Air charter services Market

Air Charter Services Market Size, Share & Trends Analysis Report by Type (Business Charter Services and Private Charter Services), and by Application (Charter Passenger, Charter Freight, and Others), Forecast Period (2025-2035)

Industry Outlook

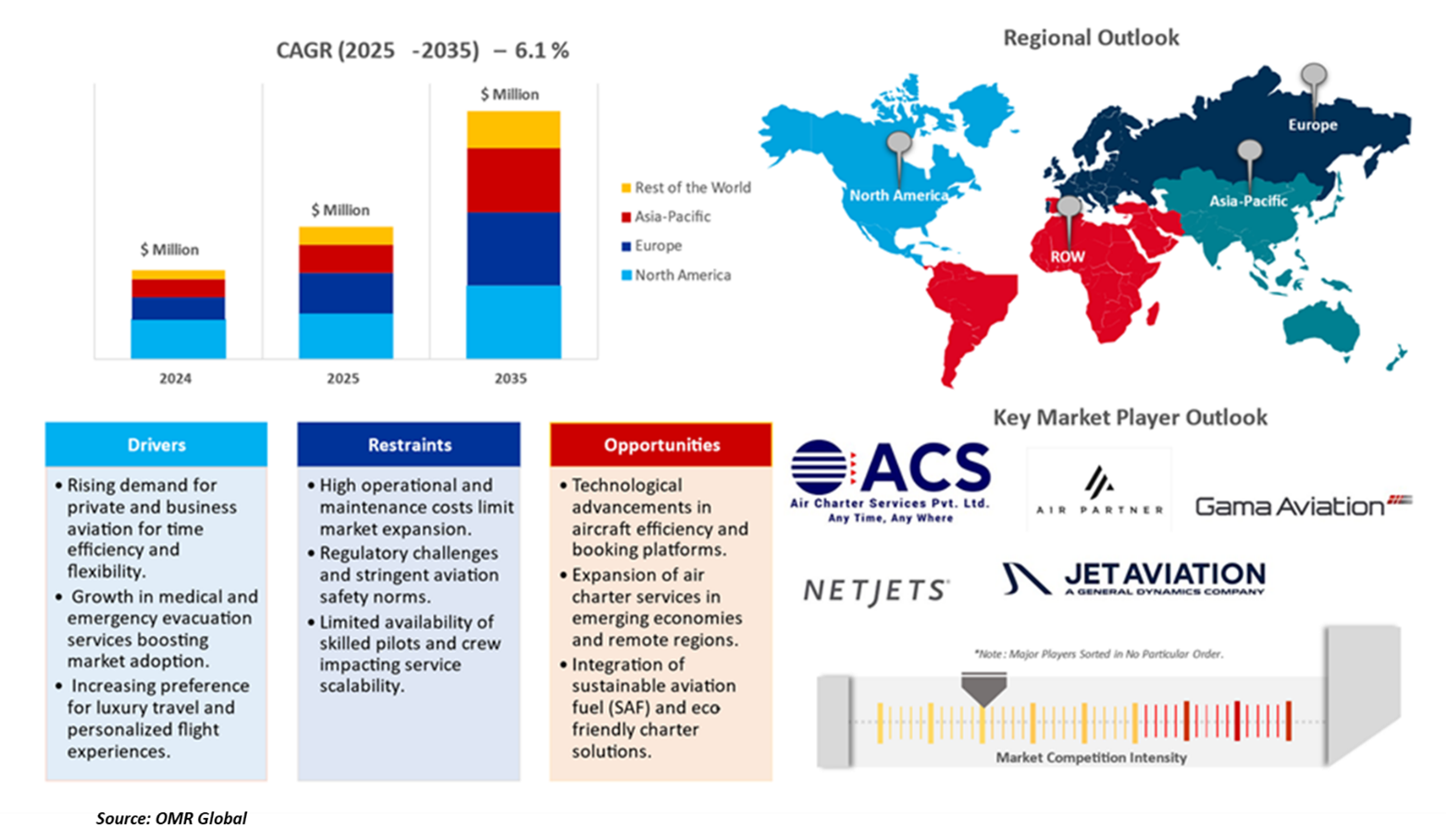

Air charter services market is projected to grow at a CAGR of 6.1% during the forecast period (2025-2035). The marketplace growth is stimulated by growing demand for private aviation, rising business travel, and the demand for luxury air travel offerings. To maintain air charter services in the market, flexibility, low journey time, and increased client services are required to be offered to the targeted customers. Air charter services play an important role in providing efficient and time-sensitive travel solutions that ensure privacy, security, and comfort for high-profile individuals and corporate executives. These services can improve travel efficiency by offering customized flight schedules, reducing airport congestion, and providing direct access to remote places.

