Autonomous Weapons Market

Autonomous Weapons Market Size, Share & Trends Analysis Report by Product (Missiles, Munitions, Guided Rockets, Hypersonic Weapon, and Others). by Platform (Land, Airborne, and Naval). and by Type (Semi-Autonomous, and Autonomous). Forecast Period (2024-2031).

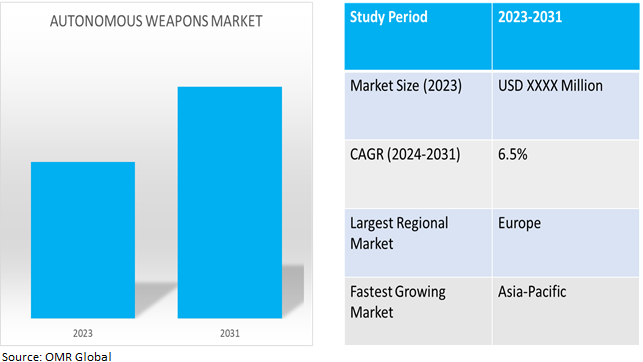

Autonomous weapons market is anticipated to grow at a considerable CAGR of 6.5% during the forecast period. Autonomous weapon systems are intended to choose and apply force to targets without human interaction. It comprises both semi, and fully autonomous weapons including air defense systems, loitering munitions, guided rockets, and others. Artificial intelligence (AI) and machine learning (ML) are often used as an enabler to enhance the capabilities of such weapons providing them with identification, strategizing, and planning abilities.

Market Dynamics

Increase in Investments and Collaboration to Develop Autonomous Weapons

The growth in autonomous weapons market is driven by rising investment and partnerships between state organization and private entities to develop autonomous weapons for defense forces with an aim to strengthen its capabilities for a new era of unmanned warfare. For instance, in February 2024, the Australian Army announced its increment on getting closer to receiving a next-generation autonomous capability owing to a collaboration between BAE Systems Australia and Trusted Autonomous Systems (TAS). The companies have created a sophisticated Artificial Intelligence (AI) system that might be utilized in unmanned ground vehicles (UGV) throughout the course of a four-year research and demonstration program. In order to accomplish mission objectives and detect and avoid any threats, several UGVs might work simultaneously owing to TAGVIEW (Trusted Autonomous Ground Vehicles in Electronic Warfare) system.

Rise in Use of Autonomous Weapons

Recently, autonomous weapon deployment was recorded by several war-involved countries such as Russia, Ukraine, Azerbaijan, and the US, which have instigated the use and development of similar weapons for other countries in a state of war. For instance, Russia was reported to have deployed "killer robot" drones in Ukraine with the apparent ability to locate and destroy targets through artificial intelligence. According to reports and videos from the front lines, the Kremlin is utilizing "kamikaze drones" with a new capability to target specific weaponry, such as western-supplied tanks, and lock on to the targets without the need for a pilot to control the final attack. The reported use of the KUB-BLA (also known as the KYB-UAV) system by Russia in Ukraine is indicative of an increasing trend, amongst a range of militarized states, toward the deployment of weapons systems with autonomy in targeting.

Segmental Outlook

Our in-depth analysis of the global autonomous weapons market includes the following segments by product, platform, and type.

- Based on product, the market is sub-segmented into missiles, munitions, guided rockets, hypersonic weapons, and others.

- Based on platform, the market is sub-segmented into land, airborne, and naval.

- Based on type, the market is sub-segmented into semi-autonomous, and autonomous.

Missiles to Emerge as a Bigger Market

Armed services globally have been developing autonomous weaponry. Currently, at least 30 countries utilize missiles, mostly to defend airfields, ground vehicles, and ships from missile assaults. Several countries are fiercely competing to produce or acquire cutting-edge autonomous weaponry with the focus on developing advanced missile deployment and attack technology to increase their arsenal for future states of war. For instance, China and Russia intend to explore the development of autonomous weapons and are actively spending on R&D operations. Furthermore, the United Kingdom's new defense plan, like Israel's, aims to boost defense capabilities using artificial intelligence.

Airborne is the Most Prominent Platform

The airborne segment will dominate the segment attributed to investments and development of autonomous navigation systems, guided rockets, drones, and missiles which are majorly used in wars due to high accuracy, long range, and cost efficiency. Furthermore, increased use of ANS in UAVs (unmanned aerial vehicles) may also drive growth in the airborne industry. For instance, Shield AI, a defense technology company developing the world's greatest AI pilot for airplanes, has officially launched its V-BAT Teams product. V-BAT Teams allow numerous V-BATs to perform missions autonomously in electronically contested areas while reading and reacting to enemies, the environment, and other V-BATs carrying out the task. It takes the shape of a modular NVIDIA GPU upgrade that runs Hivemind, Shield AI's AI pilot and is installed into the V-BAT's modular payload bays.

Fully Autonomous is Dominating the Sub-Segment

Semi-autonomous weapons have been in existence for decades but are incapable of fulfilling military requirements to supplement total human interaction. Most countries including China, Russia, the UK, the US, and Israel have been recorded developing and deploying fully autonomous weapons on the battlefield. For instance, deputy secretary of US Defense Kathleen Hicks announced the launch of ‘Replicator’ to field attainable autonomous systems at a scale of multiple thousands, in multiple domains, within the next 18-24 months.

