Artificial Intelligence (AI) in Aviation Market

Artificial Intelligence (AI) in Aviation Market Size, Share & Trends Analysis Report by Offering (Hardware, Software, and Services), by Application (Virtual Assistants, Dynamic Pricing, Smart Maintenance, Manufacturing, surveillance, Flight Operations, Training, and Others) Forecast Period (2025-2035)

Industry Overview

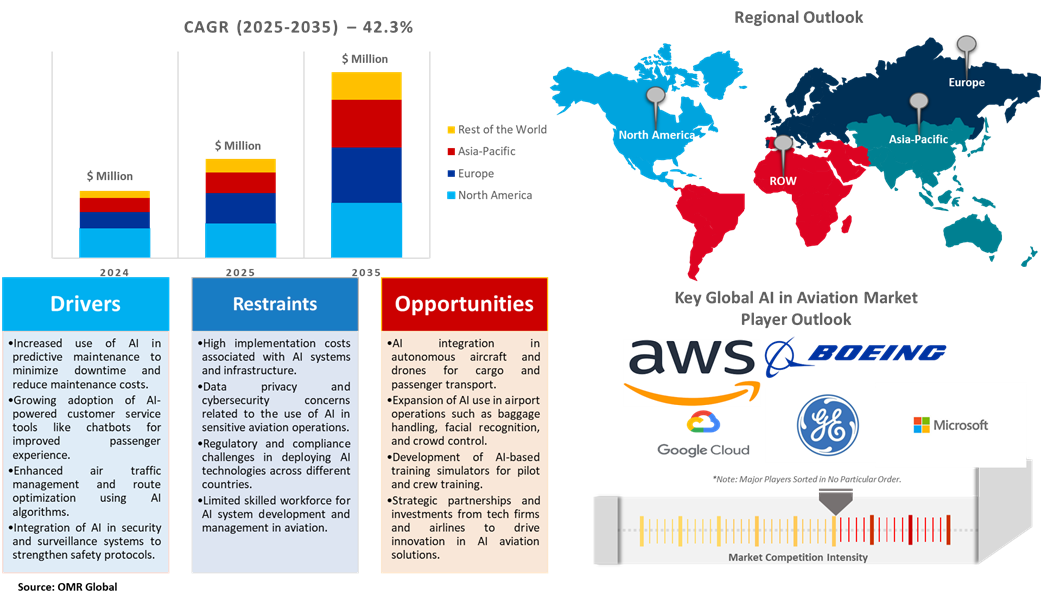

Global AI in aviation market, valued at $1,175 million in 2024, is projected to reach $56,480 million by 2035, growing at a CAGR of 42.3% during the forecast period (2025–2035). Pivotal factors such as the growing investment for automating airport infrastructure, increasing emphasis on integrating AI-based technologies by different market players including aircraft manufacturers, airport authorities, and training organizations, among others, and the rapidly expanding business footprint of the aviation market players is projected to support the adoption of AI in the aviation market. Further, the regulatory framework for AI adoption in the aviation industry across major economies is gaining traction through the implementation of roadmaps, policies, and strategies, which is expected to be a key enabler for AI in the aviation market to grow. For instance, the UK Civil Aviation Authority (CAA) launched an AI strategy to transform aviation by fostering AI adoption in aerospace and enhancing its operations. The CAA is collaborating with aerospace organizations to identify emerging AI technologies while maintaining safety and consumer protection standards. Additionally, the CAA is working on a roadmap for BVLOS drone operations, aiming for routine use by 2027.

Market Dynamics

Enhanced Passenger Experience with AI-Powered Services

AI has entered the AI race. Companies are implementing AI in different business aspects on customer comfort during the fight. The integration of chatbots, and virtual assistants improves flight booking experience and enhances in-flight services. These technologies streamline customer interactions, provide personalized assistance, and optimize operational efficiency, driving the adoption of AI in aviation. Lufthansa uses AI and ML algorithms to predict winds blowing from the northeast to southwest Switzerland. The winds, causing delays, reduce the capacity of Zurich airport by up to 30%. Google Cloud forecasting models help to predict wind patterns and plan flights accordingly. Additionally, Boeing is building crewless airplanes based on AI autopilots. Airbus does the same. Four years ago, the first autonomous take-off and landing of a pilot version of Airbus’s driverless air taxi took place. The take-off and landing were based on AI-based image-recognition software that can recognize landscapes.

