C5ISR Market

C5ISR Market Size, Share & Trends Analysis Report by Solution (Hardware, Software, and Services), by End User (Army, Navy, Air Force, and Government and Law Enforcement), and by Installation (New Installations, and Upgrades) Forecast Period (2025-2035)

Industry Overview

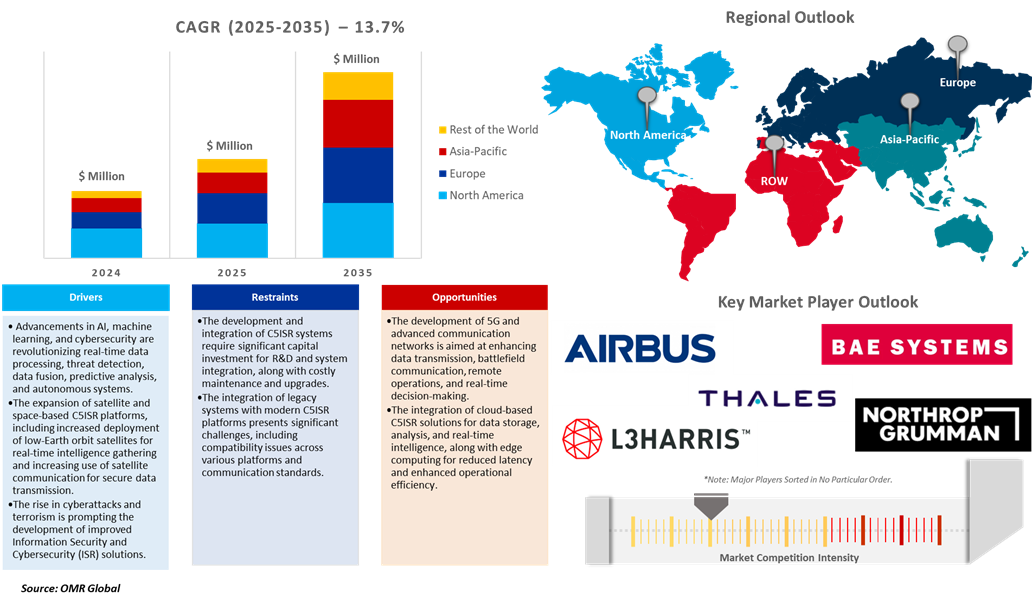

C5ISR market is projected to reach $43,459 million by 2035, from $10,720 million in 2024, at a CAGR of 13.7% during the forecast period (2025-2035). Modernization of the defense infrastructure, including C5ISR systems, is driven by the need for real-time information, integration with artificial intelligence, satellite and communication infrastructure, cybersecurity threats, the rise of unmanned systems, interoperability, and network-centric warfare. Government programs and partnerships are further being initiated to enhance defense technology and infrastructure.

Market Dynamics

Increasing Military Modernization

International defense expenditures are rising, mainly aimed at modernizing hardware and logistics support for enhanced readiness and operational capabilities in the field, which boosts the market growth. For instance, in April 2024, Leidos, awarded a follow-on prime contract to provide technology-enabled services to the US Army. This indefinite delivery/indefinite quantity (IDIQ) task order, known as Responsive Strategic Sourcing for Services (RS3), carries an 11-month base period and potentially a total value of $267 million in the event all four one-year options are exercised. The work involved includes hardware capability evaluations, hardware configuration and upgrades, and warehousing and warranty repair logistics, with the work managed by the Army Contracting Command-Aberdeen Proving Ground.

Technological Advancements

Advancements in sensor technology, artificial intelligence, and data analytics have helped enhance the efficiency and effectiveness of C5ISR systems, boosting market growth. For instance, in February 2024, QinetiQ US awarded a $42 million task order to aid the US Army Combat Capabilities Development Command's C5ISR Center's Research & Technology Integration Directorate. The order of tasks is to build intelligent sensor processing and next-generation imaging capabilities, such as Aided Target Recognition, signal and image processing algorithms, and software applications.

Market Segmentation

- Based on the Solution, the market is segmented into hardware, software (command and control software, communication software, cyber warfare software, electronic warfare software, intelligence, surveillance, and reconnaissance software), and services.

- Based on the end user, the market is segmented into the army, navy, air force, government, and law enforcement.

- Based on the installation, the market is segmented into new installations and upgrades.

