Beta Carotene Market

Beta Carotene Market Size, Share & Trends Analysis Report by Source (Fruits & Vegetables, Algae, Synthetic, Yeast, Fungi and Bacteria), by Application (Food & Beverages, Pharmaceuticals, Cosmetics, Animal Feed and Dietary Supplements), by Product (Synthetic Beta Carotene and Natural Beta Carotene) and by Form (Powder and Liquid) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

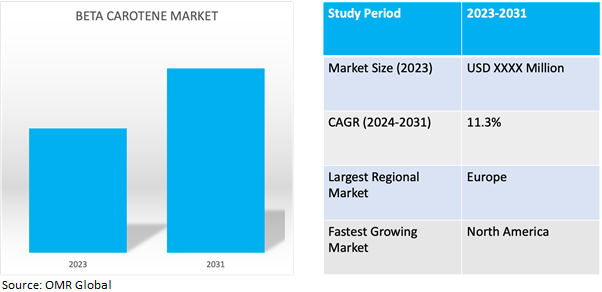

Beta carotene market is anticipated to grow at a significant CAGR of 11.3% during the forecast period (2024-2031). Beta carotene refers to the global industry involved in the production, distribution, and sale of beta carotene, a natural pigment found in various fruits and vegetables.

Market Dynamics

Rising Demand for Natural Ingredients

The demand for natural ingredients, particularly beta carotene, is experiencing a notable upsurge by several key factors including a discernible shift in consumer preferences towards products containing natural and organic ingredients, spurred by a growing health-consciousness among consumers who prioritize products perceived as healthier and safer. This trend is further accentuated by the rising popularity of clean-label products, that emphasize the use of natural and recognizable ingredients. For instance, in April 2023, Kemin unveiled the introduction of a novel range of dietary supplements formulated with beta-carotene. These supplements are specifically crafted to enhance vision, bolster immunity, and promote skin health.

End-Use Industry Growth Fuels Demand for Versatile Beta Carotene

The growth in various end-use industries is significantly driving the demand for beta carotene, reflecting its versatility and beneficial properties across diverse applications. Such as in food and beverage industry, beta carotene serves as a natural colourant, enhancing the visual appeal of a wide range of products including juices, soups, sauces, and confectionery items. The increasing preference for clean-label products further boosts the demand for natural colourants such as beta carotene. Similarly, in the dietary supplements sector, beta carotene is formulated to provide consumers with additional vitamin A and antioxidant support, aligning with the growing health consciousness among consumers.

Market Segmentation

Our in-depth analysis of the global beta carotene market includes the following segments by source, application, product and form:

- Based on source, the market is sub-segmented into fruits & vegetables, algae, synthetic, yeast, fungi and bacteria.

- Based on application, the market is sub-segmented into food & beverages, pharmaceuticals, cosmetics, animal feed and dietary supplements.

- Based on product, the market is sub-segmented into synthetic beta carotene and natural beta carotene.

- Based on form, the market is sub-segmented into powder and liquid.

Synthetic Chemical is Projected to Emerge as the Largest Segment

Based on the source, the global beta carotene market is sub-segmented into fruits & vegetables, algae, synthetic, yeast, fungi and bacteria. Among these, the synthetic sourcesub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the scalability and consistency of production. Synthetic beta carotene can be manufactured in large quantities and with precise control over its quality and purity, ensuring consistent supply to meet the increasing demand across various industries. ‘

Additionally, synthetic beta carotene often offers a cost-effective alternative to naturally sourced beta carotene, making it more accessible to manufacturers and consumers. For instance, in November 2023, Divi’s Nutraceuticals introduced a new synthetic beta-carotene variant, delivering a vibrant red colour that has various applications such as its extensive lineup of high-quality beta-carotene forms and in chemical synthesis and microencapsulation ensures tailored solutions for diverse applications, including supplements, beverages, gummies, cereals, and ice cream and also addressing the demands for additive-free products. Divi offers silicon dioxide-free synthetic beta-carotene options that is suitable for fortification and colouring purposes.

