Ophthalmic Devices Market

Global Ophthalmic Devices Market Size, Share & Trends Analysis by Devices (Surgical devices, Diagnostic and Monitoring Devices, and Vision Correction Devices) Forecast Period (2022-2028)

The global ophthalmic devices market is anticipated to grow at a significant CAGR of 5.1% during the forecast period. The market growth is attributed to the increase owing to the rising prevalence of eye diseases and technological advancements in the diagnostics domain. A rapidly aging population and patient preference for minimally invasive surgeries are also stimulating the market. Furthermore, the need for sophisticated healthcare facilities and quality care for patients is also expected to boost market growth during the forecast period. The major driving force of the global ophthalmic devices market includes increasing incidences of eye diseases and disorders across the globe.

The incidence and prevalence rate of ophthalmic diseases is growing at a significant rate across the globe. According to the WHO, in 2021, around 2.2 billion people from across the globe have been suffering from one or the other kind of visual impairment and 80% of these are considered avoidable. Most of these vision impairments are due to uncorrected refractive errors (88.4 million) and cataracts (94 million). Some other causes of visual impairment include glaucoma (7.7 million), unaddressed presbyopia (826 million), diabetic retinopathy (3.9 million), corneal opacity (4.2 million), and trachoma (2 million). Visual impairment may lead to various conditions such as accidents, depression, and anxiety disorders. This vision impairment poses an enormous financial burden due to productivity losses. Uncorrected myopia and presbyopia had alone been estimated to create an economic loss of $244.0 billion and $25.4 billion respectively.

Impact of COVID-19 Pandemic on Global Ophthalmic Devices Market

The COVID-19 pandemic has resulted in significant service cuts across the NHS, with ophthalmology being one of the hardest-hit specialties. During the first peek of the COVID-19 pandemic, outpatient clinic appointments were reduced by 87.2 percent, ophthalmic surgery by 90.9%, outpatient referrals to ophthalmology by 50.2 %, and ward reviews by 50%, according to a study published in March 2021 titled "The Impact of the First Peak of the COVID-19 Pandemic on a Pediatric Ophthalmology Service in the United Kingdom: Experience from Alder Hey Children's Hospital." There were 1377 real canceled appointments, 6.8% of which were deemed suitable for teleophthalmology. The COVID-19 pandemic has significantly limited the clinical activity of ophthalmology services.

Segmental Outlook

Based on the devices, the market is segmented into surgical devices, diagnostic and monitoring devices, and vision correction devices. Based on surgical devices, the market is segmented into glaucoma drainage devices, glaucoma stents, and implants, intraocular lenses, lasers, and other surgical devices. based on diagnostic and monitoring devices, the market is segmented into autorefractors and keratometers, corneal topography systems, ophthalmic ultrasound imaging systems, ophthalmoscopes, optical coherence tomography scanners, and other diagnostic and monitoring devices. Based on vision correction devices, the market is segmented into spectacles, and contact lenses.

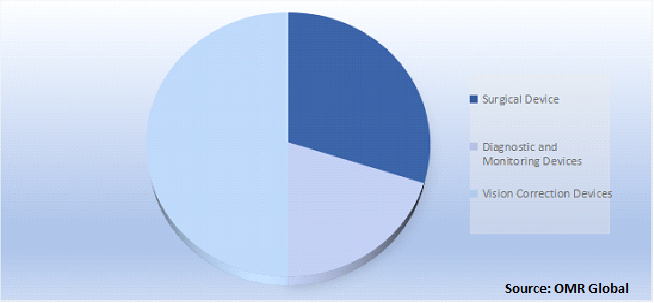

Global Ophthalmic Devices Market Share by Devices, 2021 (%)

The Vision Correction Devices Sub-Segment is Anticipated to Hold a Prominent Share in the Global Ophthalmic devices Market

Based on the devices, the market is segmented into surgical devices, diagnostic and monitoring devices, and vision correction devices. Among these, the vision correction devices segment is anticipated to hold a prominent share in the market during the forecast period. The segment growth is attributed to the increasing prevalence of refractive errors among both children and adults. For instance, according to the American Academy of Ophthalmology in 2019, more than 34 million Americans aged 40 and older are myopic, while around 14.2 million Americans aged 40 and older are hyperopic. Further, around 700,000 LASIK surgeries are performed each year in the US, making it the most common refractive surgery.