Software Segment to Lead the Market with the Largest Share

Software in the C5ISR market enhances situational awareness, decision-making, and coordination among military and defense units by automating and integrating C5ISR systems. The C5ISR market uses real-time data collection, processing, and dissemination software in defense and intelligence operations, enabling secure communication, automated threat detection, encryption, intrusion detection, vulnerability management, and AI-powered signal intelligence. Furthermore, software plays a crucial role in modernizing C5ISR systems, enhancing interoperability, and automating decision-making, providing cybersecurity, improving situational awareness, and predicting equipment failures. It additionally enhances cost efficiency and scalability, allowing for upgrades without extensive hardware changes, reducing human error, and accelerating decision-making.

Army: A Key Segment in Market Growth

The market growth is primarily driven by the need for robust C5ISR solutions to safeguard essential military infrastructures against advanced cyber threats. For instance, in February 2024, CACI International secured a $198 million contract to support the US Army DEVCOM Combat Capabilities Development Command C5ISR Center, aiming to enhance cyber defence capabilities over five years, leveraging artificial intelligence, quantum effects, and robotics.

Regional Outlook

The global C5ISR market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Technological Advancements in Asia-Pacific

The integration of 5G, AI, and electronic warfare technologies is revolutionizing the capabilities of C5ISR systems that can process information quickly, have enhanced situational awareness, and make improved decisions in changing operating environments. The growth in the market is being fueled by improving ISR operations in terms of efficiency and accuracy. For instance, in June 2023, Kratos expanded its Global Space Domain Awareness Network, including new India capabilities. The network monitors space-based radio frequency signals to measure satellites' position, maneuvering, health, and proximity. More than 140 sensors and antennas outfitted the device to accurately track and sense space vehicles in the GEO belt with real-time sensing.

North America Region Dominates the Market with Major Share

North America holds a significant share, owing to the US Department of Defense integrating advanced technologies such as AI and cyber defenses into C5ISR systems to maintain a technological edge and drive market growth. For instance, in December 2024, Viasat received a five-year, sole-source Indefinite Delivery/Indefinite Quantity (IDIQ) contract valued at $568 million by the US General Services Administration (GSA). The contract facilitated the accelerated transition of command, control, communications, computers, combat systems, intelligence, surveillance, and reconnaissance (C5ISR) capabilities from Special Operations Forces (SOF) to General Purpose Forces (GPF). Viasat continued to provide a wide range of technologies and services to enhance communications, security, intelligence, and operations for SOF and GPF warfighters.

Market Players Outlook

The major companies operating in the global C5ISR market include Airbus, BAE Systems, plc, L3Harris Technologies, Inc., Northrop Grumman, and Thales S.A., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In October 2024, the DEVCOM C5ISR Center issued a Request for Information (RFI) to identify capable navigation warfare (NAVWAR) techniques, technologies, and enablers for future research and development. The center aims to provide the maneuver force with the ability to effectively sense the environment and complete objectives. The center is interested in systems using radio frequency techniques for detecting, protecting, locating, characterizing, and identifying waveforms, in addition to those designed for other spaces.

- In December 2024, AGIS' C5ISR Software is vital for US military operations, enabling real-time identification of enemy satellites and drones. It tracks satellite location and ownership, alerting soldiers of potential surveillance. This software is vital for future military readiness, as space-based assets demand accurate detection and visualization.

- In May 2022, Sigma Defense acquired Sub U Systems, enhancing its C5ISR and JADC2 capabilities. The acquisition strengthens Sigma Defense's portfolio, offering a more robust range of solutions for specific use cases, including ISR relay, edge computing, AI/ML, and edge analytics.

- In June 2021, Clarifai signed a Cooperative Research and Development Agreement with the US Army to improve data understanding and algorithm development by labeling large-scale EO/IR data using its Scribe Labeler product, specifically for combat-ready night vision and electronic sensor applications.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global C5ISR market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global C5ISR Market Sales Analysis – Solution| End User| Installation| ($ Million)

• C5ISR Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key C5ISR Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the C5ISR Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global C5ISR Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global C5ISR Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – C5ISR Market Revenue and Share by Manufacturers

• C5ISR Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Airbus

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. BAE Systems, plc

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. L3Harris Technologies, Inc.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Northrop Grumman

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Thales S.A.