Food and Beverages Sub-segment to Hold a Considerable Market Share

The food and beverages sub-segment holds a considerable market as it serves as a natural colourant in food and beverages, providing vibrant shades of yellow, orange, and red that enhances the visual appeal of a wide range of products such as juices, soups, sauces, and confectionery items. This natural colourant is preferred by consumers seeking clean-label products with recognizable ingredients. The food and beverage industry is a source of provitamin A, providing essential nutritional benefits. As consumers become more health-conscious, there is a growing demand for products fortified with vitamins and antioxidants, including beta carotene. For instance, at the Food Ingredients China (FIC) 2023 trade show, BASF SE showcased its newest health ingredients lineup, featuring Lucarotin synthetic beta-carotene and Betatene natural mixed carotenoids, aimed at promoting health and well-being.

Regional Outlook

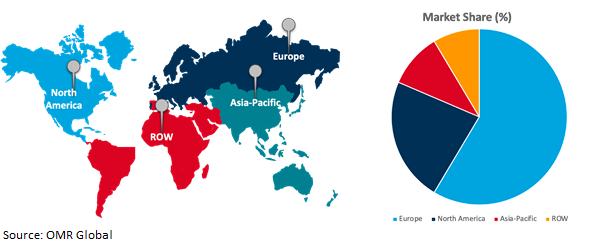

The global beta carotene market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Exhibit Considerable Growth in Global Beta Carotene Market

North American countries are seeing rapid growth due to increasing consumer demand for natural and organic products across various industries. The region's high emphasis on health and wellness, coupled with a shift towards clean-label products in the food and beverage industry, is driving the demand for beta carotene as a natural colourant and functional ingredient. The growing food & beverage industry of region is further contributing to the regional market growth. For instance, as per data from the U.S. Department of Agriculture, Mexico ranks as the third-largest food processor in North America and the fifteenth-largest globally. The food and beverage sector in Mexico experienced a 4.3% growth rate in 2020, contributing USD 39.4 billion to the GDP. This promising growth trajectory is anticipated to offer lucrative opportunities for the regional market.

Global Beta Carotene Market Growth by Region 2024-2031

Europe Holds Major Market Share

Among all the regions, Europe holds a significant share owing to the strong consumer demand for natural and healthy products across various industries, including food and beverages, dietary supplements, cosmetics, and pharmaceuticals. Europe has stringent regulations regarding food safety and labelling, which have led to a preference for natural ingredients like beta carotene over synthetic alternatives. Additionally, the European food and beverage industry is witnessing a growing shift towards clean-label products, driven by consumer preferences for natural and recognizable ingredients. This aligns with the clean-label trend and boosts the demand for beta carotene in the region. For instance, in August 2023, Otsuka Pharmaceutical Co., Ltd. unveiled an exclusive global research partnership and licensing agreement with Astex Pharmaceuticals (UK), signed by MSD (Merck and Co., Inc., Rahway, N.J., USA). The collaboration focuses on identifying potent chemical candidates targeting a tumor suppressor protein, aiming to advance cancer treatment options.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global beta carotene market include BASF SE, E.I.D. –Parry (India) Ltd., Otsuka Pharmaceutical Co., Ltd., DSM, Sensient Technologies Corp. and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in April 2023, Givaudan disclosed its acquisition of Amyris Inc.'s prominent portfolio of cosmetic ingredients, marking a strategic move to enhance its standing within the cosmetic and personal care sector. This acquisition is anticipated to bolster Givaudan's position by enabling the development of natural and chemical-free cosmetics and personal care products enriched with beta-carotene.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global beta carotene market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BASF SE

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. E.I.D. –Parry (India) Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Otsuka Pharmaceutical Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Beta Carotene Market by Source

4.1.1. Fruits & Vegetables

4.1.2. Algae

4.1.3. Synthetic

4.1.4. Yeast

4.1.5. Fungi

4.1.6. Bacteria

4.2. Global Beta Carotene Market by Application

4.2.1. Food & Beverages

4.2.2. Pharmaceuticals

4.2.3. Cosmetics

4.2.4. Animal Feed

4.2.5. Dietary Supplements

4.3. Global Beta Carotene Market by Product

4.3.1. Synthetic Beta Carotene

4.3.2. Natural Beta Carotene

4.4. Global Beta Carotene Market by Form

4.4.1. Powder

4.4.2. Liquid

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Algatechnologies Ltd.

