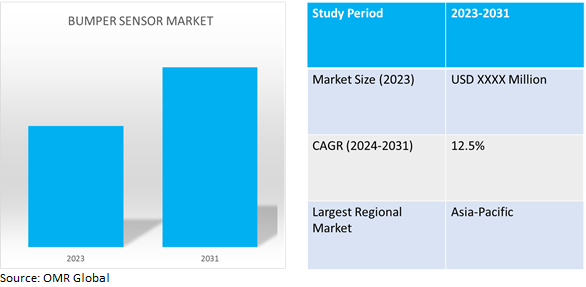

Bumper Sensor Market

Bumper Sensor Market Size, Share & Trends Analysis Report by Vehicle Type (Commercial Vehicles, and Passenger Cars), by Technology (Electromagnetic Sensors, and Ultrasonic Sensors), and by Application (Blind Spot Detection, Cross-traffic Alert, Parking Assistance, and Others (Collision Avoidance, Pedestrian Detection)) Forecast Period (2024-2031)

Bumper sensor market is anticipated to grow at a CAGR of 12.5% during the forecast period (2024-2031). A bumper sensor is a proximity sensor typically mounted on the bumpers of a vehicle to detect objects close to the vehicle, typically at the front and rear. They are most commonly used in cars, but can also be found on trucks, buses, and other motorized vehicles.

Market Dynamics

Reduction in accidents

Bumper sensors play a crucial role in preventing collisions, especially at low speeds during parking maneuvers or reversing out of driveways by detecting obstacles and providing warnings or triggering automatic braking systems, they significantly reduce the risk of accidents. With fewer accidents, there are fewer insurance claims filed, reducing overall costs for both drivers and insurance companies. Vehicle ratings are determined by independent safety groups and regulatory agencies using a variety of factors, such as collision avoidance features. Higher safety ratings are attained with the use of bumper sensors, and this can be a major selling factor for manufacturers.

Expanding automotive sector boosting demand for bumper sensors

Globally, the automotive industry is expanding with more cars being manufactured and sold, there's a natural rise in demand for all the components that make up a vehicle, including bumper sensors. High-end car models often come equipped with advanced bumper sensors that offer greater functionality, such as multifunctionality and improved accuracy. Additionally, the expanding automotive sector also encompasses electric vehicles, autonomous vehicles, and other emerging segments. These new segments might have specific requirements for bumper sensors, further diversifying the market and creating new opportunities for manufacturers.

Market Segmentation

Our in-depth analysis of the global bumper sensor market includes the following segments by vehicle type, technology, and application:

- Based on vehicle type, the market is sub-segmented into commercial vehicles and passenger cars.

- Based on technology, the market is bifurcated into electromagnetic sensors and ultrasonic sensors.

- Based on application, the market is augmented into blind spot detection, cross-traffic alert, parking assistance, and others.

Ultrasonic Sensors is Projected to Emerge as the Largest Segment

The ultrasonic sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes effectiveness in obstacle avoidance and proximity detection by ultrasonic sensors. Ultrasonic sensors, utilizing ultrasonic vibrations, are increasingly used in bumper applications for parking assistance and ADAS, due to their affordability, dependability, and adaptability.

Cross-traffic Alert Sub-segment to Hold a Considerable Market Share

Cross-traffic alert systems use radar or ultrasonic sensors mounted on the rear bumper to detect approaching vehicles from the side when backing out of a parking spot or driveway which significantly reduces the risk of collisions at blind spots, a common scenario in parking maneuvers. With rising traffic congestion and the increasing number of vehicles on the road, the demand for features that prevent such accidents is growing steadily. It often works in conjunction with other ADAS features like blind-spot monitoring. This creates a comprehensive safety net for drivers by providing them with a 360-degree awareness of their surroundings. As there is a growing emphasis on improving the overall safety features in cars, it is anticipated that the use of cross-traffic alerts will rise, driving the expansion of the bumper sensor sector.

