Biologics Market

Biologics Market Size, Share & Trends Analysis Report by Source (Microbial, Mammalian, and Others) by Product Type (Monoclonal Antibodies (mAbs), Vaccines, Recombinant Proteins, Gene Therapy, Cell Therapy and Others) by Application (Therapeutics, Diagnostics, Research Applications and Preventive), By Manufacturing Type (In-house Manufacturing, Contract Manufacturing) Forecast Period (2025-2035)

Industry Overview

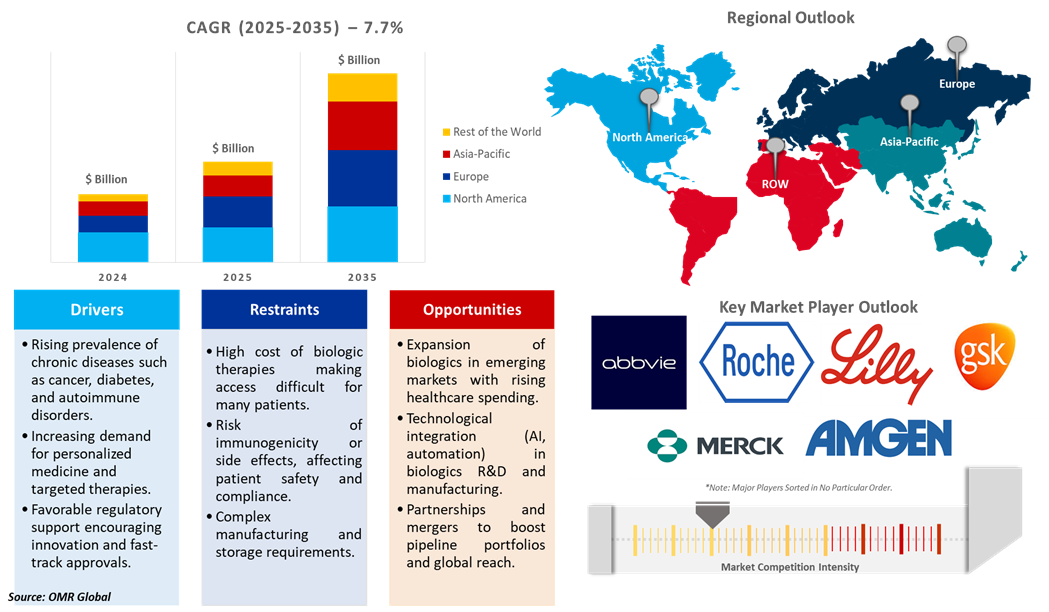

Biologics market was valued at $435.12 billion in 2024 and is projected to reach $983.94 billion by 2035, growing at a CAGR of 7.7% during the forecast period (2025–2035). The global biologics market is expanding at a fast pace owing to the rising prevalence of chronic & complex diseases, regulatory support & fast-track approvals, technological advancement in biological manufacturing, and rising healthcare expenditure & access in emerging markets. Biologics are living organism-derived products such as monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins. All these therapies are biologics are used across a wide range of disease areas, including autoimmune & inflammatory diseases, oncology, infectious diseases, neurological diseases, metabolic and endocrine disorders, among others.

Market Dynamics

Regulatory Support & Fast-Track Approvals

Supportive regulatory paths, including the FDA's fast track, accelerated approval programs, breakthrough therapy, priority review, and accelerated approval programs, have considerably accelerated biologics commercialization. These frameworks shorten development schedules, lower market entry obstacles, and promote continued investment in new medical treatments. Agencies such as the FDA/EMA offer priority review, breakthrough treatment, and rapid approval pathways for new biologics. For instance, In January 2024, BioNTech SE and Duality Biologics (Suzhou) Co., Ltd. ("DualityBio") announced that the FDA has granted Fast Track designation for BNT325/DB-1305 for the treatment of patients with platinum-resistant ovarian epithelial cancer, fallopian tube cancer, or primary peritoneal cancer who have received one to three prior systemic treatment regimens. BNT325/DB-1305 is a next-generation antibody-drug conjugate ("ADC") candidate that targets the trophoblast cell-surface antigen 2 ("TROP2") protein, which is overexpressed in a variety of tumor types.