6.2. Allied Biotech Corp.

6.3. AVANSCHEM

6.4. Bioextract

6.5. Central Drug House

6.6. Chr Hansen Holding A/S (Novonesis Group)

6.7. DDW The Color House

6.8. Divi’s Nutraceuticals (Divi’s Laboratories Ltd.)

6.9. DSM Corp.

6.10. Food RGB

6.11. Foodchem International Corp.

6.12. Kemin Industries Inc. (Kemin)

6.13. Lycored Ltd.

6.14. Mera Pharmaceuticals Inc. (Mera Pharma GmbH)

6.15. Nutralliance, Inc.

6.16. Parry Nutraceuticals Ltd.

6.17. Pharmline Inc. (Endeavor Business Media, LLC)

6.18. Reliance Private Label Supplements

6.19. San-Ei Gen F.F.I., Inc.

6.20. Sensient Technologies Corp.

6.21. U.S. Nutraceuticals, Inc. (Valensa International)

6.22. Vinayak Corp.

1. GLOBAL BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

2. GLOBAL BETA CAROTENE FROM FRUITS & VEGETABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BETA CAROTENE FROM ALGAE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SYNTHETIC BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL BETA CAROTENE FROM YEAST MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BETA CAROTENE FROM FUNGI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BETA CAROTENE FROM BACTERIA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

9. GLOBAL BETA CAROTENE FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBALBETA CAROTENEFOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BETA CAROTENE FOR COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BETA CAROTENE FOR ANIMAL FEED MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL BETA CAROTENE FOR DIETARY SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

15. GLOBAL SYNTHETIC BETA CAROTENE CAROTENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL NATURAL BETA CAROTENE CAROTENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

18. GLOBAL BETA CAROTENE POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL BETA CAROTENE LIQUID MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. NORTH AMERICAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. NORTH AMERICAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

23. NORTH AMERICAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. NORTH AMERICAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY PRODUCT,2023-2031 ($ MILLION)

25. NORTH AMERICAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY FORM,2023-2031 ($ MILLION)

26. EUROPEAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. EUROPEAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

28. EUROPEAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. EUROPEAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

30. EUROPEAN BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

31. ASIA-PACIFIC BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFICBETA CAROTENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

33. ASIA-PACIFICBETA CAROTENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. ASIA-PACIFICBETA CAROTENE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

35. ASIA-PACIFICBETA CAROTENE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

36. REST OF THE WORLD BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

37. REST OF THE WORLD BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

38. REST OF THE WORLD BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

39. REST OF THE WORLD BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

40. REST OF THE WORLD BETA CAROTENE MARKET RESEARCH AND ANALYSIS BY FORM, 2023-2031 ($ MILLION)

1. GLOBAL BETA CAROTENE MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

2. GLOBAL BETA CAROTENE FROM FRUITS & VEGETABLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BETA CAROTENE FROM ALGAE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SYNTHETIC BETA CAROTENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL BETA CAROTENE FROM YEAST MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BETA CAROTENE FROM FUNGI MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BETA CAROTENE FROM BACTERIA MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL BETA CAROTENE MARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

9. GLOBAL BETA CAROTENE FOR FOOD & BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BETA CAROTENE FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BETA CAROTENE FOR COSMETICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BETA CAROTENE FOR ANIMAL FEED MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL BETA CAROTENE FOR DIETARY SUPPLEMENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL BETA CAROTENE MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

15. GLOBAL SYNTHETIC BETA CAROTENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL NATURAL BETA CAROTENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL BETA CAROTENE MARKET SHARE BY FORM, 2023 VS 2031 (%)

18. GLOBAL BETA CAROTENE POWDER MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL BETA CAROTENE LIQUID MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL BETA CAROTENE MARKETSHARE BY REGION, 2023 VS 2031 (%)

21. US BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

22. CANADA BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

23. UK BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

24. FRANCE BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

25. GERMANY BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

26. ITALY BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

27. SPAIN BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF EUROPE BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

29. INDIA BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

30. CHINA BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

31. JAPAN BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

32. SOUTH KOREA BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF ASIA-PACIFIC BETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

34. LATIN AMERICABETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)

35. MIDDLE EAST AND AFRICABETA CAROTENE MARKET SIZE, 2023-2031 ($ MILLION)