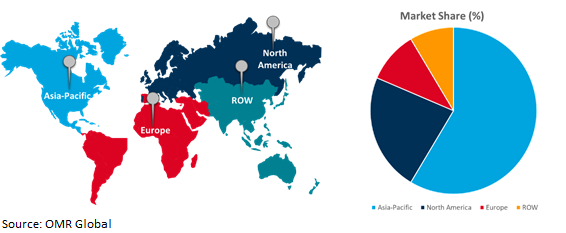

Regional Outlook

The global bumper sensor market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in ADAS

- Increasing stringent safety regulations for vehicles in the US incorporating requirements for certain Advanced Driver-Assistance Systems (ADAS) features that rely on bumper sensors push create a steady demand for bumper sensors in the region.

- Canada’s strong emphasis on technological innovation in the automotive industry fosters an environment for continuous improvement in bumper sensor technology, leading to the development of more advanced and reliable solutions.

Global Bumper Sensor Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rising auto production, rising consumer awareness of vehicle safety, and stringent legislation mandating the installation of cutting-edge driver assistance systems. Growing urbanization and traffic congestion in major economies are driving the need for accident avoidance systems. Technological developments, investments in intelligent transportation infrastructure, and the expanding automotive industry in nations like China and India are driving growth in the Asia-Pacific market. The Asia-Pacific region is known for its manufacturing prowess and cost-effective production capabilities which allows manufacturers to produce bumper sensors at competitive prices, making them more accessible to a wider range of car makers in the region.

Additionally, as disposable incomes rise in the Asia-Pacific region, consumers are becoming more aware of and interested in safety features for their vehicles. Bumper sensors are a key component of safety systems, and this growing consumer demand further fuels the market growth.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global bumper sensor market include STMicroelectronics, Continental AG, Robert Bosch GmbH, Denso Corporation, and Texas Instruments, Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, NXP introduced the Advanced Automotive Radar One-Chip Family. This product is specifically designed for the next generation of ADAS and Autonomous Driving Systems (ADS).

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global bumper sensor market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Continental AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Robert Bosch GmbH.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. STMicroelectronics N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Bumper Sensor Market by Vehicle Type

4.1.1. Passenger Cars

4.1.2. Commercial Vehicles

4.2. Global Bumper Sensor Market by Technology

4.2.1. Electromagnetic Sensors

4.2.2. Ultrasonic Sensors

4.3. Global Bumper Sensor Market by Application

4.3.1. Blind Spot Detection

4.3.2. Cross-Traffic Alert

4.3.3. Parking Assistance

4.3.4. Others (Collision Avoidance, Pedestrian Detection)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Cleverciti Systems GmbH

6.2. Denso Corporation

6.3. Ford Motor Company

6.4. HELLA GmbH & Co. KGaA

6.5. Manorshi Electronics Co., Ltd.

6.6. Murata Manufacturing Co., Ltd.

6.7. Nedap FZE

6.8. Steelmate Automotive Ltd

6.9. Texas Instruments, Inc.

6.10. Triscan A/S

6.11. Valeo SA

6.12. Xvision, Ltd.

1. GLOBAL BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BUMPER SENSOR FOR COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL BUMPER SENSOR FOR PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

5. GLOBAL BUMPER ELECTROMAGNETIC SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BUMPER ULTRASONIC SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL BUMPER SENSOR FOR BLIND SPOT DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL BUMPER SENSOR FOR CROSS-TRAFFIC ALERT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL BUMPER SENSOR FOR PARKING ASSISTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BUMPER SENSOR FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. EUROPEAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

20. EUROPEAN BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

28. REST OF THE WORLD BUMPER SENSOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL BUMPER SENSOR MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

2. GLOBAL BUMPER SENSOR FOR COMMERCIAL VEHICLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL BUMPER SENSOR FOR PASSENGER CARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BUMPER SENSOR MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

5. GLOBAL BUMPER ELECTROMAGNETIC SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BUMPER ULTRASONIC SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL BUMPER SENSOR MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL BUMPER SENSOR FOR BLIND SPOT DETECTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL BUMPER SENSOR FOR CROSS-TRAFFIC ALERT MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL BUMPER SENSOR FOR PARKING ASSISTANCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BUMPER SENSOR FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL BUMPER SENSOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

15. UK BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA BUMPER SENSOR MARKET SIZE, 2023-2031 ($ MILLION)