Continuous Innovations in Targeted Therapies

Continuous innovation in targeted therapeutics is a major biologics market trend for complex molecules. Innovations in biotechnology enable the development of medications that focus on disease mechanisms at the molecular or cellular level, increasing efficacy while minimizing negative effects. For instance, in February 2025, the FDA approved a new targeted chemotherapy drug for adults with unresectable or metastatic hormone receptor (HR)-positive, HER2-negative breast cancer. The drug, called Datroway (datopotamab deruxtecan), is approved for patients who have already received endocrine-based therapy and chemotherapy. Datroway utilizes an antibody that specifically targets TROP2, a protein located on the surface of numerous tumour cells. Trodelvy (sacituzumab govitecan), an earlier antibody-drug combination licensed for breast cancer treatment, targets the same target but delivers a different chemotherapy.

Market Segmentation

- Based on the source, the market is segmented into microbial, mammalian, and others.

- Based on the product type, the market is segmented into mAbs, vaccines, recombinant proteins, gene therapy, cell therapy, and others.

- Based on the application, the market is segmented into therapeutics, diagnostics, research applications, and preventive.

- Based on the manufacturing type, the market is segmented into in-house manufacturing and contract manufacturing.

Monoclonal Antibodies (mAbs): A Key Segment in Market Growth

Monoclonal antibodies held the largest share of the global biologics market, driven primarily by their versatility across therapeutic areas, strong clinical efficacy, and long commercial success. The strong sales performance of Keytruda in 2023 highlights the clinical importance and commercial potential of mAbs. Keytruda belongs to the drug class called immune checkpoint inhibitors and may also be called a monoclonal antibody or a biologic. In 2023, Keytruda became the best-selling medicine when AbbVie's Humira lost US market exclusivity, and demand for Covid-19 vaccinations fell at the end of the pandemic. The programmed cell death 1 (PD-1) inhibitor is the highest-grossing drug (Keytruda) in Merck & Co., Inc.'s portfolio. Keytruda's sales were $29.5 billion in 2024, up 18%. Furthermore, the medicine received three FDA licenses in 2024. mAbs drive revenue and set the standard for current biologic innovation. Furthermore, advances in recombinant biotechnology and protein chemistry, together with an improved understanding of mAb structure and function, have led to rising interest in recombinant variants of mAbs such as chimeric mAbs, mAb fragments, single domain mAbs, and multispecific mAbs.

The Microbial Segment of the Biologics Market Is Expanding at the Highest Rate

The microbial segment of the biologics market is expanding at the highest rate, owing to its distinct advantages in terms of scalability and production efficiency. Common Microbial Sources for Biologic Products include Escherichia coli (E. coli), Yeasts, Filamentous Fungi, among others. The production of biologic medicines like insulin, vaccines, hormones, and enzymes depends on microbial expression systems, particularly those of bacteria like E. coli and yeasts like Pichia pastoris. These systems are especially popular given that they enable speedy protein expression, are inexpensive to grow, and can be swiftly scaled up for industrial production. As a result, they are very appealing to both biotech startups and well-established pharmaceutical companies.

Regional Outlook

The global Biologics is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Leading the Global Biologics Market Growth

The market growth is attributed to the rising prevalence of chronic and complex diseases, expanding manufacturing capacity & CDMO ecosystem, innovations in biologics & advanced therapies, and a favorable regulatory and incentive framework. In the US, chronic autoimmune diseases such as Type 1 remain a major chronic condition. In the US, approximately 1.24 million individuals live with Type 1 diabetes, and that number is anticipated to grow to five million by 2050. In recent years, there has been an increasing number of FDA approvals of biologic medicines for various diseases such as diabetes, cancer, Alzheimer contributing to the growth of the biologic market in North America. For instance, in January 2023, the FDA approved Tzield (teplizumab-mzwv) injection to delay the onset of stage 3 type 1 diabetes (T1D) in adults and pediatric patients 8 years and older who have stage 2 T1D. Tzield is the first disease-modifying medication for T1D. Tzield does not prevent or cure T1D; however, it can reduce the need for exogenous insulin therapy, which has associated risks and requires an intensive regimen.