Segmental Outlook

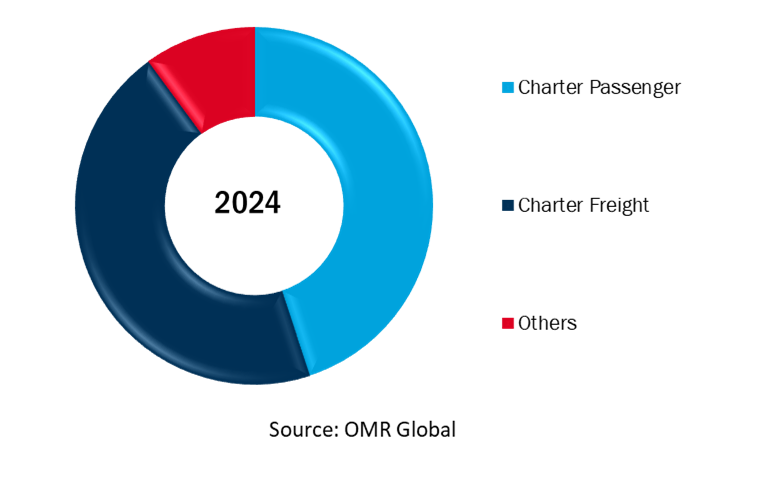

The global air charter services market is segmented by type and application. Based on the type, the market is sub-segmented into business charter services and private charter services. Based on the application, the market is sub-segmented into charter passenger, charter freight, and others. Among the applications segment, the charter flight sub-segment is anticipated to grow at a substantial rate and hold a considerable share of the market. It is owing to the increase in demand for premium charter and freight services after the global pandemic disaster owing to that the demand for charter freight services is growing and is often used by key corporate influencers and sports teams.

The Private Charter Services Sub-Segment is Anticipated to Hold a Considerable Share of the Global Air Charter Services Market.

In the type segment, the private charter services sub-segments are estimated to have a considerable share of the global air charter services market in the forecast period. The increasing priority for private air travel between high-net-worth individuals, corporate officials, and government officials has contributed significantly to the expansion of this segment. Charter passenger services provide flexibility, reduce travel time, and increase privacy, giving them an attractive option for businesses and travelers. Additionally, the increasing demand for on-demand air travel in collaboration with advancements in digital booking platforms has further driven the market.

The integration of AI-driven scheduling systems and real-time fleet management solutions has improved operational efficiency, enhancing customer experience. For instance, in February 2025, during the Singapore Airshow, charter service providers such as NetJets and VistaJet announced the expansion of a new fleet featuring fuel-efficient aircraft and enhanced onboard technology. These innovations are expected to further strengthen the status of the Charter Passenger sub-segment in the Global Air Charter Services Market, along with increasing adoption of Sustainable Aviation Fuel (SAF) and carbon offset programs.

Global Air Charter Services Market Share By Application, 2024 (%)

Regional Outlook

The global air charter services market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN Countries, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, the European regional market is expected to hold a significant share of the global air charter services market, owing to the high concentration of e-commerce players and market service providers such as Air Charter Service Pvt. Ltd., Delta Private Jets, Net Jets, Air Partner, and others.

North America is expected to grow at a Significant CAGR in the Global Air Charter Services Market.

North America is anticipated to grow at a considerable CAGR over the forecast period. This Regional expansion growth is determined by strong economic development that is increasing demand for luxury and commercial travel, and progress in digital booking platforms for air charter services. Certainly, Countries such as the US and Canada hold a significant part of the global private jet population, with a variety of options available for travelers for charter services and with an increasing number of high-net-worth individuals and corporate professionals. Additionally, the growing preference for flexible and individual travel solutions in collaboration with fleet management and technological progress in route adaptation is further enhancing the market demand.

Market Players Outlook

The major companies serving the air charter services market include air charter service Group Pvt. Ltd., Air Partner Ltd., Gama Aviation PLC, NetJetsand IP LLC, Jet Aviation AG, and others. These market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Developments

- In August 2024, Air Partner, a subsidiary of Wheels Up, launched a specialized charter service under Paddy Airlines. This exclusive charter service was utilized by Paddy Power staff where the key brand ambassadors and football fans traveled from Stansted to Dusseldorf and back for England's opening match in the UEFA Euros. The initiative highlighted the growing demand for tailored air charter services for major sporting events, enhancing accessibility and convenience for travelers.

- In February 2024, NetJets announced its takeover of the former Signature Aviation South FBO terminal. The terminal, which will undergo renovations in collaboration with Signature Aviation, will be exclusively dedicated to serving the company’s fractional aircraft owners.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global air charter services market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Air Charter Services Market Sales Analysis –Type | Application ($ Million)

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Air Charter Service Group Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Air Partner Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Gama Aviation Plc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Air Charter Services Market by Type ($ Million)

4.1.1. Business Charter Services

4.1.2. Private Charter Services

4.2. Global Air Charter Services Market by Application ($ Million)

4.2.1. Charter Passenger

4.2.2. Charter Flight

4.2.3. Others (Unscheduled Itineraries)

5. Regional Analysis

5.1. North America Air Charter Services Market Sales Analysis – Type | Application ($ Million)

5.1.1. United States

5.1.2. Canada

5.2. Europe Air Charter Services Market Sales Analysis – Type | Application ($ Million)

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific Air Charter Services Market Sales Analysis – Type | Application ($ Million)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia & New Zealand