Regional Outlook

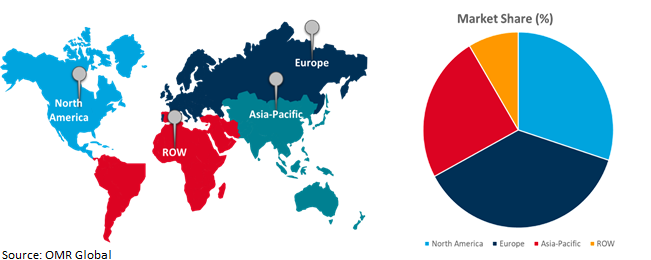

The global autonomous weapons market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe Holds Highest Share in Global Autonomous Weapons Market

The regional expansion is driven by several factors, including expanding demand for automated transportation, research and development capabilities, increased adoption and exports of automated missiles and drones, major manufacturer presence in the region, geopolitical scenarios in Europe, and rising investment by France, UK, Russia, Germany, and other major defense budget countries. For instance, the French defense budget for 2022 included $47.9 billion, reflecting the country's promise to increase defense spending by $1.8 billion annually since 2019. The yearly increment is an important part of the ministry's 2019-2025 military program law. The defense budget is growing, with the 2022 budget reflecting a $9.0 billion increase over 2017.

Global Autonomous Weapons Market Growth by Region 2024-2031

Asia-Pacific is the Fastest Growing Autonomous Weapons market

- Asia-Pacific regional growth is driven by active investments in autonomous weapon development by countries such as China, South Korea, Japan, and India.

- The Asia-Pacific region is also exposed to rising war tension in West Asia between Israel, Palestine, and Iran. Moreover, the deployment of autonomous weapons in the Russia-Ukraine war has stimulated the development of autonomous weapons among Asian countries.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global autonomous weapons market include Lockheed Martin Corp, RTX Corp (Raytheon), Rafael Advanced Defense Systems Ltd., BAE Systems plc, and Northrop Grumman Corp., among others. With growing demand, market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, April, 2020, Raytheon Technologies Corporation announced the successful completion of the all-stock merger of equal transactions between Raytheon Company and United Technologies Corporation, following the completion by United Technologies of its previously announced spin-offs of its Carrier and Otis businesses. The merger creates Raytheon Technologies Corporation, a premier systems provider with advanced technologies to address rapidly growing segments within aerospace and defense.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global autonomous weapons market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BAE Systems plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Lockheed Martin Corp

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Northrop Grumman Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Rafael Advanced Defense Systems Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. RTX Corp (Raytheon)

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Autonomous Weapons Market by Product

4.1.1. Missiles

4.1.2. Munitions

4.1.3. Guided Rockets

4.1.4. Hypersonic weapon

4.1.5. Others (loitering munition, Autonomous robots)

4.2. Global Autonomous Weapons Market by Platform

4.2.1. Land

4.2.2. Airborne

4.2.3. Naval

4.3. Global Autonomous Weapons Market by Type

4.3.1. Semi-autonomous

4.3.2. Autonomous

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. China North Industries Group Corp Ltd (NORINCO Group)

6.2. Denel SOC Ltd.

6.3. Elbit Systems Ltd.

6.4. General Dynamics Corp.

6.5. Israel Aerospace Industries Ltd. (IAI)

6.6. KBP Instrument Design Bureau

6.7. Kongsberg Gruppen ASA

6.8. L3Harris Technologies, Inc

6.9. Leonardo DRS, Inc.

6.10. MBDA

6.11. Lockheed Martin Corp.

6.12. Rheinmetall AG

6.13. Rostec (State Corp.)

6.14. Saab AB.

6.15. STM (Savunma Teknolojileri Mühendislik ve Ticaret A. ?.)

1. GLOBAL AUTONOMOUS MISSILES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

2. GLOBAL AUTONOMOUS MUNITIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AUTONOMOUS GUIDED ROCKETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AUTONOMOUS HYPERSONIC WEAPON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

7. GLOBAL LAND BASED AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AIRBORNE AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL NAVAL AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

11. GLOBAL SEMI-AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. EUROPEAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

21. EUROPEAN AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY PLATFORM, 2023-2031 ($ MILLION)

29. REST OF THE WORLD AUTONOMOUS WEAPONS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

1. GLOBAL AUTONOMOUS WEAPONS MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL AUTONOMOUS MISSILES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AUTONOMOUS MUNITIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AUTONOMOUS GUIDED ROCKETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AUTONOMOUS HYPERSONIC WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTONOMOUS WEAPONS MARKET SHARE BY PLATFORM, 2023 VS 2031 (%)

8. GLOBAL LAND BASED AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AIRBORNE AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL NAVAL AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AUTONOMOUS WEAPONS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

12. GLOBAL SEMI-AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AUTONOMOUS WEAPONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

17. UK AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA AUTONOMOUS WEAPONS MARKET SIZE, 2023-2031 ($ MILLION)