Additionally, various pharma and biotech companies such as Pfizer, Amgen, Eli Lilly, and Bristol Myers Squibb have been scaling the production of commercial biologic medicines across the US and Canada. This ensures supply stability and further promotes overall market growth by meeting rising demand, lowering production costs, and enabling faster commercialization. For instance, in April 2025, Regeneron Pharmaceuticals, Inc. announced a significant expansion of its manufacturing capacity through a new agreement with FUJIFILM Diosynth Biotechnologies to manufacture and supply bulk drug product of Regeneron’s commercial biologic medicines at Holly Springs, North Carolina, campus. Regeneron, already one of the largest biologics manufacturers across the globe, will nearly double its large-scale manufacturing capacity in the US by partnering with Fujifilm on a new modern biopharmaceutical facility. By technology transfer starting immediately and a ten-year timeline, the total investment is expected to surpass $3 billion.

Europe Maintains Strong Market Position

Europe holds a significant share, owing to the market growth is primarily driven by a well-developed healthcare system with increased access to innovative biologic treatments, boosting biologics industry growth. A high frequency of autoimmune illnesses, cancer, and other chronic conditions drives the demand for biologics. The number of individuals living with cancer in countries such as the UK has risen from nearly 3 million in 2020 to nearly 3.5 million by 2025. For all cancers combined in the UK, mortality rates are over 1.6 times higher in the most deprived areas compared to the least (337 fatalities per 100,000 against 217 fatalities). Furthermore, the region's emphasis on research and innovation, along with a robust healthcare infrastructure, creates an ideal setting for biologics market growth. In addition, higher healthcare spending, as well as joint efforts between the public and private sectors, help to fuel the market's growth.

Market Players Outlook

The major companies operating in the global biologics market include AbbVie Inc., Amgen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck & Co., Inc., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In August 2025, the FDA approved Wegovy (semaglutide) injection to treat metabolic-associated steatohepatitis (MASH) in adults with moderate-to-advanced fibrosis (excessive scar tissue in the liver). Nonalcoholic steatohepatitis, or MASH, is a severe liver condition. Approximately 6% of U.S. adults (14.9 million people) have MASH, and its prevalence is expanding.

- In June 2025, Aragen announced that it would commence GMP manufacturing at its biologics manufacturing facility in Bangalore, India. Aragen has completed its plant and machinery qualification and shown the productivity of its intensified fed batch cell culture manufacturing platform, delivering titers of more than 25 g/L.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global biologics market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Biologics Market Sales Analysis – Source | Product Type | Application | Manufacturing Type ($ Million)

• Biologics Market Sales Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Biologics Market Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Biologics Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Biologics Market: Impact Analysis

3.3. Market Opportunities

3.3.1. Opportunities For the Global Biologics Market: Impact Analysis

4. Competitive Landscape

4.1. Competitive Dashboard – Biologics Market Revenue and Share by Manufacturers

• Biologics Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. AbbVie Inc.

4.2.1.1. Overview

4.2.1.2. Battery Type Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Amgen Inc.

4.2.2.1. Overview

4.2.2.2. Battery Type Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Eli Lilly and Company

4.2.3.1. Overview

4.2.3.2. Battery Type Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. GlaxoSmithKline PLC

4.2.4.1. Overview

4.2.4.2. Battery Type Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. F. Hoffmann-La Roche Ltd

4.2.5.1. Overview

4.2.5.2. Battery Type Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Merck & Co., Inc.

4.2.6.1. Overview

4.2.6.2. Battery Type Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Battery Type Launch

4.3.3. Partnership And Collaboration

5. Global Biologics Market Sales Analysis By Source ($ Million)

5.1. Microbial

5.2. Mammalian

5.3. Others (Insect Cells, Transgenic Animals/Plants)

6. Global Biologics Market Sales Analysis By Product Type ($ Million)

6.1. Monoclonal Antibodies (mAbs)

6.2. Vaccines

6.3. Recombinant Proteins

6.4. Gene Therapy

6.5. Cell Therapy

6.6. Others (Allergy Immunotherapy, Hormones)

7. Global Biologics Market Sales Analysis By Application ($ Million)

7.1. Therapeutics

7.2. Diagnostics

7.3. Research Applications

7.4. Preventive (e.g., vaccines)

8. Global Biologics Market Sales Analysis By Manufacturing Type ($ Million)

8.1. In-house Manufacturing

8.2. Contract Manufacturing (CMOs/CDMOs)

9. Regional Analysis

9.1. North American Biologics Market Sales Analysis – Source | Product Type | Application | Manufacturing Type| Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Biologics Market Sales Analysis – Source | Product Type | Application | Manufacturing Type| Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Biologics Market Sales Analysis – Source | Product Type | Application | Manufacturing Type| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Biologics Market Sales Analysis – Source | Product Type | Application | Manufacturing Type| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. AbbVie Inc.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Amgen Inc.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. AstraZeneca PLC

