Aminic Antioxidants Market

Aminic Antioxidants Market Size, Share & Trends Analysis Report by Type (Diphenylamine-Based Antioxidants, Phenyl-?-Naphthylamine-Based Antioxidants, Alkylated Diphenylamine and Others), and by Application (Lubricants, Rubber Processing, Plastic & Polymers, Fuel Additives, and Others) Forecast Period (2025-2035)

Industry Overview

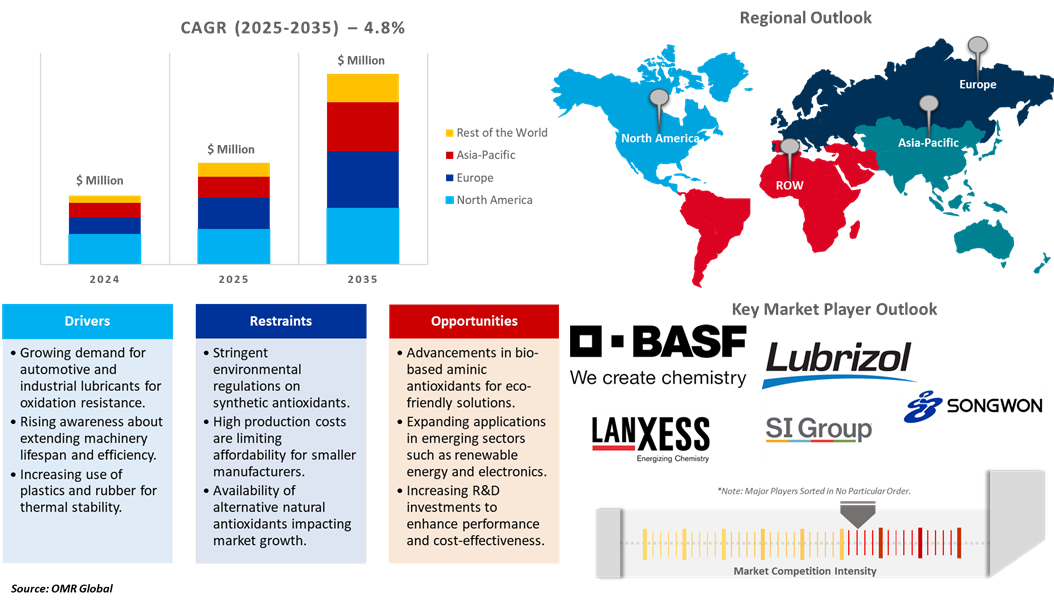

Aminic antioxidants market was valued at $1.3 billion in 2024 and is projected to reach $2.1 billion by 2035, growing at a CAGR of 4.8% during the forecast period from 2025 to 2035. The market for aminic antioxidants is seeing tremendous growth with increased application in different industries. Their improved oxidative stability and thermal stability make them essential elements in the use of lubricants, rubber, and plastic. Market growth is driven by increasing automotive and industrial segments, as the antioxidants improve the durability and performance of products.

Market Dynamics

Increasing Demand in the Adhesive and Polymer Sector

The polymer and adhesive market is increasingly adopting aminic antioxidants to promote the durability and performance of products. Aminic antioxidants are widely applied in the manufacture of high-performance plastics, coatings, and adhesives to prevent degradation owing to exposure to heat, light, and oxygen. In addition, the need for new materials in the automotive, building, and electronic industries increases daily, and they seek additives that improve stability and durability. Aminic antioxidants have a crucial role in maintaining the physical and mechanical form of polymers under control and remain resistant to premature degradation.

Growing Use in Personal Care and Pharmaceutical

The pharmaceutical and beauty industries are growingly reliant on aminic antioxidants for protection against oxidation, making them more commonly incorporated into drugs to ensure the stability and potency of drugs through inhibition of degradation caused by oxidation. They are especially important in stabilizing sensitive chemicals that need prolonged shelf life. In personal care items such as creams, lotions, and cosmetics, aminic antioxidants inhibit rancidity and ensure product integrity in storage. As consumers are more aware of product quality and shelf life, manufacturers are looking more towards these antioxidants to utilize in hair care and skincare products.

Market Segmentation

- Based on the type, the market is segmented into diphenylamine-based antioxidants, phenyl-?-naphthylamine-based antioxidants, alkylated diphenylamine, and others (secondary aromatic amines).

