Automotive Brake Pads Market

Automotive Brake Pads Market Size, Share & Trends Analysis Report by Material Type (Semi-metallic, Non-asbestos, Low-metallic and Ceramic Brake Pad) and by Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV) and Two Wheelers)Forecast Period (2024-2031)

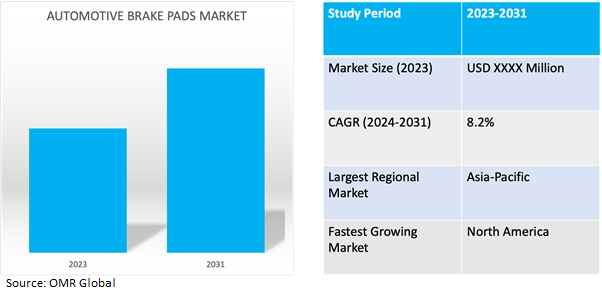

Automotive brake pads market is anticipated to grow at a considerable CAGR of 8.2% during the forecast period (2024-2031). Automotive brake pads are components that create friction against brake discs when you press the brake pedal, slowing down or stopping the vehicle and are made of materials like organic compounds, semi-metallic compounds, or ceramics.

Market Dynamics

Escalating Vehicle Sales

The increase in demand for vehicles globally is driven by factors such as population growth, rising urbanisation, improving economic conditions in many regions, and increasing consumer purchasing power. As more people have access to disposable income, there's a greater desire for personal mobility and convenience, leading to higher vehicle ownership rates and the demand for automotive brake pads also rises correspondingly, as these are essential components for vehicle safety and maintenance, contributing to the growth of the global automotive brake pads market. Additionally, advancements in automotive technology and the introduction of stricter safety regulations further stimulate demand for high-quality brake pads to ensure optimal braking performance and compliance with safety standards. For instance, in April 2023, SKF introduced an innovative line of brake pads, offering advanced performance with ceramic components designed to minimize dust, extend service life, and deliver superior noise control that incorporates a unique thermal treatment process known as scorching, enhancing the coefficient of friction for improved braking efficacy across diverse road conditions.

Transformative Technological Innovations in Automotive Brake Pads

Technological advancements in automotive brake pads are revolutionizing the industry, focusing on performance, durability, and sustainability. Innovations include the adoption of composite materials like ceramic and carbon fibre for enhanced thermal stability and longevity. The development of low-copper formulations addresses environmental concerns by reducing harmful emissions. Advanced manufacturing techniques such as laser cutting and robotic assembly ensure consistent quality and efficiency. Additionally, the integration of sensors enables features like real-time wear monitoring and smart brake systems for improved safety and control. These advancements signify a shift towards safer, more efficient, and eco-friendly braking solutions, meeting the evolving needs of consumers and regulatory standards.

For instance, in October 2023, the partnership between Brembo and SGL Carbon unveiled two advanced manufacturing facilities dedicated to producing the advanced Brembo SGL Carbon Ceramic Brakes (BSCCB) and spanning approximately 8,500 square meters, that are scheduled for completion by October 2024, with production slated to commence in January 2025 and also the strategic expansion is projected to generate approximately 80 new employmentopportunities, bolstering the automotive sector and contributing to its growth.

Market Segmentation

Our in-depth analysis of the global automotive brake pads market includes the following segments by material type and vehicle type:

- Based on material type, the market is sub-segmented into semi-metallic,non-asbestos, low-metallic and ceramic brake pads.

- Based on vehicle type, the market is sub-segmented into passenger cars, light commercial vehicles (lcv), heavy commercial vehicles (hcv) and two-wheelers.

Non-asbestos Material is Projected to Emerge as the Largest Segment

Based on the material type, the global automotive brake pads market is sub-segmented into semi-metallic,non-asbestos, low-metallic and ceramic brake pads. Among these, the non-asbestos sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the stringent regulatory restrictions on asbestos usage. Asbestos, known for its health risks, has prompted a shift towards safer alternatives like ceramics and organic compounds. These materials offer comparable performance without the health hazards, fueling increased adoption and market growth.

LCV Sub-segment to Hold a Considerable Market Share

The Light Commercial Vehicle (LCV) sub-segment is expected to hold a considerable market share in the global automotive brake pads market due to several factors that include the rising demand for LCVs, driven by increasing urbanization, e-commerce growth, and expansion of logistics and transportation sectors, contributes to higher sales of brake pads for these vehicles. Additionally, LCVs are subjected to frequent stop-and-go driving in urban environments and often carry moderate to heavy loads, placing greater stress on their braking systems. Consequently, there's a continuous need for reliable and durable brake pads to ensure safe and efficient braking performance in LCVs.

As a result, the demand for brake pads within the LCV sub-segment remains robust, supporting its significant market share in the global automotive brake pads market. For instance, in May 2022, TMD Friction revealed an expansion of its Mintex brand with the introduction of six new brake pad variants and three additional brake disc options, that offer a wide range of offerings for both commercial and passenger vehicles and also the expansion aims to equip repair shops with the latest braking solutions, enabling them to address modern braking requirements effectively, including optimal performance under high-temperature conditions.