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. BeiGene, Inc.

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Bristol-Myers Squibb Company

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Biogen, Inc

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Celltrion Inc

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Eli Lilly and Company

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Eton Pharmaceuticals, Inc.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. F. Hoffmann-La Roche Ltd

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Gilead Sciences, Inc

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. GlaxoSmithKline PLC

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Janssen Pharmaceuticals, Inc.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Merck & Co., Inc.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Moderna Inc

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Novartis AG

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Pfizer Inc

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Regeneron Pharmaceuticals Inc.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. Sanofi SA

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Samsung Bioepis Co., Ltd.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. Takeda Pharmaceuticals Inc.

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.21.5. Business Strategies

10.22. Vertex Pharmaceuticals Inc

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.22.5. Business Strategies

1. Global Biologics Market Research and Analysis By Source, 2024-2035 ($ Million)

2. Global Microbial Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

3. Global Mammalian Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

4. Global Other Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

5. Global Biologics Market Research and Analysis By Product Type, 2024-2035 ($ Million)

6. Global mAbs Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

7. Global Vaccines Biologic Market Research and Analysis By Region, 2024-2035 ($ Million)

8. Global Recombinant Proteins Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

9. Global Gene Therapy Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

10. Global Cell Therapy Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

11. Global Other Biologics Product Market Research and Analysis By Region, 2024-2035 ($ Million)

12. Global Biologics Market Research and Analysis By Application, 2024-2035 ($ Million)

13. Global Biologics For Therapeutics Market Research and Analysis By Region, 2024-2035 ($ Million)

14. Global Biologics For Diagnostics Market Research and Analysis By Region, 2024-2035 ($ Million)

15. Global Biologics For Research Applications Market Research and Analysis By Region, 2024-2035 ($ Million)

16. Global Biologics For Preventive Market Research and Analysis By Region, 2024-2035 ($ Million)

17. Global Biologics Market Research and Analysis By Manufacturing Type, 2024-2035 ($ Million)

18. Global In-house Biologics Manufacturing Market Research and Analysis By Region, 2024-2035 ($ Million)

19. Global Contract Biologics Manufacturing Market Research and Analysis By Region, 2024-2035 ($ Million)

20. Global Biologics Market Research and Analysis By Region, 2024-2035 ($ Million)

21. North American Biologics Market Research and Analysis By Country, 2024-2035 ($ Million)

22. North American Biologics Market Research and Analysis By Source, 2024-2035 ($ Million)

23. North American Biologics Market Research and Analysis By Product Type, 2024-2035 ($ Million)

24. North American Biologics Market Research and Analysis By Application, 2024-2035 ($ Million)

25. North American Biologics Market Research and Analysis By Manufacturing Type, 2024-2035 ($ Million)

26. European Biologics Market Research and Analysis By Country, 2024-2035 ($ Million)

27. European Biologics Market Research and Analysis By Source, 2024-2035 ($ Million)

28. European Biologics Market Research and Analysis By Product Type, 2024-2035 ($ Million)

29. European Biologics Market Research and Analysis By Application, 2024-2035 ($ Million)