Rising Airport Infrastructure Investments

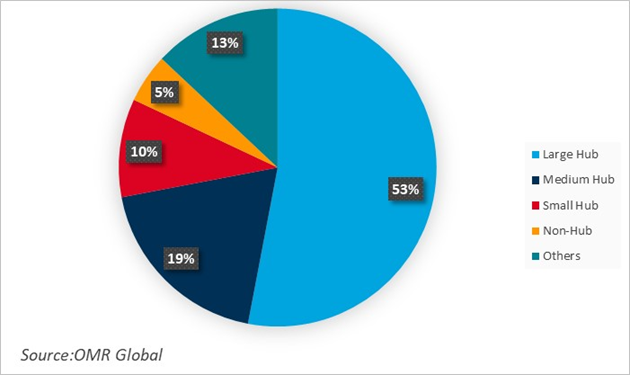

Airports globally are integrating AI-powered solutions to enhance operational efficiency, security, and passenger experience. AI-driven technologies such as predictive maintenance, AI-powered security systems, optimized baggage handling biometric check-ins, and air traffic management are revolutionizing airport operations. These advancements reduce human intervention, streamline workflows, and minimize errors, leading to cost savings and improved service quality. According to the Airports Council International-North America (ACI-NA), total airport infrastructure investment needs for the 2023-2027 period are estimated at $151 billion. Large hub airports, which handle 70% of all enplanements, require approximately $15.8 billion annually, accounting for 53% of the total infrastructure investment. Medium hub airports require $5.6 billion annually (19%), while small hub and non-hub airports account for $3.1 billion (10%) and $1.6 billion (5%) per year, respectively. This massive capital expenditure is primarily directed toward modernizing airport operations, increasing service efficiency, and enhancing the passenger experience, all of which contribute to the rapid adoption of AI technologies in aviation.

ACI-NA Estimates over $151 Billion in Infrastructure Needs for 2023-2027

Market Segmentation

- Based on the Offering the market is segmented into hardware, software, and services.

- Based on the usage, the market is segmented into Application virtual assistants, dynamic pricing, smart maintenance, manufacturing, surveillance, flight operations, training, and others.

AI-Driven Software: Empowering the Future of Aviation

AI software in Aviation refers to platforms and tools that utilize AI and ML technologies to enhance the operation, management, and integration of energy systems. These solutions analyze substantial volumes of data produced by energy infrastructure for real-time decision-making, predictive maintenance, and automation, thereby enhancing efficiency, reducing costs, and promoting sustainability. Further, the major types of AI software in aviation encompass SITA OptiClimb, Amadeus SkySYM, IBM Watson, Indra Air Automation Suite, GE Aviation’s Predix, and others. These software solutions demonstrate significant advantages for airlines, airport operators, and aviation service providers by enhancing operational efficiency, minimizing delays, improving flight scheduling, optimizing fuel consumption, and elevating the overall passenger experience.

The Role of Conversational AI and Generative AI in Aviation

Conversational Al is poised to revolutionize the aviation industry. Generative AI and foundation models are being used to develop chatbots that can provide customer service support to airline passengers. These chatbots can answer questions about flights, baggage, and other travel-related matters. They can also help passengers with tasks such as booking tickets and managing reservations. They are being used to develop pilot assistants that can provide pilots with real-time information and support during flights. These assistants can monitor aircraft systems, provide weather updates, and assist with navigation.

For instance, Infosys offers Generative AI solutions to address critical challenges in aviation safety and regulatory compliance. The aviation industry is heavily regulated, requiring civil aviation authorities to issue airworthiness directives to address safety deficiencies. Compliance with these directives is essential, but the process of searching, accessing, and analyzing relevant documents is often time-consuming, costly, and prone to human errors. This challenge is particularly difficult for new users who struggle with navigating large volumes of technical information. To overcome this, Infosys developed Generative AI solutions that integrate Large Language Models (LLMs), knowledge engineering techniques, and domain-specific ontologies. These solutions, hosted on the Amazon Bedrock platform, support aircraft maintenance and repair by enabling engineers to quickly find and interpret relevant documents with improved accuracy. Furthermore, Infosys' AI-powered tools assess answers for relevancy and authenticity, ensuring compliance with aviation safety regulations.

Regional Outlook

The global AI in Aviation market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Strengthening Aviation Safety through AI-Powered Communication Solutions

The key regional driver in AI in the aviation market is the growing emphasis on enhancing communication safety through advanced technologies. There are various communication challenges faced by the aviation industry, and the most critical challenge being addressed through AI is voice communication safety. Historically, poor voice communication has played a role in numerous aviation accidents the most catastrophic being the 1977 Tenerife runway collision, which tragically claimed 583 lives. Despite the International Civil Aviation Organization's mandate for English proficiency among international aircrews and controllers, interactions are still marred by strong regional accents, unclear enunciation, and slang, leading to potentially dangerous misunderstandings. Companies in the aviation sector are increasingly partnering with AI technology providers and academic institutions to co-develop advanced solutions for operational efficiency, safety, and customer experience. For instance, in April 2025, Honeywell, in collaboration with academic partners from Texas A&M University, University of Texas Dallas, and University of Rochester, is developing a solution that integrates AI and natural language processing (NLP) to revolutionize real-time voice communication in aviation. Their innovation, called RASP (Real-time Anonymization & Speech Protection), is a digital testbed that uses AI to instantly convert various accents and slang into standardized, easily comprehensible speech using an anonymized digital voice.

