Type 1 Diabetes Market

Global Type 1 Diabetes Treatment Market Size, Share & Trends Analysis Report By Insulin Analog (Rapid-Acting, Long-Acting, and Premix), By Drug Class (Insulin and Non-Insulin), By Devices (Insulin Pumps, Insulin Pen, Blood Glucose Meters, and Others) Forecast, 2021-2027

The global type 1 diabetes treatment market is growing at a CAGR 7.8% during the forecast period (2021-2027). According to the National Institutes of Health, in 2020, the incidence of Type 1 diabetes was 15 per 100,000 people and the prevalence was around 9.5% of the total number of diabetes cases across the globe. The factors that contribute to the market growth are the rise in the level of obesity, lack of physical activity, and rise in the geriatric population. It is seen that adults with type 1 diabetes and overweight or obesity are more susceptible to cardiovascular disease. Moreover, family history of diabetes also plays a major role as according to the reports of the Centers for Diabetes Control and Preventions (CDC), one is likely to get diabetes if one’s family has one. In addition to this, consumption of an unhealthy diet and an increase in the prevalence of diabetes are some of the other factors that drive the growth of market.

However, inadequate funding and staff numbers in the undeveloped economy, high cost of the diagnosis and treatment, and complications with insulin for certain people are some of the constraints that are estimated to hamper the growth of the market in the forecast period. Besides, strict approvals process are expected to hinder the market growth. Conversely, government initiatives to control rising cases of diabetes and technological advancement are the opportunities estimated for the market players. For instance, in December 2020, Procyon Technologies LLC and Novo Nordisk A/S announced their collaboration on the development of stem-cell-based therapy which is then to be used in Novo Nordisk's development of a novel therapy for Type 1 diabetes.

COVID-19 impact on Global Type 1 Diabetes Treatment Market

The global type-1 diabetes treatment market is hardly hit by the COVID-19 pandemic since December 2019. The outbreak of COVID-19 in these major economies has disrupted the manufacturing and supply of raw materials across the globe. This has resulted in a low supply of the products even due to a rise in diabetes cases because of lockdown. During COVID-19 pandemic, according to the American Diabetes Association (ADA), there was insufficient data to prove if persons with diabetes are more likely to become infected with COVID-19 nonetheless, those with diabetes have worse outcomes, such as greater rates of significant problems. However, the market is estimated to grow in a forecast period as people with diabetes are at higher risk of getting COVID-19 infection. The type-1 diabetes treatment industry is estimated to have a “W” shaped recovery in the forecast period.

Segmental Outlook

The market is segmented based on insulin analog, drug class, and devices. Based on the insulin analog segment, the market is segmented into rapid-acting, long-acting, and premix. Based on the drug class segment, the market is segmented into insulin and non-insulin. The insulin type segment held a considerable share in the drug class segment. When the blood sugar level is not normal it is necessary for people suffering from type 1 diabetes disease to take insulin rather than other drugs. According to the American Action Forum, around 8.3 million people require insulin to regulate blood glucose levels in the US. Around 22% of the US population was dependent on insulin for the control of diabetes. Moreover, it is estimated that the use of insulin will increase by 20% by 2030 across the globe. Further, based on the devices segment, the market is segmented into insulin pumps, insulin pens, blood glucose meters, and others.

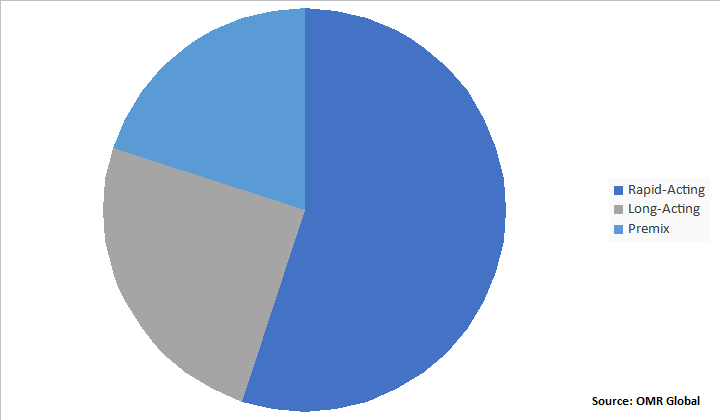

Global Type 1 Diabetes Treatment Market Share by Insulin Analog, 2020 (%)

Rapid-Acting Segment to Hold a Lucrative Share in the Global Type 1 Diabetes Treatment market

Amongst the insulin analog segment of the global type 1 diabetes treatment market, the rapid-acting insulin held a significant share in in 2020. This mainly due to the ability of insulin to work quickly and is used commonly before a start of a meal. These types of insulin also come in a form that can be inhaled through the mouth. Rapid-acting insulins can also be used in pumps but are generally costly. Insulin pumps had a significant share in 2020 in a device segment. According to the article published by the Endocrine Society, around 20% of insulin users wear an insulin pump.

