Apheresis Market

Apheresis Market Size, Share & Trends Analysis Report by Product (Apheresis Disposables, Apheresis Devices), by Procedure (Automated blood collection, Therapeutic Apheresis), and by Application (Plasmapheresis, Plateletpheresis, Erythrocytapheresis, Leukapheresis, and Photopheresis) Forecast Period (2025-2035)

Industry Outlook

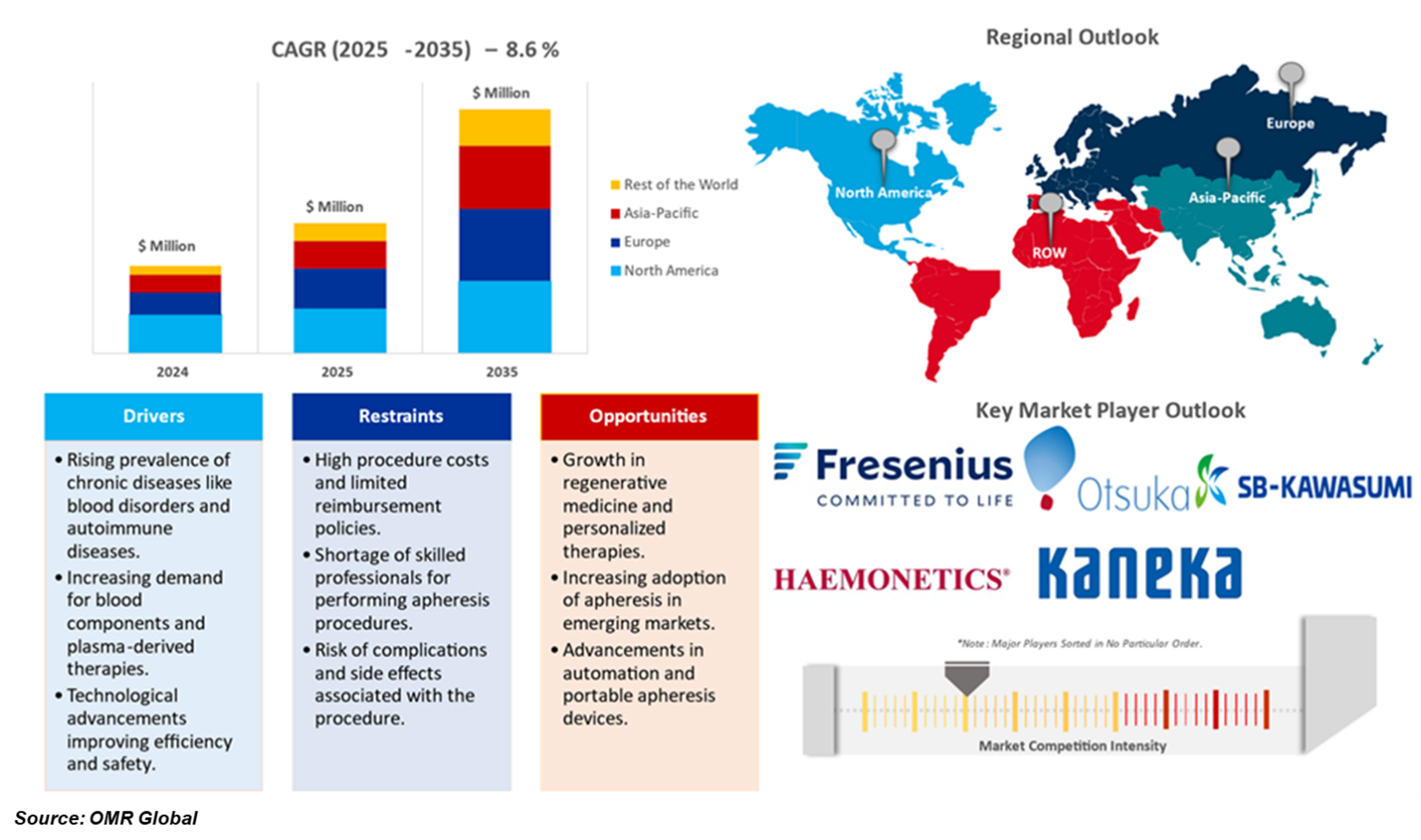

Apheresis market is projected to grow by a CAGR of 8.6%. The market is growing owing to the unexpected rise in the demand for plasma-derived products. As the prevalence of chronic disorders increases, the advancement in healthcare technology increases, this advancement boosts the market opportunities and growth. Diseases such as sickle cell anemia and other hemoglobinopathies can be treated with the aid of these technologies. Additionally, as apheresis helps with blood filtration and purification, it has been utilized in a variety of medical treatments for ailments such as cancer, diabetes, arthritis, and renal diseases. Accordingly, market players are coming up with new products to cater to the demand for automated red blood cell exchange treatment.

