Biochips Market

Biochips Market Size, Share & Trends Analysis Report, By Type (DNA Chips, Lab-on-a-Chip, Protein Chips, and Others), By Fabrication Technology (Microarrays and Microfluidics), By End-User (Hospitals and Diagnostic Centers, Academic and Research Institutes, and Biotechnology and Pharmaceutical Companies) Forecast Period (2025-2035)

Industry Overview

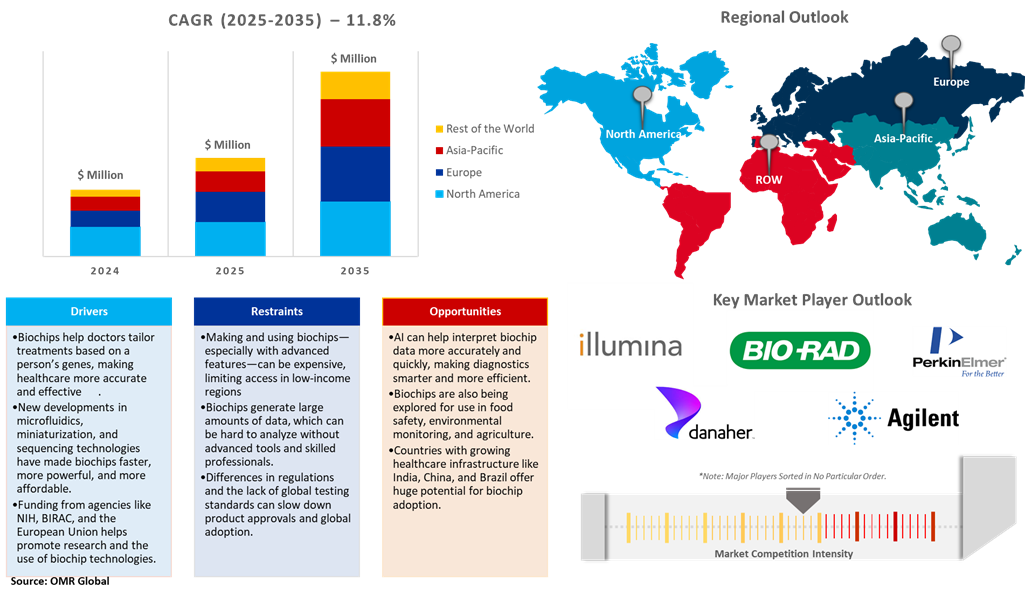

Biochips market was valued at $14,303 million in 2024 and is projected to reach $48,365 million by 2035, growing at a CAGR of 11.8% from 2025 to 2035. The major factors that are augmenting the growth of the market include technological innovations and the rising demand for personalized medicine. The rising drug development pipeline and emerging demand for genomics research-oriented products are also some crucial factors accelerating market growth. However, certain factors are restraining the growth of the market, which include the high cost of biochips and stringent government regulations. Additionally, the COVID-19 pandemic has further accelerated market growth.

The Ion Torrent chip by Thermo Fisher Scientific is one of the technologies based on sequencing by the technique of synthesis. The chip is an advancement in the Next-Generation Sequencing (NGS) technology that makes massively parallel sequencing cost-effective for every lab. Hence, the development of biochips to enhance the NGS application is anticipated to support the growth of the industry.

Market Dynamics

Rising Demand for Personalized Medicine

The global shift toward personalized medicine has significantly boosted the demand for biochip technologies, which are essential for analyzing individual genetic profiles and identifying disease-specific biomarkers. Biochips particularly DNA microarrays allow for high-throughput genomic analysis, helping clinicians tailor drug therapies and treatment plans based on a patient’s unique genetic makeup. According to the US National Institutes of Health (NIH), over $3.5 billion has been invested in the All of Us Research Program, a landmark initiative in precision medicine that relies heavily on genomic tools like biochips to collect and analyze health data from over one million participants. In Europe, the Horizon Europe framework allocated significant funding—nearly €1 billion in health research in 2023 alone—with a strong emphasis on precision diagnostics and personalized care, much of which integrates biochip-based technologies.

