Aerospace Antimicrobial Coatings Market

Global Aerospace Antimicrobial Coatings Market Size, Share & Trends Analysis Report, by Sales Channel (OEM and Aftermarket), by End-User (Commercial and Defense) and Forecast, 2020-2026

The global aerospace antimicrobial coatings market is estimated to grow at a CAGR of 5.2% during the forecast period. The major factors encouraging the growth of the market include the rising focus on passengers’ health and increasing aircraft deliveries in both commercial and military fields. In 2019, Airbus handed more than 863 jets and Boeing delivered 380 aircraft. This leads to increasing demand for aerospace antimicrobial coatings to protect against contagious diseases. The rising prevalence of COVID-19 is further leading to increasing demand for antimicrobial coatings in aircraft. For instance, in September 2020, United Airlines Holdings, Inc. declared that it would include an antimicrobial coating to the airline's cleaning and safety procedures for protection against the COVID-19.

It is applying the coating every week on over 30 aircraft and anticipates adding a new measure to its whole fleet before the end of 2020. BioX Pro, a subsidiary of BioX Group offers protective coatings to the transportation industry and its users. Bus terminals, airports, trains, subway, as well as buses, airplanes, and train cars are dependent on a durable protective shield to maintain the safety of their staff and travelers. Several antimicrobial coatings are available for protection against microbial infection. One of the antimicrobial coatings includes BioX Pro which is a highly engineered coating that combines a strong antimicrobial, antiviral, and antifungal additive.

Market Segmentation

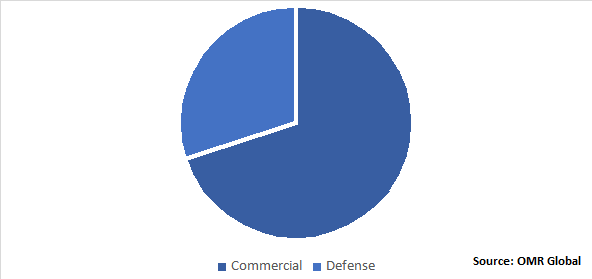

The global aerospace antimicrobial coatings market is segmented based on the sales channel, and end-user. Based on the sales channel, the market is classified into OEM and aftermarket. Based on end-user, the market is classified into commercial and defense.

Commercial Aircraft to Witness Potential Share in the End-User Segment

In 2019, commercial aircraft are expected to witness a significant share owing to the increasing focus on passengers’ safety in airplanes. Boeing is one of the major commercial aircraft manufacturers that are continuously working on research and assess new technologies to increase safety, which include antimicrobial coatings for high-touch surfaces and ultraviolet light disinfecting systems. Boeing is working with learning institutions, academics, and health experts globally to field studies and support research to minimize the potential of COVID-19 transmission on airplanes. To prevent the spread of COVID-19, several airlines are applying antimicrobial coatings for the protection of surfaces in airplanes.

For instance, in March 2020, Constant Aviation, Maintenance, Repair, and Overhaul (MRO) company in the US, declared Flexjet as the first aircraft operator that has treated its whole fleet with an antimicrobial shield product, MicroShield 360. With its whole fleet of over 160 aircraft, Flexjet has been treated with the use of an electrostatic application process. MicroShield 360 is an FDA-approved, Environmental Protection Agency (EPA)-registered, antimicrobial coating system that claims to kill 99.99% of bacteria. Constant Aviation is an aircraft MRO certified to apply the treatment in commercial and private airline aircraft cabins.

