BOPET Films Market

BOPET Films Market Size, Share & Trends Analysis Report by Thickness (Thin and Thick) and by End-use Industry (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, Electrical & Electronics, and Others) Forecast Period (2025-2035)

Industry Overview

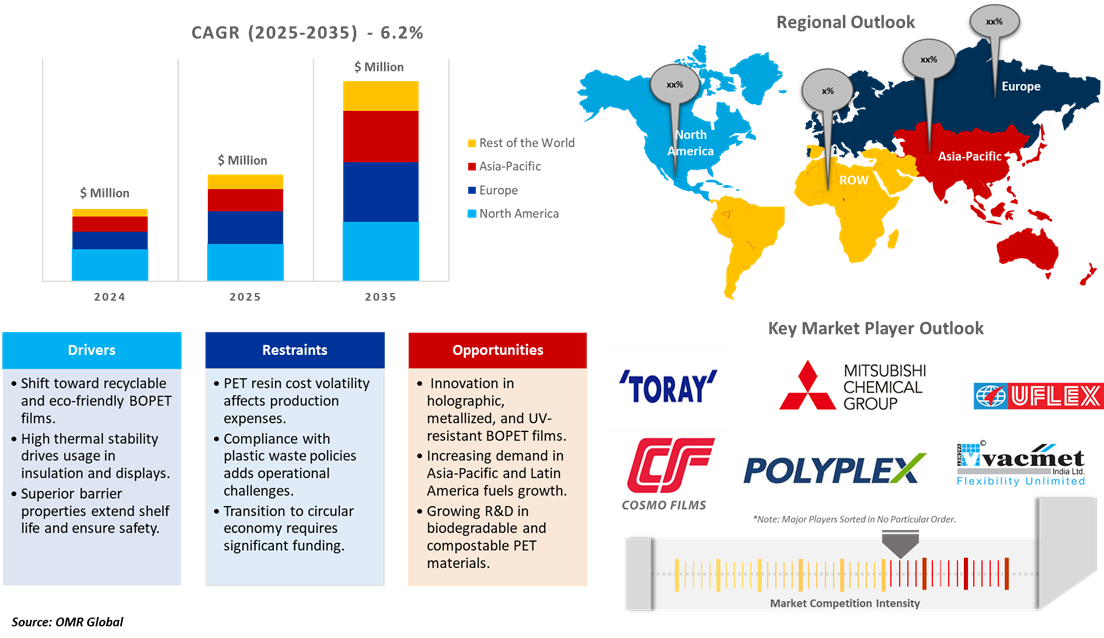

BOPET (Biaxial Oriented Polyethylene Terephthalate) films market size was $10.4 billion in 2024 and is projected to reach $20.2 billion in 2035, growing at a CAGR of 6.2% during the forecast period (2025-2035). The increasing adoption of BOPET films is across various industries owing to their versatile properties, such as high tensile strength, thermal stability, chemical and dimensional stability, transparency, reflectivity, gas and aroma barrier properties, and electrical insulation. Further, plastic BOPET films industry is projected to account for 17% ($11 billion) of the overall film market in 2025. The growing demand for lightweight and sustainable packaging solutions is further projected to support BOPET globally.

Market Dynamics

Growing Demand for Flexible Packaging in the Food & Beverages Industry

The increasing demand for flexible packaging solutions in the food & beverages industry is a major driving factor for the BOPET market. BOPET films are widely used for packaging snacks, ready-to-eat meals, and beverages owing to their barrier properties against moisture, oxygen, and UV light. According to the Flexible Packaging Association, the US flexible packaging industry was estimated to be $42.9 billion in sales for 2022, up from $37.2 billion in 2021. Additionally, as per Invest India, the Indian food processing industry is one of the largest industries in the world, and its production is likely to be $535 billion by 2025-26. Specifically, the Indian food and beverage packaging industry, with a growth rate of 14.8% per annum, is likely to touch $86 billion by 2029. This dynamic industry includes various items such as containers, cups, tableware, straws, bags, wraps, and boxes designed to safeguard or encase food. This demand supports the BOPET film market. Additionally, the shift towards recyclable and biodegradable food packaging solutions is further driving this market. For instance, Uflex Ltd. introduced Asclepius BOPET films with up to 100% recyclability to meet global food safety standards.

