Audiology Devices Market

Audiology Devices Market Size, Share & Trends Analysis Report by Technology (Digital Hearing Aids and Analog Hearing Aids), By Product (Cochlear Implants, Bone Anchored Hearing Aid Open System, Diagnostic Devices and Hearing Aids), Forecast Period 2023-2030 Update Available - Forecast 2025-2035

Audiology devices market is anticipated to grow at a CAGR of 6.8% during the forecast period. The factors such as the high prevalence of hearing disorders, increasing incidence of impairment, and loss of hearing in the younger generations are anticipated to show a positive impact on the growth of the audiology devices market during the forecast period. Audiology devices are devices that are used for the diagnosis and treatment of hearing impairment or loss and used for monitoring and studying hearing. Frequent hearing loss is often associated with old age and is a rising problem across the globe. Moreover, factors including a large prevalence of deafness, and the cosmetic appeal of hearing devices fuel the growth of the market.

Additionally, advancement in technology, cost-effective devices, and widespread acceptance of novel devices in the aging population is anticipated to boost the growth of the audiology devices industry. However, the high cost of devices used in surgeries and individuals refraining from wearing hearing aids due to social disgrace associated with deafness, and the high price of hearing impairment solutions mainly surgery based is anticipated to hamper the growth of the market. Rising awareness related to the availability of enhanced hearing aids fuel the growth of the market.

Various associations and organizations are implementing programs to grow awareness and accessibility to audiology devices. For instance, the Hearing Loss Association of America (HLAA) works in collaboration with policymakers to assist customers by improving awareness regarding hearing loss and audiology diagnostics devices that propel the market growth during the forecast period. Hearing loss occurs mainly owing to various reasons that include chronic ear infections, excessive exposure to noise, complication at the time of birth, and genetic mutations. Thus, to overcome these difficulties people have started preferring audiology devices including cochlear implants that considerably enhance the person's hearing ability. Therefore, this factor propels the growth of the industry during the forecast period.

Segmental Outlook

The global audiology devices market is segmented based on technology and products. Based on technology, the market is divided into digital hearing aids and analog hearing aids. Analog hearing aids are anticipated to have a moderate growth rate as this technology uses an amplifier and microphone to intensify the sound. The analog hearing aids are programmable including a microchip that offer program setting for various listening environment. Based on the product, the market is segmented into cochlear implants, bone-anchored hearing aid open systems, diagnostic devices, and hearing aids. Diagnostics devices are expected to have a considerable growth rate in the audiology devices market during the forecast period. Diagnostic devices offer images that assist surgeons at the time of surgical procedures that raise the surgery success rate.

Bone Anchored Hearing Aid Open System will be the largest segment by Products

Based on the product, the market is segmented into cochlear implants, bone-anchored hearing aid open systems, diagnostic devices, and hearing aids. Bone-anchored hearing aid open system is expected to hold a significant market share in the audiology devices market during the forecast period. It is an innovative technology that is approved by the FDA for the treatment of hearing loss. This technology is preferred by people suffering from chronic otitis media, acoustic neuroma, and cholesteatoma that fuel the growth of the segment.

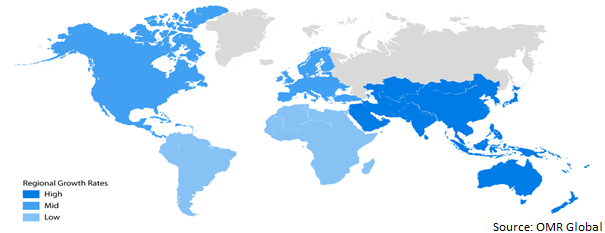

Regional Outlooks

The global audiology devices market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to have the largest market share in the audiology devices market during the forecast period due to advancements in audiology systems, the introduction of innovative digital platforms, and rising in the number of audiologists. Moreover, the introduction of a patient-centric audiology system that offers easy product handling that results in patient compliance fuels the growth of the audiology devices market over the forecast period. The European market is expected to hold a considerable growth rate owing to the increasing prevalence of hearing impairment, large market penetration of advanced products along with the presence of reimbursement policies and awareness related to the diagnosis.

