Blood Glucose Monitoring Systems Market

Blood Glucose Monitoring Systems Market Size, Share & Trends Analysis Report, By Product (Self-Monitoring Blood Glucose Systems (Blood Glucose Meters, Testing Strips, and Lancets), Continuous Glucose Monitoring Systems (Sensors, Transmitters, and Receivers)), By Application (Type 1 Diabetes and Type 2 diabetes), By End-User (Hospital, Home Care, and Diagnostics Center), Forecast Period (2022-2028)

blood glucose monitoring systems market is expected to grow at a CAGR of 6.5% during the forecast period. According to the World Health Organization (WHO), nearly 422 million people are suffering from diabetes across the globe. Diabetes is a chronic disease characterized by elevated levels of blood glucose, which leads over time to serious damage to the heart, blood vessels, eyes, kidneys and nerves. The blood glucose monitoring system allows patients to monitor the effects of medicines and identify the range of blood sugar level. The growing prevalence of diabetes among people is a major factor contributing to the growth of the global blood glucose monitoring systems market. Further, the rising support from the government and other organizations to scale-up access to essential diabetes medicines, including insulin and associated devices is expected to fuel the growth of the global blood glucose monitoring systems market during the forecast period. For instance, in April 2021, WHO together with the government of Canada launched Global Diabetes Compact, a global partnership for local solutions to pave the way for universal access to health services and medicines to prevent, screen, diagnose and treat diabetes.

Segmental Outlook

The global blood glucose monitoring systems market is segmented based on the product, application and end-user. Based on the product, the market is segmented into self-monitoring blood glucose systems (blood glucose meters, testing strips, and lancets), and continuous glucose monitoring systems (sensors, transmitters, and receivers). Based on the application, the market is segmented into type 1 diabetes and type 2 diabetes. Based on end-user, the market is segmented into hospitals, home care, and diagnostics centre. The above mentioned segments can be customized as per the requirements.

Home Care is Expected to Hold Significant Share in the Market During the Forecast Period

The hospital segment held the dominant share in the global blood glucose monitoring systems market owing to the improved infrastructure and increase in healthcare expenditure by both government and private hospitals. However, the home care segment is expected to register the fastest growth rate during the forecast period. Home care includes devices which support to record and monitor glucose level in-house such as self-monitoring blood glucose systems and continuous glucose monitoring systems. The factors such as the integration of advanced technologies with medical devices, the growing use of telemedicine, and the launch of innovative devices for glucose monitoring are factors which will continue to propel the growth of the home care segment in the blood glucose monitoring systems market. For Instance, in March 2021, Roche announced the launch of the new Accu-Chek Instant system, a new connected blood glucose monitoring system. Accu-Chek has Bluetooth-enabled connectivity to the mySugr app, which allows wireless transfer of blood glucose results to the mySugr app.

Regional Outlook

The global blood glucose monitoring systems market is segmented based on geography including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement.

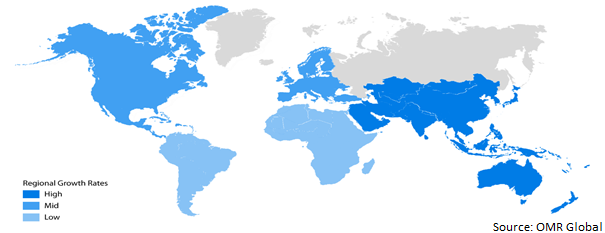

Global Blood Glucose Monitoring Systems Market Growth, by Region 2022-2028

Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Blood Glucose Monitoring Systems Market During the Forecast Period

The rising diabetes population is leading to an increasing demand for blood glucose monitoring systems in the region. According to the Asian Diabetes Prevention Initiative, 60% of diabetics in the world live in Asia. By 2030, both China and India combined will have almost half a billion diabetics. This, in turn, is expected to further drive the demand for blood glucose monitoring systems in the region. Several key manufacturers are focusing on launching their products in the region, which in turn, is offering an opportunity for market growth in the region. For instance, in November 2020, Abbott declared that the FreeStyle Libre system, continuous glucose monitoring (CGM) technology, is now available for adults and children (above the age of four) living with diabetes in India and women with gestational diabetes (diabetes during pregnancy), offering them the choice to check glucose levels anytime and anywhere, ultimately improving glucose control.

The FreeStyle Libre sensor measures glucose every minute in interstitial fluid through a small (5.5mm long) filament that is inserted just under the skin and held in place with a small adhesive pad. A quick scan of the sensor with a reader provides a real-time glucose reading on demand and a complete picture of a person's glucose levels, without the need for painful, routine fingersticks or daily calibration, enabling meaningful lifestyle and therapy interventions.

