Acoustic Insulation Market

Global Acoustic Insulation Market Size, Share & Trends Analysis Report, By Type (Mineral Wool, Foamed Plastics, and Others), By End-Use Industry (Building & Construction, Transportation, and Manufacturing & Processing) and Forecast, 2019-2025

The global acoustic insulation market is estimated to grow at a CAGR of 5.4% during the forecast period. The major factors contributing to the market growth include a significant rise in the construction sector and rapid industrialization across the globe. Rising investment in the construction sector has been witnessed coupled with the increasing demand for residential and commercial construction. As per the US Census Bureau, in the US, in February 2020, building permits for privately?owned residential units were 1,464,000, which is 13.8% more than the rate of 1,287,000 in February 2019.

As per the Statistics Canada, total investment in the construction of buildings in Canada reached $15.6 billion in September 2019, increased 1.0% from August 2019. The construction investment has witnessed rise for both residential and non-residential construction with 1.2% and 0.4%, respectively. Total investment increased 2.4% from the second quarter to the third quarter. With the increasing construction sector, there is an emerging demand for acoustic insulation materials to prevent sound from being transmitted in buildings. In the design stage of buildings, an accurate preliminary study based on acoustic conditions is required in certain countries. In several countries, there are specific national regulations with particular needs in terms of sound insulation in the building.

As a result, builders need to follow the minimum insulation requirements set by the government. These requirements are associated with the behavior of buildings towards the sound coming from the outside or adjacent houses, as well as direct noise transmission among different rooms of the same residential unit. The acoustic performance of the buildings is normally subjected to several international technical standards. These regulations include ISO 140-5, ISO 140-4, and ISO 140-7. These standards allow the sound insulation measurement of building elements and in buildings.

In addition, it offers the parameters suitable to every topology of noise insulation and the way they have to measure on-site or during the design phase. Increasing noise pollution has increased the need for buildings that restrict the sound to come inside and create a disturbance. Therefore, acoustic insulation is playing a vital role in the construction sector. The market has considerable opportunity owing to the increasing demand for next-generation vehicles, including electric vehicles, hybrid vehicles, and self-driving vehicles with lightweight and improved acoustic properties.

Market Segmentation

The global acoustic insulation market is segmented based on the type and end-use industry. Based on type, the market is classified into mineral wool, foamed plastics, and others. Based on end-use industry, the market is classified into building & construction, transportation, and manufacturing & processing. Acoustic insulation is being significantly adopted in the transportation industry during the forecast period. Vehicles are the major source of noise pollution and therefore, the government implemented noise regulations to reduce traffic noise that affects human health.

In the US, The Noise Control Act of 1972 aims to encourage an environment free from noise that put at risk the health and welfare of Americans. Under the act, the main causes of noise comprise transportation vehicles and equipment, appliances, and machinery. Additionally, increasing demand for electric vehicles is expected to drive the demand for acoustic insulation materials as it contains lightweight, high-strength, and noise absorbing properties.

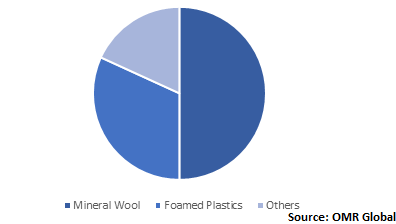

Mineral wool holds significant share in type segment

In 2018, mineral wool held the largest share in the application segment owing to the rising demand for glass and stone wool. The acoustic mineral wool density tends to be highly efficient as compared to several alternate techniques for sound control. It is considered as the ideal solution for adding potential soundproofing control in buildings. It is the optimal eco- friendly sound absorber which is being significantly utilized in buildings to deliver thermal, acoustic, and fire insulation properties. It supports considerable sound absorption while implemented into the cavities of walls, floors, and ceilings.

