Buy Now Pay Later (BNPL) Market

Buy Now Pay Later (BNPL) Market Size, Share & Trends Analysis Report by Channel (Online and Point of Sale (POS)), by Application (Retail Goods, Media & Entertainment, Healthcare & Wellness, Automotive, Home Improvement, and Others), and by Enterprise Size (Large Enterprises, and Small-Medium Enterprises) Forecast Period (2022-2028)

Buy now pay later (BNPL) market is anticipated to grow at a significant CAGR of 32.7% during the forecast period. It is a type of short-term financing that allows consumers to make purchases and pay for them at a future date without paying the complete amount at the time of purchasing, which is often interest-free. The increasing adoption of BNPL service by retailers is increasing the market as it provides affordable and convenient payment service which influences the people to purchase more and hence increases sales. The customers are slowly moving away from traditional credit cards due to high-interest rates, declining credit limits, and others, due to which people are using BNPL services more. Retailers want to get paid right away, even if their customers want to spread the cost. A BNPL supplier such as Klarna, Affirm, or Sezzle will immediately transfer funds to the retailer upon a customer’s purchase, due to this reason the retailers are accepting the BNPL services, which is further influencing the customers to use more of this service and hence propelling the BNPL market.

According to Klarna Bank AB, BNPL accounted for 3.6% of all online retail sales in the UK in 2020, with over 10 million users 2020. Almost two-thirds (64%) 2 of adults that have previously used a BNPL service to make an online payment said that the flexibility had helped them manage their finances. With the growth of the online payments sector and the shift from credit to debit, new solutions in the form of BNPL products have rapidly risen in popularity, also it is anticipated that over 10 million people (one-fifth of the UK’s adult population) used a BNPL option to purchase goods online in 2020, with the payment method accounting for nearly 4% of all retail sales made online in 2020. Hence these factors are increasing the BNPL market during the forecast period.

Segmental Outlook

The global buy now pay later (BNPL) market is segmented based on channel, application, and enterprise size. Based on channel, the market is segmented into online, and POS. Based on application, the market is sub-segmented into retail goods, media & entertainment, healthcare & wellness, automotive, home improvement, and others. Based on enterprise size, the market is segmented into large enterprises and SMEs. The above-mentioned segments can be customized as per the requirements.

Among the channel, the online sub-segment is anticipated to grow at a considerable rate during the forecast period. Due to the increasing adoption of online payments among the customer the segment is expected to grow across the globe. According to the World Health Organization (WHO), in 2022, the COVID-19 pandemic has spurred financial inclusion, driving a large increase in digital payments amid the global expansion of formal financial services. As per the same source, as of 2021, 76% of adults globally have an account at a bank, other financial institution, or with a mobile money provider, up from 68% in 2017 and 51% in 2011. Further, two-thirds of adults globally now make or receive a digital payment, with the share in developing economies growing from 35% in 2014 to 57% in 2021. Hence, these factors show the increasing trend of the online payment segment, which is also boosting the BNPL market.

Regional Outlooks

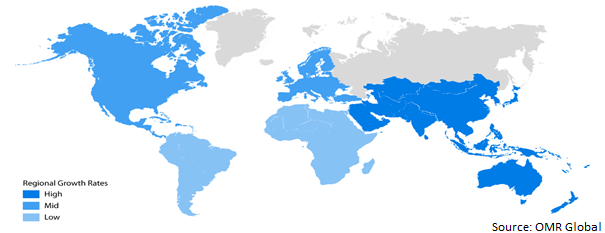

The global buy now pay later (BNPL) market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to grow at the fastest rate during the forecast period. The increasing number of the younger population is bolstering the demand for BNPL services. The younger population purchases costly products for their use such as laptops, smartphones, and other things through various BNPL services using credit cards and others.

Global Buy Now Pay Later (BNPL) Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold the Considerable Share in the Global Buy Now Pay Later (BNPL) Market

The Asia-Pacific region is expected to hold a considerable share in the global buy now pay later market during the forecast period. The increasing number of mobile users and internet users in the Asia-Pacific region is propelling the demand for BNPL services in the regional market. According to the World Bank report, in 2020, around 43% of the total individual Indian population is using the internet which shows the increasing use of the internet, which is further anticipated to grow and have huge potential. As per the same source, approximately 84 people per 100 people have a mobile cellular subscription in India. Hence, such factors are expected to fuel the demand for BNPL service across the region. Further, due to the rising mobile subscription, the companies are providing many online payment services for the customers, such as the BNPL service, which provokes the customers to purchase more and use the BNPL service for purchasing. Smartphones provide convenience to customers to pay for their products and services, and with the use of BNPL services, they try to shop more. These strong factors are fuelling the demand for BNPL service in the market.

