Blue Ammonia Market

Blue Ammonia Market Size, Share & Trends Analysis Report Market by Technology (Steam Methane Reforming, Autothermal Reforming, and Gas Partial Oxidation), by Application (Heavy Road Transport, Power Industrial Heating, and Industrial Feedstock), and by End-User Industry (Agriculture, Textiles, Mining, Pharmaceutical, Refrigeration, and Other End-User Industries) Forecast Period (2023-2030)

Blue ammonia market is anticipated to grow at a considerable CAGR of 5.5% during the forecast period. Blue ammonia is a type of ammonia that is produced using natural gas as a feedstock with the carbon dioxide by-product from hydrogen production captured and stored. This makes blue ammonia a lower-carbon alternative to traditional ammonia production, which releases large amounts of greenhouse gases into the atmosphere. Growing focus on reducing greenhouse gas emissions and increasing efforts toward empowering the hydrogen economy will drive the demand for the Blue Ammonia Market. The primary driving force behind this growth is the potential of blue ammonia to serve as a fuel for both transportation and power generation. In June 2023, Yara International ASA and BASF collaborated to develop and build a world-scale low-carbon blue ammonia production facility with carbon capture in the Gulf Coast region of the United States. To meet the expanding worldwide demand for low-carbon ammonia, the companies are investigating the possibility of a facility with a total capacity of 1.2 to 1.4 million tons annually.

Segmental Outlook

The global blue ammonia market is segmented by technology, application, and end-user industry. By technology, the market is segmented into steam methane reforming, autothermal reforming, and gas partial oxidation. By application, the market is sub-segmented into heavy road transport, power industrial heating, and industrial feedstock. By the end-user industry, the market is further segmented into agriculture, textiles, mining, pharmaceutical, refrigeration, and other end-user industries. Among these, the industrial feedstock segment is expected to hold the significant share during the forecast period, in the industrial feedstock segment the fertilizer industry is expected to remain the largest consumer of blue ammonia. Ammonia is used to produce fertilizers, which are essential for crop production.

Steam Methane Reforming Sub-Segment is Expected to Dominate the Market

Among the technology, steam methane reforming is expected to hold a prominent share of the global blue ammonia market. This is primary owing to its cost-effectiveness and energy-efficient method of manufacturing pure hydrogen, steam methane reforming leads the blue ammonia market, with the largest market share and the highest growth rate. Because of the established infrastructure and lower investment costs than other technologies, such as solid oxide electrolysis and alkaline electrolysis, drive this trend. Steam methane reforming (SMR) accounts for around 60% of the total ammonia production globally.

Regional outlooks

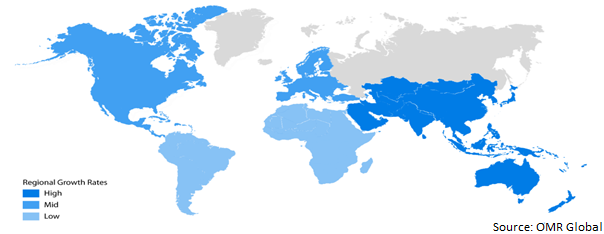

The global blue ammonia market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific market is expected to register fastest revenue growth rate in the global blue ammonia market over the forecast period. Because compared to other countries, Japan has made continuous breakthroughs in ammonia procuring technology through extensive long-term development, resulting in numerous advantages. For instance, in May 2021, to create an end-to-end blue ammonia supply chain that connects Western Canada ammonia to Japan and other Asian markets, North American midstream corporation Pembina signed a deal with one of the biggest trading firms in Japan.

Global Blue Ammonia Market Growth by Region 2023-2030

North America is Expected to be the Largest Region in the Blue Ammonia Market

Blue ammonia is viewed as a viable solution to the climate emergency due to its cleaner production process. It is versatile and finds applications in fuel cells, maritime operations, and fertilizer production. With the increasing demand for blue ammonia, there is a high probability of establishing more projects in North America. For instance, in June 2023, BASF and Yara Clean Ammonia are collaborating on a joint study to develop and construct a world-scale low-carbon blue ammonia production facility with carbon capture in the U.S. Gulf Coast region. Policies are also enforced to propel R&D and encourage the use of clean fuels for energy. Utilities are going through a significant operational shift, including decentralization, digitalization, and decarbonization. On a large scale, renewable energy is used for power generation.