Market Players Outlook

The major companies operating in the global blood glucose monitoring systems market include Abbott Laboratories, B. Braun Melsungen AG, Dexcom, Inc., F. Hoffman-La Roche Ltd., and Sanofi S.A. The market players are contributing significantly to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, partnerships, and new product launches, to stay competitive in the market. For instance, in May 2021, Roche declared the launch of the new Accu-Chek Instant system, a new "connected" blood glucose monitoring (BGM) system, which supports and enables Roche’s approach of integrated Personalised Diabetes Management (iPDM). Accu-Chek Instant features Bluetooth-enabled connectivity to the mySugr app, allowing wireless transfer of blood glucose results to the mySugr app. This app offers users quick insights into their diabetes data in addition to diabetes management features such as the mySugr insulin calculator.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blood glucose monitoring systems market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Abbott Laboratories

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. B. Braun Melsungen AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Dexcom, Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. F. Hoffman-La Roche Ltd.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Sanofi S.A.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Blood Glucose Monitoring System Market by Product

4.1.1. Self-Monitoring Blood Glucose Systems

4.1.1.1. Blood Glucose Meters

4.1.1.2. Testing Strips

4.1.1.3. Lancets

4.1.2. Continuous Glucose Monitoring Systems

4.1.2.1. Sensors

4.1.2.2. Transmitters

4.1.2.3. Receivers

4.2. Global Blood Glucose Monitoring System Market by Application

4.2.1. Type 1 Diabetes

4.2.2. Type 2 Diabetes

4.3. Global Blood Glucose Monitoring System Market by End-User

4.3.1. Hospitals

4.3.2. Home Care

4.3.3. Diagnostics Centre

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Acon Labs Inc.

6.2. AgaMatrix, Inc.

6.3. Arkray, Inc.

6.4. Ascensia Diabetes Care Holdings AG

6.5. GlySens Inc.

6.6. Insulet Corp.

6.7. Medtronic plc

6.8. Nipro Corp.

6.9. Nova Biomedical

6.10. Novo Nordisk A/S

6.11. Prodigy Diabetes Care, LLC

6.12. Pulsatom Healthcare Private Limited

6.13. Senseonics Holdings, Inc.

6.14. Terumo Corp.

6.15. Ypsomed AG

1. GLOBAL BLOOD GLUCOSE MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

4. GLOBAL BLOOD GLUCOSE METERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL TESTING STRIPS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL LANCETS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

9. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS TRANSMITTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS RECEIVERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET FOR TYPE 1 DIABETES RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET FOR TYPE 2 DIABETES RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. GLOBALBLOOD GLUCOSE MONITORING SYSTEM MARKET FOR HOSPITALS RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET FOR HOME CARE RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

19. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET FOR DIAGONOSTIC CENTER RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

20. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

21. NORTH AMERICAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. NORTH AMERICAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

23. NORTH AMERICAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. NORTH AMERICAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. EUROPEAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. EUROPEAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

27. EUROPEAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. EUROPEAN BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30. ASIA-PACIFIC BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

31. ASIA-PACIFIC BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

32. ASIA-PACIFIC BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

33. REST OF THE WORLD BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

34. REST OF THE WORLD BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

35. REST OF THE WORLD BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

36. REST OF THE WORLD BLOOD GLUCOSE MONITORING SYSTEM MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL BLOOD GLUCOSE MONITORING SYSTEMS MARKET SHARE BY PRODUCT, 2021 VS 2028 (%)

2. GLOBAL SELF-MONITORING BLOOD GLUCOSE SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL BLOOD GLUCOSE METERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL TESTING STRIPS MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL LANCETS MARKET SHARE BY REGION, 2021 VS 2028(%)

6. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS SENSORS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS TRANSMITTERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL CONTINUOUS GLUCOSE MONITORING SYSTEMS RECEIVERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

11. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM FOR TYPE 1 DIABETES MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET FOR TYPE 2 DIABETES SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET SHARE BY END-USER, 2021 VS 2028 (%)

14. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM FOR HOSPITALS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM FOR HOME CARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM FOR DIAGONOSTICS CENTER MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL BLOOD GLUCOSE MONITORING SYSTEM MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. US BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

20. UK BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD BLOOD GLUCOSE MONITORING SYSTEM MARKET SIZE, 2021-2028 ($ MILLION)