Market Players Outlook

The major companies serving the global buy now pay later market include Affirm, Inc., Afterpay US Services, LLC, Klarna Inc., PayPal Payments Private Ltd., Splitit Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in April 2022, Nelo launched an all-in-one application in Mexico City. Nelo’s app is the first of its kind in the region, where customers can shop and pay in installments at their favorite stores like Mercado Libre, Amazon, and Liverpool.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global buy now pay later market (BNPL). Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Affirm, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Afterpay US Services, LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Klarna Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. PayPal Payments Private Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Splitit Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Buy Now Pay Later Market by Channel

4.1.1. Online

4.1.2. Point of Sale (POS)

4.2. Global Buy Now Pay Later Market by Application

4.2.1. Retail Goods

4.2.2. Media & Entertainment

4.2.3. Healthcare & Wellness

4.2.4. Automotive

4.2.5. Home Improvement

4.2.6. Others

4.3. Global Buy Now Pay Later Market by Enterprise Size

4.3.1. Large Enterprises

4.3.2. Small-Medium Enterprises

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Afterpay Ltd.

6.2. Affirm

6.3. Klarna

6.4. LatitudePay Australia Pty Ltd.

6.5. Laybuy Group Holdings Ltd.

6.6. Openpay Group

6.7. Opy USA Inc.

6.8. PayPal Holdings, Inc.

6.9. Perpay, Inc.

6.10. Quadpay, Inc.

6.11. Sezzle

6.12. Splitit

6.13. Social Money Ltd.

1. GLOBAL BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY CHANNEL, 2021-2028 ($ MILLION)

2. GLOBAL BUY NOW PAY LATER BY ONLINE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BUY NOW PAY LATER BY POS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL BUY NOW PAY LATER FOR RETAIL GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL BUY NOW PAY LATER FOR MEDIA & ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL BUY NOW PAY LATER FOR HEALTHCARE & WELLNESS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL BUY NOW PAY LATER FOR AUTOMOTIVEMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL BUY NOW PAY LATER FOR HOME IMPROVEMENTMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL BUY NOW PAY LATER FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

12. GLOBAL BUY NOW PAY LATER IN LARGE ENTERPRISE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL BUY NOW PAY LATER IN SME MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. NORTH AMERICAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY CHANNEL, 2021-2028 ($ MILLION)

17. NORTH AMERICAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

19. EUROPEAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY CHANNEL, 2021-2028 ($ MILLION)

21. EUROPEAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. EUROPEAN BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY CHANNEL, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY CHANNEL, 2021-2028 ($ MILLION)

29. REST OF THE WORLD BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

30. REST OF THE WORLD BUY NOW PAY LATER MARKET RESEARCH AND ANALYSIS BY ENTERPRISE SIZE, 2021-2028 ($ MILLION)

1. GLOBAL BUY NOW PAY LATER MARKET SHARE BY CHANNEL, 2021 VS 2028 (%)

2. GLOBAL BUY NOW PAY LATER BY ONLINE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL BUY NOW PAY LATER BY POS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL BUY NOW PAY LATER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

5. GLOBAL BUY NOW PAY LATER FOR RETAIL GOODS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL BUY NOW PAY LATER FOR MEDIA & ENTERTAINMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL BUY NOW PAY LATER FOR HEALTHCARE & WELLNESS MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL BUY NOW PAY LATER FOR AUTOMOTIVEMARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL BUY NOW PAY LATER FOR HOME IMPROVEMENTMARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL BUY NOW PAY LATER FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL BUY NOW PAY LATER MARKET SHARE BY ENTERPRISE SIZE, 2021 VS 2028 (%)

12. GLOBAL BUY NOW PAY LATER IN LARGE ENTERPRISE MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL BUY NOW PAY LATER IN SME MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL BUY NOW PAY LATER MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. US BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

17. UK BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD BUY NOW PAY LATER MARKET SIZE, 2021-2028 ($ MILLION)