CBRNe Defense Market

CBRNe Defense Market Size, Share & Trends Analysis Report by Equipment (Protective Wearables, Respiratory Systems, Decontamination Systems), By End-user (Military and Civil & Law Enforcement Agencies), Forecast period (2020-2026)

The global CBRNe defense market is anticipated to grow at a significant CAGR during the forecast period. The CBRNe defense involves the training of the defense team to work against the potential CBRNe threats and attacks. The increasing purchasing of advanced CNRNe equipment will drive the CBRNe defense market significantly over the forecast period. In addition to this, the increasing cold war situations across the globe are also anticipated to increase the CBRNe defense market.

Additionally, the increasing R&D activities for the development of technologically advanced CBRNe defenses equipment present simple opportunity for the growth of the CBRNe defense market during the forecast period. Moreover, the surge in the defense budgets and activities of the emerging economies provide a future opportunity for the CBRNEe defense market growth during the forecast period.

Segmental Outlook

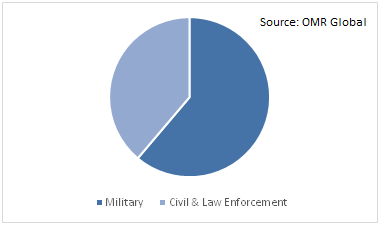

The global CBRNe defense market is segmented based on equipment and end-user. Based on the equipment, the market is sub-segmented into the protective wearables, respiratory systems, decontamination systems, and others. The protective wearables segment is estimated to hold a prominent share in the market. Protective wearables are designed for the protection of first responders from CBRN material exposure, such as firefighters and counter-terrorism teams. Based on end-user, the market is bifurcated into the military and civil &law enforcement agencies. The military segment is estimated to hold a significant share in the market.

Global CBRNe Defense Market Share by End-User, 2019 (%)

The Military will Contribute a Significant Share in the Market

The military segment is anticipated to hold a prominent share in the CBRNe defense market owing to the defense organization's role as a front-line worker in any situation of CBRNe attacks. Defense agencies receive the highest training of CBRNe defense compared to other legal agencies in the country. In addition, growing threats from terrorists and rising political tensions further drive the growth of the market. Additionally, the increasing adoption of CBRNe equipment by the various defense agencies across the globe is significantly driving the CBRNe defense market during the forecast period.

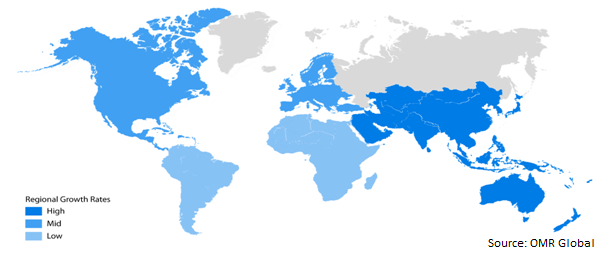

Regional Outlooks

The global CBRNe defense market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold the largest market share in the CBRNe defense during the forecast period. The market growth is attributed to the increasing spending of defense and military budget in broadening the CBRNe response equipment portfolio. Additionally, the active key market players such as AirBoss of America Corp., Leidos Inc., and many more across the region will also fuel the CBRNe defense market significantly during the forecast period.

Global CBRNe Defense Market Growth by Region, 2020-2026

Asia-Pacific to Augment with a Considerable Growth Rate in the Market

Asia-Pacific is anticipated to exhibit a significant growth rate in the CBRNe defense market owing to the increasing military significance across the country. Additionally, the increasing activities related to the CBRNe defense training by the militaries across the region will also drive the CBRNe defense market across the region.

Market Players Outlook

Some of the key players operating in the global CBRNe defense market include AirBoss of America Corp., Thales Group, Rapiscan Systems (OSI Systems Inc.), Leidos Holdings Inc., FLIR Systems Inc., Smiths Group Plc, and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, mergers and acquisitions, collaborations with government, and new product launches to stay competitive in the market.

