Antibiotics Market

Global Antibiotics Market Size, Share & Trends Analysis Report by Product Type (Cephalosporins, Penicillins, Fluoroquinolones, Macrolides, Carbapenems, Aminoglycosides, and Other Product Types), By Spectrum (Broad-spectrum Antibiotics and Narrow-spectrum Antibiotics), Forecast 2019-2025 Update Available - Forecast 2025-2035

The antibiotics market is anticipated to expand at a CAGR of over 4% during the forecast period. Antibiotics are the class of drugs that are used by the body to ward off diseases caused by bacteria. The antibiotics are only effective in fighting bacterial infections when used to treat other health conditions these can be proved to be harmful to the overall health. The factor such as increasing incidence of bacterial infections such as urinary tract infections, strep throat, and some forms of pneumonia is anticipated to drive the market growth. In addition, the advantages offered by antibiotics such as simplified dosing, predictable response, lower risk of allergies are fuelling the market growth during the forecast period.

Moreover, the adverse effects of antibiotics use such as digestive issues, bone damage,and sensitivity to sunlight is anticipated to reduce the market of antibiotics. Taking antibiotics too often or for the too long can make bacteria resistant to antibiotics so much that future taking of antibiotics doesn't work against them which is also a major restraining factor for the antibiotics market. Other factors such as delay in manufacturing processes coupled with the shortage of antibiotics drugs will also act as restraints for the antibiotics market. The growing problem of antibiotic resistance is also restraining the growth of the antibiotics market during the forecast period.

Segmental Outlook

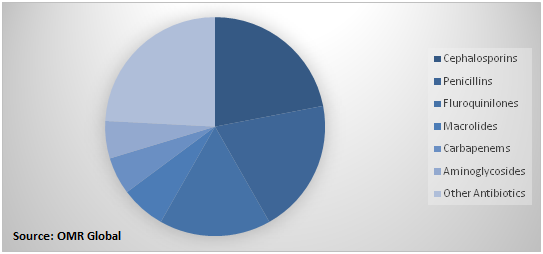

The antibiotics market is segmented on the basis of product type and spectrum. Based on product type, the market is sub-segmented into cephalosporins, penicillin, fluoroquinolones, macrolides, carbapenems, aminoglycosides, and other antibiotics such as imidazoles, tetracyclines, lincosamides, and monoclonal antibodies. Based on the spectrum, the market is sub-segmented into broad-spectrum antibiotics and narrow-spectrum antibiotics. There is an increasing demand for broad-spectrum antibiotics, which contribute significantly to the segmental growth of the market.

Global Antibiotics Market Share by Product Type, 2018 (%)

Cephalosporin to Hold a Significant Share in the Market

Cephalosporin segment is anticipated to hold a significant share in the global antibiotics market owing to its increasing use of the product for the treatment of bacterial infections in the patients who are allergic to penicillin. Cephalosporins are a type of beta-lactam antibiotic that can be used for the reduction of bacterial infection and can be taken in the oral form or injected into a vein (intravenous injection) depending on the infection. The most common application of cephalosporins includes in the treatment of respiratory tract infections, skin infections, and urinary tract infections.

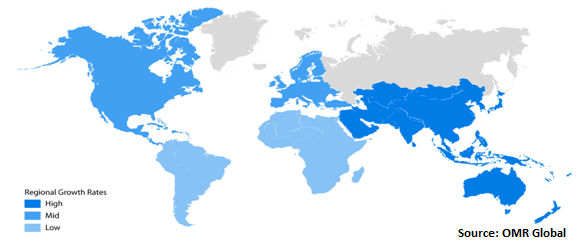

Regional Outlooks

The global antibiotics market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is estimated to hold the largest market share in the antibiotics market during the forecast period. The region has a well-developed healthcare infrastructure that facilitates the availability of branded drugs. In addition, the presence of key players in the region further gives a boost to the regional growth of the market.