30. European Biologics Market Research and Analysis By Manufacturing Type, 2024-2035 ($ Million)

31. Asia-Pacific Biologics Market Research and Analysis By Country, 2024-2035 ($ Million)

32. Asia-Pacific Biologics Market Research and Analysis By Source, 2024-2035 ($ Million)

33. Asia-Pacific Biologics Market Research and Analysis By Product Type, 2024-2035 ($ Million)

34. Asia-Pacific Biologics Market Research and Analysis By Application, 2024-2035 ($ Million)

35. Asia-Pacific Biologics Market Research and Analysis By Manufacturing Type, 2024-2035 ($ Million)

36. Rest of The World Biologics Market Research and Analysis By Country, 2024-2035 ($ Million)

37. Rest of The World Biologics Market Research and Analysis By Source, 2024-2035 ($ Million)

38. Rest Of The World Biologics Market Research and Analysis By Product Type, 2024-2035 ($ Million)

39. Rest of The World Biologics Market Research and Analysis By Application, 2024-2035 ($ Million)

40. Rest of The World Biologics Market Research and Analysis By Manufacturing Type, 2024-2035 ($ Million)

1. Global Biologics Market Share By Source, 2024 Vs 2035 (%)

2. Global Microbial Biologics Market Share By Region, 2024 Vs 2035 (%)

3. Global Mammalian Biologics Market Share By Region, 2024 Vs 2035 (%)

4. Global Other Biologics Source Market Share By Region, 2024 Vs 2035 (%)

5. Global Biologics Market Share By Product Type, 2024 Vs 2035 (%)

6. Global mAbs Biologics Market Share By Region, 2024 Vs 2035 (%)

7. Global Vaccines Biologics Market Share By Region, 2024 Vs 2035 (%)

8. Global Recombinant Proteins Biologics Market Share By Region, 2024 Vs 2035 (%)

9. Global Gene Therapy Biologics Market Share By Region, 2024 Vs 2035 (%)

10. Global Cell Therapy Biologics Market Share By Region, 2024 Vs 2035 (%)

11. Global Other Biologics Product Market Share By Region, 2024 Vs 2035 (%)

12. Global Biologics Market Share By Application, 2024 Vs 2035 (%)

13. Global Biologics For Therapeutics Market Share By Region, 2024 Vs 2035 (%)

14. Global Biologics For Diagnostics Market Share By Region, 2024 Vs 2035 (%)

15. Global Biologics For Research Applications Market Share By Region, 2024 Vs 2035 (%)

16. Global Biologics For Preventive Market Share By Region, 2024 Vs 2035 (%)

17. Global Biologics Market Share By Manufacturing Type, 2024 Vs 2035 (%)

18. Global In-house Biologics Manufacturing Market Share By Region, 2024 Vs 2035 (%)

19. Global Contract Biologics Manufacturing Market Share By Region, 2024 Vs 2035 (%)

20. US Biologics Market Size, 2024-2035 ($ Million)

21. Canada Biologics Market Size, 2024-2035 ($ Million)

22. UK Biologics Market Size, 2024-2035 ($ Million)

23. France Biologics Market Size, 2024-2035 ($ Million)

24. Germany Biologics Market Size, 2024-2035 ($ Million)

25. Italy Biologics Market Size, 2024-2035 ($ Million)

26. Spain Biologics Market Size, 2024-2035 ($ Million)

27. Russia Biologics Market Size, 2024-2035 ($ Million)

28. Rest of Europe Biologics Market Size, 2024-2035 ($ Million)

29. India Biologics Market Size, 2024-2035 ($ Million)

30. China Biologics Market Size, 2024-2035 ($ Million)

31. Japan Biologics Market Size, 2024-2035 ($ Million)

32. South Korea Biologics Market Size, 2024-2035 ($ Million)

33. Australia and New Zealand Biologics Market Size, 2024-2035 ($ Million)

34. ASEAN Economies Biologics Market Size, 2024-2035 ($ Million)

35. Rest of Asia-Pacific Biologics Market Size, 2024-2035 ($ Million)

36. Latin America Biologics Market Size, 2024-2035 ($ Million)

37. Middle East and Africa Biologics Market Size, 2024-2035 ($ Million)

FAQS

The size of the Biologics market in 2024 is estimated to be around $435.12 billion.

North America holds the largest share in the Biologics market.

Leading players in the Biologics market include AbbVie Inc., Amgen Inc., Eli Lilly and Company, F. Hoffmann-La Roche Ltd, GlaxoSmithKline PLC, Merck & Co., Inc., among others.

Biologics market is expected to grow at a CAGR of 7.7% from 2025 to 2035.

The Biologics Market growth is driven by increasing prevalence of chronic diseases, rising demand for targeted therapies, and advancements in biotechnology.