- Based on the application, the market is segmented into lubricants, rubber processing, plastic & polymers, fuel additives, and others (adhesives, coatings, food packaging).

Diphenylamine-Based Antioxidants Segment to Lead the Market with the Largest Share

The aminic antioxidants industry is observing increased growth with growing demand for diphenylamine-based antioxidants for their exceptional properties of oxidation resistance. The antioxidants prove to significantly improve the thermal stability and lifetime of lubricants, gaining prominence in high-performance applications. Diphenylamine-similar antioxidants are increasingly being utilized within the automotive and industrial industries to enhance engine efficiency and reduce wear and tear. Their resistance to oils degrading under harsh temperatures is fueling widespread usage within the transportation and heavy equipment industries. Increasing regulatory requirements on lubricant performance and emissions control are additionally fueling demand throughout the market. For instance, Sunshield Chemicals Ltd. provides Diphenylamine-Based aminic Antioxidants products such as Di-Octylated Diphenylamine – Powder / Flakes, Di-Cumylated Diphenylamine - Powder, Nonylated Diphenylamine, Styrenated Diphenylamine, and Butylated Octylated Diphenylamine.

Lubricants: A Key Segment in Market Growth

The market for aminic antioxidants is witnessing rapid growth on account of the rising demand from lubricant applications. Employment of such antioxidants improves the thermal stability and oxidative resistance, and this further enhances the service life of lubricants. Growing applications for high-performance lubricants in the automotive, industrial, and marine markets are driving the market forward. Further, the tighter emission standards and environmental compliance are driving the usage of high-tech lubricant products. Rising industrialization and speeding up machinery development are also boosting demand for lubricants. For instance, SI Group, Inc. provides ETHANO 4757 as an octylated, butylated diphenyl amine, ashless aminic antioxidant with superior performance in a wide variety of industrial lubricants, greases, automotive fluids, and oils.

Regional Outlook

The global aminic antioxidants market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Aminic Antioxidants in the Asia-Pacific Manufacturing Sector

The Asia-Pacific aminic antioxidants market is growing strongly with the strong manufacturing economy of the region. Expanded industrialization and infrastructure development have accelerated demand for high-performance lubricants, where aminic antioxidants form a key constituent for improving efficiency and longevity. Having major automobile and machinery manufacturers within countries such as China, India, and Japan has spurred sustained market expansion. Increasing manufacturing of heavy-duty machinery and industrial equipment is further driving the demand for high-performance antioxidant solutions. Government policies favoring local manufacturing and industrial automation are developing positive market trends.

Europe Region Dominates the Market with Major Share

The European aminic antioxidants market is expanding at a fast rate, with high-performance industrial and automotive lubricants in high demand. Stringent environmental regulations are propelling low-emission and fuel-efficient vehicles, leading to the adoption of sophisticated antioxidant solutions. Research and development investment is increasing, driving innovations in oxidation-resistant products, engine efficiency, and durability. R&D investment is increasing with financing of oxidation-resistant product improvements, engine performance, and life. Specialty lubricant additives are being driven by the growing demand in the electric vehicle segment. Moreover, production and availability of aminic antioxidants are facilitated by the strong base manufacturing industry within the region.

Market Players Outlook

The major companies operating in the global aminic antioxidants market include BASF SE, LANXESS AG, Lubrizol Corp., SI Group, Inc., and Songwon Management AG, among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In March 2025, BASF SE is investing in its production facility in Puebla, Mexico, to boost the capacity of aminic antioxidants in lubricants. The upgrade highlights BASF's components supplier for the lubricant segment, meeting the rising demand for antioxidant additives owing to growing stability demands in lubricant oils and the increasing number of vehicles on the road.

- In September 2022, SI Group, a performance additives business, reported it added manufacturing capacity and capability to start producing ETHANOX 4757, aminic antioxidant, at its Rasal, India, plant. ETHANOX 4757 is an octylated-butylated diphenylamine primary antioxidant for lubricants, greases, industrial, automotive, and heat transfer fluids.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aminic antioxidants market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Aminic Antioxidants Market Sales Analysis – Type | Application| ($ Million)

• Aminic Antioxidants Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Aminic Antioxidants Industry Trends

