North American E-Commerce Logistics Market

North American E-Commerce Logistics Market Size, Share & Trends Analysis Report by Services (Transportation Services, Warehousing Services, and Other E-Commerce Logistics Services), By Product (Baby Products, Personal Care Products, Books, Home Furnishing Products, Apparel Products, Electronics Products, Automotive Products, and Others), By Location (International, and Local) Forecast, 2021-2027 Update Available - Forecast 2024-2030

The North American e-commerce logistics market is anticipated to grow at a CAGR of 13.8% during the forecast period. the major factors that are driving the growth of the North American e-commerce logistics market include technological advancements, the development of infrastructure in major economies such as the US and Canada, and wide connectivity through roadways & railways. For instance, the railways of the US and Canada one of the largest railway networks across the region.

Increasing e-commerce sales and growing global e-commerce market has been also contributing to the North American e-commerce logistics market. For instance, according to the announcement by the Census Bureau of the Department of Commerce in 2020, in the US, the total e-commerce sales were around $791.7 billion, which is increased by 32.4% as compared to 2019. E-commerce sales in 2020 accounted for around 14% of the total sales, and in 2019 it was 11% of the total sales. The US contributes the highest in the growth of the North American e-commerce market followed by Canada due to quality infrastructure and smooth logistic system. The presence of a huge number of e-commerce industries, high disposable income, and high internet penetration is also driving the North American e-commerce logistics market during the forecast period.

Although the electrification of road transport vehicles is under the development phase, it is expected to create opportunities for e-commerce companies to grow their logistics services. The US and Canada are continuously investing in their infrastructure to develop road, rail, and air transport facilities. For instance, according to the Organization for Economic Co-operation and Development (OECD) in 2016, the total investment in the infrastructure development of road transport was around $86 billion in the US and $6 billion in Canada. Similarly, the investment in the infrastructure development of railway transport was around $811 million in Canada. However, unfavourable government regulations, a high ratio of product return, and rising fuel prices are factors that are restraining the growth of the North American e-commerce logistics market.

Impact of COVID-19 Pandemic on North American e-commerce Logistics Market

The North American e-commerce Logistics market is hardly hit by the COVID-19 pandemic since December 2019. Logistics firms, that are involved in the movement or flow of goods, have been directly affected by the COVID-19 pandemic. Despite that, the COVID-19 pandemic has driven e-commerce growth by expansion to new companies, consumers, and product categories. It has given consumers access to a wide range of goods from the comfort and protection of their own homes, and it has enabled businesses to continue operating through communication limitations and other restrictions. Self-imposed social distance to prevent contagion, along with rigid confinement policies introduced in many OECD nations, has effectively placed a substantial portion of conventional brick-and-mortar retail on hold, at least during the pandemic.

Around February and April 2020, retail and food service revenues in the US fell 7.7% relative to the same time in 2019. Grocery stores and non-store retailers (mostly e-commerce providers) saw sales rise by 16.0% and 14.0%, respectively. The COVID-19 pandemic has disrupted the supply of raw materials and products across the globe, hence impacted the North American e-commerce Logistics market negatively. The market will witness “V” shape recovery in near future owing to the restart of key industries in major economies.

Segmental Outlook

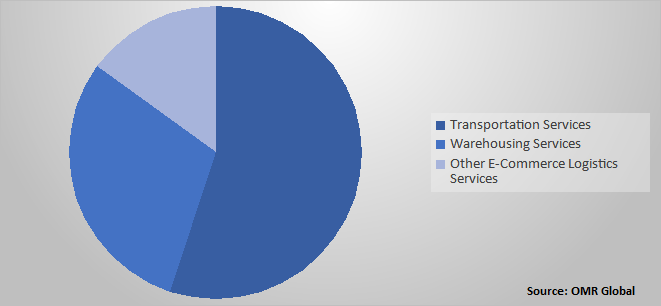

The North American e-commerce logistics market is segmented based on services, products, and location. Based on the services, the market is segmented into transportation services, warehousing services, and other e-commerce logistics services. Among the services, the transportation service segment is expected to grow at a considerable CAGR during the forecast period due to the continuous investment by the US and Canada in infrastructure development of road, rail, and air transport services. Based on the product, the North American e-commerce logistics market is segmented into baby products, personal care products, books, home furnishing products, apparel products, electronics products, automotive products, and others. Apart from this, based on the location, the market is segmented into international, and local.