Segmental Outlook

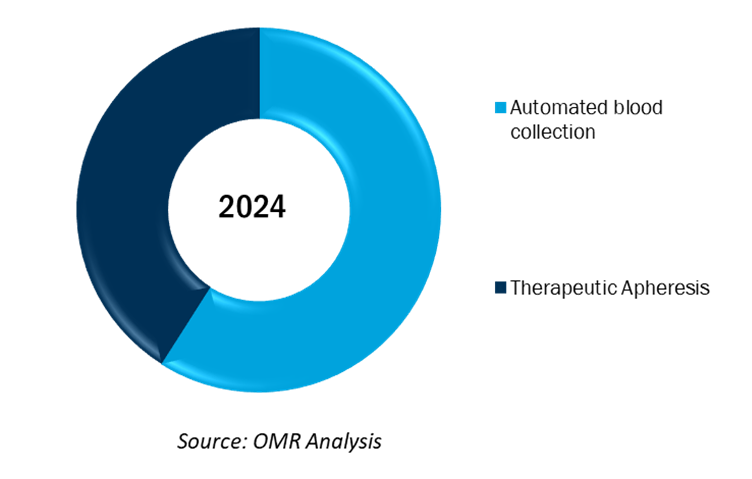

The global apheresis market is segmented by product, procedure, and application. Based on the product, the market is sub-segmented into apheresis disposables, apheresis devices, centrifugal apheresis devices, and membrane separation devices. Based on the procedure, the market is sub-segmented into automated blood collection, therapeutic apheresis, therapeutic apheresis disposables, and therapeutic apheresis devices. Further, based on application, the market is sub-segmented into plasmapheresis, plateletpheresis, erythrocytapheresis, leukapheresis, and photopheresis. Among the applications, the photospheres sub-segment is anticipated to hold a considerable share of the market owing to the growing demand for photopheresis in organ transplant rejection therapies and the increased prevalence of blood diseases.

The Photopheresis Sub-Segment Is Anticipated to grow more in the projected years.

Photopheresis is widely utilized in organ transplant rejection therapy and immune-related issues, it is expected to rise in the apheresis market. This process works especially well for treating cutaneous T-cell lymphoma (CTCL), graft-versus-host disease (GVHD), and other autoimmune conditions. In photopheresis, technological advancements have improved therapy effectiveness and convenience. This development improved patient convenience, speed, and safety of therapy. Additionally, as photopheresis may choose specific immune responses with few side effects, it has evolved into a worthwhile immune modulation treatment as the movement toward personalized medicine continues to grow.

Global Apheresis Market Share By Procedure, 2024 (%)

Regional Outlook

The global apheresis market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia-Pacific is anticipated to hold a prominent share of the market across the globe, owing to the high population density with an increase in the senior citizen population.

The North American Region is Expected to Grow Significantly in Apheresis Market

The market indicates high growth in the North American region owing to having a large market share as various elements raise the number of blood-related diseases, such as cancer, kidney diseases, metabolic diseases, and neurological disorders. According to the National Health Account (NHA), in March 2025, NIH delivered $2.56 in economic activity, a multiplier effect that extends the agency’s impact as the largest public funder of biomedical research in the world. The report also shows that the agency awarded more than $36.9 billion to researchers. NIH-funded research has improved patient health; boosted job creation directly and indirectly, supported the purchase of research-related goods and services; and produced spin-out companies that drive tax revenue and attract innovation-intensive businesses.