Advancements in BOPET Film Manufacturing Technologies

Simultaneously, the innovations and technological advancements in BOPET film offerings, such as the development of ultra-thin films and the integration of nanotechnology, are expected to drive demand for BOPET Film. These advancements majorly support manufacturers to produce films with enhanced properties, such as improved barrier performance, higher transparency, and better printability. Streamlining offerings as per industry needs stimulated market players to constantly invest and introduce products comprising novel technological and manufacturing capabilities that align with the future market landscape.

Market Segmentation

- Based on the thickness, the market is segmented into thin and thick.

- Based on the end-use industry, the market is segmented into food & beverages, pharmaceuticals, personal care & cosmetics, electrical & electronics, and others.

Thin BOPET Films Segment to Dominate the Market

The Thin BOPET Films segment is expected to remain the largest market share, owing to its widespread use in flexible packaging applications. Thin films are preferred for packaging lightweight products such as snacks, confectionery, and beverages due to their cost-effectiveness and excellent barrier properties. Thin BOPET films are mainly used in packaging food & beverages, therefore, this demand will further boost the demand for BOPET films.

Regional Outlook

The global BOPET films market is further divided by geography, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Region to Lead the Global BOPET Films Market

The Asia-Pacific region is anticipated to dominate the global BOPET films market, driven by rapid industrialization, urbanization, and the growing demand for packaged food products. Nations such as China and India are contributing heavily towards growth in the pharmaceuticals and food & beverages sectors, which is boosting demand for BOPET films. As per the packaging in South Asia, application of BOPET films for food packaging is gaining popularity continuously in low per capita consumption countries such as the Indian sub-continent and Southeast Asia, where food packaged in this material is increasingly accessible.

Growing Demand for BOPET Films in the Plastic Industry in the US

The strong growth of the plastics industry is a significant driver of the growing demand for BOPET films, and the expansion of flexible packaging further supports the BOPET market. For instance, in 2023, the industry was a substantial contributor, supporting more than one million jobs and shipping volumes worth $519 billion. Factoring in the suppliers to the industry shows an even greater economic footprint. Texan plastics industry employment ranked top in the country, while Indiana employed the highest proportion of plastics industry workers. Real value-added growth in the industry outpaced the overall manufacturing industry.

Market Players Outlook

The major companies operating in the global BOPET films market include Toray Industries, Inc., Mitsubishi Polyester Film GmbH, Flex Films (UFlex Ltd.), Cosmo Films, Polyplex, and Vacmet India Ltd., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In March 2025, Polyplex Corporation Ltd. began trial runs for a new 50,000 MT/year BOPET thin film line at its US subsidiary, raising total US capacity to 81,000 MT/year. It also completed debottlenecking at its PET resin plant, increasing capacity from 58,000 to 86,000 MT/year. The $124 million investment, funded through internal accruals and borrowings, reinforces Polyplex’s position as a leading, cost-competitive BOPET producer in the US, with commercial production set to start soon.

- In December 2024, Bostik, the adhesive solutions segment of Arkema, and Brückner Maschinenbau partnered to develop a coextruded, peelable, BOPET lidding film that addresses the demands of film producers for streamlined production efficiencies, improved consumer ease of use, and reduced end-of-life impact through the use of optimized equipment.

- In August 2023, Origin Materials, Inc. and Terphane, part of Tredegar Corp., announced a strategic partnership to produce sustainable, high-performance bio-polymer films. In this partnership, Terphane signed a multi-year capacity reservation agreement to purchase the advanced bio-polymer PEF for use in film applications, including food and beverage packaging and high-value industrial applications. BOPEF is biaxially oriented PEF, and BOPET is biaxially oriented PET.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global BOPET film market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global BOPET Films Market Sales Analysis – Thickness| End-Use Industry ($ Million)

• BOPET Films Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key BOPET Films Industry Trends

