Broadcast Equipment Market

Broadcast Equipment Market Size, Share & Trends Analysis Report by Product (Dish Antennas, Switches, Video Servers, Encoders, Transmitters & Repeaters, and Others), By Technology (Digital Broadcasting and Analog Broadcasting), By Application (Radio and Television) Forecast Period (2025-2035)

Industry Overview

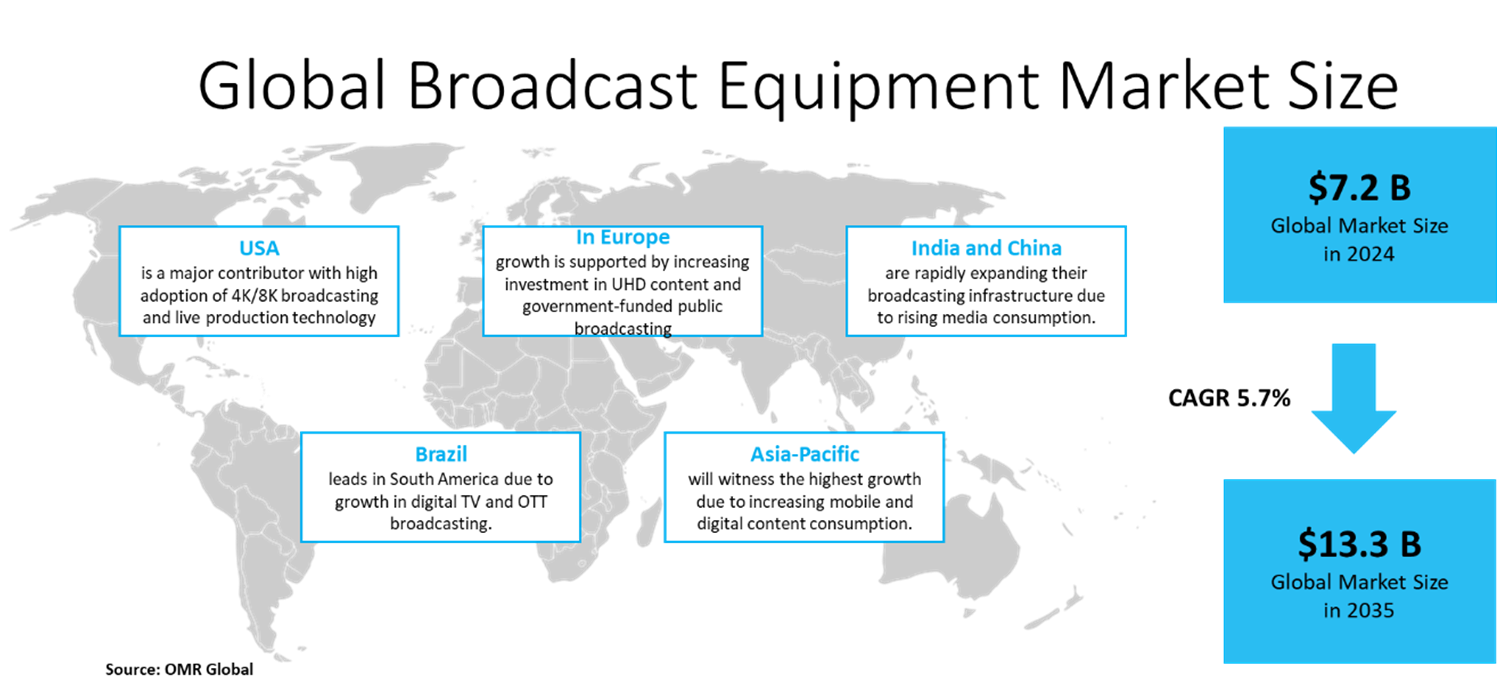

Broadcast equipment market was valued at $7.2 billion in 2024 and is projected to reach $13.3 billion by 2035, growing at a CAGR of 5.7% from 2025 to 2035. The key factors that drive the growth of the market include the rising number of devices integrated with digital media as well as increased internet penetration. This has leveraged the customers with an option to access media content individually in terms of entertainment, social activity, and information at anytime and anywhere. Further, an increase in the demand for ultra-HD content production and its effective transmission drives the growth of the market. The radical shift towards software-oriented systems from hardware and open architecture-based systems also supports market growth.

Moreover, rising demand for direct-to-consumer (D2C) offerings via multi-channel networks and over-the-top (OTT) services in both developing and developed economies is likely to drive growth in the global broadcast equipment market during the forecast period. Additionally, online media content consumption has surged significantly over the past decade. According to a 2023 report by Sandvine, video continues to dominate internet traffic, accounting for over 65% of total global internet traffic, with platforms like YouTube, Netflix, TikTok, and other streaming services leading the charge.

