Bionics Market

Global Bionics Market Size, Share & Trends Analysis Report, By Product (Bionic Heart, Bionic orthopaedic, Bionic Brain, Bionic Vision, Bionic Ear, and Others), By Type of Fixation (Externally Worn and Implantable), By Technology (Electronic Bionics and Mechanical Bionics), By Application (Healthcare, Defense, and Industrial) and Forecast, 2019-2025

The global bionics market is estimated to grow at a CAGR of nearly 9.0% during the forecast period. Some crucial factors encouraging market growth include the increasing demand for organ transplantation and a significant rise in neurostimulation procedures. The demand for organ transplantation has increased significantly owing to the rising number of patients with heart failure, kidney failure, and liver damage. As per the Division of Transplantation within the Health Resources and Services Administration, in 2019, there were 39,718 transplants performed in the US. In 2019, over 112,000 men, women, and children were waiting for organ transplantation in the US.

The total number of donors was 19,267, of which 7,397 were living donors and 11,870 were deceased donors. The increasing shortage of organs has been supporting the increasing demand for artificial organs that provides support to the patients and increase the survival rate of patients as well as eliminate the complexities associated with organ rejection while taking from living and deceased donors. There are several companies involved in the manufacturing of artificial heart valves, which include Abbott Laboratories, Edwards Lifesciences Corp., and Boston Scientific Corp.

The Edwards SAPIEN family of valves include the Edwards SAPIEN 3, Edwards SAPIEN XT, and the Edwards SAPIEN 3 Ultra transcatheter aortic heart valves, and their respective delivery systems, are utilized for the treatment of heart valve disease with the use of catheter-based approaches for certain patients with congenital heart disease and severe symptomatic aortic stenosis. These heart valves can support patients to live a better life as compared to patients receiving conventional surgical therapies. The company’s sales of transcatheter aortic valve replacement products represented 63%, 61%, and 59% of its net sales in 2019, 2018, and 2017, respectively. The increasing sales of artificial valves represents an increasing demand for artificial organs and thereby driving the market growth.

Market Segmentation

The global bionics market is classified into product, type of fixation, technology, and application. Based on the product, the market is classified into bionic heart, bionic orthopaedic, bionic brain, bionic vision, bionic ear, and others. Based on the type of fixation, the market is classified into externally worn and implantable. Based on technology, the market is classified into electronic bionics and mechanical bionics. Based on application, the market is classified into healthcare, defense, and industrial.

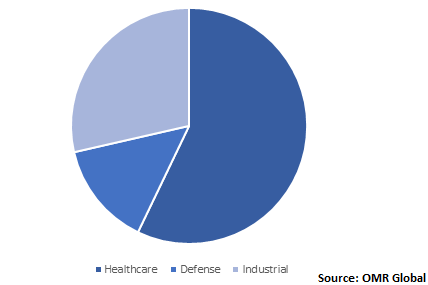

Healthcare is anticipated to hold major share in the application segment

In 2018, healthcare is expected to hold a considerable share in the market owing to the rising geriatric population and increasing demand for implantation procedures. Increasing prevalence of Parkinson’s disease (PD) has increased the demand for neurostimulation procedures. According to Parkinson’s Foundation, approximately one million Americans are suffering from PD, which is higher than the total number of patients diagnosed with Lou Gehrig's, muscular dystrophy, and multiple sclerosis disease. Each year, nearly 60,000 Americans are diagnosed with PD. The incidence of PD grows with age, however, an estimated 4% of people are diagnosed with PD, before the age of 50 years.

For the treatment of PD, DBS, a minimally invasive surgical procedure can be used for the treatment of neurological symptoms of PD, such as rigidity, movement control and tremors. DBS employs a neurostimulation device, like a heart pacemaker that enables to transmit electrical pulses to a very exact location in the brain circuits which influence PD symptom. The electrical pulses generated from the DBS device obstruct the activity of these circuits. As a result, the rest of the brain can work more normally. Additionally, increasing demand for artificial organs and exoskeleton devices for paralyzed patients are further contributing to the considerable share of bionics in healthcare applications.

Global Bionics Market Share by Application, 2018 (%)

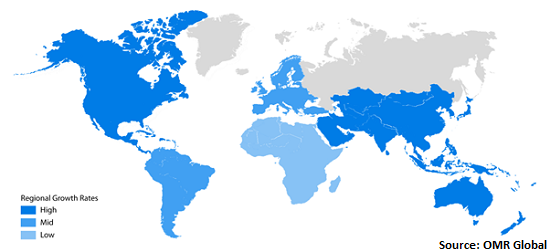

Regional Outlook

The global bionics market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2018, North America is anticipated to witness a significant share in the market owing to the increasing number of heart failures, rising geriatric population, and increasing spinal cord injuries in the region. As per the American Heart Association, there were 5.7 million adults had heart failure during the period, 2009-2012 which increased to nearly 6.5 million during the period, 2011-2014. This, in turn, leads the demand for artificial heart transplants to support end-stage heart failure patients to live a better life.

Global Bionics Market Growth, by Region 2019-2025

Market Players Outlook

The major players operating in the market include Abbott Laboratories, Medtronic plc, Boston Scientific Corp., Ekso Bionics, and Lockheed Martin Corp. The market players are using certain strategies, including mergers and acquisitions, partnerships and collaborations, and product launches, to expand market share and gain a competitive advantage. For instance, in August 2019, Ekso Bionics Holdings, Inc. launched EksoNR, the next generation EksoGT, an intuitive exoskeleton device which is designed for neurorehabilitation. The device offers support to the patients to recover from stroke and other diseases to walk again with a natural gait.