Government and Organizational Support

Government agencies and health organizations around the world are helping to grow the biochips market by funding research, supporting innovation, and encouraging the use of advanced diagnostic tools. In the US, the NIH has been a key supporter of genetic research, providing over $45 billion in funding in 2024. A large part of this funding goes to projects in precision medicine and biotechnology that use technologies like biochips. One major project, the All of Us Research Program, has received more than $3.5 billion to help develop personalized healthcare using tools such as DNA microarrays and lab-on-a-chip systems. In India, the Biotechnology Industry Research Assistance Council (BIRAC)—an initiative of the Department of Biotechnology—has launched multiple grant schemes and public-private partnerships to support indigenous development of biochips for diagnostic and therapeutic applications. As of 2023, BIRAC had funded over 1,500 startups and biotech companies, with biochip-related innovations receiving increased focus in health and agricultural diagnostics.

Meanwhile, the European Union continues to invest heavily in healthcare innovation through its Horizon Europe program, with a €95.5 billion budget (2021–2027). Within this, a significant allocation has gone toward projects developing microfluidic and biosensor technologies—including biochips—to support early diagnosis, real-time health monitoring, and pandemic preparedness.

Market Segmentation

- Based on the type, the market is segmented into DNA chips, lab-on-a-chip, protein chips, and others.

- Based on fabrication technology, the market is segmented into microarrays and microfluidics.

- Based on the end-user industry, the market is segmented into hospitals and diagnostic centers, academic and research institutes, and biotechnology and pharmaceutical companies.

DNA Chips Hold a Prominent Share in the Type Segment

DNA microarray tool is used to assess whether the DNA from a specific individual contains a mutation in genes such as BRCA1 and BRCA2. They are mostly used in medical research to speed up the process while minimizing research time. DNA microarrays have applications in clinical diagnostic tests for certain conditions. Often, they are also utilized to determine which drugs are considered best recommended for individuals, as genes assess how their bodies handle the chemistry corresponding to those drugs.

The innovations in new DNA sequencing technologies have resulted in a shift from microarrays to DNA microarrays. However, microarray tests are regarded as less expensive compared to sequencing, and therefore, DNA microarrays may be used for very large studies and some clinical tests. Some of the major companies involved in the development of DNA chips include Thermo Fisher Scientific Inc., Perkin Elmer, Inc., Oxford Gene Technology, Illumina, Inc., Bio-Rad Laboratories Inc., and others.

End Use Industry Insights

The biotechnology & pharmaceutical companies segment dominated the biochip market and accounted for the largest revenue share of 55.90% in 2024. Biochips find diverse applications within pharmaceutical companies, driving advancements in drug discovery, development, and manufacturing. These companies utilize biochips for high-throughput screening of compound libraries, enabling rapid identification of lead candidates for further development. Biochips also aid in target identification & validation, facilitating the selection of novel therapeutic targets.

Regional Outlook

The global biochip market is analyzed based on geographical regions, such as North America, Europe, Asia Pacific, and the Rest of the World (RoW). Asia-Pacific will likely offer an opportunity for the adoption of biochips owing to the rising molecular diagnostics market expansion of pharmaceutical companies and the rising availability of contract research organizations (CROs) in the region. Moreover, improved healthcare spending and the rising number of multi-specialty hospitals can further contribute to the adoption of biochips in the region.

North America Region Dominates the Market with Major Share

North America has dominated the biochip market, with a share of 47.7% in 2024. This is attributed to several key factors, such as the increasing prevalence of chronic diseases, technological advancements, and the growing demand for personalized medicine. The region's robust healthcare infrastructure and significant investments in research & development foster innovation and adoption of biochip technologies across hospitals and diagnostic centers. Thereby propelling the demand for the biochip in the region over the forecast period.

Market Players Outlook

Key players operating in the market include Bio-Rad Laboratories, Inc., Illumina Inc., Danaher Corp., Agilent Technologies, Inc., and PerkinElmer Inc. These market players adopt different marketing strategies such as mergers and acquisitions, product launches, and geographical expansion.

