Amphibious Excavator Market

Global Amphibious Excavator Market Size, Share & Trends Analysis Report, By Capacity (Less than 10 tons, 10-30 tons, and More than 30 tons), By Application (Dredging, Pipeline Installation, Landscaping, Other) and Forecast, 2020-2026

Amphibious excavators are the specially designed excavators which perform construction and dredging activities in the shallow water. A modest growth rate is expected in the amphibious excavators market during the forecast period. Some of the major factors for the growth of the market include rising marine trade, and new port construction, which generates a demand for dredging activities. Moreover, increasing pipeline installations through water reservoirs, increasing landscaping activities are some of the other major factors for the rising demand for amphibious excavator globally. The amphibious excavator can be used as a mechanical dredger as they offer several benefits including swiftness, preciseness, and mobility along with the ability to handle bigger dredge materials. However, the high costs of acquiring, operating, and maintaining the equipment are some of the major restarting factors for the market.

A large share of the dredging revenue is generated from the government contracts to clean the water reservoir at a regular interval. Due to this, a considerable demand for the amphibious excavator will be there even after the economic slowdown due to the COVID-19 pandemic. Besides, a trend of sustainable construction activities such as usage of bio-fuel in the excavators will be witnessed during the forecast period.

Market Segmentation

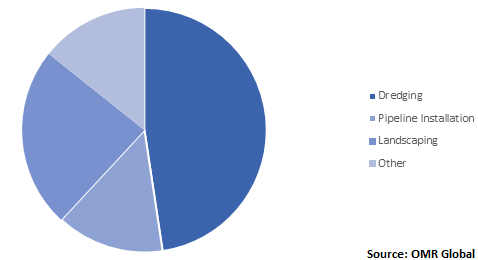

The global amphibious excavator market is segmented based on capacity and application. By capacity, the market is further segmented into less than 10 tons, 10-30 tons, and more than 30 tons capacity. 10-30 tons is expected to have a major market share with a significant growth rate during the forecast period. By application, the market is segmented into dredging, pipeline installation, landscaping, and other activities. Dredging is expected to hold the major market share all across the globe. Activities such as river cleaning to control floods are one of the major factors for the growth of the segment.

Global Amphibious Excavator Market Share by End-User, 2019 (%)

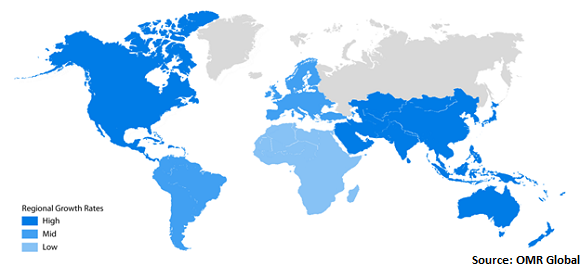

Regional Outlook

On the basis of geography, the global amphibious excavator market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). Asia-Pacific holds a significant market share during the forecast period. Countries such as China, Japan, India, and other South Asian countries are performing significant dredging activities for the management of their water reservoirs and seaports. China is expected to be the largest player in the market during the forecast period.

North America is also expected to hold a significant market share in the global market. Alone in the US, the domestic dredging bid market was around $1.7 billion in 2019. Some of the major dredging projects in 2019 in the country include a deepening project in Georgia, a coastal protection project in New York, two coastal protection projects in Virginia, a maintenance project in Texas, and maintenance projects on the Mississippi River. Europe and the Rest of the World are also expected to hold a major market share during the forecast period. Oil-producing countries are expected to contribute significantly to both regions.

Global Amphibious Excavator Market Growth, by Region 2020-2026

Market Players Outlook

As the amphibious excavator needs a considerable amount of customizations, few players are operating in the market. Most of the global construction equipment manufacturer offers amphibious excavator by customizing their existing excavator product portfolio. Some of the major players operating in the market include Caterpillar Inc., AB Volvo, Bohr- & Rammtechnik Berlin GmbH, Doosan Group, EIK International Corp., EMU OY, Hitachi Construction Machinery Co., Ltd., J.C. Bamford Excavators Ltd., and XCMG Group. These companies are adopting growth strategies including new product launches, customization, geographical expansions, partnerships & collaborations to gain a competitive edge in the market. For instance, in June 2017, Chinese construction equipment manufacturer XCMG Group launched XE215S, an amphibious excavator. It is the first domestically designed 20 ton capacity amphibious excavator. The newly designed amphibious excavator will have fewer issues related to wear, and short service life. In May 2019, Remu Oy has introduced a variant of amphibious excavator, Big Float E15 with a capacity of 10 to 15 tons. The earlier amphibious excavator product line of the company includes Big Float E10 and Big Float E25.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Amphibious Excavator market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Caterpillar Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. AB Volvo

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Hitachi Construction Machinery Co., Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Doosan Group

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. J.C. Bamford Excavators Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Amphibious Excavator Market by Capacity

5.1.1. Less than 10 tons

5.1.2. 10-30 tons

5.1.3. More than 30 tons

5.2. Global Amphibious Excavator Market by Application

5.2.1. Dredging

5.2.2. Pipeline Installation

5.2.3. Landscaping

5.2.4. Other

5.2.5. Surveillance

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Italy

6.2.3. France

6.2.4. Spain

6.2.5. Italy

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AB Volvo

7.2. Bell Dredging Pumps B.V.

7.3. Bohr- & Rammtechnik Berlin GmbH

7.4. Caterpillar Inc.

7.5. Chancos Industrial (Shanghai) Co., Ltd.

7.6. Doosan Group

7.7. EIK International Corp.

7.8. EMU OY

7.9. Gulf Coast Specialty Energy Services (GCSES)

7.10. Hitachi Construction Machinery Co., Ltd. (HCM)

7.11. Hyundai Construction Equipment Co. Ltd.

7.12. J.C. Bamford Excavators Ltd.

7.13. Marsh Buggies Inc.

7.14. Maxway Machine Co. Ltd.

7.15. Remu Oy

7.16. Senwatec GmbH & Co. KG

7.17. Thainex-Asia Co., Ltd.

7.18. Ultratrex Machinery Sdn Bhd

7.19. Waterking BV

7.20. Wetland Equipment Co.

7.21. XCMG Group

1. GLOBAL AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2019-2026 ($ MILLION)

2. GLOBAL LESS THAN 10 TONS AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

3. GLOBAL 10-30 TONS AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

4. GLOBAL MORE THAN 30 TONS AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

5. GLOBAL AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL DREDGING MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

7. GLOBAL PIPELINE INSTALLATION MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

8. GLOBAL LANDSCAPING MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

9. GLOBAL OTHER Application MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

10. GLOBAL SURVEILLANCE MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

11. NORTH AMERICAN AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPE AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPE AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2019-2026 ($ MILLION)

16. EUROPE AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA PACIFIC AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA PACIFIC AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2019-2026 ($ MILLION)

19. ASIA PACIFIC AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. REST OF THE WORLD AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY CAPACITY, 2019-2026 ($ MILLION)

22. REST OF THE WORLD AMPHIBIOUS EXCAVATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL AMPHIBIOUS EXCAVATOR MARKET SHARE BY CAPACITY, 2019 VS 2026 (%)

2. GLOBAL AMPHIBIOUS EXCAVATOR MARKET SHARE BY PROPULSION APPLICATION, 2019 VS 2026 (%)

3. GLOBAL AMPHIBIOUS EXCAVATOR MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF WORLD AMPHIBIOUS EXCAVATOR MARKET SIZE, 2019-2026 ($ MILLION)