2.2.2. Market Recommendations

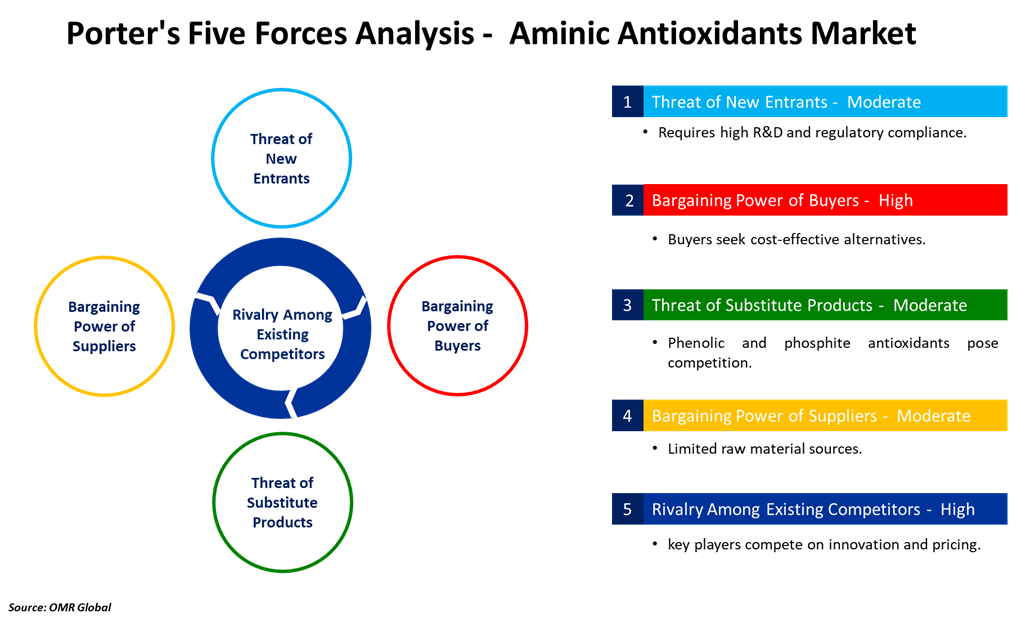

2.3. Porter's Five Forces Analysis for the Aminic Antioxidants Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Aminic Antioxidants Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Aminic Antioxidants Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Aminic Antioxidants Market Revenue and Share by Manufacturers

• Aminic Antioxidants Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. BASF SE

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. LANXESS AG

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Lubrizol Corp.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. SI Group, Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Songwon Management AG

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Aminic Antioxidants Market Sales Analysis by Type ($ Million)

5.1. Diphenylamine-Based Antioxidants

5.2. Phenyl-?-Naphthylamine-Based Antioxidants

5.3. Alkylated Diphenylamine

5.4. Others (Secondary Aromatic Amines)

6. Global Aminic Antioxidants Market Sales Analysis by Application ($ Million)

6.1. Lubricants

6.2. Rubber Processing

6.3. Plastic & Polymers

6.4. Fuel Additives

6.5. Others (Adhesives, Coatings, Food Packaging)

7. Regional Analysis

7.1. North American Aminic Antioxidants Market Sales Analysis – Type | Application| Country ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European Aminic Antioxidants Market Sales Analysis – Type | Application| Country ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific Aminic Antioxidants Market Sales Analysis – Type | Application| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World Aminic Antioxidants Market Sales Analysis – Type | Application| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Actylis

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. BASF SE

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Cayman Chemical Company

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. DMR Group Sp. z o.o.

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Dorf Ketal Chemicals.

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. DOUBLE BOND CHEMICAL IND. CO., LTD.

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Hangzhou Sungate Chemical

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. JIYI HOLDINGS GROUP

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. King Industries, LLC.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. KRAHN UK

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. LANXESS AG

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Lubrizol Corp.

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. NiMAC LTD.

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Shenyang Lubricants Co., Ltd.

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. SI Group, Inc.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Songwon Management AG.

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. Sunshield Chemicals Ltd.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Vanderbilt Holding Company, Inc.

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Yasho Industries Ltd.

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Zhengzhou Chorus Lubricant Additive Co., Ltd.

