Agricultural Robots Market

Agricultural Robots Market Size, Share & Trends Analysis Report by Type (Driverless Tractors, Unmanned Aerial Vehicles (UAVs), Milking Robots, Automated Harvest Robots, Sorting and Packing Robots, Autonomous Weed Control and Others), and by Application (Planting & Seeding, Spraying, Milking, Monitoring & Surveillance, Harvest Management and Others), Forecast Period (2023-2030)

Agricultural robots market is anticipated to grow at a CAGR of 15.1% during the forecast period (2023-2030). The growing adoption of efficient and flexible robotic systems in agriculture is the key factor supporting the growth of the market globally. Feeding is one of the biggest costs on a dairy farm and, in addition, the most labor-intensive activity after milking. The new feed distribution robot helps to optimize the conversion of the roughage dry matter into milk. Hence, the market players are also focusing on introducing new feed distribution agricultural robot solutions that further bolster the market growth. For instance, in March 2023, DeLaval launched a new feed distribution robot as part of its total feeding solution. The range of DeLaval robots is now being expanded with an autonomous feed distribution robot – OptiWagon. The new robot is a module in its complete automated feeding solution, DeLaval Optimat™. This total feeding solution provides everything from weighing, cutting, and mixing to delivering the feed to the feed table.

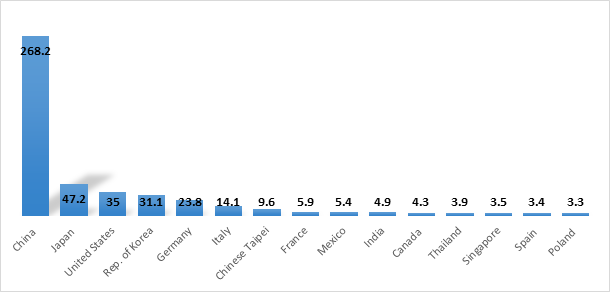

Annual Installation of Industrial Robots 15 largest markets 2021

Source: World Robotics 2022

According to the World Robotics Report, in 2021, there was an all-time high of 517,385 new industrial robots installed in factories around the globe, an increase of 31.0% compared with 2020. This brings the stock of operational robots around the globe to a new record of about 3.5 million units. By country, Asia remains the global largest market for industrial robots, with a share of 74.0% of all newly deployed robots in 2021. China, with a strong growth of 51.0% or 268,195 new units installed, is the country with the largest installation of industrial robots globally. This increase brings the stock of operational robots in China to the 1-million-unit mark. In second came Japan where installations were up 22.0% in 2021 with 47,182 new units. Japan is also the global predominant robot manufacturing country where exports of Japanese industrial robots achieved a new peak level of 186,102 units in 2021.

Segmental Outlook

The global agricultural robots market is segmented on the type and application. Based on the type, the market is sub-segmented into driverless tractors, unmanned aerial vehicles (UAVs), milking robots, automated harvest robots, sorting and packing robots, autonomous weed control, and others (planter robots, spray robots). Further, based on application, the market is sub-segmented into planting & seeding, spraying, milking, monitoring & surveillance, harvest management, and others (irrigation management). Among the applications, the planting & seeding sub-segment is anticipated to hold a considerable share of the market owing to the rise in the development of cost-efficient agricultural robots for crop seeding in agriculture fields.

The Autonomous Weed Control Sub-Segment is Anticipated to Hold a Considerable Share of the Global Agricultural Robots Market

Among the types, the autonomous weed control sub-segment is expected to hold a considerable share of the global agricultural robot market. The segmental growth is attributed to the growing influence of the weeding technologies, the robots utilize high-power lasers to eradicate weeds through thermal energy, without disturbing the soil. The automated robots allow farmers to use fewer herbicides and reduce labor to remove unwanted plants while improving the reliability and predictability of costs, crop yield, and more. For instance, in April 2021, Carbon Robotics, an autonomous robotics company, launched its third-generation autonomous weed elimination robots. The autonomous weeder leverages robotics, artificial intelligence (AI), and laser technology to safely and effectively drive through crop fields to identify, target, and eliminate weeds.

Regional Outlook

The global agricultural robots market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the growing demand for sustainable and precision farming practices in Asia-Pacific has driven the demand for precision agriculture tools such as autonomous tractors, drones, and robotic harvesters.

Global Agricultural Robots Market Growth, by Region 2023-2030

The North America Region is Expected to Grow at a Significant CAGR in the Global Agricultural Robots Market

Among all regions, the North American region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the adoption of agricultural robots and automation technologies to embrace efficiency gains and improved crop yields. The region benefits from a high level of access to advanced agricultural technologies. North America has a robust ecosystem of tech companies, research institutions, and innovation hubs focused on agriculture. This favorable environment fosters the development and adoption of innovative agricultural robotics solutions.