Market Dynamics

Growing Investments in Content Production is Driving the Market

In today's media landscape, people want to watch top-notch content whenever they want and in the best quality. This has put pressure on broadcasters to come up with exciting shows, movies, documentaries, live events, and more. To make this kind of captivating content, broadcasters and creators need really good broadcasting equipment. This includes things like cameras, video production gear, audio recording tools, editing software, and more. With these tools, professionals can create content that looks and sounds amazing, making it stand out in the crowded media world. Hence, when broadcasters invest in making great content, they also need to invest in top-notch equipment to do it right. This equipment helps them produce high-quality and interesting content that grabs the audience's attention. Since content is at the core of the broadcasting industry, these investments will keep driving the demand for broadcasting equipment.

Government Regulations and Public Broadcasting Investment

Government policy and investment in public broadcasting infrastructure directly influence market demand for broadcast equipment. Many countries support the modernization of public broadcasters through funding and policy incentives. The Ministry of Information and Broadcasting (India) allocated over ?2,600 crore (approx. $320 million) in 2023–24 towards broadcasting services, including upgrades to Doordarshan and All India Radio with digital and HD equipment. For instance, Doordarshan's transition to HD terrestrial transmission in key cities led to large-scale procurement of new broadcasting gear, boosting local and international broadcast equipment suppliers in the region.

Market Segmentation

- Based on the product, the market is segmented into dish antennas, switches, video servers, encoders, transmitters & repeaters, and others.

- Based on technology, the market is segmented into digital broadcasting and analog broadcasting.

- Based on the application, the market is segmented into radio and television.

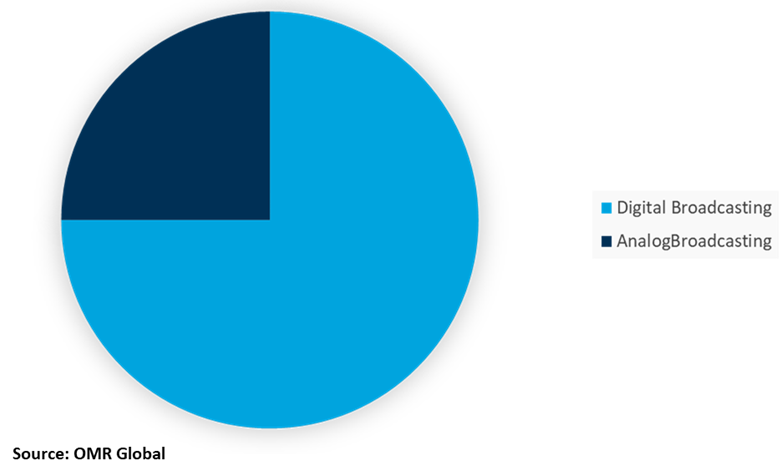

Digital Broadcasting Segment to Register Significant Market Growth

Amongst the technology, digital broadcasting is likely to register significant growth in the global broadcasting equipment market. The segmental growth of the market is attributed to the continuous evolution of digital broadcast technology. This has also led to several benefits such as a rise in the capacity of the transmitted bandwidth, enhanced picture quality, and upgraded coverage across the globe. It has also added various features such as it allows the viewers to check out player statistics and get various information such as news and weather forecasts while watching a different program. Thus, these benefits overall contribute to the segmental growth of the market.

Global Broadcast Equipment Market Share by Technology, 2024 (%)

Television Segment is Projected to Have Largest Market Share

Television has an extensive and enduring consumer base worldwide. It remains a primary source of news, entertainment, and information for billions of households. This consistent viewership drives the demand for broadcast equipment dedicated to television broadcasting. Television content is delivered through various platforms, including terrestrial, cable, satellite, and digital streaming. Each platform requires specialized equipment to ensure seamless transmission. Moreover, Governments in many countries invest in broadcasting infrastructure and technology. These factors are contributing to the higher demand for broadcasting equipment for television applications.

Regional Outlook

The global broadcast equipment market is segmented geographically into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific region is estimated to grow significantly during the forecast period. The growth of the region is backed by several factors including an increase in the cable & satellite television channels along with an upsurge in the internet penetration that created a scope to provide high-quality content to the viewers.