2.2.2. Market Recommendations

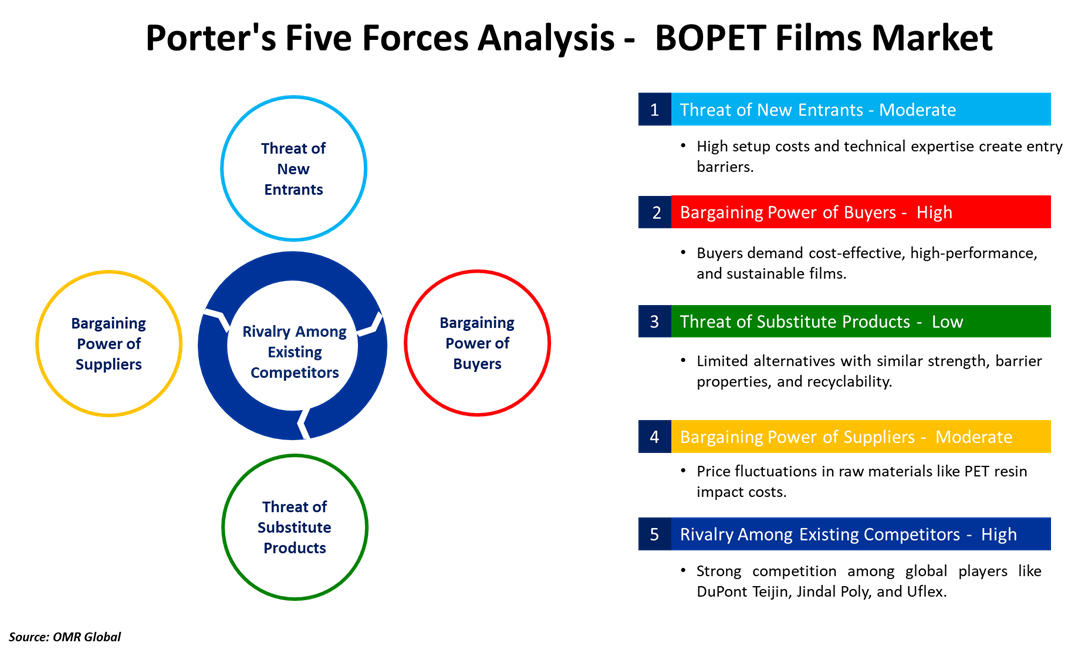

2.3. Porter's Five Forces Analysis for the BOPET Films Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global BOPET Films Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global BOPET Films Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – BOPET Films Market Revenue and Share by Manufacturers

• BOPET Films Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Toray Industries, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Mitsubishi Polyester Film GmbH

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Flex Films (UFlex Ltd.)

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Polyplex

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Vacmet India Ltd.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global BOPET Films Market Sales Analysis By Thickness ($ Million)

