Anti-Hypertensive Drugs Market

Anti-Hypertensive Drugs Market Size, Share & Trends Analysis Report by Drug Class (Thiazide Diuretics, Calcium Channel Blockers, ACE Inhibitors, Angiotensin II Receptor Antagonists (ARBs), Beta-Blockers, and Others), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global anti-hypertensive drugs market is anticipated to grow at a CAGR of over 4% during the forecast period. The anti-hypertensive drugs are used to restrict any complications of high blood pressure including myocardial infarction, stroke, and many more. In addition to this, anti-hypertensive drugs have their primary action on systemic vascular resistance and it also reduces systemic vascular resistance with long-term use. Moreover, hypertension is directly associated with increased cardiovascular risk, and reducing blood pressure and the use of the anti-hypertensive drug is recommended which significantly decreases such risks. Hence, factors such as increasing cases of diabetes, hypertension, cardiovascular diseases associated with high blood pressure will directly impact the growth of the global anti-hypertensive market during the forecast period.

However, the high cost associated with anti-hypertensive drugs will turn out to be a major restraint for the growth of the anti-hypertensive market, as it has to be given to the patient for a longer period. Additionally, the low awareness and less diagnosis rate in the developing countries will also hamper the growth of the anti-hypertensive drugs market during the forecast period. Moreover, the side effects of anti-hypertensive drugs such as calcium channel blockers used during pregnancy include tachycardia, palpitations, peripheral edema, headaches, and facial flushing, which will lower the adoption of these drugs. Hence, the low adoption rate of anti-hypertensive drugs during pregnancy will majorly restrict the growth of the anti-hypertensive drug market during the forecast period.

Segmental Outlook

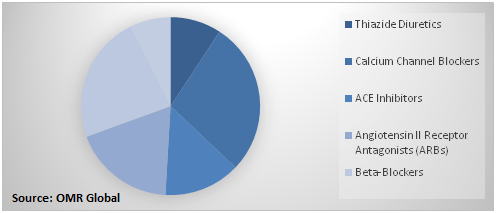

The global anti-hypertensive drugs market is segmented on the basis of the drug class. Based on the drug class, the market is sub-segmented into and thiazide diuretics, calcium channel blockers, ACE inhibitors, angiotensin II receptor antagonists (ARBs), beta-blockers, and others such as renin inhibitors.

Global Anti-Hypertensive Drugs Market Share by Drug Class 2019, (%)

Calcium Channel Blockers to Hold Prominent Share in the Market

The calcium channel blockers segment is anticipated to hold a significant share market share in the anti-hypertensive drugs market. Calcium channel blocker drugs exhibit blood-pressure-lowering effects by decreasing the excitability of heart muscle. Calcium channel blocker drugs are potentially used in various types of abnormally rapid heart rhythms treatments. Hence, the versatile application of calcium channel blocker drugs segment in the treatment of rapid heart rhythms that is a case of hypertension is anticipated to drive the segmental growth of the market.

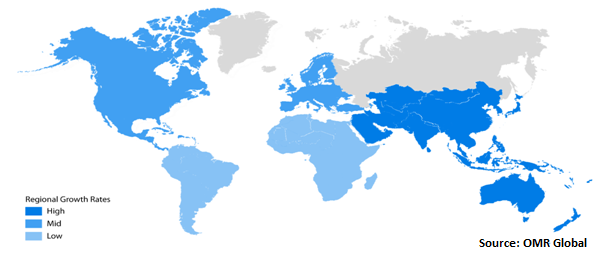

Regional Outlooks

The global anti-hypertensive drugs market is further segmented on the basis of geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is estimated to hold the largest market share in the anti-hypertensive drugs during the forecast period owing to the well-developed healthcare structure coupled with the huge number of patients diagnosed with hypertension and cardiovascular diseases in the region. According to the American Thoracic Society (ATS), around 250,000 cases of pulmonary embolism occur each year in the US. Additionally, the easy availability of anti-hypertensive drugs due to the presence of key industry players across the region will also drive the anti-hypertensive drugs market across the region.

Global Anti-Hypertensive Drugs Market Growth, by Region 2020-2026

Asia-Pacific to Augment with the Fastest Growth Rate in the Anti-Hypertensive Drugs Market

Asia-Pacific is anticipated to exhibit the fastest growth rate in the anti-hypertensive drugs market owing to the increasing cases of hypertension cases across the region. According to WHO estimation, around 270 million people have hypertension alone in China. Additionally, government and non-government initiatives to increase awareness regarding hypertension across the region will also drive the growth of anti-hypertensive market growth. For instance, HOPE Asia Network, which stands for Hypertension Cardiovascular Outcome and Prevalence Evidence in Asia is one such non-government initiative in Asia-Pacific. The initiative is aimed to implement culturally specific various education programs that can increase awareness of hypertension and its relationship to cardiovascular disease across the region.

Market Players Outlook

Some of thekey players operating in the global anti-hypertensive drugs market include Pfizer Inc., Johnson & Johnson Services, Inc., Sanofi SA, Boehringer Ingelheim International GmbH, AstraZeneca PLC, Daiichi Sankyo Co.Ltd., Teva Pharmaceutical Industries Ltd., and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, merger, and acquisition, collaborations and new drug launch to stay competitive in the market.

For instance, in May 2019, Daiichi Sankyo Co. Ltd. announced the launch of MINNEBRO Tablets 1.25 mg, 2.5 mg and 5 mg (generic name: esaxerenone; hereafter, the drug)in Japan. Daiichi Sankyo expects the drug to benefit patients by providing a new therapeutic option for the treatment of hypertension.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global anti-hypertensive drugs market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Pfizer Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Johnson & Johnson Services, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Sanofi SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Boehringer IngelheimInternational GmbH

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. AstraZeneca PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Antihypertensive Drugs Market by Drug Class

5.1.1. Thiazide Diuretics

5.1.2. Calcium Channel Blockers

5.1.3. ACE Inhibitors

5.1.4. Angiotensin II Receptor Antagonists (ARBS)

5.1.5. Beta Blockers

5.1.6. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AstraZeneca PLC

7.2. Bayer AG

7.3. Boehringer Ingelheim International GmbH

7.4. Daiichi Sankyo Co., Ltd.

7.5. Johnson & Johnson Services, Inc.

7.6. Lupin Ltd.

7.7. Merck KGaA

7.8. Noden Pharma DAC

7.9. Novartis International AG

7.10. Pfizer Inc.

7.11. Ranbaxy Laboratories Ltd.

7.12. Renata Ltd.

7.13. Sanofi S.A.

7.14. Sun Pharmaceuticals LLC

7.15. Takeda Pharmaceutical Company Ltd.

7.16. Teva Pharmaceutical Industries Ltd.

7.17. Unichem Laboratories Ltd.

7.18. United Therapeutics Corp.

1. GLOBAL ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

2. GLOBAL THIAZIDE DIURETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CALCIUM CHANNEL BLOCKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ACE INHIBITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ANGIOTENSIN II RECEPTOR ANTAGONISTS (ARBS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ALPHA BLOCKERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL BETA BLOCKERSMARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHER ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL HYPERTENSION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

12. EUROPEAN ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. EUROPEAN ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

14. ASIA-PACIFIC ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. ASIA-PACIFIC ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ANTIHYPERTENSIVE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

1. GLOBAL ANTIHYPERTENSIVE DRUGS MARKET SHARE BY DRUG CLASS, 2019 VS 2026(%)

2. GLOBAL ANTIHYPERTENSIVE DRUGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026(%)

3. US ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

5. UK ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD ANTIHYPERTENSIVE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)