Regional Outlook

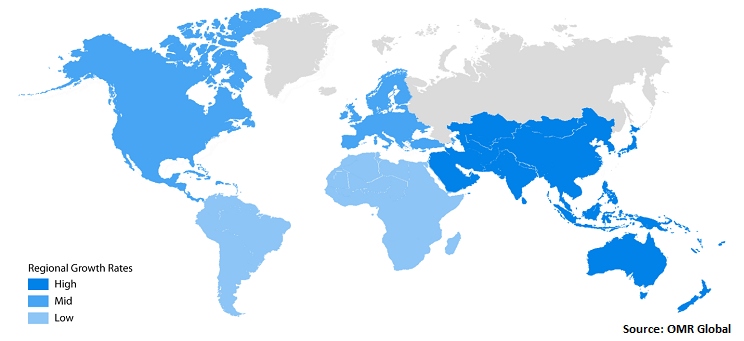

The global type 1 diabetes treatment market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. Based on the geography, the market is bifurcated into North America (the US and Canada), Europe (Germany, Spain, Italy, France, the UK, and the Rest of Europe), Asia-Pacific (India, China, Japan South Korea, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East and Africa, and Latin America). North America is estimated to have one of the major shares in the type 1 diabetes treatment market. High prevalence of cancer diseases, investment in R&D in the US, regulatory approvals by FDA and CE for commercial use of these type 1 diabetes treatment tests, and improved healthcare infrastructure are some of the factors that contribute to the growth of the market in this region. According to the IDF (International Diabetes Federation), in 2019, the total adult population in the US with diabetes was 31.0 million while in Canada was 2.8 million. The US has the largest population of children and adolescents with type 1 diabetes (175,900).

Global Type 1 Diabetes Treatment Market Growth, by Region 2020-2026

Asia-Pacific is projected to highest Contributor to the growth of the Global Type 1 Diabetes Treatment Market

Asia-Pacific is anticipated to the fastest-growing region in the global type 1 diabetes treatment market. This is due to the rise in awareness about the diagnosis and treatment for diabetes within emerging economies like India and China and government checks on the rising level of diabetic patients. Further, there is growth in commitment to research, design, production, and a rise in awareness among people in the region backed by various government initiatives. According to the National Institutes of Health, in 2020, the incidences of the diabetes was 15 per 100,000 people in region are living with Type 1 diabetes and prevalence per 10,000 was around 9.6.

Market Players Outlook

Key players of the type 1 diabetes treatment market include Abbott Laboratories, Merck & Co., Inc., Novo-Nordisk A/S, Sanofi S.A., Medtronic PLC, AstraZeneca, PLC, F. Hoffmann-La Roche Ltd, and Becton, Dickinson, and Co, among others. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion so on. In August 2020, Medtronic PLC announced the acquisition of privately-held Companion Medical. The Medical company was a manufacturer of InPen which was the only insulin pen to date which got FDA approval. With this acquisition, Medtronic aims to expand the company’s ability to serve people where they are in their diabetes journey.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global type 1 diabetes treatment market based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Type 1 Diabetes Treatment Industry

• Recovery Scenario of Global Type 1 Diabetes Treatment Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Abbott Laboratories

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. AstraZeneca PLC

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Bayer AG

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Eli-Lilly and Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. F-Hoffman La Roche Ltd.

3.1.6. Overview

3.1.7. Financial Analysis

3.1.8. SWOT Analysis

3.1.9. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Type 1 Diabetes Treatment Market by Insulin Analog

