Indian Cardiology Market

Indian Cardiology Market Size, Share & Trends Analysis Report by Cardiology Device Types (Angioplasty, Cardiovascular Stents, Cardiovascular Catheters, Cardiac Rhythm Management, and Cardiovascular Assistive Devices) by Drugs Types (Antithrombotic Drugs, Antidyslipidemic Drugs, Antihypertensive Drugs, and Anti-Stroke Drugs) by Surgery Types (Coronary Artery Bypass Grafting, Transmyocardial Laser Revascularization, Heart Valve Repair, Arrhythmia Treatment, Aneurysm Repair, and Heart Transplant) Forecast, 2021-2028 Update Available - Forecast 2024-2030

The Indian cardiology market is anticipated to grow at a significant CAGR during the forecast period(2021-2028). The market is growing rapidly due to improving quality and operation standards in the country, variation in the lifestyle and rising aging population which is attracting the investors to invest across the country. Cardiology is basically dealing with the disorders of the heart as well as parts of the circulatory system. in addition, it deals with the diseases and abnormalities of the heart. There are certain risk and causes of cardiac problems which include high blood pressure and an increase in stress level at younger age obesity. Cardiovascular devices in the Indian market are beneficial in technological advancements and low-cost medication which are dominated by domestic manufacturers. These manufacturers are playing a vital role in the Indian market to grow it substantially as a medical giant to attract investors. Innovation should progress from developing new products to gain an advantage over such products more efficiently with new innovative techniques and business models.

There are other factors also which are boosting the market growth of the Indian market such as R&D, growing cardiac healthcare units in the country and rise in domestic industries to compete with multinationals. Rising diagnostic centers across the globe, investment from the government and private players have bolstered the market growth. Moreover, rising medical tourism and increasing awareness among the society regarding the heart-related diseases are creating an opportunity for Indian cardiology market to grow. India being on a preference list is the perfect destination for the healthcare services, especially for cardiac surgery.

Impact of COVID-19 Pandemic on Indian Cardiology Market

As the global burden of COVID-19 continues to increase, particularly in low and middle-income countries such as India, it imposes huge costs on individuals, communities, health systems, and economies. The impact of COVID-19 on the Indian market has been negative due to deferral in elective cardiovascular procedures in the region, as the number of hospital visits declined. People with chronic conditions are disproportionately prone to COVID-19–related hospitalizations, intensive care admissions, and mortality compared to those without chronic conditions.The spread of COVID-19 in India is of great concern due to the country’s large and densely populated areas with widespread poverty and high migration rates, coupled with a high prevalence of chronic conditions. As per, Clinical Epidemiology and global health, In India the number of people with total CVD nearly doubled from 271 million in 1990 to 523 million in 2019, and deaths due to CVD climbed significantly from 12.1 million in 1990 to 18.6 million in 2019.

Segmental Outlook

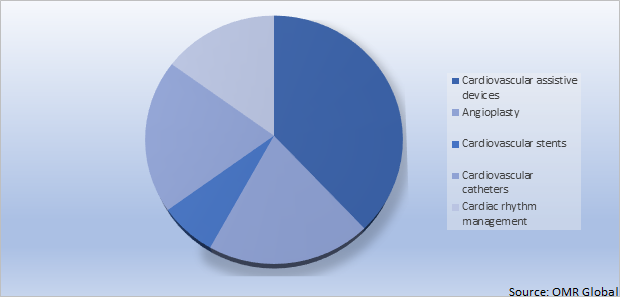

The Indian cardiology market is segmented based on the cardiology device types, drug types, and surgery types. Based on cardiology device types, the market is sub-segmented into angioplasty, cardiovascular stents, cardiovascular catheters, cardiac rhythm management, and cardiovascular assistive devices. Based on drug types the market is bifurcated into, antithrombotic drugs, antidyslipidemic drugs, antihypertensive drugs, and anti-stroke drugs. Based on surgery types, the market is sub-segmented into coronary artery bypass grafting, transmyocardial laser revascularization, heart valve repair, arrhythmia treatment, aneurysm repair, and heart transplant. Based on cardiology device types, the cardiovascular catheters segment is expected to grow at the fastest rate, owing to its wider benefits for the treatment of heart related diseases. The cardiovascular catheters are majorly used for the treatment of cardiovascular diseases, and coronary artery diseases, as the cardiovascular catheter procedure opened up the blockage of coronary arteries, which increases the flow of blood from the heart to other parts of the body.

Indian Cardiology Market Share by Cardiology Surgery Type, 2021 (%)

The Cardiovascular Assistive Devices is the Major Contributor for the Growth of the Market

Based on the cardiology surgery type, the cardiovascular assistive devices segment has shown stagnant growth during the forecast period. The demand for cardiovascular assistive devices has increased, as these devices help to treat congestive heart patients by enhancing the pumping efficiency of the heart and helps in maintaining the optimal amount of blood flow throughout the body and requiring no mechanical bearings. Moreover, cardiovascular assistive devices promote assistance until the heart recovers after the transplantation, and it is proven to be a long-term device. Owing to the rise in the need to increase the survival rate is elevating the growth of the segment.

Market Players Outlook

The prominent players contributing in the Indian cardiology market Boston Scientific Corp., Bristol-Myers Squibb Co., Cook Group Inc., F. Hoffmann-La Roche Ltd., GE Healthcare, Johnson and Johnson Inc.