Global Antibiotics Market Growth by Region, 2019-2025

Asia-Pacific to augment with the fastest growth rate during the forecast period

Asia-Pacific is anticipated to expand at a higher growth rate in the antibiotics market due to the presence of major antibiotics production sites in China. China is ranked as the largest exporter of vitamins and antibiotic raw materials across the globe. China dominates most of the API market which would fuel the antibiotic market in the Asia-Pacific region. Additionally, populations in the Asia-Pacific region are vulnerable to infectious diseases, hence promoting the antibiotics market in the region. Moreover, the ongoing R&D in the region with the presence of major market players will also drivethe Asia-Pacific antibiotics market growth during the forecast period.

Market Players Outlook

Some of the key players operating in the global antibiotics market include Johnson & Johnson Services Inc., GlaxoSmithKline PLC, Merck & Co. Inc., Astellas Pharma Inc., Pfizer Inc., Cipla Ltd., Lupin Ltd., Melinta Therapeutics, Inc, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including new product launch, merger, and acquisition, collaborations with government, funding to the start-ups, and technological advancements to stay competitive in the market. For instance, in July 2019, Cipla USA Inc., a wholly-owned subsidiary of the Cipla Ltd., announced the acquisition of the prescription drug ZEMDRI (Plazomicin) from Achaogen Inc. Cipla USA has acquired global rights of ZEMDRI (excluding Greater China) with its allied assets and limited liabilities.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global antibiotics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Pfizer Inc.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. GlaxoSmithKline PLC

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Johnson& Johnson Services Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Merck& Co. Inc.

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. Astellas Pharma Inc.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Antibiotics Market by Product Type

5.1.1. Cephalosporins

5.1.2. Penicillin

5.1.3. Fluoroquinolones

5.1.4. Macrolides

5.1.5. Carbapenems

5.1.6. Aminoglycosides

5.1.7. Others

5.2. Global Antibiotics Market by Spectrum

5.2.1. Broad-spectrum Antibiotics

5.2.2. Narrow-spectrum Antibiotics

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Astellas Pharma, Inc.

7.2. Bayer AG

7.3. Bristol-Myers Squibb Company

7.4. Cipla Ltd.

7.5. Eli Lilly and Company

7.6. F. Hoffmann La. Roche Ltd.

7.7. GlaxoSmithKline PLC

7.8. Johnson & Johnson Services Inc.

7.9. Lupin Ltd.

7.10. Melinta Therapeutics, Inc:

7.11. Merck & Co. Inc.

7.12. Pfizer Inc.

7.13. Sanofi SA

7.14. Sun Pharmaceutical Industries Ltd.

7.15. Taisho Pharmaceutical Holdings Co. Ltd.

1. GLOBAL ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL CEPHALOSPORINS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL PENICILLINS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL FLUOROQUINILONES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MACROLIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL CARBAPENEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL AMINOGLYCOSIDES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL OTHER ANTIBIOTICS PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY SPECTRUM, 2018-2025 ($ MILLION)

10. GLOBAL NARROW-SPECTRUM ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL BROAD-SPECTRUM ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. NORTH AMERICAN ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BYPRODUCT TYPE, 2018-2025 ($ MILLION)

15. NORTH AMERICAN ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY SPECTRUM, 2018-2025 ($ MILLION)

16. EUROPEAN ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. EUROPEAN ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BYPRODUCT TYPE, 2018-2025 ($ MILLION)

18. EUROPEAN ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY SPECTRUM, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BYPRODUCT TYPE, 2018-2025 ($ MILLION)

21. ASIA-PACIFIC ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY SPECTRUM, 2018-2025 ($ MILLION)

22. REST OF THE WORLD ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

23. REST OF THE WORLD ANTIBIOTICS MARKET RESEARCH AND ANALYSIS BY SPECTRUM, 2018-2025 ($ MILLION)

1. GLOBAL ANTIBIOTICS MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL ANTIBIOTICS MARKET SHARE BY SPECTRUM, 2018 VS 2025 (%)

3. GLOBAL ANTIBIOTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ANTIBIOTICS MARKET SIZE, 2018-2025 ($ MILLION)