Automotive Biometrics Market

Automotive Biometrics Market Size, Share & Trends Analysis Report by Technology (Fingerprint Recognition, Voice Recognition, Facial Recognition, Palm Recognition, and Other), and by Vehicle Type (Passenger Cars and Commercial Vehicles) Forecast Period (2024-2031)

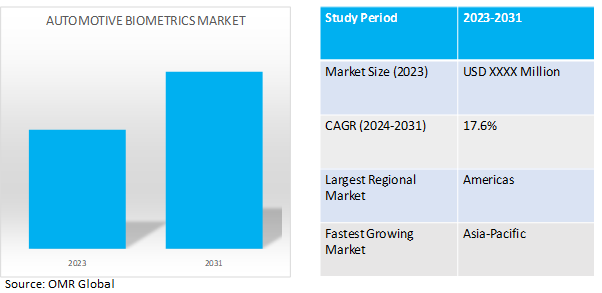

Automotive biometrics market is anticipated to grow at a significant CAGR of 17.6% during the forecast period (2024-2031). Biometrics in automobiles uses built-in sensors to identify and authenticate drivers and passengers. These sensors can use face, iris, voice, and fingerprint biometrics for safety, security, and comfort. The growing technological advancements in automobiles to improve safety & security features have driven the growth of the global automotive biometrics market. The high cost of installation of these advanced features may restrain its market potential. However, the growing adoption of autonomous vehicles is anticipated to offer lucrative opportunities to the growth of the global market.

Market Dynamics

Growing demand for vehicle security & passenger comfort

The integration of biometrics in automobiles offers another level of security to a vehicle. The biometric components allow the driver to personalize the vehicle settings such as music, seat mirror position, navigation, and temperature. The system will be connected to an interior camera which recognizes the driver’s face, thus personalizing his settings. The Emotion management system (EMS) technology uses a combination of sensors and cameras to monitor the driver’s heart rate, grip on the steering wheel, body temperature, arm movement, head movement, vocal patterns, and respiration rate. If any of these are triggered, the system would offer stimuli like nature sounds, fragrance, relaxing music or cool blasts of air to change driver’s behavior. In case of a light headed feeling while driving under the influence, the biometric powered vehicle will slow and stop safely, preventing any impending accident.

Growing market for autonomous vehicles

In an autonomous vehicle, the car could pull over to the side of the road or be programmed to call emergency services for assistance if the driver shows signs of being ill. Biometrics can be utilized for vehicle in-cabin preferences and personalization for vehicles with more than one driver. For instance, in-cabin iris scanning technology can authorize a driver to start the car and automatically adjust the seats and mirrors and load music and GPS locations to the driver’s preset preferences. Therefore, the growing demand for autonomous vehicles is anticipated to drive the growth of the global automotive biometrics market.

Market Segmentation

Our in-depth analysis of the global automotive biometrics market includes the following segments by technology and vehicle type:

- Based on technology, the market is sub-segmented into fingerprint recognition, voice recognition, facial recognition, palm recognition, and other (iris recognition).

- Based on vehicle type, the market is sub-segmented into passenger cars and commercial vehicles.

Fingerprint Holds Major Share in the Global Market

Based on the technology, the global automotive biometrics market is sub-segmented into fingerprint recognition, voice recognition, facial recognition, palm recognition, and other (iris recognition). Fingerprint holds major share in the global market based on technology. Fingerprint security is a way to protect information or access to devices by using user’s unique fingerprint. Fingerprint recognition in automobiles can help personalize the vehicle's operation and differentiate the user experience. It can be a faster and more secure alternative to other security measures like passwords, patterns, or PINs.

The high adoption of fingerprint recognition technology to get biometric information in automobiles is a key contributor to the high share of this market segment. In March 2021, the US Patent and Trademark Office has published a patent filed by Samsung exhibiting a fingerprint biometric automobile ignition system (USPTO). The application implies that a fingerprint sensor implanted in an automobile's steering wheel might be used to start the car, possibly in conjunction with the driver's smartphone as a physical secondary identification element. The ongoing development in this field is further contributing to the segmental growth.