5.1. Thin

5.2. Thick

6. Global BOPET Films Market Sales Analysis By End-Use Industry ($ Million)

6.1. Food & Beverages

6.2. Pharmaceuticals

6.3. Personal Care & Cosmetics

6.4. Electrical & Electronics

6.5. Other

7. Regional Analysis

7.1. North American BOPET Films Market Sales Analysis – Thickness| End-Use Industry ($ Million)

• Macroeconomic Factors for North America

7.1.1. United States

7.1.2. Canada

7.2. European BOPET Films Market Sales Analysis – Thickness| End-Use Industry ($ Million)

• Macroeconomic Factors for Europe

7.2.1. UK

7.2.2. Germany

7.2.3. Italy

7.2.4. Spain

7.2.5. France

7.2.6. Russia

7.2.7. Rest of Europe

7.3. Asia-Pacific BOPET Films Market Sales Analysis – Thickness| End-Use Industry ($ Million)

• Macroeconomic Factors for Asia-Pacific

7.3.1. China

7.3.2. Japan

7.3.3. South Korea

7.3.4. India

7.3.5. Australia & New Zealand

7.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

7.3.7. Rest of Asia-Pacific

7.4. Rest of the World BOPET Films Market Sales Analysis –Thickness| End-Use Industry ($ Million)

• Macroeconomic Factors for the Rest of the World

7.4.1. Latin America

7.4.2. Middle East and Africa

8. Company Profiles

8.1. Anhui Guofeng New Materials Co., Ltd.

8.1.1. Quick Facts

8.1.2. Company Overview

8.1.3. Product Portfolio

8.1.4. Business Strategies

8.2. Aegios Polyfilms Private Ltd.

8.2.1. Quick Facts

8.2.2. Company Overview

8.2.3. Product Portfolio

8.2.4. Business Strategies

8.3. Brückner Maschinenbau GmbH

8.3.1. Quick Facts

8.3.2. Company Overview

8.3.3. Product Portfolio

8.3.4. Business Strategies

8.4. Cosmo Films

8.4.1. Quick Facts

8.4.2. Company Overview

8.4.3. Product Portfolio

8.4.4. Business Strategies

8.5. Fatra A.S. (AGROFERT Group.)

8.5.1. Quick Facts

8.5.2. Company Overview

8.5.3. Product Portfolio

8.5.4. Business Strategies

8.6. Flex Films (UFlex Ltd.)

8.6.1. Quick Facts

8.6.2. Company Overview

8.6.3. Product Portfolio

8.6.4. Business Strategies

8.7. Garware Hi-Tech Films Ltd.

8.7.1. Quick Facts

8.7.2. Company Overview

8.7.3. Product Portfolio

8.7.4. Business Strategies

8.8. Ganapathy Industries

8.8.1. Quick Facts

8.8.2. Company Overview

8.8.3. Product Portfolio

8.8.4. Business Strategies

8.9. Jiangsu Shuangxing Color Plastic New Materials Co., Ltd.

8.9.1. Quick Facts

8.9.2. Company Overview

8.9.3. Product Portfolio

8.9.4. Business Strategies

8.10. Marubeni Europe plc

8.10.1. Quick Facts

8.10.2. Company Overview

8.10.3. Product Portfolio

8.10.4. Business Strategies

8.11. Mitsubishi Polyester Film GmbH

8.11.1. Quick Facts

8.11.2. Company Overview

8.11.3. Product Portfolio

8.11.4. Business Strategies

8.12. Polyplex

8.12.1. Quick Facts

8.12.2. Company Overview

8.12.3. Product Portfolio

8.12.4. Business Strategies

8.13. PT Trias Sentosa Tbk

8.13.1. Quick Facts

8.13.2. Company Overview

8.13.3. Product Portfolio

8.13.4. Business Strategies

8.14. Polinas

8.14.1. Quick Facts

8.14.2. Company Overview

8.14.3. Product Portfolio

8.14.4. Business Strategies

8.15. Qingdao Cloud film Packaging materials Co., Ltd.

8.15.1. Quick Facts

8.15.2. Company Overview

8.15.3. Product Portfolio

8.15.4. Business Strategies

8.16. Qingdao Kingchuan Yuanrong International Trading Co., Ltd

8.16.1. Quick Facts

8.16.2. Company Overview

8.16.3. Product Portfolio

8.16.4. Business Strategies

8.17. RETAL INDUSTRIES LTD.

8.17.1. Quick Facts

8.17.2. Company Overview

8.17.3. Product Portfolio

8.17.4. Business Strategies

8.18. Raghav Polymers

8.18.1. Quick Facts

8.18.2. Company Overview

8.18.3. Product Portfolio

8.18.4. Business Strategies

8.19. Sparsh Industries

8.19.1. Quick Facts

8.19.2. Company Overview

8.19.3. Product Portfolio

8.19.4. Business Strategies

8.20. Sumilon Group

8.20.1. Quick Facts

8.20.2. Company Overview

8.20.3. Product Portfolio

8.20.4. Business Strategies

8.21. TERPHANE

8.21.1. Quick Facts

8.21.2. Company Overview

8.21.3. Product Portfolio

8.21.4. Business Strategies

8.22. Toray Films Europe (Toray Industries, Inc.)

8.22.1. Quick Facts

8.22.2. Company Overview

8.22.3. Product Portfolio

8.22.4. Business Strategies

8.23. UNITIKA LTD.

8.23.1. Quick Facts

8.23.2. Company Overview

8.23.3. Product Portfolio

8.23.4. Business Strategies

8.24. Vacmet India Ltd.

8.24.1. Quick Facts

8.24.2. Company Overview

8.24.3. Product Portfolio

8.24.4. Business Strategies

8.25. Venoflex B.V.

8.25.1. Quick Facts

8.25.2. Company Overview

8.25.3. Product Portfolio

8.25.4. Business Strategies

1. Global BOPET Films Market Research And Analysis By Thickness, 2024-2035 ($ Million)

2. Global Thin BOPET Films Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Thick BOPET Films Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global BOPET Films Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

