European Pharmaceutical Contract Manufacturing Market

European Pharmaceutical Contract Manufacturing Market Size, Share & Trends Analysis Report By Manufacturing Process Type (Sterile Manufacturing, and Non-Sterile Manufacturing) By Product Type (OTC, API, Finished Dosage Formulation, and Others) By Route of Administration (Oral, Inhaled, Parenteral, and Others) By Service (R&D, Manufacturing, and Non-Clinical) Forecast 2021-2027 Update Available - Forecast 2024-2030

European Pharmaceutical Contract Manufacturing is projected to have a considerable CAGR of around 6.1% during the forecast period. The outsourcing of pharmaceutical manufacturing products to outside vendors through a formal agreement is known as pharmaceutical contract manufacturing. The contract manufacturing organizations serve the pharmaceutical industry and provide services related to manufacturing and drug development. Outsourcing with CDMO, pharmaceutical industries can expand their business and technical resources on a big level, and it enables pharmaceutical firms to reduce drug development costs and save time for further processes. Additionally, pharmaceutical contract manufacturing company provides an array of services to drug companies include drug developments, manufacturing, and commercial production, pre-formulation, documentation of compliance with FDA regulatory requirements, among others. The growing pharmaceutical industry owing to the rising demands for pharmaceutical products, and high expenditure in R&D activities are the major factors driving the growth of the European pharmaceutical contract manufacturing market. According to the European Federation of Pharmaceutical Industries and Association in 2018, the production of pharmaceutical products reached $315 billion, and $442 billion were invested in R&D. Moreover, increasing demand for generic drugs and the presence of major players is further contributing towards the market growth.

However, the issues over quality control and shift towards Asia-Pacific countries such as India and China for pharmaceutical outsourcing are hindering the growth of the European pharmaceutical contract manufacturing market. In addition, advances in drug discovery and increasing R&D investment by contract manufacturers are expected to create a significant opportunity for the market in the near future.

Impact of COVID-19 on European Pharmaceutical Contract Manufacturing Market

The European pharmaceutical contract manufacturing market was benefited from the impact of the COVID-19 pandemic due to an increase in pharmaceuticals including vaccines, antiviral vaccines, antibody therapy, and various pharmaceutical products. During the COVID-19 pandemic, many pharmaceutical manufacturing units in Europe hired contract development and manufacturing organizations (CDMO) for drug development and manufacturing, due to this the increase in growth of CDMO has been witnessed. Due to this, the growth in the European contract manufacturing market has been seen.

Segmental Outlook

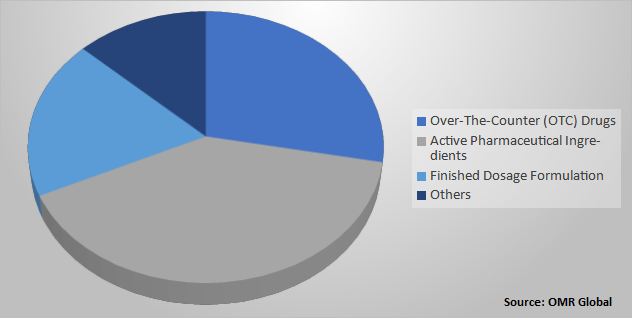

The European pharmaceutical contract manufacturing market is segmented based on manufacturing process type, product type, route of administration, and service. Based on the manufacturing process, the European pharmaceutical contract manufacturing market is bifurcated into sterile manufacturing and non-sterile manufacturing. On the basis of product type, the market is classified into over-the-counter (OTC) drugs, active pharmaceutical ingredients (API), finished dosage formulation, and others (nutritional products and packaging). Similarly, based on the route of administration, the market is further categorized into Oral, Inhaled, Parenteral, and others. whereas, the market is segmented on the basis of service into R&D, manufacturing, and non-clinical service (supply chain management).

European Pharmaceutical Contract Manufacturing Market Share by Product Type, 2020 (%)

API segment is projected to Register Significant Growth in the European Pharmaceutical Contract Manufacturing Market

Based on product type, the API held the largest market share in 2020, and it is projected to register significant growth during the forecast period. The demand for API manufacturing has increased over the past few years, and it is expected to continue rising. Many pharmaceutical industries shifted to developments of biological APIs due to chronic disorders and an increase in the aging population. That led to market growth. In addition, manufacturing companies are focusing on increasing their capabilities to produce more APIs to fulfil the market demand and consumers that drive the segment growth. Rising investment in R&D regarding the development of APIs will further increase the growth opportunities.

Regional Outlook

European pharmaceutical contract manufacturing market is classified into countries such as UK, Germany, Italy, Spain, France, Russia, Rest of Europe. Among these, Germany dominated the market, and it is expected to maintain its dominance during the forecast period owing to the increasing demands for API in the healthcare sector. The presence of some major CDMO such as Boehringer Ingelheim International GmbH and B. Braun Medical Inc., also boost the market growth. Moreover, France is expected to show potential growth during the forecast period due to increasing pharmaceutical R&D investment in the country.

