Analytical Standards Market

Global Analytical Standards Market Size, Share & Trends Analysis Report by Product Type (Organic, and Inorganic), by Technique (Chromatography, Spectroscopy, Titrimetry, Physical Properties Tests and, Others) by Application (Bioanalytical Testing, Stability Testing, Raw Material Testing, Microbial Testing, and Others) Forecast Period (2021-2027)

The global analytical standards market is anticipated to grow at a significant CAGR of around 5 % during the forecast period. The rising application of analytical standards in proteomics and metabolomics coupled with pollution control monitoring is increasing globally, also greater regulatory emphasis on effective pollution monitoring and control is anticipated to grow the analytical standards market. According to an update by the World Health Organization (WHO) as of September 2021, has issues Global Air Quality Guidelines (AQGs), it stated that significantly reduced the recommended levels of pollutants that can be considered safe for human health under these guidelines and it was first WHO update since 2005. The guidelines are derived for all countries across the globe to meet acceptable air quality levels. Guidelines recommend air quality standards for six major pollutants in that the health impacts from exposure have improved. Moreover, in November 2021, US Environmental Protection Agency, proposed a rule to combat climate change and for preserving public health. The rule cut methane and other harmful air pollutants from both new and current sources in the oil and natural gas industry. However, the key factor that is hampering the analytical standard market is currently public is not focusing and is less aware of the effective pollution monitoring strategies.

Impact of COVID-19 Pandemic on Global Analytical Standards Market

The analytical standards and instruments sector has faced various challenges throughout the COVID-19 pandemic. . The decline in product demand from major end-users, limited operations in all industries, inadequate funding to research and academic institutes, temporary closure of major academic institutes all these factors have contributed to low demand for analytical standards for end-users that in terms has disrupted all over the analytical standard market in COVID-19.

Segmental Outlook

The global analytical standards market is segmented based on the product type, technique, and application. Based on the product type, the market is sub-segmented into organic and Inorganic. Based on technique, the market is sub-segmented into chromatography, spectroscopy, titrimetry, physical properties tests and, others. Based on the applications, the market is sub-segmented into bioanalytical testing, stability testing, raw material testing, microbial testing, and others. Among the Application segment, the raw material sub-segment is anticipated to dominate due to increasing manufacturing of medicine and petrochemicals products, high growth in the food and beverage industry.

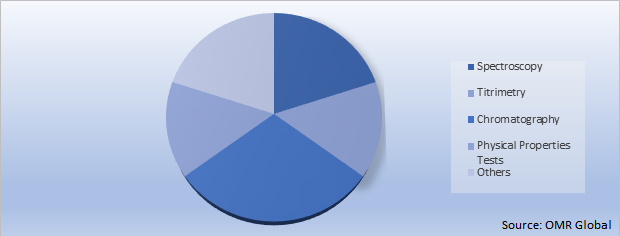

Global Analytical Standards Market Share by Technique, 2020 (%)

The Chromatography Segment is Dominating in the Global Analytical Standards Market

The chromatography technique is anticipated to dominate due to its high performance in identification and separating the impurities with the most straightforward procedures, this technique is a rapid and precise method of separation in several forms of the sample that contains a wide range of components. Additionally, the available equipment, reagents, and reference standards for various types of chromatography such as liquid chromatography, gas chromatography, and others have surged their demand in end-user applications. Application of this equipment in line with other analytical instruments includes mass spectrometers have increased adoption of the technique.Furthermore, increase in the use of chromatography in various testing such as environmental testing, food testing, cosmetics, chemicals, research, forensic, and oil & petrochemical sectors. For instance, In March 2021, Thermo Fisher Scientific Inc., launched Analytical Instrument and Software to Improve Laboratory Workflows with an enhanced high-performance liquid chromatography (HPLC) system. It will deliver maximized instrument uptime and precision for any operator, regardless of experience.

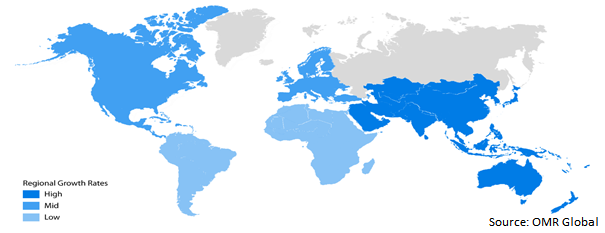

Regional Outlooks

The global analytical standards market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America). North America is expected to dominate the market. As per the report published by the US Department of Health & Human Services in May 2021, about 36,801 people in the United States were diagnosed with HIV in 2019. The need of developing high-quality drugs and other products with enhanced safety and precautions in less period is the reason that the demand for analytical standards in the North America region is increasing.