Asia-Pacific Region is Experiencing the Fastest Growth in AI Adoption

China's civil aviation industry is rapidly evolving into a smart, technology-driven ecosystem, with AI playing a central role in enhancing safety, efficiency, and passenger experience. In 2021, 66 airports adopted facial recognition systems, and 234 airports were offering fully paperless journeys through e-boarding and e-security checks. These advancements supported by AI and data analytics are streamlining operations, reducing congestion, and improving identity verification. Additionally, with 842 aircraft providing inflight Wi-Fi services, AI-enabled inflight connectivity is creating opportunities for real-time data sharing, predictive maintenance, and personalized passenger services.

According to the Civil Aviation Administration of China’s (CAAC) smart aviation strategy, AI is also being integrated across the entire aviation value chain from air travel and logistics to customs clearance and regulatory oversight. The major areas include radio-frequency identification (RFID) for baggage tracking, AI-based automatic luggage check-in, and intelligent customer inquiry systems. The development and deployment of technologies such as the BeiDou navigation system and 5G are further accelerating the application of AI in real-time aircraft monitoring, route optimization, and ground support automation.

Market Players Outlook

The major companies operating in the global AI in Aviation market include Amazon Web Services (AWS), Boeing, Microsoft, Google Cloud, and General Electric Company among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Development

- In May 2024, IDEMIA and SITA’s expanded collaboration builds on their initial agreement to improve travel management, also focusing on baggage management and operational efficiency in airports.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AI in the aviation market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global AI in Aviation Market Sales Analysis - Offering | Application ($ Million)

• AI in Aviation Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key AI in Aviation Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the AI in Aviation Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global AI in Aviation Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global AI in Aviation Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard - AI in Aviation Market Revenue and Share by Manufacturers

• AI in Aviation Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.3. Amazon Web Services (AWS)

4.3.1.1. Overview

4.3.1.2. Product Portfolio

4.3.1.3. Financial Analysis (Subject to Data Availability)

4.3.1.4. SWOT Analysis

4.3.1.5. Business Strategy

4.4. The Boeing Company

4.4.1.1. Overview

4.4.1.2. Product Portfolio

4.4.1.3. Financial Analysis (Subject to Data Availability)

4.4.1.4. SWOT Analysis

4.4.1.5. Business Strategy

4.5. Microsoft Corp.

4.5.1.1. Overview

4.5.1.2. Product Portfolio

4.5.1.3. Financial Analysis (Subject to Data Availability)

4.5.1.4. SWOT Analysis

4.5.1.5. Business Strategy

4.6. Google, LLC

4.6.1.1. Overview

4.6.1.2. Product Portfolio

4.6.1.3. Financial Analysis (Subject to Data Availability)

4.6.1.4. SWOT Analysis

4.6.1.5. Business Strategy

4.7. General Electric Company

4.7.1.1. Overview

4.7.1.2. Product Portfolio

4.7.1.3. Financial Analysis (Subject to Data Availability)

4.7.1.4. SWOT Analysis

4.7.1.5. Business Strategy

4.8. Top Winning Strategies by Market Players

4.8.1. Merger and Acquisition

4.8.2. Product Launch

4.8.3. Partnership And Collaboration

5. Global AI in Aviation Market Sales Analysis by Offering ($ Million)

5.1. Hardware

5.2. Software

5.3. Services

6. Global AI in Aviation Market Sales Analysis by Application ($ Million)

6.1. Virtual Assistants

6.2. Dynamic Pricing

6.3. Smart Maintenance

6.4. Manufacturing

6.5. Surveillance

6.6. Flight Operations

6.7. Training

6.8. Others

7. Regional Analysis

7.1. North American AI in Aviation Market Sales Analysis - Offering | Application |Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European AI in Aviation Market Sales Analysis - Offering | Application |Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific AI in Aviation Market Sales Analysis - Offering | Application |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World AI in Aviation Market Sales Analysis Offering | Application |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Addepto sp. z o.o.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Airbus SE

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Cirium, part of LexisNexis

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Garmin Ltd.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Infosys Ltd

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Intel Corp.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. International Business Machines Corp (IBM)

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Lockheed Martin Corp.

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Micron Technology, Inc.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Northrop Grumman Corp.

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Nvidia Corp.