5. Global BOPET Films For Food & Beverages Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global BOPET Films For Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global BOPET Films For Personal Care & Cosmetics Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global BOPET Films For Electrical & Electronics Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global BOPET Films For Other Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global BOPET Films Market Research And Analysis By Region, 2024-2035 ($ Million)

11. North American BOPET Films Market Research And Analysis By Country, 2024-2035 ($ Million)

12. North American BOPET Films Market Research And Analysis By Thickness, 2024-2035 ($ Million)

13. North American BOPET Films Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

14. European BOPET Films Market Research And Analysis By Country, 2024-2035 ($ Million)

15. European BOPET Films Market Research And Analysis By Thickness, 2024-2035 ($ Million)

16. European BOPET Films Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

17. Asia-Pacific BOPET Films Market Research And Analysis By Country, 2024-2035 ($ Million)

18. Asia-Pacific BOPET Films Market Research And Analysis By Thickness, 2024-2035 ($ Million)

19. Asia-Pacific BOPET Films Market Research And Analysis By End-Use Industry 2024-2035 ($ Million)

20. Rest Of The World BOPET Films Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Rest Of The World BOPET Films Market Research And Analysis By Thickness, 2024-2035 ($ Million)

22. Rest Of The World BOPET Films Market Research And Analysis By End-Use Industry, 2024-2035 ($ Million)

1. Global BOPET Films Market Share By Thickness, 2024 Vs 2035 (%)

2. Global Thin BOPET Films Market Share By Region, 2024 Vs 2035 (%)

3. Global Thick BOPET Films Market Share By Region, 2024 Vs 2035 (%)

4. Global BOPET Films Market Share By End-Use Industry, 2024 Vs 2035 (%)

5. Global BOPET Films For Food & Beverages Market Share By Region, 2024-2035 ($ Million)

6. Global BOPET Films For Pharmaceuticals Market Share By Region, 2024-2035 $ Million)

7. Global BOPET Films For Personal Care & Cosmetics Market Share By Region, 2024-2035 ($ Million)

8. Global BOPET Films For Electrical & Electronics Market Share By Region, 2024-2035 ($ Million)

9. Global BOPET Films For Other Market Share By Region, 2024-2035 ($ Million)

10. Global BOPET Films Market Share By Region, 2024 Vs 2035 (%)

11. US BOPET Films Market Size, 2024-2035 ($ Million)

12. Canada BOPET Films Market Size, 2024-2035 ($ Million)

13. UK BOPET Films Market Size, 2024-2035 ($ Million)

14. France BOPET Films Market Size, 2024-2035 ($ Million)

15. Germany BOPET Films Market Size, 2024-2035 ($ Million)

16. Italy BOPET Films Market Size, 2024-2035 ($ Million)

17. Spain BOPET Films Market Size, 2024-2035 ($ Million)

18. Rest Of Europe BOPET Films Market Size, 2024-2035 ($ Million)

19. India BOPET Films Market Size, 2024-2035 ($ Million)

20. China BOPET Films Market Size, 2024-2035 ($ Million)

21. Japan BOPET Films Market Size, 2024-2035 ($ Million)

22. South Korea BOPET Films Market Size, 2024-2035 ($ Million)

23. Australia & New Zealand BOPET Films Market Size, 2024-2035 ($ Million)

24. ASEAN Countries BOPET Films Market Size, 2024-2035 ($ Million)

25. South Korea BOPET Films Market Size, 2024-2035 ($ Million)

26. Rest Of Asia-Pacific BOPET Films Market Size, 2024-2035 ($ Million)

27. Latin America BOPET Films Market Size, 2024-2035 ($ Million)

28. Middle East And Africa BOPET Films Market Size, 2024-2035 ($ Million)

FAQS

The size of the BOPET Films Market in 2024 is estimated to be around $10.4 billion.

Asia-Pacific holds the largest share in the BOPET Films Market.

Leading players in the BOPET Films Market include Toray Industries, Inc., Mitsubishi Polyester Film GmbH, Flex Films (UFlex Ltd.), Cosmo Films, Polyplex, and Vacmet India Ltd., among others.

BOPET Films Market is expected to grow at a CAGR of 6.2% from 2025 to 2035.

The BOPET Films Market is growing due to rising demand for durable, recyclable packaging in food, electronics, and e-commerce industries.