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global C5ISR Market Sales Analysis by Solution ($ Million)

5.1. Hardware

5.2. Software

5.2.1. Command and Control Software

5.2.2. Communication Software

5.2.3. Cyber Warfare Software

5.2.4. Electronic Warfare Software

5.2.5. Intelligence, Surveillance, and Reconnaissance Software

5.3. Services

6. Global C5ISR Market Sales Analysis by End User ($ Million)

6.1. Army

6.2. Navy

6.3. Air Force

6.4. Government and Law Enforcement

7. Global C5ISR Market Sales Analysis by Installation ($ Million)

7.1. New Installations

7.2. Upgrades

8. Regional Analysis

8.1. North American C5ISR Market Sales Analysis – Solution| End User| Installation| Country ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European C5ISR Market Sales Analysis – Solution| End User| Installation| Country ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific C5ISR Market Sales Analysis – Solution| End User| Installation| Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World C5ISR Market Sales Analysis – Solution| End User| Installation| Country ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. Airbus

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Atlantic Diving Supply, Inc. (ADS)

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. BAE Systems, plc

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. CACI International Inc.

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. Crown Point Systems

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. Cubic Corp.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. EIZO Rugged Solutions Inc.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. Elbit Systems Ltd.

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Excelitas Technologies Corp.

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. Indra Co.

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Intelsat US LLC

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. KNL

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Kratos Defense & Security Solutions, Inc.

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.13.4. Business Strategies

9.14. L3Harris Technologies, Inc.

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Leidos, Inc.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Lockheed Martin Corp.

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. ManTech International Corp.

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

9.18. Northrop Grumman

9.18.1. Quick Facts

9.18.2. Company Overview

9.18.3. Product Portfolio

9.18.4. Business Strategies

9.19. QinetiQ Group

9.19.1. Quick Facts

9.19.2. Company Overview

9.19.3. Product Portfolio

9.19.4. Business Strategies

9.20. Singapore Technologies Engineering Ltd.

9.20.1. Quick Facts

9.20.2. Company Overview

9.20.3. Product Portfolio

9.20.4. Business Strategies

9.21. Spathe Systems

9.21.1. Quick Facts

9.21.2. Company Overview

9.21.3. Product Portfolio

9.21.4. Business Strategies

9.22. TE Connectivity Corporation

9.22.1. Quick Facts

9.22.2. Company Overview

9.22.3. Product Portfolio

9.22.4. Business Strategies

9.23. Thales S.A.

9.23.1. Quick Facts

9.23.2. Company Overview

9.23.3. Product Portfolio

9.23.4. Business Strategies

1. Global C5ISR Market Research And Analysis By Solution, 2024-2035 ($ Million)

2. Global C5ISR Hardware Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global C5ISR Software Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global C5ISR Command and Control Software Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global C5ISR Communication Software Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global C5ISR Cyber Warfare Software Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global C5ISR Electronic Warfare Software Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global C5ISR Intelligence, Surveillance, and Reconnaissance Software Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global C5ISR Services Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global C5ISR Market Research And Analysis By End User, 2024-2035 ($ Million)

11. Global C5ISR For Army Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global C5ISR For Navy Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global C5ISR For Air Force Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global C5ISR For Government and Law Enforcement Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global C5ISR Market Research And Analysis By Installation, 2024-2035 ($ Million)

16. Global New Installations For C5ISR Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global Upgrades For C5ISR Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global C5ISR Market Research And Analysis By Region, 2024-2035 ($ Million)

