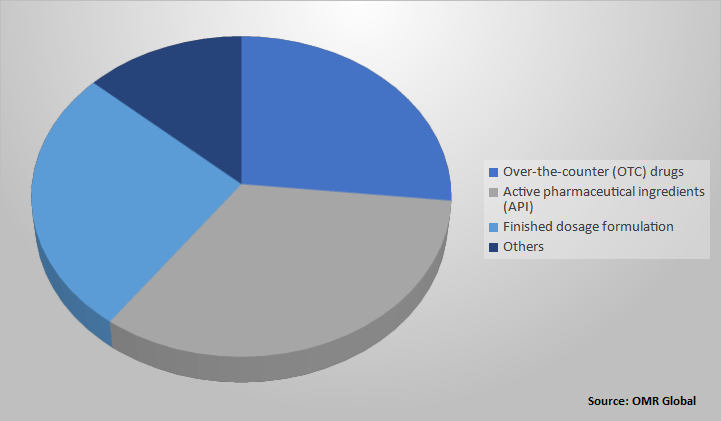

China Pharmaceutical Contract Manufacturing Market Share by Product Type, 2020 (%)

The API segment is projected to dominate the China pharmaceutical contract manufacturing market

Among product types, the API segment is estimated to be the dominating segment in the China pharmaceutical contract manufacturing market. The market is increasing in API is due to the increasing demand for API manufacturing, the key players in this market are focusing on the advancement of biological APIs. Additionally, the increasing initiatives by the regional government in biologics, increasing healthcare expenditure, increasing prevalence of cancer and age-related diseases. Moreover, the biologics manufacturing services segment accounted for the highest growth rate. The major factor driving the growth of this segment is the growing demand for vaccines and biosimilars.

Market Player Outlook

Key players of the China pharmaceutical contract manufacturing market include Bayer AG, GlaxoSmithKline PLC, Merck & Co., Inc., Pfizer Inc., WuXi AppTec, Evonik Industries AG, China Chemical & Pharmaceutical Co., Ltd., Shanghai Fosun Pharmaceutical (Group) Co., Ltd. To sustain a strong position in the market, these players adopt different marketing strategies such as product launches. For Instance, in July 2019, Evonik and ThyssenKrupp Industrial Solutions had agreed to grant a license for HPPO Technology to Zibo Qixiang Tengda Chemical Co. to produce propylene oxide. Qixiang Tengda Chemical will construct a plant in China for supportable production of propylene oxide, Evonik closes an additional supply contract for custom-made catalyst.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the China pharmaceutical contract manufacturing market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the China Pharmaceutical Contract Manufacturing Industry

• Recovery Scenario of China Pharmaceutical Contract Manufacturing industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. China Pharmaceutical Contract Manufacturing Market by Manufacturing Process Type

5.1.1. Sterile Manufacturing

5.1.2. Non-Sterile Manufacturing

5.2. China Pharmaceutical Contract Manufacturing Market by Product Type

5.2.1. Over-The-Counter (OTC) Drugs

5.2.2. Active Pharmaceutical Ingredients (API)

5.2.3. Finished Dosage Formulation

5.2.4. Others (Nutritional Products and Packaging)

5.3. China Pharmaceutical Contract Manufacturing by Route of Administration

5.3.1. Oral Administration

5.3.2. Inhaled Administration

5.3.3. Parenteral Administration

5.3.4. Others (Rectal and Vaginal)

5.4. China Pharmaceutical Contract Manufacturing by Service

5.4.1. R&D

5.4.2. Manufacturing

5.4.3. Non-Clinical Services

6. Company Profiles

6.1. Agno Pharma

6.2. B. Braun Melsungen AG

6.3. Bayer AG

6.4. Boehringer Ingelheim International GmbH

6.5. Canagen Pharmaceuticals Inc.

6.6. Catalent Pharma Solutions, Inc.

6.7. China Chemical & Pharmaceutical Co., Ltd.

6.8. Dishman Carbogen Amcis Ltd.

6.9. Evonik Industries AG

6.10. Gilead Sciences, Inc.

6.11. GlaxoSmithKline PLC

6.12. Hangzhou VIWA Co., Ltd.

6.13. HISUN USA, inc.

6.14. Ingredient China Group Ltd.

6.15. Mercator Pharma

6.16. Merck & Co., Inc.

6.17. Novozymes A/S

6.18. Pfizer Inc.

6.19. Shandong Xinhua Pharma.

6.20. Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

6.21. Siegfried Holding AG

6.22. Sirio Pharma Co., Ltd.

6.23. STA Pharmaceutical Co., Ltd.

6.24. West Pharmaceutical Services, Inc.

6.25. WuXiAppTec

6.26. Wuxi Griffin Pharmaceutical Co., Ltd.

6.27. Zhejiang Jingxin Pharmaceutical Co., Ltd.

1. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING BY MANUFACTURING PROCESS TYPE, 2020-2027 ($ MILLION)

2. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING BY, PRODUCT TYPE, 2020-2027 ($ MILLION)

3. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING BY ROUTE OF ADMINISTRATION, 2020-2027 ($ MILLION)

4. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING BY SERVICE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON CHINA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON CHINA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF CHINA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2021-2027 (%)

4. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING SHARE BY MANUFACTURING PROCESS TYPE, 2020 VS 2027 (%)

5. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

6. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING SHARE BY ROUTE OF ADMINISTRATION, 2020 VS 2027 (%)

7. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING SHARE BY SERVICE, 2020 VS 2027 (%)

8. CHINA PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2021-2023 ($ MILLION)