AI-enabled Testing Market

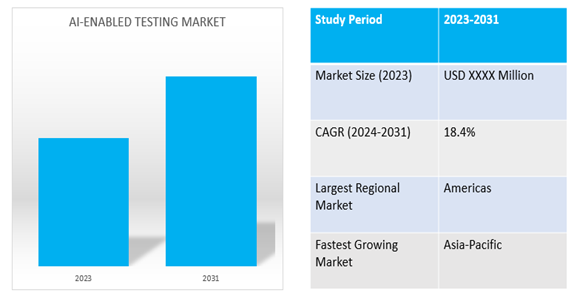

AI-enabled Testing Market Size, Share & Trends Analysis Report by Deployment Mode (Cloud-based and On-premises), by Testing Type (Functional Testing, Performance Testing, Security Testing, Compatibility Testing, and Usability Testing), by End-User (IT and Telecommunications, BFSI (Banking, Financial Services, and Insurance), Healthcare, Automotive, Manufacturing, Government and Defense, and Others) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

AI-enabled testing market is anticipated to grow at a significant CAGR of 17.4% during the forecast period (2024-2031). The AI-enabled testing market integrates AI technologies such as machine learning and natural language processing to automate test case generation, prioritize testing efforts, and predict software defects. It enhances efficiency by automating tasks such as test execution and maintenance, while also improving accuracy through predictive analytics and cognitive testing.

Market Dynamics

Growing Demand for Codeless Testing Solutions Drives Market Growth

The market growth is attributed to the rising demand for codeless testing solutions, facilitated by low-code or codeless platforms offering an intuitive graphical interface, enabling testers to create AI-enabled designs and implement automated test cases with minimal coding. This enhances test automation accessibility, reaching a wider audience, including users with limited coding skills. As a result, low-code test automation is increasingly widespread for its ability to accelerate and simplify the testing automation process.

With codeless test automation platform, companies are introducing the solutions that offers cross-platform support, and AI features. Such innovation and competition within the AI-enabled testing market is driving further advancements and adoption of similar solutions by other companies. n November 2022, QMetry, an AI enabled continuous testing platform company launchedtheall-new codeless test automation platform - QMetry Automation Studio (QAS). QMetry Automation Studio offers cross-platform support, CI/CD integrations, built-in test data management, real-time reporting, and AI features. Integrated with QMetry Test Management for enhanced project control and collaboration. Such developments are further aiding to the market growth.

Market Segmentation

Our in-depth analysis of the global AI-enabled testingmarket includes the following segments by vehicle type, propulsion type, and application:

- Based on deployment mode, the market is bifurcated into cloud-based and on-premises.

- Based on testing type, the market is sub-segmental into functional testing, performance testing, security testing, compatibility testing, and usability testing.

- Based on end-user, the market is augmented into IT and Telecommunications, BFSI healthcare, automotive, manufacturing, government and defense, and others. Where, others include retail.

Functional Testing is Projected to Grow During the Forecast Period

Based on the testing type, the global AI-enabled testing market is sub-segmented into functional testing, performance testing, security testing, compatibility testing, and usability testing. Among these, the functional testing sub-segment is expected to grow over the forecast period. The primary factor driving the segment's growth includes the fact that AI-driven functional testing tools offers advanced capabilities like intelligent test case generation, self-healing test scripts, and predictive analytics.

Healthcare Sub-segment to Hold a Majority Market Sharein the AI-enabled Testing Market

By end-user industry, the healthcare segment holds the majority market share during the forecast period. The segmental growth is attributed to the increasing demand for improved healthcare services, the growing adoption of AI in medical diagnostics, the need to address healthcare challenges, and regulatory support. Owing to such factors, healthcare diagnostics companies are expanding their collaborative efforts to prioritize the development of AI-enabled diagnostic testing solutions for patients.

In November 2022, Mayo Clinic and healthcare diagnostics company Numares Health expanded their partnership focused on developing AI-enabled diagnostic testing for patients with chronic diseases, including kidney, liver, cardiovascular, and neurological conditions.Mayo Clinic expanded support for Numares Health with a convertible equity investment, enabling the development of diagnostic testing for metabolic dysfunction using ML. Numares utilized AI algorithms to combine biomarkers, accurately measuring chronic disease progression.

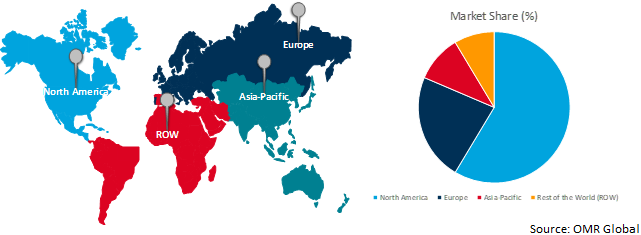

Regional Outlook

The globalAI-enabled testingmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific is the Fastest-Growing Region in the AI-Enabled Testing Market

- Emerging economies in Asia Pacific, including India, China, Japan, and other nations, are driving market growth through innovation and the introduction of new products and platforms.

- Key innovations of 5G in Japan are boosting market growth in this region. The potential surge in demand for automated and efficient telecom infrastructure testing and maintenance lead to increased utilization of AI-enabled testing technologies in Japan.

