Airline Technology Integration Market

Airline Technology Integration Market Size, Share & Trends Analysis Report by Technology (Internet of Things (IoT), Cybersecurity, Artificial Intelligence, Advanced Analytics, Biometrics, Blockchain, Wearable Technology, and Others), by Offering (Software, and Hardware), by Deployment (On-Premise and Cloud), Forecast Period (2025-2035)

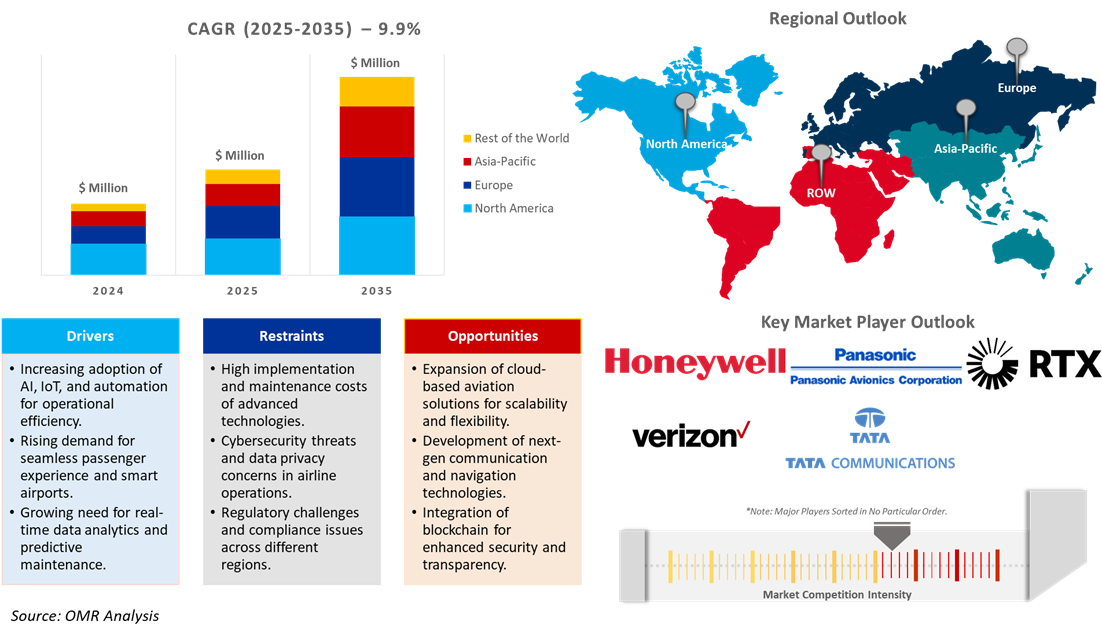

Industry Outlook

Airline technology integration market was valued at $23.9 billion in 2024 and is projected to reach $61.1 billion by 2035, growing at a CAGR of 9.9% during the forecast period (2025-2035). The market growth is attributed to the convergence of advanced technology, such as IoT, AI/ML, and blockchain, driving the growth of the aviation industry. The utilization and integration of innovative technologies by airlines enhances their operational effectiveness, safety, and passenger experience. This includes integrating state-of-the-art technology, software, and systems into all aspects of their business. AI helps in predicting the maintenance of the aircraft and, in traffic management, identifies potential equipment failures before they occur. Blockchain also uses cryptography, decentralization, and consensus technology to maintain cybersecurity in the global aviation industry.

Segmental Outlook

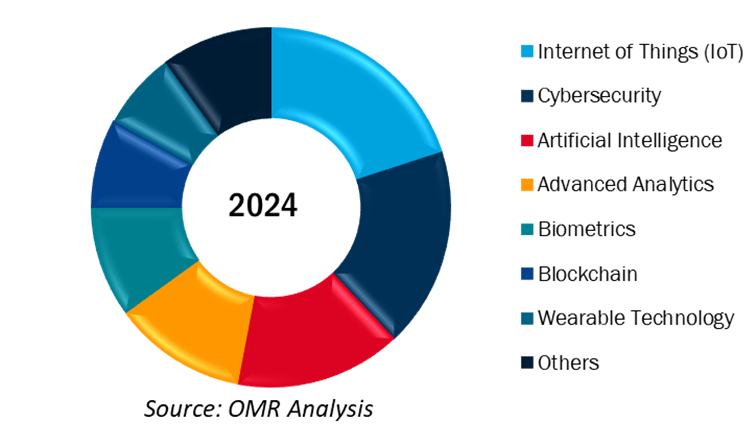

- Based on technology, the market is segmented into Internet of Things (IoT), cybersecurity, artificial intelligence, advanced analytics, biometrics, blockchain, wearable technology, and others.

- Based on the offering, the market is segmented into software and hardware.

- Based on the deployment, the market is segmented into on-premise and cloud.

The Cloud Sub-Segment is Anticipated to Hold a Considerable Share of the Global Airline Technology Integration Market.