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Pilot AI Labs, Inc.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. Samsung Electronics co., ltd.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. SoluLab

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Talonic GmbH.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. TAV Technologies

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Thales Group

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Veryon

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Xilinx, part of AMD

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

1. Global AI In Aviation Market Research And Analysis By Application, 2024-2035 ($ Million)

2. Global AI In Aviation For Virtual Assistants Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global AI In Aviation For Dynamic Pricing Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global AI In Aviation For Smart Maintenance Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global AI In Aviation For Manufacturing Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global AI In Aviation For Surveillance Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global AI In Aviation For Flight Operations Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global AI In Aviation For Training Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global AI In Aviation For Others Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global AI In Aviation Market Research And Analysis By Region, 2024-2035 ($ Million)

11. North American AI In Aviation Market Research And Analysis By Country, 2024-2035 ($ Million)

12. North American AI In Aviation Market Research And Analysis By Offering, 2024-2035 ($ Million)

13. North American AI In Aviation Market Research And Analysis By Application, 2024-2035 ($ Million)

14. European AI In Aviation Market Research And Analysis By Country, 2024-2035 ($ Million)

15. European AI In Aviation Market Research And Analysis By Offering, 2024-2035 ($ Million)

16. European AI In Aviation Market Research And Analysis By Application, 2024-2035 ($ Million)

17. Asia-Pacific AI In Aviation Market Research And Analysis By Country, 2024-2035 ($ Million)

18. Asia-Pacific AI In Aviation Market Research And Analysis By Offering, 2024-2035 ($ Million)

19. Asia-Pacific AI In Aviation Market Research And Analysis By Application, 2024-2035 ($ Million)

20. Rest Of The World AI In Aviation Market Research And Analysis By Country, 2024-2035 ($ Million)

21. Rest Of The World AI In Aviation Market Research And Analysis By Offering, 2024-2035 ($ Million)

22. Rest Of The World AI In Aviation Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global AI In Aviation Market Share By Offering, 2024 Vs 2035 (%)

2. Global AI In Aviation By Hardware Market Share By Region, 2024 Vs 2035 (%)

3. Global AI In Aviation By Software Market Share By Region, 2024 Vs 2035 (%)

4. Global AI In Aviation By Service Market Share By Region, 2024 Vs 2035 (%)

5. Global AI In Aviation Market Share By Application, 2024 Vs 2035 (%)

6. Global AI In Aviation For Virtual Assistants Market Share By Region, 2024 Vs 2035 (%)

7. Global AI In Aviation For Dynamic Pricing Market Share By Region, 2024 Vs 2035 (%)

8. Global AI In Aviation For Smart Maintenance Market Share By Region, 2024 Vs 2035 (%)

9. Global AI In Aviation For Manufacturing Market Share By Region, 2024 Vs 2035 (%)

10. Global AI In Aviation For Surveillance Market Share By Region, 2024 Vs 2035 (%)

11. Global AI In Aviation For Flight Operations Market Share By Region, 2024 Vs 2035 (%)

12. Global AI In Aviation For Training Market Share By Region, 2024 Vs 2035 (%)

13. Global AI In Aviation For Others Market Share By Region, 2024 Vs 2035 (%)

14. Global AI In Aviation Market Share By Region, 2024 Vs 2035 (%)

15. US AI In Aviation Market Size, 2024-2035 ($ Million)

16. Canada AI In Aviation Market Size, 2024-2035 ($ Million)

17. UK AI In Aviation Market Size, 2024-2035 ($ Million)

18. France AI In Aviation Market Size, 2024-2035 ($ Million)

19. Germany AI In Aviation Market Size, 2024-2035 ($ Million)

20. Italy AI In Aviation Market Size, 2024-2035 ($ Million)

21. Spain AI In Aviation Market Size, 2024-2035 ($ Million)

22. Rest Of Europe AI In Aviation Market Size, 2024-2035 ($ Million)

23. India AI In Aviation Market Size, 2024-2035 ($ Million)

24. China AI In Aviation Market Size, 2024-2035 ($ Million)

25. Japan AI In Aviation Market Size, 2024-2035 ($ Million)

26. South Korea AI In Aviation Market Size, 2024-2035 ($ Million)

27. Rest Of Asia-Pacific AI In Aviation Market Size, 2024-2035 ($ Million)

28. Rest Of The World AI In Aviation Market Size, 2024-2035 ($ Million)

FAQS

The size of the Artificial Intelligence (AI) in Aviation market in 2024 is estimated to be around $1,175 million.

Asia-Pacific holds the largest share in the Artificial Intelligence (AI) in Aviation market.

Leading players in the Artificial Intelligence (AI) in Aviation market include Amazon Web Services (AWS), Boeing, Microsoft, Google Cloud, and General Electric Company among others.

Artificial Intelligence (AI) in Aviation market is expected to grow at a CAGR of 42.3% from 2025 to 2035.

Rising demand for automation, predictive maintenance, and enhanced passenger experience drives the growth of the AI in Aviation Market.