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

1. Global Aminic Antioxidants Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Diphenylamine-Based Antioxidants Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Phenyl-?-Naphthylamine-Based Antioxidants Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Alkylated Diphenylamine Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Other Type Aminic Antioxidants Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Aminic Antioxidants Market Research And Analysis By Application, 2024-2035 ($ Million)

7. Global Aminic Antioxidants For Lubricants Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Aminic Antioxidants For Rubber Processing Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Aminic Antioxidants For Plastic & Polymers Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Aminic Antioxidants For Fuel Additives Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Aminic Antioxidants For Other Application Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Aminic Antioxidants Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Aminic Antioxidants Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Aminic Antioxidants Market Research And Analysis By Type24-2035 ($ Million)

15. North American Aminic Antioxidants Market Research And Analysis By Application, 2024-2035 ($ Million)

16. European Aminic Antioxidants Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Aminic Antioxidants Market Research And Analysis By Type, 2024-2035 ($ Million)

18. European Aminic Antioxidants Market Research And Analysis By Application, 2024-2035 ($ Million)

19. Asia-Pacific Aminic Antioxidants Market Research And Analysis By Country, 2024-2035 ($ Million)

20. Asia-Pacific Aminic Antioxidants Market Research And Analysis By Type, 2024-2035 ($ Million)

21. Asia-Pacific Aminic Antioxidants Market Research And Analysis By Application, 2024-2035 ($ Million)

22. Rest Of The World Aminic Antioxidants Market Research And Analysis By Region, 2024-2035 ($ Million)

23. Rest Of The World Aminic Antioxidants Market Research And Analysis By Type, 2024-2035 ($ Million)

24. Rest Of The World Aminic Antioxidants Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Aminic Antioxidants Market Share By Type, 2024 Vs 2035 (%)

2. Global Diphenylamine-Based Antioxidants Market Share By Region, 2024 Vs 2035 (%)

3. Global Phenyl-?-Naphthylamine-Based Antioxidants Market Share By Region, 2024 Vs 2035 (%)

4. Global Alkylated Diphenylamine Market Share By Region, 2024 Vs 2035 (%)

5. Global Other Type Aminic Antioxidants Market Share By Region, 2024 Vs 2035 (%)

6. Global Aminic Antioxidants Market Share By Application, 2024 Vs 2035 (%)

7. Global Aminic Antioxidants For Lubricants Market Share By Region, 2024 Vs 2035 (%)

8. Global Aminic Antioxidants For Rubber Processing Market Share By Region, 2024 Vs 2035 (%)

9. Global Aminic Antioxidants For Plastic & Polymers Market Share By Region, 2024 Vs 2035 (%)

10. Global Aminic Antioxidants For Fuel Additives Market Share By Region, 2024 Vs 2035 (%)

11. Global Aminic Antioxidants For Other Application Market Share By Region, 2024 Vs 2035 (%)

12. Global Aminic Antioxidants Market Share By Region, 2024 Vs 2035 (%)

13. US Aminic Antioxidants Market Size, 2024-2035 ($ Million)

14. Canada Aminic Antioxidants Market Size, 2024-2035 ($ Million)

15. UK Aminic Antioxidants Market Size, 2024-2035 ($ Million)

16. France Aminic Antioxidants Market Size, 2024-2035 ($ Million)

17. Germany Aminic Antioxidants Market Size, 2024-2035 ($ Million)

18. Italy Aminic Antioxidants Market Size, 2024-2035 ($ Million)

19. Spain Aminic Antioxidants Market Size, 2024-2035 ($ Million)

20. Russia Aminic Antioxidants Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Aminic Antioxidants Market Size, 2024-2035 ($ Million)

22. India Aminic Antioxidants Market Size, 2024-2035 ($ Million)

23. China Aminic Antioxidants Market Size, 2024-2035 ($ Million)

24. Japan Aminic Antioxidants Market Size, 2024-2035 ($ Million)

25. South Korea Aminic Antioxidants Market Size, 2024-2035 ($ Million)

26. Australia and New Zealand Aminic Antioxidants Market Size, 2024-2035 ($ Million)

27. ASEAN Economies Aminic Antioxidants Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Aminic Antioxidants Market Size, 2024-2035 ($ Million)

29. Latin America Aminic Antioxidants Market Size, 2024-2035 ($ Million)

30. Middle East And Africa Aminic Antioxidants Market Size, 2024-2035 ($ Million)

FAQS

The size of the Aminic Antioxidant Market in 2024 is estimated to be around $1.3 billion.

Europe holds the largest share in the Aminic Antioxidant Market.

Leading players in the Aminic Antioxidant Market include BASF SE, LANXESS AG, Lubrizol Corp., SI Group, Inc., and Songwon Management AG, among others.

Aminic Antioxidant Market is expected to grow at a CAGR of 4.8% from 2025 to 2035.

The Aminic Antioxidant Market is growing due to rising demand in lubricants, plastics, and automotive applications for thermal and oxidative stability.