- In May2022, Singapore introduced the world’s first AI Governance Testing Framework and Toolkit. AI Verify is currently a minimum Viable Product (MVP) which aimed to promote transparency between companies and their stakeholders. It is done through a combination of technical tests and process checks.

Global AI-enabled Testing Market Growth by Region 2024-2031

North America holds a Major Market Share

Among all regions, North America holds a significant share in the AI-enabled testing market owing to rising investment in R&D activities, increasing preference for automated testing solutions, and launching new products are also driving the regional market growth. Technical advancement in AI text recognition has the potential to greatly improve the efficiency and accuracy of automated testing processes. This invention inspires other market players to invest in similar technologies, boosted the development of AI-enabled testing solutions and encouraged greater adoption across various industries. In August 2023, Tricentis, a pioneer in continuous testing and quality engineering, received approval from the US Patent and Trademark Office (USPTO) for a new patent, No. 11,710,302. This patent related to Tricentis' method and system for single pass optical character recognition (OCR), aimed at accelerating and improving AI text recognition.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global AI-enabled testing market include Functionize Inc., mabl Inc., Sauce Labs Inc., Tricentis, Keysight Technologies, Inc., Applitools Ltd., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2023, Software testing platform Sofy launched of SofySense, an innovative mobile app testing solution that merges AI and no-code automation. This offering enhanced Sofy’s pre-existing platform by incorporating GPT-integrated, intelligent software-testing AI technology, thereby providing quality assurance (QA) assistance.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI-enabled testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Functionize Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. mabl Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sauce Labs Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Tricentis

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global AI-enabled Testing Market by Deployment Mode

4.1.1. Cloud-based

4.1.2. On-premises

4.2. Global AI-enabled Testing Market by Testing Type

4.2.1. Functional Testing

4.2.2. Performance Testing

4.2.3. Security Testing

4.2.4. Compatibility Testing

4.2.5. Usability Testing

4.3. Global AI-enabled Testing Market by End-User

4.3.1. IT and Telecommunications

4.3.2. BFSI (Banking, Financial Services, and Insurance)

4.3.3. Healthcare

4.3.4. Automotive

4.3.5. Manufacturing

4.3.6. Government and Defense

4.3.7. Others (Retail)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Applitools Ltd.

6.2. Capgemini SE

6.3. D2l Corp.

6.4. Diffblue Ltd.

6.5. IBM Watson AI

6.6. Keysight Technologies, Inc.

6.7. Kobiton, Inc.

6.8. Leapwork ApS

6.9. Micro Focus International Plc

6.10. Parasoft Corp.

6.11. Perforce Software, Inc.

6.12. Retest Gmbh

6.13. Testrigor

6.14. Tricentis

6.15. Worksoft, Inc.

1. GLOBAL AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

2. GLOBAL CLOUD-BASED AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ON-PREMISES AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

5. GLOBAL AI-ENABLED FUNCTIONAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AI-ENABLED PERFORMANCE TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AI-ENABLED SECURITY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AI-ENABLED COMPATIBILITY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AI-ENABLED USABILITY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

11. GLOBAL AI-ENABLED TESTING FOR IT AND TELECOMMUNICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AI-ENABLED TESTING FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AI-ENABLED TESTING FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AI-ENABLED TESTING FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AI-ENABLED TESTING FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL AI-ENABLED TESTING FOR GOVERNMENT AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL AI-ENABLED TESTING FOR OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. NORTH AMERICAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

22. NORTH AMERICAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. EUROPEAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. EUROPEAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

25. EUROPEAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

26. EUROPEAN AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

31. REST OF THE WORLD AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

34. REST OF THE WORLD AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL AI-ENABLED TESTING MARKET SHARE BY DEPLOYMENT MODE, 2023 VS 2031 (%)

2. GLOBAL CLOUD-BASEDAI-ENABLED TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ON-PREMISES AI-ENABLED TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AI-ENABLED TESTING MARKET SHARE BY TESTING TYPE, 2023 VS 2031 (%)

5. GLOBAL AI-ENABLED FUNCTIONAL TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AI-ENABLED PERFORMANCE TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AI-ENABLED SECURITY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AI-ENABLED COMPATIBILITY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AI-ENABLED USABILITY TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AI-ENABLED TESTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023 VS 2031 (%)

11. GLOBAL AI-ENABLED TESTING FOR IT AND TELECOMMUNICATIONSMARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AI-ENABLED TESTING FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL AI-ENABLED TESTING FOR HEALTHCAREMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AI-ENABLED TESTING FOR AUTOMOTIVEMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL AI-ENABLED TESTING FOR MANUFACTURINGMARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL AI-ENABLED TESTING FOR GOVERNMENT AND DEFENSEMARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL AI-ENABLED TESTING FOR OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL AI-ENABLED TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

21. UK AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

22. FRANCE AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

23. GERMANY AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

24. ITALY AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

25. SPAIN AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF EUROPE AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

27. INDIA AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

28. CHINA AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

29. JAPAN AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

30. SOUTH KOREA AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF ASIA-PACIFIC AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST & AFRICA AI-ENABLED TESTING MARKET SIZE, 2023-2031 ($ MILLION)