Global Aerospace Antimicrobial Coatings Market Share by End-User, 2019 (%)

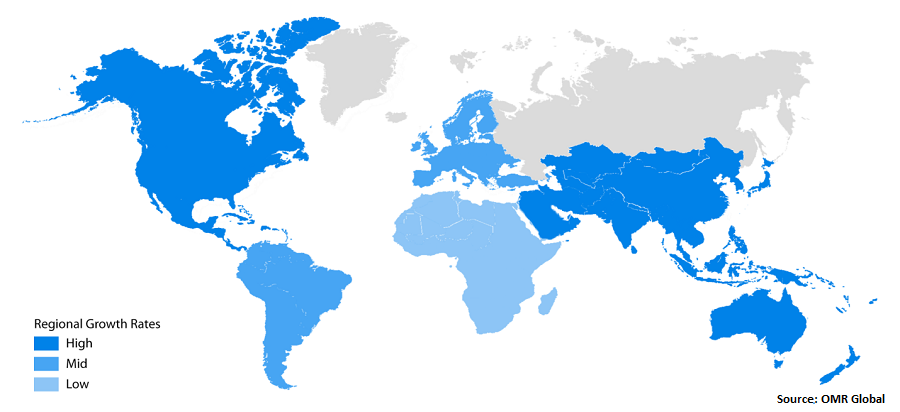

Regional Analysis

Geographically, in 2019, North America is anticipated to hold a potential share in the market owing to the significant presence of major aircraft manufacturers and the rising demand for advanced military aircraft in the region. Boeing Inc. and Cessna Aircraft Co. are some key aircraft manufacturers that operate in the region. Additionally, the US is the largest military spenders across the globe. Military spending by the US increased by 5.3% to $732 billion in 2019 and represented 38% of global military spending. This results in an increasing demand for military aircraft in the region to offer an additional layer of protection against harmful microbes.

Global Aerospace Antimicrobial Coatings Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include BASF SE, PPG Industries, Inc., Sherwin-Williams Co., AkzoNobel N.V., and Mankiewicz Gebr. & Co. (Gmbh & Co. KG). Product launches and partnerships and collaborations are regarded as some potential strategies implemented by the market players to increase their position in the marketplace. For instance, in August 2020, Aereos, Inc., declared the first built-in antimicrobial high-touch components for aircraft interior cabins and lavatories. Such antimicrobial components offer longer protection against harmful microbes. It offers airlines to replace older parts with new parts that add protection layers at no incremental cost (and significantly less than OEMs). In response to the COVID-19, the company is also adding a range of antimicrobial coating solutions for the prevention of harmful microbes from transmitting on high-touch surfaces including arm caps and galley cart handles.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aerospace antimicrobial coatings market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. PPG Industries, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Sherwin-Williams Co.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. AkzoNobel N.V.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Mankiewicz Gebr. & Co. (Gmbh & Co. KG)

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Aerospace Microbial Coatings Market by Sales Channel

5.1.1. OEM

5.1.2. Aftermarket

5.2. Global Aerospace Microbial Coatings Market by End-User

5.2.1. Commercial

5.2.2. Defense

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aereos, Inc.

7.2. AkzoNobel N.V.

7.3. BASF SE

7.4. BioCote, Ltd.

7.5. Dunmore Corp.

7.6. Flora Coatings, LLC

7.7. Henkel AG & Co. KGaA

7.8. Hentzen Coatings, Inc.

7.9. Hexion, Inc.

7.10. Kastus Technologies

7.11. Mankiewicz Gebr. & Co. (GmbH & Co. KG)

7.12. Momentive Performance Materials, Inc.

7.13. Nano-Care Deutschland AG

7.14. Permagard Pty. Ltd.

7.15. Polymer Technologies, Inc.

7.16. PPG Industries, Inc.

7.17. Hydromer, Inc.

7.18. Sherwin-Williams Co.

1. GLOBAL AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

2. GLOBAL OEMAEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL AFTER MARKET AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

5. GLOBAL AEROSPACE MICROBIAL COATINGS FOR COMMERICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL AEROSPACE MICROBIAL COATINGS FOR DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

10. NORTH AMERICAN AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

11. EUROPEAN AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. EUROPEAN AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

13. EUROPEAN AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

17. REST OF THE WORLD AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

18. REST OF THE WORLD AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY SALES CHANNEL, 2019-2026 ($ MILLION)

2. GLOBAL AEROSPACE MICROBIAL COATINGS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

3. GLOBAL AEROSPACE MICROBIAL COATINGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD AEROSPACE MICROBIAL COATINGS MARKET SIZE, 2019-2026 ($ MILLION)