5.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

5.3.7. Rest of Asia-Pacific

5.4. Rest of the World Air Charter Services Market Sales Analysis – Type | Application ($ Million)

5.4.1. Latin America

5.4.2. Middle East and Africa

6 Company Profiles

6.1 Air Charter Advisors, LLC

6.2 Air Charter Service Ltd.

6.3 Air Partner PLC

6.4 Avinode Group

6.5 Chapman Freeborn Airchartering

6.6 Charter Flight Group, LLC

6.7 Delta Private Jets, Inc.

6.8 Flexjet LLC

6.9 Gama Aviation Plc

6.10 Jet Linx Aviation, Inc.

6.11 JetSuite, Inc.

6.12 Kuehne+Nagel

6.13 Lufthansa Private Jet GmbH

6.14 NetJets, Inc.

6.15 PrivateFly Ltd.

6.16 SaxonAir Charter Ltd.

6.17 Solairus Aviation

6.18 Skyservice Business Aviation Inc.

6.19 Vistajet International Ltd.

6.20 XOJET Aviation LLC

1. Global Air Charter Services Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Business Air Charter Services Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Private Air Charter Services Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Air Charter Services Market Research And Analysis By Application, 2024-2035 ($ Million)

5. Global Air Charter Services For Passenger Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Air Charter Services For Freight Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Air Charter Services For Other Applications Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Air Charter Services Market Research And Analysis By Region, 2024-2035 ($ Million)

9. North American Air Charter Services Market Research And Analysis By Country, 2024-2035 ($ Million)

10. North American Air Charter Services Market Research And Analysis By Type, 2024-2035 ($ Million)

11. North American Air Charter Services Market Research And Analysis By Application, 2024-2035 ($ Million)

12. European Air Charter Services Market Research And Analysis By Country, 2024-2035 ($ Million)

13. European Air Charter Services Market Research And Analysis By Type, 2024-2035 ($ Million)

14. European Air Charter Services Market Research And Analysis By Application, 2024-2035 ($ Million)

15. Asia-Pacific Air Charter Services Market Research And Analysis By Country, 2024-2035 ($ Million)

16. Asia-Pacific Air Charter Services Market Research And Analysis By Type, 2024-2035 ($ Million)

17. Asia-Pacific Air Charter Services Market Research And Analysis By Application, 2024-2035 ($ Million)

18. Rest Of The World Air Charter Services Market Research And Analysis By Country, 2024-2035 ($ Million)

19. Rest Of The World Air Charter Services Market Research And Analysis By Type, 2024-2035 ($ Million)

20. Rest Of The World Air Charter Services Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Air Charter Services Market Share By Type, 2024 Vs 2035 (%)

2. Global Business Charter Services Market Share By Region, 2024 Vs 2035 (%)

3. Global Private Charter Services Market Share By Region, 2024 Vs 2035 (%)

4. Global Air Charter Services Market Share By Application, 2024 Vs 2035 (%)

5. Global Air Charter Services For Passenger Market Share By Region, 2024 Vs 2035 (%)

6. Global Air Charter Services For Freight Market Share By Region, 2024 Vs 2035 (%)

7. Global Air Charter Services For Other Applications Market Share By Region, 2024 Vs 2035 (%)

8. Global Air Charter Services Market Share By Region, 2024 Vs 2035 (%)

9. US Air Charter Services Market Size, 2024-2035 ($ Million)

10. Canada Air Charter Services Market Size, 2024-2035 ($ Million)

11. UK Air Charter Services Market Size, 2024-2035 ($ Million)

12. France Air Charter Services Market Size, 2024-2035 ($ Million)

13. Germany Air Charter Services Market Size, 2024-2035 ($ Million)

14. Italy Air Charter Services Market Size, 2024-2035 ($ Million)

15. Spain Air Charter Services Market Size, 2024-2035 ($ Million)

16. Spain Air Charter Services Market Size, 2024-2035 ($ Million)

17. Rest Of Europe Air Charter Services Market Size, 2024-2035 ($ Million)

18. India Air Charter Services Market Size, 2024-2035 ($ Million)

19. Australia & New Zealand Air Charter Services Market Size, 2024-2035 ($ Million)

20. ASEAN Countries Air Charter Services Market Size, 2024-2035 ($ Million)

21. China Air Charter Services Market Size, 2024-2035 ($ Million)

22. Japan Air Charter Services Market Size, 2024-2035 ($ Million)

23. South Korea Air Charter Services Market Size, 2024-2035 ($ Million)

24. Rest Of Asia-Pacific Air Charter Services Market Size, 2024-2035 ($ Million)

25. Rest Of The World Air Charter Services Market Size, 2024-2035 ($ Million)

FAQS

The size of the Air charter services market in 2024 is estimated to be around USD 32.2 billion.

North America holds the largest share in the Air charter services market.

Leading players in the Air charter services market include Group Pvt. Ltd., Air Partner Ltd., Gama Aviation PLC, NetJetsand IP LLC, Jet Aviation AG, and others.

Air charter services market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

The air charter services market is growing due to rising demand for luxury travel, on-demand mobility, air ambulances, business aviation, and technological advancements in aircraft.