Medtronic PLC, and others. These key manufacturers are adopting various strategies like new product launches, mergers and acquisitions, partnerships and collaborations, and many others to thrive in a competitive environment. For instance, in April 2022, Dr.Reddy has agreed with Novartis AG to acquire its cardiovascular brand Cidmus in India. Cidmus is an addition to the company’s portfolio in the cardiovascular segment alongside its brands including Stamlo, Reclide-XR, and Reclimet-XR. Moreover, cidmus comprises a combination of Valsartan and Sacubitril which reduces the ejection fraction for heart failure patients.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the Indian cardiology market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Indian Cardiology Market

• Recovery Scenario of Indian Cardiology Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key CompanyAnalysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Indian Cardiology Market by Cardiology Device Types

5.1.1. Angioplasty

5.1.2. Cardiovascular Stents

5.1.3. Cardiovascular Catheters

5.1.4. Cardiac Rhythm Management

5.1.5. Cardiovascular Assistive Devices

5.2. Indian Cardiology Market by Drugs Types

5.2.1. Antithrombotic Drugs

5.2.2. Antidyslipidemic Drugs

5.2.3. Antihypertensive Drugs

5.2.4. Anti-Stroke Drugs

5.3. Indian Cardiology Market by Surgery Types

5.3.1. Coronary Artery Bypass Grafting

5.3.2. Transmyocardial Laser Revascularization

5.3.3. Heart Valve Repair

5.3.4. Arrhythmia Treatment

5.3.5. Aneurysm Repair

5.3.6. Heart Transplant

6. Company Profiles

6.1. Abbott Laboratories Inc.

6.2. Bayer AG

6.3. Boston Scientific Corp.

6.4. Bristol-Myers Squibb Co.

6.5. Cook Group Inc.

6.6. F. Hoffmann-La Roche Ltd.

6.7. GE Healthcare

6.8. Johnson and Johnson Inc.

6.9. Medtronic PLC

6.10. Meril Life Sciences Pvt. Ltd.

6.11. Novartis International AG

6.12. Pfizer Inc.

6.13. Pinnacle Biomed Pvt. Ltd.

6.14. Sanofi SA

6.15. St. Jude Medical, Inc.

6.16. Takeda Pharmaceutical Co. Ltd.

6.17. Teleflex Inc.

6.18. Trivitron Healthcare

1. INDIAN CARDIOLOGY MARKET RESEARCH AND ANALYSIS BY CARDIOLOGY DEVICE TYPES, 2021-2028($ MILLION)

2. INDIAN CARDIOLOGY DEVICE FOR ANGIOPLASTY MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

3. INDIAN CARDIOLOGY DEVICE FOR CARDIOVASCULAR STENTS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

4. INDIAN CARDIOLOGY DEVICE FOR CARDIOVASCULAR CATHETERSMARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

5. INDIAN CARDIOLOGY DEVICE FOR CARDIAC RHYTHM MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

6. INDIAN CARDIOLOGY DEVICE FOR CARDIOVASCULAR ASSISTIVE MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

7. INDIAN CARDIOLOGY MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2021-2028($ MILLION)

8. INDIAN ANTITHROMBOTIC DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

9. INDIAN ANTIDYSLIPIDEMIC DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

10. INDIAN ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

11. INDIAN ANTI-STROKE DRUGS MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

12. INDIAN CARDIOLOGY MARKET RESEARCH AND ANALYSIS BY SURGERY TYPE, 2021-2028($ MILLION)

13. INDIAN CORONARY ARTERY BYPASS GRAFTING MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

14. INDIAN TRANSMYOCARDIAL LASER REVASCULARIZATION MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

15. INDIAN HEART VALVE REPAIR MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

16. INDIAN ARRHYTHMIA TREATMENT MARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

17. INDIAN NEURYSM REPAIRMARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

18. INDIAN HEART TRANSPLANTMARKET RESEARCH AND ANALYSIS, 2021-2028($ MILLION)

1. IMPACT OF COVID-19 ON INDIAN CARDIOLOGY MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON INDIAN CARDIOLOGY MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF INDIAN CARDIOLOGY MARKET, 2021-2028 (%)

4. INDIAN CARDIOLOGY MARKET SHARE BY CARDIOLOGY DEVICES TYPES, 2021 VS 2028 (%)

5. INDIAN CARDIOLOGY DEVICE FOR ANGIOPLASTY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. INDIAN CARDIOLOGY DEVICE FOR CARDIOVASCULAR STENTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. INDIAN CARDIOLOGY DEVICE FOR CARDIOVASCULAR CATHETERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. INDIAN CARDIOLOGY DEVICE FOR CARDIAC RHYTHM MANAGEMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. INDIAN CARDIOLOGY DEVICE FOR CARDIOVASCULAR ASSISTIVE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. INDIAN CARDIOLOGY MARKET SHARE BY DRUG TYPE, 2021 VS 2028 (%)

11. INDIAN ANTITHROMBOTIC DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. INDIAN ANTIDYSLIPIDEMIC DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. INDIAN ANTIHYPERTENSIVE DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. INDIAN ANTI-STROKE DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. INDIAN CARDIOLOGY MARKET SHARE BY SURGERY TYPE, 2021 VS 2028 (%)

16. INDIAN CORONARY ARTERY BYPASS GRAFTING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. INDIAN TRANSMYOCARDIAL LASER REVASCULARIZATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. INDIAN HEART VALVE REPAIR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. INDIAN ARRHYTHMIA TREATMENT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20. INDIAN ANEURYSM REPAIR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21. INDIAN HEART TRANSPLANT MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)