Recent Development

- In January 2025, Bioretec Ltd. obtained CE mark approval for its RemeOs™ trauma screws, enabling the company to market these bioresorbable orthopedic implants within the European Union. This approval signifies a major advancement in orthopedic surgery, offering implants that naturally dissolve in the body, thereby eliminating the need for removal surgeries.

- In December 2024, Intelligent Bio Solutions Inc. submitted a 510(k) premarket notification to the U.S. Food and Drug Administration (FDA) for its Intelligent Fingerprinting Drug Screening System. This innovative, non-invasive technology utilizes fingerprint sweat to rapidly detect drugs of abuse, delivering results within ten minutes.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biochips market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Biochips Market Sales Analysis – Type | Fabrication Technology | End User ($ Million)

• Biochips Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Biochips Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Biochips Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Biochips Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Biochips Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Biochips Market Revenue and Share by Manufacturers

• Biochips Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Illumina, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Bio-Rad Laboratories, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Agilent Technologies, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Danaher Corp.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Biochips Market Sales Analysis by Type ($ Million)

5.1. DNA Chips

5.2. Lab-on-a-Chip

5.3. Protein Chips

5.4. Others

6. Global Biochips Market Sales Analysis by Fabrication Technology ($ Million)

6.1. Microarrays

6.2. Microfluidics

7. Global Biochips Market Sales Analysis by End-User ($ Million)

7.1. Hospitals and Diagnostic Centers

7.2. Academic and Research Institutes

7.3. Biotechnology and Pharmaceutical Companies

8. Regional Analysis

8.1. North American Biochips Market Sales Analysis – Type | Fabrication Technology | End User |Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Biochips Market Sales Analysis – Type | Fabrication Technology | End User |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Biochips Market Sales Analysis – Type | Fabrication Technology | End User |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Biochips Market Sales Analysis – Type | Fabrication Technology | End User |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Abbott Laboratories

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Agilent Technologies, Inc.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Bio-Rad Laboratories, Inc.

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Cellix Ltd.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Danaher Corp.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. GeneCopoeia, Inc.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Horiba, Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Illumina, Inc.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Merck KGaA

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Micronit Microfluidics BV

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. PerkinElmer, Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Randox Laboratories Ltd.

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Thermo Fisher Scientific Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Toray Industries, Inc.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Toyo Kohan Co., Ltd.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

1. Global Biochips Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global DNA Chips Market Research And Analysis, 2024-2035 ($ Million)