Global Acoustic Insulation Market Share by Type, 2018 (%)

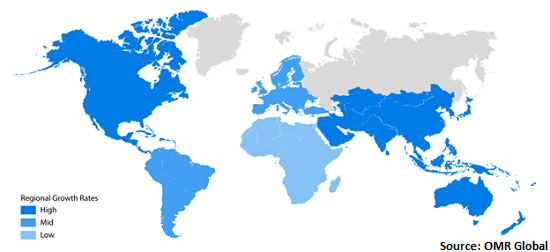

Regional Outlook

The global acoustic insulation market is classified into North America, Europe, Asia-Pacific, and Rest of the World (RoW). Asia-Pacific is estimated to witness considerable growth during the forecast period owing to the significant rise in the construction industry and growing industrialization coupled with the government initiatives to boost the manufacturing sector and increasing Foreign Direct Investment (FDI) in the manufacturing sector. This is expected to contribute to the demand for industrial construction, which increases the need for noise protection materials during the construction of industries.

There is a strict pollution control regulation (water, air, and noise) in the region. For instance, Under the Law of the People's Republic of China on the Prevention and Control of Environmental Noise Pollution, the release of industrial noise to the nearby environment across the urban districts shall follow to the border environmental noise discharge standards as established by the state for industrial enterprises. Therefore, strict environmental regulations are expected to drive the adoption of acoustic insulation materials in the region.

Global Acoustic Insulation Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include Owens Corning, BASF SE, Compagnie de Saint-Gobain S.A., Kingspan Group plc, and Rockwool International A/S. These market players are constantly focusing on gaining major market share by adopting mergers & acquisitions, geographical expansion, product launch, and partnerships and collaborations. For instance, in May 2019, Compagnie de Saint-Gobain S.A. acquired Pritex, a provider of acoustic and thermal insulation solutions. Pritex solutions are produced from polymer-based composite materials, which aims for the mobility market. The increasing production of electric vehicles has increased the demand for different noise control and lightweight solutions. Pritex has expertise in thermo-acoustic insulation materials and design for the automotive industry and has a strong presence in Europe. With this acquisition, Saint-Gobain will further accelerate its Saint-Gobain High-Performance Solutions (Mobility business unit).

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global acoustic insulation market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Owens Corning

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. BASF SE

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Compagnie de Saint-Gobain S.A.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Kingspan Group plc

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Rockwool International A/S

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Acoustic Insulation Market by Type

5.1.1. Mineral Wool

5.1.1.1. Glass Wool

5.1.1.2. Stone Wool

5.1.1.3. Slag Wool

5.1.2. Foamed Plastics

5.1.3. Others (Aerogel and Cellulose Acetate)

5.2. Global Acoustic Insulation Market by End-Use Industry

5.2.1. Building & Construction

5.2.2. Transportation

5.2.2.1. Automotive

5.2.2.2. Aerospace

5.2.2.3. Marine

5.2.2.4. Railways

5.2.3. Manufacturing & Processing

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Armacell International S.A.

7.3. Autoneum Holding AG

7.4. BASF SE

7.5. Blachford UK Ltd.

7.6. Cellecta Ltd.

7.7. Compagnie de Saint-Gobain S.A.

7.8. Fletcher Building Ltd.

7.9. Huntsman Corp.

7.10. Hush Acoustics

7.11. International Cellulose Corp. (ICC)

7.12. Johns Manville

7.13. KCC Corp.

7.14. Kingspan Group plc

7.15. Knauf Insulation Sprl

7.16. LANXESS AG

7.17. Marves Industries

7.18. Owens Corning

7.19. Rockwool International A/S

7.20. Trelleborg Retford Ltd.

7.21. Trocellen GmbH

7.22. URSA Insulation SA

1. GLOBAL ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL MINERAL WOOL ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL FOAMED PLASTIC ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL OTHER ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

6. GLOBAL ACOUSTIC INSULATION IN BUILDING & CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ACOUSTIC INSULATION IN TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL ACOUSTIC INSULATION IN MANUFACTURING & PROCESSING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

13. EUROPEAN ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

19. REST OF THE WORLD ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD ACOUSTIC INSULATION MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL ACOUSTIC INSULATION MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL ACOUSTIC INSULATION MARKET SHARE BY END-USE INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL ACOUSTIC INSULATION MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ACOUSTIC INSULATION MARKET SIZE, 2018-2025 ($ MILLION)