Asia-Pacific is Projected to Grow Fastest

Many countries in the Asia-Pacific region are experiencing robust economic growth, resulting in increased consumer spending and a growing middle class. This economic prosperity is driving demand for high-quality content and entertainment, leading to investments in broadcast equipment. Also, the media and entertainment industry in Asia-Pacific is expanding rapidly. The region is home to a large and diverse audience, leading to investments in content production and broadcasting infrastructure to cater to these markets thereby driving the market growth. Additionally, the media and entertainment industry in Asia-Pacific is expanding rapidly and will account for over 30% of global entertainment and media revenue by 2027, with significant contributions from digital video, OTT, and gaming sectors.

Market Players Outlook

Some of the prominent players operating in the global broadcast equipment market include Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Harmonic Inc., Alcatel-Lucent SA, CommScope, Inc., Sony Corp., Panasonic Corp., and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global broadcast equipment market.

Recent Developments

- In April 2025, EVS Broadcast Equipment secured a landmark deal with Al Jazeera Media Network to implement its MediaCeption content management solution across five key locations: Doha, London, Washington D.C., New York, and Sarajevo.

- In April 2025, at the NAB Show in Las Vegas, companies showcased the latest in NextGen TV (ATSC 3.0). Now reaching 76% of US households across 78 markets, it offers better picture and sound with HDR video and Dolby Atmos audio for a more immersive viewing experience.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global broadcast equipment market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Broadcast Equipment Market Sales Analysis – Product | Technology | Application ($ Million)

• Broadcast Equipment Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Broadcast Equipment Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Broadcast Equipment Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Broadcast Equipment Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Broadcast Equipment Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Broadcast Equipment Market Revenue and Share by Manufacturers

• Broadcast Equipment Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Cisco Systems Inc.

4.2.1.1. Product Portfolio

4.2.1.2. Financial Analysis (Subject to Data Availability)

4.2.1.3. SWOT Analysis

4.2.1.4. Business Strategy

4.2.2. Telefonaktiebolaget LM Ericsson

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Harmonic Inc

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Alcatel-Lucent SA

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. CommScope, Inc.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Sony Corp.

4.2.6.1. Overview

4.2.6.2. Product Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.2.7. Panasonic Corp.

4.2.7.1. Overview

4.2.7.2. Product Portfolio

4.2.7.3. Financial Analysis (Subject to Data Availability)

4.2.7.4. SWOT Analysis

4.2.7.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Broadcast Equipment Market Sales Analysis by Product ($ Million)

5.1. Dish Antennas

5.2. Switches

5.3. Video Servers

5.4. Encoders

5.5. Transmitters &Repeaters

5.6. Others

6. Global Broadcast Equipment Market Sales Analysis by Technology ($ Million)

6.1. Digital Broadcasting

6.2. Analog Broadcasting

7. Global Broadcast Equipment Market Sales Analysis by Application ($ Million)

7.1. Radio

7.2. Television

8. Regional Analysis

8.1. North American Broadcast Equipment Market Sales Analysis – Product | Technology | Application | Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Broadcast Equipment Market Sales Analysis – Product | Technology | Application |Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Broadcast Equipment Market Sales Analysis – Product | Technology | Application |Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Broadcast Equipment Market Sales Analysis – Product | Technology | Application |Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Alcatel-Lucent SA

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. AVL Technologies

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Blackmagic Design Pty Ltd

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Broadcast Electronics

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Cisco Systems Inc.

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Clyde Broadcast

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. CommScope, Inc.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Datum Systems

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Eletec Broadcast Telecom

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. ETL Systems Ltd

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Evertz Microsystems

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Evs Broadcast Equipment Sa

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Global Invacom

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. Harmonic Inc

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. NEC Corporation

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. OMB Broadcast

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Panasonic Corp.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Rhode & Schwarz.

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. Sencore

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Sony Corp.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Telefonaktiebolaget LM Ericsson

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

1. Global Broadcast Equipment Market Research And Analysis By Product, 2024-2035 ($ Million)

2. Global Broadcasting Dish Antennas Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Broadcasting Switches Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Broadcasting Video Servers Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Broadcasting Encoders Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Broadcasting Transmitters &Repeaters Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Other Broadcast Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Broadcast Equipment Market Research And Analysis By Technology, 2024-2035 ($ Million)

9. Global Digital Broadcasting Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Analog Broadcasting Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Broadcast Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

12. Global Radio Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global Television Market Research And Analysis By Region, 2024-2035 ($ Million