19. North American C5ISR Market Research And Analysis By Country, 2024-2035 ($ Million)

20. North American C5ISR Market Research And Analysis By Solution, 2024-2035 ($ Million)

21. North American C5ISR Market Research And Analysis By End User, 2024-2035 ($ Million)

22. North American C5ISR Market Research And Analysis By Installation, 2024-2035 ($ Million)

23. European C5ISR Market Research And Analysis By Country, 2024-2035 ($ Million)

24. European C5ISR Market Research And Analysis By Solution, 2024-2035 ($ Million)

25. European C5ISR Market Research And Analysis By End User, 2024-2035 ($ Million)

26. European C5ISR Market Research And Analysis By Installation, 2024-2035 ($ Million)

27. Asia-Pacific C5ISR Market Research And Analysis By Country, 2024-2035 ($ Million)

28. Asia-Pacific C5ISR Market Research And Analysis By Solution, 2024-2035 ($ Million)

29. Asia-Pacific C5ISR Market Research And Analysis By End User, 2024-2035 ($ Million)

30. Asia-Pacific C5ISR Market Research And Analysis By Installation, 2024-2035 ($ Million)

31. Rest Of The World C5ISR Market Research And Analysis By Region, 2024-2035 ($ Million)

32. Rest Of The World C5ISR Market Research And Analysis By Solution, 2024-2035 ($ Million)

33. Rest Of The World C5ISR Market Research And Analysis By End User, 2024-2035 ($ Million)

34. Rest Of The World C5ISR Market Research And Analysis By Installation, 2024-2035 ($ Million)

1. Global C5ISR Market Research And Analysis By Solution, 2024 Vs 2035 (%)

2. Global C5ISR Hardware Market Share By Region, 2024 Vs 2035 (%)

3. Global C5ISR Software Market Share By Region, 2024 Vs 2035 (%)

4. Global C5ISR Command and Control Software Market Share By Region, 2024 Vs 2035 (%)

5. Global C5ISR Communication Software Market Share By Region, 2024 Vs 2035 (%)

6. Global C5ISR Cyber Warfare Software Market Share By Region, 2024 Vs 2035 (%)

7. Global C5ISR Electronic Warfare Software Market Share By Region, 2024 Vs 2035 (%)

8. Global C5ISR Intelligence, Surveillance, and Reconnaissance Software Market Share By Region, 2024 Vs 2035 (%)

9. Global C5ISR Services Market Share By Region, 2024 Vs 2035 (%)

10. Global C5ISR Market Research And Analysis By End User, 2024 Vs 2035 (%)

11. Global C5ISR For Army Market Share By Region, 2024 Vs 2035 (%)

12. Global C5ISR For Navy Market Share By Region, 2024 Vs 2035 (%)

13. Global C5ISR For Air Force Market Share By Region, 2024 Vs 2035 (%)

14. Global C5ISR For Government and Law Enforcement Market Share By Region, 2024 Vs 2035 (%)

15. Global C5ISR Market Research And Analysis By Installation, 2024 Vs 2035 (%)

16. Global New Installations For C5ISR Market Share By Region, 2024 Vs 2035 (%)

17. Global Upgrades For C5ISR Market Share By Region, 2024 Vs 2035 (%)

18. Global C5ISR Market Share By Region, 2024 Vs 2035 (%)

19. US C5ISR Market Size, 2024-2035 ($ Million)

20. Canada C5ISR Market Size, 2024-2035 ($ Million)

21. UK C5ISR Market Size, 2024-2035 ($ Million)

22. France C5ISR Market Size, 2024-2035 ($ Million)

23. Germany C5ISR Market Size, 2024-2035 ($ Million)

24. Italy C5ISR Market Size, 2024-2035 ($ Million)

25. Spain C5ISR Market Size, 2024-2035 ($ Million)

26. Russia C5ISR Market Size, 2024-2035 ($ Million)

27. Rest Of Europe C5ISR Market Size, 2024-2035 ($ Million)

28. India C5ISR Market Size, 2024-2035 ($ Million)

29. China C5ISR Market Size, 2024-2035 ($ Million)

30. Japan C5ISR Market Size, 2024-2035 ($ Million)

31. South Korea C5ISR Market Size, 2024-2035 ($ Million)

32. ASEAN C5ISR Market Size, 2024-2035 ($ Million)

33. Australia and New Zealand C5ISR Market Size, 2024-2035 ($ Million)

34. Rest Of Asia-Pacific C5ISR Market Size, 2024-2035 ($ Million)

35. Latin America C5ISR Market Size, 2024-2035 ($ Million)

36. Middle East And Africa C5ISR Market Size, 2024-2035 ($ Million)

FAQS

The size of the C5ISR Market in 2024 is estimated to be around $10,720.

North America holds the largest share in the C5ISR Market.

Leading players in the C5ISR Market include Airbus, BAE Systems, plc, L3Harris Technologies, Inc., Northrop Grumman, and Thales S.A., among others.

C5ISR Market is expected to grow at a CAGR of 13.7% from 2025 to 2035.

The C5ISR Market is growing due to rising defense modernization, demand for real-time intelligence, and integration of advanced communication technologies.