To provide farmers with an accessible and affordable solution that not only optimizes the farming industry but builds new productivity into the food supply chain at the point of harvest to push the industry into a new era of prosperity, ethical sourcing, and sustainability. For instance, in February 2021, Future Acres launched to bring sustainable agricultural robotics to the farm industry and optimize workforce efficiency and safety. AI, automation, and electrification technology streamlined the harvesting of specialty crops and increased production efficiency by up to 30.0% with improved working conditions.

Market Players Outlook

The major companies serving the agricultural robots market include Deere & Company, GEA Group AG, Lely Industries N.V., Yanmar Holdings Co., Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2021, Deere & Company signed a definitive agreement to acquire Bear Flag Robotics for $250 million. The deal accelerates the development and delivery of automation and autonomy on the farm and supports John Deere's long-term strategy to create smarter machines with advanced technology to support individual customer needs.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global agricultural robots market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. DeLaval, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Deere & Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. GEA Group AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Yanmar Holdings Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Agricultural Robots Market by Type

4.1.1. Driverless Tractors

4.1.2. Unmanned Aerial Vehicles (UAVs)

4.1.3. Milking Robots

4.1.4. Automated Harvest Robots

4.1.5. Sorting and packing Robots

4.1.6. Autonomous Weed Control

4.1.7. Others (Planter Robot, Spray Robot)

4.2. Global Agricultural Robots Market by Application

4.2.1. Planting & Seeding

4.2.2. Spraying

4.2.3. Milking

4.2.4. Monitoring & Surveillance

4.2.5. Harvest Management

4.2.6. Others (Irrigation Management)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AgJunction Inc.

6.2. Agrobot

6.3. Agro Intelligence A/S

6.4. Autonomous Solutions Inc.

6.5. Carbon Autonomous Robotic Systems, Inc.

6.6. Clearpath Robotics, Inc.

6.7. Ekobot AB

6.8. FANUC Corp.

6.9. Farming Revolution GmbH

6.10. Harvest Automation, Inc.

6.11. Harvest CROO Robotics, LLC

6.12. Lely Industries N.V.

6.13. Naio Technologies

6.14. OCTINION

6.15. Raven Industries, Inc.

6.16. Robotics Plus, Ltd.

6.17. Trimble Inc.

1. GLOBAL AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL AGRICULTURAL DRIVERLESS TRACTORS ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL AGRICULTURAL UNMANNED AERIAL VEHICLES (UAVS) ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AGRICULTURAL MILKING ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL AGRICULTURAL AUTOMATED HARVEST ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL AGRICULTURAL SORTING AND PACKING ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL AGRICULTURAL AUTONOMOUS WEED CONTROL ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL OTHERS AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

10. GLOBAL AGRICULTURAL ROBOTS FOR PLANTING & SEEDING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL AGRICULTURAL ROBOTS FOR SPRAYING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

12. GLOBAL AGRICULTURAL ROBOTS FOR MILKING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL AGRICULTURAL ROBOTS FOR MONITORING & SURVEILLANCE MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

14. GLOBAL AGRICULTURAL ROBOTS FOR HARVEST MANAGEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

15. GLOBAL AGRICULTURAL ROBOTS FOR OTHERS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

16. GLOBAL AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. NORTH AMERICAN AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. EUROPEAN AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. EUROPEAN AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

22. EUROPEAN AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

26. REST OF THE WORLD AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

27. REST OF THE WORLD AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL AGRICULTURAL ROBOTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022 VS 2030 (%)

2. GLOBAL AGRICULTURAL DRIVERLESS TRACTORS ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AGRICULTURAL UNMANNED AERIAL VEHICLES (UAVS) ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL AGRICULTURAL MILKING ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL AGRICULTURAL AUTOMATED HARVEST ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL AGRICULTURAL SORTING AND PACKING ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL AGRICULTURAL AUTONOMOUS WEED CONTROL ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL OTHERS AGRICULTURAL ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL AGRICULTURAL ROBOTS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

10. GLOBAL AGRICULTURAL ROBOTS FOR PLANTING AND SEEDING MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL AGRICULTURAL ROBOTS FOR SPRAYING MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL AGRICULTURAL ROBOTS FOR MILKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL AGRICULTURAL ROBOTS FOR MONITORING & SURVEILLANCE MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL AGRICULTURAL ROBOTS FOR HARVEST MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL AGRICULTURAL ROBOTS FOR OTHERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL AGRICULTURAL ROBOTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. US AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

19. UK AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

30. LATIN AMERICA AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)

31. MIDDLE EAST AND AFRICA AGRICULTURAL ROBOTS MARKET SIZE, 2022-2030 ($ MILLION)