Regional Outlook

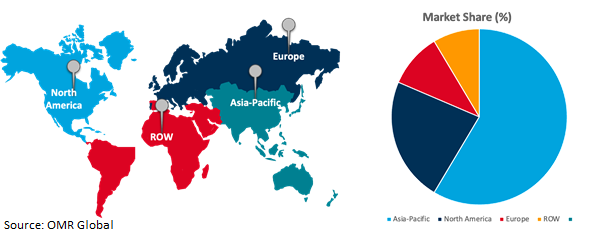

The global automotive brake pads market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in automotive brake pads

North American countries are investing in automotive brake pads due to their significant automotive manufacturing sector, stringent safety standards, and the growing demand for advanced braking technologies. With a focus on electric and hybrid vehicles, as well as a preference for premium performance, there's a clear need for high-quality brake pads tailored to meet evolving consumer demands in the region. For instance, in June 2023, Tenneco, a USbased supplier, announced plans to enhance its revenue from brake parts sales in China. The company also aims to achieve this by strategically targeting local manufacturers of electrified vehicles, which significantly contribute to the country's brake pad market.

Global Automotive Brake Pads Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant sharedue to factors such as rapid economic growth, increased vehicle production, and strong demand for aftermarket components. Additionally, the presence of major automotive manufacturers and favourable government regulations promoting road safety contribute to its significant market share. For instance, in March 2023, Brakes India, a prominent Tier-1 supplier serving both domestic and international OEMs, unveiled ZAP brake pads, incorporating advanced friction technology specifically engineered for electric vehicles (EVs) and also the specialized brake pads are meticulously crafted to address the distinctive requirements of EV users, offering enhanced corrosion resistance and delivering quieter braking performance.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automotive brake padsmarket include Robert Bosch LLC, Brembo S.p.A., Delphi, Akebono Brake Corp., ZF Friedrichshafen AG and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in July 2022, Brembo and Gold Phoenix established a joint venture named Shandong BRGP Friction Technology Co. This collaboration leverages Brembo's renowned expertise in braking systems and Gold Phoenix's proficiency in friction solutions. The joint venture aims to establish a dedicated manufacturing facility exclusively focused on producing aftermarket brake pads.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualised market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive brake padsmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Brembo S.p.A

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Delphi Technologies

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Robert Bosch LLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Brake Pads Market by Material Type

4.1.1. Semi-metallic

4.1.2. Non-asbestos

4.1.3. Low-metallic

4.1.4. Ceramic Brake Pads

4.2. Global Automotive Brake Pads Market by Vehicle Type

4.2.1. Passenger Cars

4.2.2. Light Commercial Vehicles (LCV)

4.2.3. Heavy Commercial Vehicles (HCV)

4.2.4. Two Wheelers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ADVICS Co., Ltd.

6.2. Bosch Ltd.

6.3. Brake Parts Inc. LLC.

6.4. Continental AG

6.5. DRiV Automotive Inc. (DRiV Incorporated)

6.6. Dynamic Friction Co.

6.7. EBC Brakes

6.8. HELLA GmbH & Co. KGaA

6.9. Hitachi Astemo, Ltd.

6.10. ITT Inc.

6.11. Maruti Suzuki India Ltd.

6.12. Masu Brakes

6.13. Nisshinbo Brake Inc.

6.14. SKF

6.15. Tenneco Inc.

6.16. TMD

6.17. TOMEX Brakes sp. z o.o.sp.k.

6.18. Webb Wheel Products, Inc.

1. GLOBAL AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SEMI-METALLIC AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NON-ASBESTOS AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LOW-METALLIC AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CERAMIC BRAKE PADS AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE BRAKE PADS FOR PASSENGER VEHICLESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBALAUTOMOTIVE BRAKE PADS FOR LCV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMOTIVE BRAKE PADS FOR HCV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AUTOMOTIVE BRAKE PADS FOR TWO-WHEELERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

15. EUROPEAN AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFICAUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFICAUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD AUTOMOTIVE BRAKE PADS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE BRAKE PADS MARKETSHARE BY MATERIAL TYPE, 2023 VS 2031 (%)

2. GLOBAL SEMI-METALLIC AUTOMOTIVE BRAKE PADS MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NON-ASBESTOS AUTOMOTIVE BRAKE PADS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL LOW-METALLIC AUTOMOTIVE BRAKE PADS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CERAMIC BRAKE PADS AUTOMOTIVE BRAKE PADS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AUTOMOTIVE BRAKE PADS MARKET SHAREBY VEHICLE TYPE, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE BRAKE PADS FOR PASSENGER VEHICLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE BRAKE PADS FOR LCV MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMOTIVE BRAKE PADS FOR HCV MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AUTOMOTIVE BRAKE PADS FOR TWO WHEELERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AUTOMOTIVE BRAKE PADS MARKETSHARE BY REGION, 2023 VS 2031 (%)

12. US AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

14. UK AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA AUTOMOTIVE BRAKE PADS MARKET SIZE, 2023-2031 ($ MILLION)