The airline technology integration market is experiencing a tremendous surge owing to the use of cloud-based solutions. Cloud computing enables airlines to streamline their operations, customize passenger experiences, and optimize their data management. Cloud computing provides real-time access to data, predictive maintenance, and interoperability among stakeholders. Furthermore, cloud platforms enable the integration of artificial intelligence and machine learning for enhanced decision-making. Airlines are increasingly using cloud technology to improve flight scheduling, crew management, and customer service. The need for scalable and affordable IT solutions is driving additional cloud usage in the aviation sector. Security and compliance issues are also influencing the development of cloud-based airline technologies.

Global Airline Technology Integration Market Share By Technology, 2024 (%)

Regional Outlook

The global airline technology integration market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, ASEAN countries, Australia & New Zealand and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). In the regional outlook, the demand for new technologies keeps moving, and growth is expected, particularly in the Asia-Pacific region.

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Airline Technology Integration Market

The Asia-Pacific market for airline technology integration is witnessing strong growth owing to the growing demand for air travel and fast-paced digitalization. Airlines are adopting innovative technologies such as artificial intelligence, cloud computing, and IoT to improve operational efficiency. Growing passenger expectations of smooth travel experiences are driving the use of automated check-in and intelligent baggage handling systems. Regional governments are promoting digital programs to enhance aviation infrastructure. The growth in low-cost carriers is adding to the demand for effective technology solutions. Cybersecurity issues are leading airlines to implement strong data protection methods. The development of 5G networks is facilitating quick and secure communication in airline operations.

Market Players Outlook

The major companies serving the airline technology integration market include Honeywell International Inc., Panasonic Avionics Corp., RTX Corp, Verizon Communications Inc., Tata Communications Group, and others. These market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Developments

- In March 2025, Salesforce and Singapore Airlines (SIA) announced that the Airline is incorporating Agentforce, Einstein in Service Cloud, and Data Cloud into its customer base management system, enabling it to deliver more consistent and personalized service to its customers. The two companies also plan to co-develop Artificial Intelligence (AI) solutions for airlines at the Salesforce AI Research hub in Singapore, aiming to provide greater value and additional benefits to the industry.

- In March 2025, General Atomics (GA) announced the strategic acquisition of North Point Defense, Inc. (NPD), a leading provider of Signals Intelligence (SIGINT).

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global airline technology integration market. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Airline Technology Integration Market Sales Analysis – Technology | Offering | Deployment ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Airline Technology Integration Industry Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Airline Technology Integration Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Airline Technology Integration Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Airline Technology Integration Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Airline Technology Integration Market by Technology ($ Million)

5.1. Internet of Things (IoT)

5.2. Cybersecurity

5.3. Artificial Intelligence

5.4. Advanced Analytics

5.5. Biometrics

5.6. Blockchain

5.7. Wearable Technology

5.8. Others (Digital Transformation and Mobile Apps, Security and Passenger Screening Systems, and Environmental Sustainability Technologies)

6. Global Airline Technology Integration Market by Offering ($ Million)

6.1. Software

6.2. Hardware

7. Global Airline Technology Integration Market by Deployment ($ Million)

7.1. On-Premises

7.2. Cloud

8. Regional Analysis

8.1. North American Airline Technology Integration Market Sales Analysis – Technology| Offering | Deployment | Country ($ Million)

8.1.1. United States

8.1.2. Canada

8.2. European Airline Technology Integration Market Sales Analysis – Technology| Offering | Deployment | Country ($ Million)

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Airline Technology Integration Market Sales Analysis – Technology| Offering | Deployment | Country ($ Million)

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Airline Technology Integration Market Sales Analysis – Technology| Offering | Deployment | Country ($ Million)

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Amadeus IT Group SA

9.2. Cisco, Inc.

9.3. Collins Aerospace

9.4. FLYHT Aerospace Solutions Ltd

9.5. GE Aviation

9.6. Honeywell International Inc.

9.7. IBM Corp.

9.8. IBS Software

9.9. IFS (Industrial and Financial Systems)

9.10. Lufthansa Systems GmbH

9.11. Microsoft Corp.

9.12. NXP Semiconductors

9.13. NEC Corp.

9.14. Panasonic Avionics Corp.

9.15. RTX Corp.

9.16. Sabre GLBL Inc.

9.17. SITA

9.18. THALES Group

9.19. Unisys Corp.

9.20. Verizon Communications Inc.

1. Global Airline Technology Integration Market Research And Analysis By Technology, 2024-2035 ($ Million)

2. Global Airline Internet Of Things (IoT) Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Airline Cybersecurity Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Airline Artificial Intelligence Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Airline Advanced Analytics Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Airline Biometrics Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Airline Blockchain Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Airline Wearable Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Others Airline Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Airline Technology Integration Market Research And Analysis By Offering, 2024-2035 ($ Million)

11. Global Airline Software Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Airline Hardware Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Airline Technology Integration Market Research And Analysis By Deployment, 2024-2035 ($ Million)