3. Global Lab-On-A-Chip Market Research And Analysis, 2024-2035 ($ Million)

4. Global Protein Chips Market Research And Analysis, 2024-2035 ($ Million)

5. Global Other Types Of Biochips Market Research And Analysis, 2024-2035 ($ Million)

6. Global Biochips Market Research And Analysis By Fabrication Technology, 2024-2035 ($ Million)

7. Global Microarrays Biochips Market Research And Analysis, 2024-2035 ($ Million)

8. Global Microfluidics Biochips Market Research And Analysis, 2024-2035 ($ Million)

9. Global Biochips Market Research And Analysis, By End-User, 2024-2035 ($ Million)

10. Global Biochips in Hospitals And Diagnostic Centers Market Research And Analysis, 2024-2035 ($ Million)

11. Global Biochips in Academic And Research Institutes Market Research And Analysis, 2024-2035 ($ Million)

12. Global Biochips in Biotechnology And Pharmaceutical Companies Market Research And Analysis, 2024-2035 ($ Million)

13. Global Biochips Market Research And Analysis By Geography, 2024-2035, ($ Million)

14. North America Biochips Market Research And Analysis By Country, 2024-2035 ($Million)

15. North America Biochips Market Research And Analysis By Type, 2024-2035($Million)

16. North America Biochips Market Research And Analysis By Fabrication Technology, 2024-2035($Million)

17. North America Biochips Market Research And Analysis By End-User, 2024-2035($Million)

18. Europe Biochips Market Research And Analysis, By Country, 2024-2035 ($ Million)

19. Europe Biochips Market Research And Analysis By Type, 2024-2035 ($ Million)

20. Europe Biochips Market Research And Analysis By Fabrication Technology, 2024-2035 ($ Million)

21. Europe Biochips Market Research And Analysis By End-User, 2024-2035 ($ Million)

22. Asia-Pacific Biochips Market Research And Analysis By Type, 2024-2035 ($ Million)

23. Asia-Pacific Biochips Market Research And Analysis, By Fabrication Technology, 2024-2035 ($ Million)

24. Asia-Pacific Biochips Market Research And Analysis By End-User, 2024-2035 ($ Million)

25. Asia-Pacific Biochips Market Research And Analysis By Country, 2024-2035 ($ Million)

26. Rest of the World Biochips Market Research And Analysis By Type, 2024-2035 ($ Million)

27. Rest of the World Biochips Market Research And Analysis, By Fabrication Technology, 2024-2035 ($ Million)

28. Rest of the World Biochips Market Research And Analysis By End-User, 2024-2035 ($ Million)

29. Rest of the World Biochips Market Research And Analysis By Region, 2024-2035 ($ Million)

1. Global Biochips Technologies Market Share By Type, 2024 Vs 2035 (%)

2. Global DNA Biochips Market Share By Region, 2024 Vs 2035 (%)

3. Global Lab-on-Biochips Market Share By Region, 2024 Vs 2035 (%)

4. Global Protein Biochips Market Share By Region, 2024 Vs 2035 (%)

5. Global Others Biochips Market Share By Region, 2024 Vs 2035 (%)

6. Global Biochips Market Share By Fabrication Technologies, 2024 Vs 2035 (%/)

7. Global Microarrays Biochips Market Share By Region, 2024 Vs 2035 (%)

8. Global Microfluidics Biochips Market Share By Region, 2024 Vs 2035 (%)

9. Global Biochips Technologies Market Share By End User, 2024 Vs 2035 (%)

10. Global Biochips For Hospitals and Diagnostic Centers Market Share By Region, 2024 Vs 2035 (%)

11. Global Biochips For Academic and Research Institutes Market Share By Region, 2024 Vs 2035 (%)

12. Global Biochips For Biotechnology and Pharmaceutical Companies Market Share By Region, 2024 Vs 2035 (%)

13. Global Biochips Market Share By Region, 2024 Vs 2035 (%)

14. US Biochips Market Size, 2024-2035 ($ Million)

15. Canada Biochips Market Size, 2024-2035 ($ Million)

16. UK Biochips Market Size, 2024-2035 ($ Million)

17. France Biochips Market Size, 2024-2035 ($ Million)

18. Germany Biochips Market Size, 2024-2035 ($ Million)

19. Italy Biochips Market Size, 2024-2035 ($ Million)

20. Spain Biochips Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Biochips Market Size, 2024-2035 ($ Million)

22. India Biochips Market Size, 2024-2035 ($ Million)

23. China Biochips Market Size, 2024-2035 ($ Million)

24. Japan Biochips Market Size, 2024-2035 ($ Million)

25. South Korea Biochips Market Size, 2024-2035 ($ Million)

26. Australia and New Zealand Biochips Market Size, 2024-2035 ($ Million)

27. South Korea Biochips Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Biochips Market Size, 2024-2035 ($ Million)

29. Latin America Biochips Market Size, 2024-2035 ($ Million)

30. Middle East and Africa Biochips Market Size, 2024-2035 ($ Million)

FAQS

The size of the Biochips market in 2024 is estimated to be around $14,303 million.

North America holds the largest share in the Biochips market.

Leading players in the Biochips market include Bio-Rad Laboratories, Inc., Illumina Inc., Danaher Corp., Agilent Technologies, Inc., and PerkinElmer Inc.

Biochips market is expected to grow at a CAGR of 11.8% from 2025 to 2035.

The Biochips Market is growing due to rising demand for personalized medicine, rapid diagnostics, and advancements in genomics and proteomics technologies.