5.1.1. Rapid-Acting

5.1.2. Long-Acting

5.1.3. Premix

5.2. Global Type 1 DiabetesTreatment Market by Drug Class

5.2.1. Insulin

5.2.2. Non-Insulin

5.3. Global Type 1 Diabetes Treatment Market by Devices

5.3.1. Insulin Pumps

5.3.2. Insulin Pen

5.3.3. Blood Glucose Meters

5.3.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. AstraZeneca, PLC

7.3. F. Hoffmann-La Roche Ltd

7.4. Eli Lilly and Co.

7.5. Astellas Pharma Inc.

7.6. Becton, Dickinson and Co.

7.7. Boehringer Ingelheim International GmbH.

7.8. Bristol-Myers Squibb

7.9. Dexcom, Inc.

7.10. GlaxoSmithKline Plc

7.11. Medtronic, PLC

7.12. Merck & Co., Inc.

7.13. Novartis International AG

7.14. Novo-Nordisk A/S

7.15. Sanofi S.A.

7.16. Takeda Pharmaceutical, Ltd.

7.17. Tandem Diabetes Care, Inc.

7.18. ViaCyte, Inc.

7.19. Welldoc, Inc.

1. GLOBAL TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLIONS)

2. GLOBAL TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY INSULIN ANALOG, 2020-2027 ($ MILLION)

3. GLOBAL RAPID-ACTING INSULIN ANALOG FOR TYPE-1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

4. GLOBAL LONG-ACTING INSULIN ANALOG FOR TYPE-1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

5. GLOBAL PREMIX INSULIN ANALOG FOR TYPE-1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

6. GLOBAL TYPE 1 DIABETES TREATMENT MARKET AND RESEARCH ANALYSIS BY DRUG CLASS BY REGION, 2020-2027 ($ MILLIONS)

7. GLOBAL INSULIN FOR TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

8. GLOBAL NON-INSULIN FOR TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

9. GLOBAL TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DEVICES, 2020-2027 ($ MILLIONS)

10. GLOBAL INSULIN PUMPS FOR TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2017-20223 ($ MILLIONS)

11. GLOBAL INSULIN PEN FOR TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027($ MILLIONS)

12. GLOBAL BLOOD GLUCOSE MONITORS FOR TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

13. GLOBAL OTHERS DEVICES FOR TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLIONS)

14. NORTH AMERICAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLIONS)

15. NORTH AMERICAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY INSULIN ANALOG, 2020-2027 ($MILLIONS)

16. NORTH AMERICAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2020-2027 ($MILLIONS)

17. NORTH AMERICAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DEVICES, 2020-2027 ($MILLIONS)

18. EUROPEAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLIONS)

19. EUROPEAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY INSULIN ANALOG, 2020-2027 ($MILLIONS)

20. EUROPEAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2020-2027 ($MILLIONS)

21. EUROPEAN TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DEVICES, 2020-2027 ($MILLIONS)

22. ASIA-PACIFIC TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLIONS)

23. ASIA-PACIFIC TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY INSULIN ANALOG, 2020-2027 ($MILLIONS)

24. ASIA-PACIFIC TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2020-2027 ($MILLIONS)

25. ASIA-PACIFIC TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DEVICES, 2020-2027 ($MILLIONS)

26. REST OF THE WORLD TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DEVICES, 2020-2027 ($MILLIONS)

27. REST OF THE WORLD TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY INSULIN ANALOG, 2020-2027 ($MILLIONS)

28. REST OF THE WORLD TYPE 1 DIABETES TREATMENT MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2020-2027 ($MILLIONS)

1. IMPACT OF COVID-19 ON GLOBAL TYPE 1 DIABETES TREATMENT MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL TYPE 1 DIABETES TREATMENT MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL TYPE 1 DIABETES TREATMENT MARKET, 2020-2027 (%)

4. GLOBAL TYPE 1 DIABETES TREATMENT MARKET SHARE BY INSULIN ANALOG,2020 VS 2027, (IN %)

5. GLOBAL TYPE 1 DIABETES TREATMENT MARKET SHARE BY DRUG CLASS, 2020 VS 2027, (IN %)

6. GLOBAL TYPE 1 DIABETES TREATMENT MARKET SHARE BY DEVICES, 2020 VS 2027, (IN %)

7. GLOBAL TYPE 1 DIABETES TREATMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027, (IN %)

8. GLOBAL RAPID-ACTING INSULIN ANALOG FOR TYPE-1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

9. GLOBAL LONG-ACTING INSULIN ANALOG FOR TYPE-1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%))

10. GLOBAL PREMIX INSULIN ANALOG FOR TYPE-1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

11. GLOBAL INSULIN FOR TYPE 1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

12. GLOBAL NON-INSULIN FOR TYPE 1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

13. GLOBAL INSULIN PUMPS FOR TYPE 1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

14. GLOBAL INSULIN PEN FOR TYPE 1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

15. GLOBAL BLOOD GLUCOSE METERS FOR TYPE 1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

16. GLOBAL OTHER DEVICES FOR TYPE 1 DIABETES TREATMENT MARKET SHARE BY REGION, 2020 VS 2027(%)

17. US TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

18. CANADA TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

19. UK TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

20. FRANCE TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

21. GERMANY TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

22. ITALY TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

23. SPAIN TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

24. ROE TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

25. INDIA TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

26. CHINA TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

27. JAPAN TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

28. SOUTH KOREA TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

29. ROAPAC TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)

30. REST OF THE WORLD TYPE 1 DIABETES TREATMENT MARKET SIZE, 2020-2027 ($MILLIONS)