Regional Outlooks

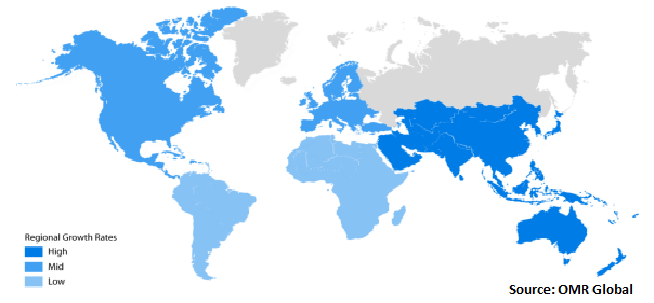

The global ophthalmic devices market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the Asia Pacific regional market is expected to cater to considerable growth during the forecast period as the prevalence of high myopia is expected to increase by around 24% by the end of 2050 in the high-income Asia-Pacific economies.

Global Ophthalmic Devices Market Growth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global Ophthalmic Devices Market

The North American region is expected to hold a prominent share in the global ophthalmic devices market. According to the CDC, the total annual economic impact of vision problems in the US is around $51.4 billion. Cataracts and myopia are the major vision problems. According to the National Eye Institute, the number of people in the US with cataracts is expected to double from 24.4 million to about 50 million by 2050. According to WHO, myopia and high myopia were expected to affect around 52.0% and 10.0% of the global population respectively by 2050. The prevalence of myopia is high in East Asia, which includes countries such as China, Japan, the Republic of Korea, and Singapore.

Market Players Outlook

The major companies serving the global ophthalmic devices market include Canon Medical System USA, Inc., Heidelberg Engineering GmbH., HEINE Optotechnik GmbH & Co. KG, and Johnson & Johnson Services Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, new launches, and partnerships. For instance, in September 2020, Johnson & Johnson vision launched TECNIS Synergy Toric II, an Intraocular Lens (IOL) as well as CATALYS System cOS 6.0 software, which offers new features for astigmatism management workflow for surgeons using the CATALYS Precision Laser System.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ophthalmic devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Ophthalmic Devices Market

- Recovery Scenario of Global Ophthalmic Devices Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.1.1.Overview

3.1.2.Financial Analysis

3.1.3.SWOT Analysis

3.1.4.Recent Developments

3.2.Key Strategy Analysis

3.3.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Ophthalmic devices Market by Device

4.1.1.Surgical Device

4.1.2.Diagnostic And Monitoring Devices

4.1.3.Vision Correction Device

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Canon Medical System USA, Inc.

6.2.Carl Zeiss Meditec AG

6.3.Essilor International SA

6.4.Haag-Streit Holding AG

6.5.Heidelberg Engineering GmbH

6.6.HEINE Optotechnik GmbH & Co. KG

6.7.Johnson & Johnson Services Inc.

6.8.Nidek Co., Ltd

6.9.AlconVision LLC.

6.10.Ophthalmic Instruments Inc.

6.11.HOYA Corp.

6.12.Topcon Corp.

6.13.Veatch Ophthalmic Instruments

6.14.Ziemer Ophthalmic Systems

6.15.Kowa American Corp.

1.GLOBAL OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICES, 2021-2028 ($ MILLION)

2.GLOBAL OPHTHALMIC SURGICAL DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL OPHTHALMIC DIAGNOSTIC AND MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL OPHTHALMIC VISION CORRECTION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

6.NORTH AMERICAN OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

7.NORTH AMERICAN OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICES, 2021-2028 ($ MILLION)

8.EUROPEAN OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

9.EUROPEAN OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICES, 2021-2028 ($ MILLION)

10.ASIA-PACIFIC OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11.ASIA-PACIFIC OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICES, 2021-2028 ($ MILLION)

12.REST OF THE WORLD OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13.REST OF THE WORLD OPHTHALMIC DEVICES MARKET RESEARCH AND ANALYSIS BY DEVICES, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL OPHTHALMIC DEVICES MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL OPHTHALMIC DEVICES MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL OPHTHALMIC DEVICES MARKET, 2022-2028 (%)

4.GLOBAL OPHTHALMIC DEVICES MARKET SHARE BY DEVICES, 2021 VS 2028 (%)

5.GLOBAL OPHTHALMIC SURGICAL DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL OPHTHALMIC DIAGNOSTIC AND MONITORING DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL OPHTHALMIC VISION CORRECTION DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL OPHTHALMIC DEVICES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.US OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

10.CANADA OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

11.UK OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

12.FRANCE OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

13.GERMANY OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

14.ITALY OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

15.SPAIN OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

16.REST OF EUROPE OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

17.INDIA OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

18.CHINA OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

19.JAPAN OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

20.SOUTH KOREA OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

21.REST OF ASIA-PACIFIC OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

22.REST OF THE WORLD OPHTHALMIC DEVICES MARKET SIZE, 2021-2028 ($ MILLION)