It comprises software enhancements and new features that provide support to the patients and physical therapists to achieve significant benefits from rehabilitation session. It is equipped with a new touchscreen controller, EksoView that enables physical therapists to intuitively adapt assistance to challenge patients with the use of real-time feedback and carry out outcome measures during application. EksoView offers visualization of several exercises beyond gait training, including lifting one leg, balancing, standing in place, squatting from sit-to-stand positioning, or to actively involve patients and accelerate the use of these helpful features.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bionics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Novel Technologies

2.4. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Medtronic plc

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Boston Scientific Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Ekso Bionics

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Lockheed Martin Corp.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Bionics Market by Product

5.1.1. Bionic Heart

5.1.1.1. Artificial Heart Valve

5.1.1.2. Total Artificial Heart

5.1.1.3. Ventricular Assist Device

5.1.1.4. Pacemaker

5.1.2. Bionic Orthopaedic

5.1.2.1. Exoskeleton

5.1.2.2. Hand

5.1.2.3. Leg

5.1.2.4. Others

5.1.3. Bionic Brain

5.1.3.1. Deep Brain Stimulators

5.1.3.2. Spinal Cord Stimulators

5.1.3.3. Transcutaneous Electric Nerve Stimulation

5.1.3.4. Vagus Nerve Stimulators

5.1.3.5. Others

5.1.4. Bionic Vision

5.1.5. Bionic Ear

5.1.5.1. Cochlear Implants

5.1.5.2. Auditory Brainstem Implants

5.1.5.3. Bone Anchored Hearing Aid (BAHA)

5.1.6. Others

5.2. Global Bionics Market by Type of Fixation

5.2.1. Externally Worn

5.2.2. Implantable

5.3. Global Bionics Market by Technology

5.3.1. Electronic Bionics

5.3.2. Mechanical Bionics

5.4. Global Bionics Market by Application

5.4.1. Healthcare

5.4.2. Defense

5.4.3. Industrial

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Abiomed, Inc.

7.3. Berlin Heart GmbH

7.4. BiVACOR, Inc.

7.5. Boston Scientific Corp.

7.6. Cochlear Ltd.

7.7. CryoLife, Inc.

7.8. CYBERDYNE Inc.

7.9. Edwards Lifesciences Corp.

7.10. Ekso Bionics

7.11. Fillauer LLC

7.12. Gogoa Mobility Robots

7.13. Hyundai Motor Group

7.14. Integra LifeSciences Holdings Corp.

7.15. Johnson & Johnson Services Inc.

7.16. LifeNet Health

7.17. LivaNova PLC

7.18. Lockheed Martin Corp.

7.19. Medtronic plc

7.20. Mobius Bionics LLC

7.21. Orthofix Medical Inc.

7.22. Össur hf.

7.23. Ototronix, LLC

7.24. Ottobock SE & Co. KGaA

7.25. Pixium Vision S.A.

7.26. Raytheon Co.

7.27. Second Sight

7.28. Sonova Holding AG

7.29. Terumo Corp.

7.30. Toyota Motor Corp.

1. GLOBAL BIONICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

2. GLOBAL BIONIC HEART MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL BIONIC ORTHOPAEDIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL BIONIC BRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL BIONIC VISION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL BIONIC EAR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OTHER BIONIC PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL BIONICS MARKET RESEARCH AND ANALYSIS BY TYPE OF FIXATION, 2018-2025 ($ MILLION)

9. GLOBAL EXTERNALLY WORN BIONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL IMPLANTABLE BIONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL BIONICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

12. GLOBAL ELECTRONIC BIONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL MECHANICAL BIONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL BIONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

15. GLOBAL BIONICS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL BIONICS IN DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL BIONICS IN INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL BIONICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

19. NORTH AMERICAN BIONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. NORTH AMERICAN BIONICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

21. NORTH AMERICAN BIONICS MARKET RESEARCH AND ANALYSIS BY TYPE OF FIXATION, 2018-2025 ($ MILLION)

22. NORTH AMERICAN BIONICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

23. NORTH AMERICAN BIONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

24. EUROPEAN BIONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

25. EUROPEAN BIONICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

26. EUROPEAN BIONICS MARKET RESEARCH AND ANALYSIS BY TYPE OF FIXATION, 2018-2025 ($ MILLION)

27. EUROPEAN BIONICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

28. EUROPEAN BIONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

29. ASIA-PACIFIC BIONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

30. ASIA-PACIFIC BIONICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

31. ASIA-PACIFIC BIONICS MARKET RESEARCH AND ANALYSIS BY TYPE OF FIXATION, 2018-2025 ($ MILLION)

32. ASIA-PACIFIC BIONICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

33. ASIA-PACIFIC BIONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

34. REST OF THE WORLD BIONICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2018-2025 ($ MILLION)

35. REST OF THE WORLD BIONICS MARKET RESEARCH AND ANALYSIS BY TYPE OF FIXATION, 2018-2025 ($ MILLION)

36. REST OF THE WORLD BIONICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2018-2025 ($ MILLION)

37. REST OF THE WORLD BIONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL BIONICS MARKET SHARE BY PRODUCT, 2018 VS 2025 (%)

2. GLOBAL BIONICS MARKET SHARE BY TYPE OF FIXATION, 2018 VS 2025 (%)

3. GLOBAL BIONICS MARKET SHARE BY TECHNOLOGY, 2018 VS 2025 (%)

4. GLOBAL BIONICS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

5. GLOBAL BIONICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

6. US BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

7. CANADA BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

8. UK BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

9. FRANCE BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

10. GERMANY BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

11. ITALY BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

12. SPAIN BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

13. ROE BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

15. CHINA BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

16. JAPAN BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF ASIA-PACIFIC BIONICS MARKET SIZE, 2018-2025 ($ MILLION)

18. REST OF THE WORLD BIONICS MARKET SIZE, 2018-2025 ($ MILLION)