14. Global Airline On-Premises Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

15. Global Airline Cloud Technology Integration Research And Analysis By Region, 2024-2035 ($ Million)

16. North America Airline Technology Integration Market Research And Analysis By Country, 2024-2035 ($ Million)

17. North American Airline Technology Integration Market Research And Analysis By Technology Type, 2024-2035 ($ Million)

18. North American Airline Technology Integration Market Research And Analysis By Offering, 2024-2035 ($ Million)

19. North American Airline Technology Integration Market Research And Analysis By Deployment, 2024-2035 ($ Million)

20. European Airline Technology Integration Market Research And Analysis By Country, 2024-2035 ($ Million)

21. European Airline Technology Integration Market Research And Analysis By Technology, 2024-2035 ($ Million)

22. European Airline Technology Integration Market Research And Analysis By Offering, 2024-2035 ($ Million)

23. European Airline Technology Integration Market Research And Analysis By Deployment, 2024-2035 ($ Million)

24. Asia-Pacific Airline Technology Integration Market Research And Analysis By Country, 2024-2035 ($ Million)

25. Asia-Pacific Airline Technology Integration Market Research And Analysis By Technology Type, 2024-2035 ($ Million)

26. Asia-Pacific Airline Technology Integration Market Research And Analysis By Offering, 2024-2035 ($ Million)

27. Asia-Pacific Airline Technology Integration Market Research And Analysis By Deployment, 2024-2035 ($ Million)

28. Rest Of The World Airline Technology Integration Market Research And Analysis By Region, 2024-2035 ($ Million)

29. Rest Of The World Airline Technology Integration Market Research And Analysis By Technology, 2024-2035 ($ Million)

30. Rest Of The World Airline Technology Integration Market Research And Analysis By Offering, 2024-2035 ($ Million)

31. Rest Of The World Airline Technology Integration Market Research And Analysis By Deployment, 2024-2035 ($ Million)

1. Global Airline Technology Integration Market Share By Technology, 2024 Vs 2035 (%)

2. Global Airline Internet Of Things (IoT) Technology Integration Market Share By Region, 2024 Vs 2035 (%)

3. Global Airline Cybersecurity Technology Integration Market Share By Region, 2024 Vs 2035 (%)

4. Global Airline Artificial Intelligence Technology Integration Market Share By Region, 2024 Vs 2035 (%)

5. Global Airline Advanced Analytics Technology Integration Market Share By Region, 2024 Vs 2035 (%)

6. Global Airline Biometrics Technology Integration Market Share By Region, 2024 Vs 2035 (%)

7. Global Airline Blockchain Technology Integration Market Share By Region, 2024 Vs 2035 (%)

8. Global Airline Wearable Technology Integration Market Share By Region, 2024 Vs 2035 (%)

9. Global Others Airline Technology Integration Market Share By Region, 2024 Vs 2035 (%)

10. Global Airline Technology Integration Market Share By Offering, 2024 Vs 2035 (%)

11. Global Airline Software Technology Integration Market Share By Region, 2024 Vs 2035 (%)

12. Global Airline Hardware Technology Integration Market Share By Region, 2024 Vs 2035 (%)

13. Global Airline Technology Integration Market Share By Deployment, 2024 Vs 2035 (%)

14. Global Airline On-Premises Technology Integration Market Share By Region, 2024 Vs 2035 (%)

15. Global Airline Cloud Technology Integration Market Share By Region, 2024 Vs 2035 (%)

16. US Airline Technology Integration Market Size, 2024-2035 ($ Million)

17. Canada Airline Technology Integration Market Size, 2024-2035 ($ Million)

18. UK Airline Technology Integration Market Size, 2024-2035 ($ Million)

19. France Airline Technology Integration Market Size, 2024-2035 ($ Million)

20. Germany Airline Technology Integration Market Size, 2024-2035 ($ Million)

21. Italy Airline Technology Integration Market Size, 2024-2035 ($ Million)

22. Spain Airline Technology Integration Market Size, 2024-2035 ($ Million)

23. Russia Airline Technology Integration Market Size, 2024-2035 ($ Million)

24. Rest of Europe Airline Technology Integration Market Size, 2024-2035 ($ Million)

25. India Airline Technology Integration Market Size, 2024-2035 ($ Million)

26. China Airline Technology Integration Market Size, 2024-2035 ($ Million)

27. Japan Airline Technology Integration Market Size, 2024-2035 ($ Million)

28. South Korea Airline Technology Integration Market Size, 2024-2035 ($ Million)

29. Australia and New Zealand Airline Technology Integration Market Size, 2024-2035 ($ Million)

30. ASEAN Airline Technology Integration Market Size, 2024-2035 ($ Million)

31. Rest of Asia-Pacific Airline Technology Integration Market Size, 2024-2035 ($ Million)

32. Rest Of The World Airline Technology Integration Market Size, 2024-2035 ($ Million)

FAQS

The size of the Airline Technology Integration market in 2024 is estimated to be around $23.9 billion.

Asia-Pacific holds the largest share in the Airline Technology Integration market.

Leading players in the Airline Technology Integration market include Honeywell International Inc., Panasonic Avionics Corp., RTX Corp, Verizon Communications Inc., Tata Communications Group, and others.

Airline Technology Integration market is expected to grow at a CAGR of 9.9% from 2025 to 2035.

Rising demand for operational efficiency, enhanced passenger experience, and real-time data analytics is driving growth in the Airline Technology Integration Market.