Market Players Outlook

The major companies serving the global apheresis market include Fresenius SE & Co. KGaA, Otsuka Holdings Co., Ltd., SB-KAWASUMI LABORATORIES, INC., Haemonetics, Kaneka Corp., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2022, Terumo Blood and Cell Technologies and Eliaz Therapeutics Inc. (ETI) collaborated to optimize the selective removal of an upstream inflammatory protein termed Galectin-3 (Gal-3) from blood plasma to help treat AKI and S-AKI.

Recent Development

- In June 2024, Terumo Blood and Cell Technologies announced that the NHS MedTech Funding Mandate (MTFM) in the UK has chosen to treat sickle cell disease using the automated red blood cell exchange (RBCX) process carried out on the company's Spectra Optia Apheresis System. This decision will lead to a wider implementation of Spectra Optia in hospitals throughout England. This will improve access to this transformative medication for sickle cell disease sufferers.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global apheresis market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Apheresis Market Sales Analysis – Product | Producer| Application ($ Million)

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Global Apheresis Market Trends

2.2.2. Market Recommendations

2.2.3. Conclusion

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Apheresis Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Apheresis Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Global Apheresis Market Revenue by Manufacturers

4.2. Key Company Analysis

4.2.1. Overview

4.2.2. Product Portfolio

4.2.3. Financial Analysis (Subject to Data Availability)

4.2.4. SWOT Analysis

4.2.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Apheresis Market by Product ($ Million)

5.1. Apheresis Disposables

5.2. Apheresis Devices

6. Global Apheresis Market by Producer ($ Million)

6.1. Automated Blood Collection (Donor Apheresis)

6.2. Therapeutic Apheresis

7. Global Apheresis Market by Application ($ Million)

7.1. Plasmapheresis

7.2. Plateletpheresis

7.3. Erythrocytapheresis

7.4. Leukapheresis

7.5. Photopheresis

8. Regional Analysis

• North American Apheresis Market Sales Analysis Product | Producer| Application | Country ($ Million)

8.1.1. United States

8.1.2. Canada

• European Apheresis Market Sales Analysis Product | Producer| Application | Country ($ Million)

8.1.3. UK

8.1.4. Germany

8.1.5. Italy

8.1.6. Spain

8.1.7. France

8.1.8. Russia

8.1.9. Rest of Europe

• Asia-Pacific Apheresis Market Sales Analysis Product | Producer| Application | Country ($ Million)

8.1.10. China

8.1.11. Japan

8.1.12. South Korea

8.1.13. India

8.1.14. Australia & New Zealand

8.1.15. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

8.1.16. Rest of Asia-Pacific

• Rest of the World Apheresis Market Sales Analysis Product | Producer| Application | Country ($ Million)

8.1.17. Latin America

8.1.18. Middle East and Africa

9. Company Profiles

9.1. Adcem Healthcare

9.2. Asahi Kasei Medical Co., Ltd.

9.3. B. Braun SE

9.4. Becton, Dickinson, and Co.

9.5. Cerus Corp.

9.6. DIAMED Medizintechnik GmbH

9.7. ElevateBio

9.8. Fresenius SE & Co. KGaA

9.9. Haemonetics

9.10. Haier Biomedical

9.11. Kaneka Corp.

9.12. Medica SPA

9.13. Meise Medizintechnik GmbH

9.14. Miltenyi Biotec

9.15. Nikkiso Co., Ltd.

9.16. Otsuka Holdings Co., Ltd.

9.17. Promedix Trading Group

9.18. SB-KAWASUMI LABORATORIES, INC.

9.19. Span Healthcare Pvt. Ltd.

9.20. Terumo BCT, Inc.

1. Global Apheresis Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Apheresis Disposables Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Apheresis Devices Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Apheresis Market Research And Analysis By Procedure, 2024-2035 ($ Million)

5. Global Automated Blood Collection Apheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Therapeutic Apheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Apheresis Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Apheresis For Plasmapheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Apheresis For Plateletpheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Apheresis For Erythrocytapheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Apheresis For Leukapheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Apheresis For Photopheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Apheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