14. Global Broadcast Equipment Market Research And Analysis By Geography, 2024-2035 ($ Million)

15. North American Broadcast Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

16. North American Broadcast Equipment Market Research And Analysis By Product, 2024-2035 ($ Million)

17. North American Broadcast Equipment Market Research And Analysis By Technology, 2024-2035 ($ Million)

18. North American Broadcast Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

19. European Broadcast Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

20. European Broadcast Equipment Market Research And Analysis By Product, 2024-2035 ($ Million)

21. European Broadcast Equipment Market Research And Analysis By Technology, 2024-2035 ($ Million)

22. European Broadcast Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

23. Asia-Pacific Broadcast Equipment Market Research And Analysis By Country, 2024-2035 ($ Million)

24. Asia-Pacific Broadcast Equipment Market Research And Analysis By Product, 2024-2035 ($ Million)

25. Asia-Pacific Broadcast Equipment Market Research And Analysis By Technology, 2024-2035 ($ Million)

26. Asia-Pacific Broadcast Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

27. Rest Of The World Broadcast Equipment Market Research And Analysis By Region, 2024-2035 ($ Million)

28. Rest Of The World Broadcast Equipment Market Research And Analysis By Product, 2024-2035 ($ Million)

29. Rest Of The World Broadcast Equipment Market Research And Analysis By Technology, 2024-2035 ($ Million)

30. Rest Of The World Broadcast Equipment Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Broadcast Equipment Market Research And Analysis By Product, 2024 Vs 2035 (%)

2. Global Broadcasting Dish Antennas Market Research And Analysis By Region, 2024 Vs 2035 (%)

3. Global Broadcasting Switches Market Research And Analysis By Region, 2024 Vs 2035 (%)

4. Global Broadcasting Video Servers Market Research And Analysis By Region, 2024 Vs 2035 (%)

5. Global Broadcasting Encoders Market Research And Analysis By Region, 2024 Vs 2035 (%)

6. Global Broadcasting Transmitters &Repeaters Market Research And Analysis By Region, 2024 Vs 2035 (%)

7. Global Other Broadcast Equipment Market Research And Analysis By Region, 2024 Vs 2035 (%)

8. Global Broadcast Equipment Market Research And Analysis By Technology, 2024 Vs 2035 (%)

9. Global Digital Broadcasting Market Research And Analysis By Region, 2024 Vs 2035 (%)

10. Global Analog Broadcasting Market Research And Analysis By Region, 2024 Vs 2035 (%)

11. Global Broadcast Equipment Market Research And Analysis By Application, 2024 Vs 2035 (%)

12. Global Radio Market Research And Analysis By Region, 2024 Vs 2035 (%)

13. Global Television Market Research And Analysis By Region, 2024 Vs 2035 (%)

14. Global Broadcast Equipment Market Share By Region, 2024 Vs 2035 (%)

15. US Broadcast Equipment Market Size, 2024-2035 ($ Million)

16. Canada Broadcast Equipment Market Size, 2024-2035 ($ Million)

17. UK Broadcast Equipment Market Size, 2024-2035 ($ Million)

18. France Broadcast Equipment Market Size, 2024-2035 ($ Million)

19. Germany Broadcast Equipment Market Size, 2024-2035 ($ Million)

20. Italy Broadcast Equipment Market Size, 2024-2035 ($ Million)

21. Spain Broadcast Equipment Market Size, 2024-2035 ($ Million)

22. Russia Broadcast Equipment Market Size, 2024-2035 ($ Million)

23. Rest Of Europe Broadcast Equipment Market Size, 2024-2035 ($ Million)

24. India Broadcast Equipment Market Size, 2024-2035 ($ Million)

25. China Broadcast Equipment Market Size, 2024-2035 ($ Million)

26. Japan Broadcast Equipment Market Size, 2024-2035 ($ Million)

27. South Korea Broadcast Equipment Market Size, 2024-2035 ($ Million)

28. ASEAN Broadcast Equipment Market Size, 2024-2035 ($ Million)

29. Australia and New Zealand Broadcast Equipment Market Size, 2024-2035 ($ Million)

30. Rest Of Asia-Pacific Broadcast Equipment Market Size, 2024-2035 ($ Million)

31. Latin America Broadcast Equipment Market Size, 2024-2035 ($ Million)

32. Middle East And Africa Broadcast Equipment Market Size, 2024-2035 ($ Million)

FAQS

The size of the Broadcast Equipment market in 2024 is estimated to be around $7.2 billion.

North America holds the largest share in the Broadcast Equipment market.

Leading players in the Broadcast Equipment market include Cisco Systems Inc., Telefonaktiebolaget LM Ericsson, Harmonic Inc., Alcatel-Lucent SA, CommScope, Inc., Sony Corp., Panasonic Corp., and others.

Broadcast Equipment market is expected to grow at a CAGR of 5.7% from 2025 to 2035.

The Broadcast Equipment Market is growing due to rising demand for UHD content, IP-based streaming, cloud broadcasting, and live event production technologies.