Regional Outlook

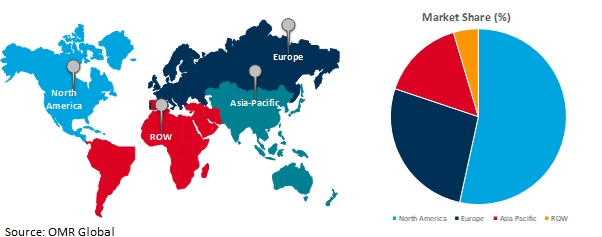

The global automotive biometrics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Patent Application Across Asia-Pacific

The growing number of patent application from key automobile manufacturers related to automotive biometrics across the Asia-Pacific is a key factor driving the growth of the regional market. Tokai Rika, Japanese automobile manufacturer is one of the leading patent filers in biometric vehicle access. The company has filed a patent for a system using driver's facial recognition for biometric vehicle access. Some other key patent filers in the space include Denso and Sumitomo Electric Industries.

Global Automotive Biometrics Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the presence of one of the largest automotive manufacturing hubs. The rising number of patents and ongoing applications for patents across the region have made significant contribution to the regional market growth. For instance, in April 2022, Hyundai has patented a biometric system to verify a driver via iris recognition to allow engine ignition and adjust the cabin to that driver's stored preferences, reports The Drive. The system is aided by an infrared camera to detect whether the driver is wearing sunglasses or whether the face is otherwise obstructed. The presence of major automobile maker such as BMW, Mercedes-Benz, Volkswagen, and Ford that have already integrated biometric technology in their high-end luxury segmented cars with high-security features is a major contributor to regional market share.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automotive biometrics market include Aware Inc., Continental AG, Fingerprints Card AB, Synaptics Inc., and Shenzhen Goodix Technology Co. Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, Qualcomm has built a smart car biometrics system in collaboration with Salesforce, which provides its Automotive Cloud, and J.P. Morgan for payments through an in-vehicle digital wallet. Daon provides the digital identity technology to back insurance transactions on the Snapdragon Digital Chassis, and Wink is contributing biometric registration and authentication for personalization.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive biometrics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aware Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Continental AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fingerprint Cards AB

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Synaptics Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Biometrics Market by Technology

4.1.1. Fingerprint Recognition

4.1.2. Voice Recognition

4.1.3. Facial Recognition

4.1.4. Palm Recognition

4.1.5. Other (Iris Recognition)

4.2. Global Automotive Biometrics Market by Vehicle Type

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. B-Secur Ltd.

6.2. Cerence Inc. (Nuance Communications Inc.)

6.3. EyeLock Inc.

6.4. Fujitsus

6.5. Hitachi Ltd.

6.6. Methode Electronics

6.7. Nuance Communications

6.8. Precise Biometrics AB

6.9. Robert Bosch GmbH

6.10. Safran S.A.

6.11. Sensory Inc.

6.12. Shenzhen Goodix Technology Co. Ltd.

6.13. Valeo S.A.

6.14. Voicebox Technologies Corp.

6.15. Voxx International

1. GLOBAL AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

2. GLOBAL FINGERPRINT RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL VOICE RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL FACIAL RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PALM RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHER (IRIS RECOGNITION) IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

8. GLOBAL AUTOMOTIVE BIOMETRICS IN PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMOTIVE BIOMETRICS IN COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

14. EUROPEAN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

16. EUROPEAN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

20. REST OF THE WORLD AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

22. REST OF THE WORLD AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023 VS 2031 (%)

2. GLOBAL FINGERPRINT RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL VOICE RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL FACIAL RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL PALM RECOGNITION IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER (IRIS RECOGNITION) IN AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE BIOMETRICS IN PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMOTIVE BIOMETRICS IN COMMERCIAL VEHICLESS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL AUTOMOTIVE BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

11. US AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

13. UK AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)

26. THE MIDDLE EAST & AFRICA AUTOMOTIVE BIOMETRICS MARKET SIZE, 2023-2031 ($ MILLION)