14. North American Apheresis Market Research And Analysis By Country, 2024-2035 ($ Million)

15. North American Apheresis Market Research And Analysis By Product, 2024-2035 ($ Million)

16. North American Apheresis Market Research And Analysis By Procedure, 2024-2035 ($ Million)

17. North American Apheresis Market Research And Analysis By Application, 2024-2035 ($ Million)

18. European Apheresis Market Research And Analysis By Country, 2024-2035 ($ Million)

19. European Apheresis Market Research And Analysis By Product, 2024-2035 ($ Million)

20. European Apheresis Market Research And Analysis By Procedure, 2024-2035 ($ Million)

21. European Apheresis Market Research And Analysis By Application, 2024-2035 ($ Million)

22. Asia-Pacific Apheresis Market Research And Analysis By Country, 2024-2035 ($ Million)

23. Asia-Pacific Apheresis Market Research And Analysis By Product, 2024-2035 ($ Million)

24. Asia-Pacific Apheresis Market Research And Analysis By Procedure, 2024-2035 ($ Million)

25. Asia-Pacific Apheresis Market Research And Analysis By Application, 2024-2035 ($ Million)

26. Rest Of The World Apheresis Market Research And Analysis By Region, 2024-2035 ($ Million)

27. Rest Of The World Apheresis Market Research And Analysis By Product, 2024-2035 ($ Million)

28. Rest Of The World Apheresis Market Research And Analysis By Procedure, 2024-2035 ($ Million)

29. Rest Of The World Apheresis Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Apheresis Market Share By Product, 2024 Vs 2035 (%)

2. Global Apheresis Disposables Market Share By Region, 2024 Vs 2035 (%)

3. Global Apheresis Devices Market Share By Region, 2024 Vs 2035 (%)

4. Global Apheresis Market Share By Procedure, 2024 Vs 2035 (%)

5. Global Automated Blood Collection Apheresis Market Share By Region, 2024 Vs 2035 (%)

6. Global Therapeutic Apheresis Market Share By Region, 2024 Vs 2035 (%)

7. Global Apheresis Market Share Analysis By Application, 2024 Vs 2035 (%)

8. Global Apheresis For Plasmapheresis Market Share By Region, 2024 Vs 2035 (%)

9. Global Apheresis For Plateletpheresis Market Share By Region, 2024 Vs 2035 (%)

10. Global Apheresis For Erythrocytapheresis Market Share By Region, 2024 Vs 2035 (%)

11. Global Apheresis For Leukapheresis Market Share By Region, 2024 Vs 2035 (%)

12. Global Apheresis For Photopheresis Market Share By Region, 2024 Vs 2035 (%)

13. Global Apheresis Market Share By Region, 2024 Vs 2035 (%)

14. US Apheresis Market Size, 2024-2035 ($ Million)

15. Canada Apheresis Market Size, 2024-2035 ($ Million)

16. UK Apheresis Market Size, 2024-2035 ($ Million)

17. France Apheresis Market Size, 2024-2035 ($ Million)

18. Germany Apheresis Market Size, 2024-2035 ($ Million)

19. Italy Apheresis Market Size, 2024-2035 ($ Million)

20. Russia Apheresis Market Size, 2024-2035 ($ Million)

21. Spain Apheresis Market Size, 2024-2035 ($ Million)

22. Rest Of Europe Apheresis Market Size, 2024-2035 ($ Million)

23. India Apheresis Market Size, 2024-2035 ($ Million)

24. China Apheresis Market Size, 2024-2035 ($ Million)

25. Japan Apheresis Market Size, 2024-2035 ($ Million)

26. South Korea Apheresis Market Size, 2024-2035 ($ Million)

27. Australia & New Zealand Apheresis Market Size, 2024-2035 ($ Million)

28. ASEAN Countries Apheresis Market Size, 2024-2035 ($ Million)

29. Rest Of Asia-Pacific Apheresis Market Size, 2024-2035 ($ Million)

30. Rest Of The World Apheresis Market Size, 2024-2035 ($ Million)

FAQS

The size of the Apheresis market in 2024 is estimated to be around USD 2.49 billion.

North American holds the largest share in the Apheresis market.

Leading players in the Apheresis market include Fresenius SE & Co. KGaA, Otsuka Holdings Co., Ltd., SB-KAWASUMI LABORATORIES, INC., Haemonetics, Kaneka Corp., and others.

Apheresis market is expected to grow at a CAGR of 8.6% from 2025 to 2035.

The growth of the Apheresis market is driven by the increasing prevalence of chronic diseases and advancements in apheresis technology.