Global Analytical Standards Market Growth, by Region 2021-2027

The Asia-Pacific Region is Fastest Growing in the Global Analytical Standards Market

Asia Pacific region is expected to show the fastest growth in analytical standards market due to expanding pharmaceutical industry in the region’s major economies such as China, and India. Also the significant government regulation and initiatives in this major economies to expand and strengthen healthcare expenditure is also boosting the overall market growth. Moreover, encouraged increased R&D spending on clinical trials and genomic techniques for efficient diagnosis are factors that drive the market in the region. For instance, in September 2020, Bharat Petroleum Corporation Ltd (BPCL), launched India's first certified reference material an analytical standard for petroleum laboratories for testing chemical components of crude oil that are approved by the National Physical Laboratory, New Delhi. The analytical reference material has traceability to the international system of units being produced by BPCL'S Sewree Laboratory.

Market Players Outlook

The major companies serving the global analytical standards market include Agilent Technologies, Inc., Crescent Chemical Co., LGC Ltd., Merck KGaA, PerkinElmer Inc., Restek Corp. WATERS CORP, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2020, LGC launched, ACCURUN Anti-SARS-CoV-2 is a reference Material Kit to address the critical need for clinical laboratories to respond to the COVID-19. It bears CE mark and IVD symbol which signifies the ACCURUN Anti-SARS-CoV-2 Controls Kit meets extensive design control requirements.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global analytical standards market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Analytical Standards Market

• Recovery Scenario of Global Analytical Standards Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Agilent Technologies, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. LGC Ltd

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Merck KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PerkinElmer Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. WATERS CORP.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Analytical Standards Market by Product Type

4.1.1. Orgaanic

4.1.2. Inorganic

4.2. Global Analytical Standards Market by Technique

4.2.1. Chromatography

4.2.2. Spectroscopy

4.2.3. Titrimetry

4.2.4. Physical Properties Tests

4.2.5. Others

4.3. Global Analytical Standards Market by Application

4.3.1. Bioanalytical Testing

4.3.2. Stability Testing

4.3.3. Raw Material Testing

4.3.4. Microbial Testing

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AccuStandard

6.2. BCP Instruments

6.3. Biosynth Carbosynth.

6.4. Campro Scientific GmbH

6.5. Cayman Chemical Co.

6.6. CPI International |

6.7. Crescent Chemical Co.

6.8. Inorganic Ventures

6.9. LUMITOS AG

6.10. Mallinckrodt Pharmaceuticals

6.11. General Electric Co

6.12. GFS Chemicals, Inc.

6.13. Groundsailer Media B.V.

6.14. Reagecon Diagnostics Ltd.

6.15. Restek Corp.

6.16. Ricca Chemical Co.

6.17. Spex CertiPrep

6.18. Takara Bio USA, Inc.

6.19. Thermo Fisher Scientific Inc.

6.20. US Pharmacopeial Convention

1. GLOBAL ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

2. GLOBAL ORGANIC ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL INORGANIC ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2020-2027 ($ MILLION)

5. GLOBAL CHROMATOGRAPHY ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL SPECTROSCOPY ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL TITRIMETRY ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL PHYSICAL PROPERTIES TESTS ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL OTHERS ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

11. GLOBAL ANALYTICAL STANDARDS FOR BIO ANALYTICAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL ANALYTICAL STANDARDS FOR STABILITY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL ANALYTICAL STANDARDS FOR RAW MATERIAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL ANALYTICAL STANDARDS FOR MICROBIAL TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL ANALYTICAL STANDARDS FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

17. NORTH AMERICAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

19. NORTH AMERICAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

21. EUROPEAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. EUROPEAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

23. EUROPEAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2020-2027 ($ MILLION)

24. EUROPEAN ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

29. REST OF THE WORLD ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. REST OF THE WORLD ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY TECHNIQUE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD ANALYTICAL STANDARDS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ANALYTICAL STANDARDS MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ANALYTICAL STANDARDS MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL ANALYTICAL STANDARDS MARKET, 2021-2027 (%)

4. GLOBAL ANALYTICAL STANDARDS MARKET SHARE BY PRODUCT TYPE, 2020 VS 2027 (%)

5. GLOBAL ORGANIC ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL INORGANIC ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL ANALYTICAL STANDARDS MARKET SHARE BY TECHNIQUE, 2020 VS 2027 (%)

8. GLOBAL CHROMATOGRAPHY ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL SPECTROSCOPY ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL TITRIMETRY ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL PHYSICAL PROPERTIES TESTS ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL OTHERS ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL ANALYTICAL STANDARDS MARKET SHARE BY APPLICATION, 2020 VS 2027 (%)

14. GLOBAL ANALYTICAL STANDARDS FOR BIOANALYTICAL TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL ANALYTICAL STANDARDS FOR STABILITY TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL ANALYTICAL STANDARDS FOR RAW MATERIAL TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL ANALYTICAL STANDARDS FOR MICROBIAL TESTING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL ANALYTICAL STANDARDS FOR OTHERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. GLOBAL ANALYTICAL STANDARDS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

20. US ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

21. CANADA ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

22. UK ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

23. FRANCE ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

24. GERMANY ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

25. ITALY ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

26. SPAIN ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF EUROPE ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

28. INDIA ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

29. CHINA ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

30. JAPAN ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

31. SOUTH KOREA ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF ASIA-PACIFIC ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)

33. REST OF THE WORLD ANALYTICAL STANDARDS MARKET SIZE, 2020-2027 ($ MILLION)