Global Audiology Devices Market Growth, by Region 2023-2030

Asia-Pacific will augment with the fastest rate in the audiology devices market

The market in Asia-Pacific is expected to be the fastest-growing region mainly owing to rising aging populations and improving healthcare infrastructure. Moreover, factors such as increasing awareness regarding the products, age-related hearing problems, and growing healthcare expenditure fuel the growth of the market in the region. The favorable government support and funding for cochlear implants, for instance, various initiatives undertaken by the government of India that include newborn screening programs for early diagnosis and treatment of hearing loss propels the growth of the market.

Market Players Outlook

The major players in the audiology devices market include Demant A/S, Starkey Hearing Technologies, Starkey Laboratories, Inc., SonovaHolding AG, Sivantos Pte. Ltd., WIDEX A/S, Medtronic PLC, Benson Medical Instruments, WS Audiology A/S, and MicroTech.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global audiology devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cochlear, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Demant A/S

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sivantos Pte. Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Starkey Laboratories, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Widex A/S

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Audiology DEVICES MARKET by Technology

4.1.1. Digital Hearing Aids

4.1.2. Analog Hearing Aids

4.2. Global Audiology Devices Market by Products

4.2.1. Cochlear Implants

4.2.2. Bone Anchored Hearing Aid Open System

4.2.3. Diagnostic Devices

4.2.3.1. Tympanometers

4.2.3.2. Otoscopes

4.2.3.3. Audiometers

4.2.4. Hearing Aids

4.2.4.1. In The Ear Aids

4.2.4.2. Receiver In The Ear Aids

4.2.4.3. Behind The Ear Aids

4.2.4.4. Canal Hearing

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AMBCO

6.2. Audioscan (a Division of Etymonic Design, Inc.)

6.3. Benson Medical Instruments, Co.

6.4. Cochlear, Ltd.

6.5. Demant A/S

6.6. GN Store Nord A/S

6.7. Grason-Stadler, Inc.

6.8. MAICO Diagnostics

6.9. MED-ELCorp.

6.10. MedRX, Inc.

6.11. Medtronic, PLC.

6.12. Natus Medical, Inc.

6.13. Nurotron Biotechnology Co., Ltd.

6.14. Sivantos Pte. Ltd. (A Division of Siemens AG)

6.15. Sonova Holding AG

6.16. Starkey Laboratories, Inc.

6.17. Widex A/S

6.18. WS Audiology Denmark A/S

1. GLOBAL AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

2. GLOBAL DIGITAL HEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL ANALOG HEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2022-2030 ($ MILLION)

5. GLOBAL DIAGNOSTIC DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL COCHLEAR IMPLANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BONE ANCHORED HEARING AID OPEN SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL HEARING AIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. NORTH AMERICAN AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

11. NORTH AMERICAN AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2022-2030 ($ MILLION)

12. EUROPEAN AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. EUROPEAN AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

14. EUROPEAN AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2022-2030 ($ MILLION)

18. REST OF THE WORLD AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

19. REST OF THE WORLD AUDIOLOGY DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCTS, 2022-2030 ($ MILLION)

20. JAPAN AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

1. GLOBAL AUDIOLOGY DEVICES MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

2. GLOBAL AUDIOLOGY DEVICES MARKET SHARE BY PRODUCTS, 2022 VS 2030 (%)

3. GLOBAL AUDIOLOGY DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL DIGITAL HEARING AIDS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL ANALOG HEARING AIDS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL DIAGNOSTIC DEVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL COCHLEAR IMPLANTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL BONE ANCHORED HEARING AID OPEN SYSTEM MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL HEARING AIDS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. THE US AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

11. CANADA AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

12. UK AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

13. FRANCE AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

14. GERMANY AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

15. ITALY AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

16. SPAIN AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

17. ROE AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

18. INDIA AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)

19. CHINA AUDIOLOGY DEVICES MARKET SIZE, 2022-2030 ($ MILLION)