North American E-Commerce Logistics Market Share by Services, 2020 (%)

Transportation Service Segment holds the significant share in the North American E-Commerce Logistics Market

Among services, the transportation service segments held the major share in 2020 and further anticipated to grow significantly during the forecast period. Transportation Services refer to operations that help a person go from one location to another to access services or carry out life activities. E-commerce companies either sell their goods to consumers with their network or through the support of third-party logistics companies including FedEx, DHL Express, and others. Several programs are being used by these firms to lure a vast number of e-commerce businesses. For instance, in May 2018, DHL has launched DHL SmarTrucking for innovative road transportation. DHL SmarTrucking is launched for the development of technology-led logistics solutions and with considerable efficiency from DHL SmarTrucking, the company expects to deliver transport 100,000 tons of cargo and cover a distance of approximately 4 million kilometers every day.

Regional Outlooks

The North American e-commerce logistics market is further segmented based on the country including the US, Canada, Mexico, and the Rest of North America. North American is growing due to the presence of various major players and the integration of the US companies with Canadian logistics companies. Drone logistics systems are being used by e-commerce firms such as United Parcel Service and Amazon in the US and Canada to enable quicker and simpler shipping, which is expected to improve the companies' operational performance. The US and Canada are investing heavily in their networks to improve road, rail, and air transportation. Owing to the innovation such as the advent of automation, robots, wearable technology, drone technology, self-driving cars, cloud computing, and IoT in logistics technology, the US has a significant share of the North American e-commerce logistics industry.

Market Players Outlook

The key players of the North American e-commerce logistics market include TFI International Inc. (UPS), FedEx Corp, DHL International GmbH, A-1 International Inc, ABF Freight System Inc., Intelcom Express, ShipBob Inc., CEVA Logistics AG, Belgian Postal Group (Bpost)among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, fundings, geographical expansion, collaborations, and new product launches, to stay competitive in the market. For instance, in September 2020, ShipBob Inc., an e-commerce technology company, has announced funding of $68 million by SoftBank. The new funds will be used to improve the company's ability to provide world-class delivery to more consumers, as well as to fuel expansion, extend its tech infrastructure, and scale its global fulfilment network.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the North American e-commerce logistics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the North Americann E-Commerce Logistics Industry

• Recovery Scenario of North Americann E-Commerce Logistics Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. North American E-Commerce Logistics Market by Services

5.1.1. Transportation Services

5.1.2. Warehousing Services

5.1.3. Other E-Commerce Logistics Services

5.2. North AmericanE-Commerce Logistics Market by Product

5.2.1. Baby Products

5.2.2. Personal Care Products

5.2.3. Books

5.2.4. Home Furnishing Products

5.2.5. Apparel Products

5.2.6. Electronics Products

5.2.7. Automotive Products

5.2.8. Others

5.3. North AmericanE-Commerce Logistics Market by Location

5.3.1. International

5.3.2. Local

6. Regional Analysis

6.1. United States

6.2. Canada

6.3. Mexico

6.4. Rest of North American

7. Company Profiles

7.1. A-1 INTERNATIONAL Inc.,

7.2. Apex Logistics International, Inc.

7.3. ArcBest Corp. (ABF Freight System Inc.)

7.4. Belgian Postal Group (Bpost)

7.5. Canada Post Corp.

7.6. CEVA Logistics AG

7.7. Denver/Boulder Couriers

7.8. DHL International GmbH

7.9. FedEx Corp.

7.10. Flexport Inc.

7.11. Gannett Co., Inc. (Delaware.com)

7.12. Gold Cross Courier Services Inc. (Purple Mountain Solutions Inc.)

7.13. Intelcom Express

7.14. Landmark Global Inc.

7.15. LaserShip Inc.

7.16. Priority Courier Experts

7.17. Purolator, Inc.

7.18. Quicksilver Express Courier (QEC)

7.19. ShipBob, Inc.

7.20. TFI International Inc. (UPS)

7.21. TransForce Logistics

7.22. XPO Logistics, Inc.

1. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

3. NORTH AMERICAN E-COMMERCE LOGISTICS TRANSPORTATION SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

4. NORTH AMERICAN E-COMMERCE LOGISTICS WAREHOUSING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

5. NORTH AMERICAN OTHER E-COMMERCE LOGISTICS SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

6. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 ($ MILLION)