Market Players Outlook

The major companies serving the global blue ammonia market include Air Liquide S.A., Saudi Arabian Oil Co., Yara International ASA, TechnipFMC plc, and CF Industries Holdings, Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in March 2023, Mitsui & Co., Ltd., and CF Industries Holdings, Inc., the largest ammonia producer, announced their collaborative plan to develop a greenfield ammonia production facility in the United States. The newly established facility will produce blue ammonia using carbon capture and sequestration techniques, reducing carbon emissions by over 60% rather than using traditional ammonia production methods.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global blue ammonia market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. CF Industries Holdings, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. CSBP Ltd. (Decipher AgTech)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Ma’aden

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Mitsubishi Heavy Industries, Ltd

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Siemens Energy AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Blue Ammonia Market by Technology

4.1.1. Steam Methane Reforming

4.1.2. Autothermal Reforming

4.1.3. Gas Partial Oxidation

4.2. Global Blue Ammonia Market by Application

4.2.1. Heavy Road Transport

4.2.2. Power Industrial Heating

4.2.3. Industrial Feedstock

4.3. Global Blue Ammonia Market by End-User Industry

4.3.1. Agriculture

4.3.2. Textiles

4.3.3. Mining

4.3.4. Pharmaceutical

4.3.5. Refrigeration

4.3.6. Other End-User Industries (Transportation and Fertilizers)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Air Liquide S.A.

6.2. BASF SE

6.3. Casale SA

6.4. Haldor Topsoe A/S

6.5. IHI Corp.

6.6. Linde plc

6.7. OCI Global OCI Global

6.8. Saudi Arabian Oil Co.

6.9. Saudi Basic Industries Corp.

6.10. TechnipFMC plc

6.11. ThyssenKrupp AG

6.12. Toyo Engineering India Private Ltd.

6.13. Yara International ASA

1. GLOBAL BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

2. GLOBAL STEAM METHANE REFORMING BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL AUTO THERMAL REFORMING BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL GAS PARTIAL OXIDATION BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL BLUE AMMONIA FOR HEAVY ROAD TRANSPORTMARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL BLUE AMMONIA FOR POWER INDUSTRIAL HEATING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL BLUE AMMONIA FOR INDUSTRIAL FEEDSTOCK MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

10. GLOBAL BLUE AMMONIA IN AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL BLUE AMMONIA IN TEXTILES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL BLUE AMMONIA IN MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL BLUE AMMONIA IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL BLUE AMMONIA IN REFRIGERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL OTHER BLUE AMMONIA IN END-USER INDUSTRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. NORTH AMERICAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. NORTH AMERICAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

21. EUROPEAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

22. EUROPEAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

23. EUROPEAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. EUROPEAN BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION

29. REST OF THE WORLD BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. REST OF THE WORLD BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

31. REST OF THE WORLD BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

32. REST OF THE WORLD BLUE AMMONIA MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

1. GLOBAL BLUE AMMONIA MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

2. GLOBAL STEAM METHANE REFORMING BLUE AMMONIA MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AUTOTHERMAL REFORMING BLUE AMMONIA MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL GAS PARTIAL OXIDATION WOUND CARE BLUE AMMONIA MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL OTHER TYPE OF BLUE AMMONIA MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL BLUE AMMONIA MARKET SHARE BY APPLICATION, 2022 VS 2030 ($ MILLION)

7. GLOBAL BLUE AMMONIA FOR HEAVY ROAD TRANSPORT MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL BLUE AMMONIA FOR POWER INDUSTRIAL HEATING MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL BLUE AMMONIA FOR INDUSTRIAL FEEDSTOCK MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL BLUE AMMONIA MARKET SHARE BY END-USER INDUSTRY, 2022 VS 2030 ($ MILLION)

11. GLOBAL BLUE AMMONIA IN AGRICULTURE MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL BLUE AMMONIA IN TEXTILES MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL BLUE AMMONIA IN MINING MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL BLUE AMMONIA IN PHARMACEUTICAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL BLUE AMMONIA IN REFRIGERATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL BLUE AMMONIA IN OTHER END-USER INDUSTRY MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL BLUE AMMONIA MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. US BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

19. CANADA BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

20. UK BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

21. FRANCE BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

22. GERMANY BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

23. ITALY BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

24. SPAIN BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF EUROPE BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

26. INDIA BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

27. CHINA BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

28. JAPAN BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

29. SOUTH KOREA BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF ASIA-PACIFIC BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD BLUE AMMONIA MARKET SIZE, 2022-2030 ($ MILLION)