Market Players Outlook

The key players in the European pharmaceutical contract manufacturing market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market are Aenova Group, Baxter Healthcare Corp., Boehringer Ingelheim International GmbH, Catalent Inc., Famar SA, Galena Pharma Oy, Jubilant Life Sciences Ltd., Lonza Group, Patheon Inc., Pfizer CentreOne, Recipharm AB (publ), among others. These market players adopt different marketing strategies such as mergers & acquisitions, partnership collaboration, R&D, product launches, and geographical expansions to generated more revenue and to remain competitive in the market. For instance, in May 2021, Aenova Group recently announced that it is building a new sterile production area at its site in Latina, Italy for the expansion of its fill and finish capacity for the production of Biologics and especially BSL1 and BSL2 vaccines against the SARS-CoV-2 virus. With an investment volume of more than 16 million euros, the focus is on a new "Fill and Finish" area for vials and prefilled syringes (PFS) with high-speed filling lines including compounding.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the European Pharmaceutical Contract Manufacturing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global European Pharmaceutical Contract Manufacturing Industry

• Recovery Scenario of Global European Pharmaceutical Contract Manufacturing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of Covid on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global European Pharmaceutical Contract Manufacturing Market, By Manufacturing Process

5.1.1. Sterile Manufacturing

5.1.2. Non-Sterile Manufacturing

5.2. Global European Pharmaceutical Contract Manufacturing Market, By Product Type

5.2.1. Over-The-Counter (OTC) Drugs

5.2.2. Active Pharmaceutical Ingredients (API)

5.2.3. Finished Dosage Formulation

5.2.3.1. Solid Dose

5.2.3.2. Liquid Dose

5.2.3.3. Injectable Dose

5.2.4. Others (Nutritional Products and Packaging)

5.3. Global European Pharmaceutical Contract Manufacturing Market, By Route of Administration

5.3.1. Oral

5.3.2. Inhaled

5.3.3. Parenteral

5.3.4. Others (Rectal and Vaginal)

5.4. Global European Pharmaceutical Contract Manufacturing Market, By Services

5.4.1. R&D

5.4.2. Manufacturing

5.4.3. Non-Clinical Service Such as Supply Chain Management

6. Regional Analysis

6.1. Europe

6.1.1. UK

6.1.2. Germany

6.1.3. Italy

6.1.4. Spain

6.1.5. France

6.1.6. Russia

6.1.7. Rest of Europe

7. Company Profiles

7.1. AenovaGroup

7.2. Almac Group Ltd.

7.3. Aurena Laboratories AB

7.4. Baxter Healthcare Corp.

7.5. Beltapharm S.p.A

7.6. Boehringer Ingelheim International GmbH

7.7. Catalent Inc.

7.8. Cenexi SAS

7.9. CordenPharma International GmbH

7.10. Delorbis Pharmaceuticals Ltd.

7.11. Delpharm SAS

7.12. Esteve Química SA

7.13. Ever Neuro Pharma GmbH

7.14. Evonik Industries AG

7.15. Famar SA

7.16. Galena Pharma Oy

7.17. Gebro Pharma GmbH

7.18. GlaxoSmithKline PLC

7.19. Jubilant Life Sciences Ltd.

7.20. Lonza Group

7.21. NextPharma TechnologiesHolding Ltd.

7.22. Novozymes A/S

7.23. Onyx Scientific Ltd.

7.24. Patheon Inc.

7.25. ProBioGen AG

7.26. Pfizer CentreOne (Pfizer Inc.)

7.27. Recipharm AB (publ)

7.28. Samedan Ltd.

7.29. Saneca Pharmaceuticals AS

7.30. SOPHARMA AD

7.31. Venus Pharma GmbH

7.32. Vetter Pharma International GmbH

7.33. Wacker Biotech GmbH

1. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY MANUFACTURING PROCESS TYPE, 2020-2027 ($ MILLION)

2. EUROPEAN STERILE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

3. EUROPEAN NON-STERILE MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

4. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYPRODUCT TYPE, 2020-2027 ($ MILLION)

5. EUROPEAN OVER-THE-COUNTER (OTC) DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

6. EUROPEAN API MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

7. EUROPEAN FINISHED DOSAGE FORMULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. EUROPEAN OTHERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

9. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2020-2027 ($ MILLION)

10. EUROPEAN ORAL ADMINISTRATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

11. EUROPEAN INHALED ADMINISTRATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

12. EUROPEAN PARENTERAL ADMINISTRATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. EUROPEAN OTHERS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICE, 2020-2027 ($ MILLION)

15. EUROPEAN R&D MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. EUROPEAN NON-CLINICAL SERVICE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2020-2027 (%)

4. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY MANUFACTURING PROCESS TYPE, 2020 VS 2027 (%)

5. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

6. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY ROUTE OF ADMINISTRATION, 2020 VS 2027 (%)

7. EUROPEAN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE BY SERVICE, 2020 VS 2027 (%)

8. UK PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

9. FRANCE PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

10. GERMANY PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

11. ITALY PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

12. SPAIN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

13. ROE PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)