7. NORTH AMERICAN BABY PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

8. NORTH AMERICAN PERSONAL CARE PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

9. NORTH AMERICAN BOOKS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

10. NORTH AMERICAN HOME FURNISHING PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

11. NORTH AMERICAN APPAREL PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN ELECTRONICS PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN OTHER PRODUCTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

15. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATIONS, 2020-2027 ($ MILLION)

16. NORTH AMERICAN INTERNATIONAL E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. NORTH AMERICAN LOCAL E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY UNIT SHIPMENTS, 2020-2027 (BILLION UNITS)

19. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 (BILLION UNITS)

20. NORTH AMERICAN E-COMMERCE LOGISTICS TRANSPORTATION SERVICES MARKET VOLUME, 2020-2027 (BILLION UNITS)

21. NORTH AMERICAN E-COMMERCE LOGISTICS WAREHOUSING SERVICES MARKET VOLUME, 2020-2027 (BILLION UNITS)

22. NORTH AMERICAN OTHER E-COMMERCE LOGISTICS SERVICES MARKET VOLUME, 2020-2027 (BILLION UNITS)

23. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2020-2027 (BILLION UNITS)

24. NORTH AMERICAN BABY PRODUCTS MARKET VOLUME, 2020-2027 (BILLION UNITS)

25. NORTH AMERICAN PERSONAL CARE PRODUCTS MARKET VOLUME, 2020-2027 (BILLION UNITS)

26. NORTH AMERICAN BOOKS MARKET VOLUME, 2020-2027 (BILLION UNITS)

27. NORTH AMERICAN HOME FURNISHING PRODUCTS MARKET VOLUME, 2020-2027 (BILLION UNITS)

28. NORTH AMERICAN APPAREL PRODUCTS MARKET RESEARCH AND ANALYSIS, 2020-2027 (BILLION UNITS)

29. NORTH AMERICAN ELECTRONICS PRODUCTS MARKET VOLUME, 2020-2027 (BILLION UNITS)

30. NORTH AMERICAN AUTOMOTIVE PRODUCTS MARKET VOLUME, 2020-2027 (BILLION UNITS)

31. NORTH AMERICAN OTHER PRODUCTS MARKET VOLUME, 2020-2027 (BILLION UNITS)

32. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY LOCATION, 2020-2027 (BILLION UNITS)

33. NORTH AMERICAN INTERNATIONAL E-COMMERCE LOGISTICS MARKET VOLUME, 2020-2027 (BILLION UNITS)

34. NORTH AMERICAN LOCAL E-COMMERCE LOGISTICS MARKET VOLUME, 2020-2027 (BILLION UNITS)

35. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY 2020-2027 ($ MILLION)

36. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON NORTH AMERICAN E-COMMERCE LOGISTICS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON NORTH AMERICAN E-COMMERCE LOGISTICS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF NORTH AMERICAN E-COMMERCE LOGISTICS MARKET, 2021-2027 (%)

4. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET SHARE BY PRODUCT, 2020 VS 2027 (%)

5. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET SHARE BY SERVICES, 2020 VS 2027 (%)

6. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET SHARE BY LOCATION, 2020 VS 2027 (%)

7. NORTH AMERICAN E-COMMERCE LOGISTICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. NORTH AMERICAN BABY PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

9. NORTH AMERICAN PERSONAL CARE PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

10. NORTH AMERICAN BOOKS MARKET SIZE, 2020-2027 ($ MILLION)

11. NORTH AMERICAN HOME FURNISHING PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

12. NORTH AMERICAN APPAREL PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

13. NORTH AMERICAN ELECTRONIC PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

15. NORTH AMERICAN OTHER PRODUCTS MARKET SIZE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN E-COMMERCE TRANSPORTATION LOGISTICS SERVICES MARKET SIZE, 2020-2027 ($ MILLION)

17. NORTH AMERICAN E-COMMERCE WAREHOUSE LOGISTICS SERVICES MARKET SIZE, 2020-2027 ($ MILLION)

18. NORTH AMERICAN OTHER-COMMERCE LOGISTICS SERVICES MARKET SIZE, 2020-2027 ($ MILLION)

19. NORTH AMERICAN INTERNATIONAL E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN LOCAL E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027 ($ MILLION)

21. US E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)

22. CANADA E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)

23. MEXICO E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)

24. REST OF NORTH AMERICAN E-COMMERCE LOGISTICS MARKET SIZE, 2020-2027($ MILLION)