Recent Activities

- In September 2019, AirBoss of America Corp. received a contract for indefinite-delivery/indefinite-quantity (IDIQ) from the US Department of Defense for the manufacture and sale of up to 600,000 pairs of Molded CBRN Lightweight Over boots (MALO).

- In January 2019, the US Department of Defense’s Joint Program Executive Office for CBRND’s Joint Project Manager, and Nuclear Biological Chemical Contamination Avoidance (JPM-NBC CA) collaboratively selected Smiths Detection (SDI) for the development of chemical detector. The company will supply the design and engineer an Aerosol and Vapor Chemical Agent Detector (AVCAD) which will be a miniaturized chemical detection.

- In September 2018, Leidos Inc.’s Australian site received a contract of $243.5 million for Land 2110 Phase 1B from the Australian Department of Defence. The company would deliver critical capability to Defence in the area of CBRN defense to enhance the support of government agencies in domestic CBRN incidents.

- In July 2017, Saab AB together with its partners Bader Sultan & Bros in Kuwaiti started the operation of an integrated national CBRN center in Kuwait. The CBRN center delivered by the company will the whole area of Kuwait with fixed and mobile CBRN sensors and units. The CBRN center will also provide a unique capability for simulated training sessions.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global CBRNe defense market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Air Boss of America Corp.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.2. Thales Group

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. Leidos Holdings, Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

3.2.4. Rapiscan Systems (OSI Systems, Inc.)

3.2.4.1. Overview

3.2.4.2. Financial Analysis

3.2.4.3. SWOT Analysis

3.2.4.4. Recent Developments

3.2.5. FLIR Systems, Inc.

3.2.5.1. Overview

3.2.5.2. Financial Analysis

3.2.5.3. SWOT Analysis

3.2.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global CBRNe Defense Market by Equipment

5.1.1. Protective Wearables

5.1.2. Respiratory Systems

5.1.3. Decontamination Systems

5.1.4. Others

5.2. Global CBRNe Defense Market by End-User

5.2.1. Military

5.2.2. Civil and Law Enforcement

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. AirBoss of America Corp.

7.3. Argon Electronics (UK) Ltd.

7.4. Avon Polymer Products Ltd.

7.5. BLUCHER GmbH

7.6. Chemring Group plc

7.7. Environics Oy

7.8. FLIR Systems, Inc.

7.9. ILC Dover LP

7.10. Karcher Futuretech GmbH

7.11. Leidos, Inc.

7.12. MSA Safety, Inc.

7.13. Nexter group KNDS

7.14. QinetiQ Group

7.15. Rapiscan Systems (OSI Systems, Inc.)

7.16. Respirex International Ltd.

7.17. Saab AB

7.18. Smiths Detection Group Ltd. (Smiths Group PLC)

7.19. Thales Group

7.20. Tingley Rubber Corp.

1. GLOBAL CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

2. GLOBAL PROTECTIVE WEARABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL RESPIRATORY SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL DECONTAMINATION SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

6. GLOBAL OTHER CBRNE DEFENSE EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

7. GLOBAL CBRNE DEFENSE FOR MILITARY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL CBRNE DEFENSE FOR CIVIL AND LAW ENFORCEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

12. NORTH AMERICAN CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

13. EUROPEAN CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

15. EUROPEAN CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

19. REST OF THE WORLD CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2019-2026 ($ MILLION)

20. REST OF THE WORLD CBRNE DEFENSE MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL CBRNE DEFENSE MARKET SHARE BY EQUIPMENT, 2019 VS 2026(%)

2. GLOBAL CBRNE DEFENSE MARKET SHARE BY END-USER, 2019 VS 2026(%)

3. GLOBAL CBRNE DEFENSE MARKET SHARE BY GEOGRAPHY, 2019 VS 2026(%)

4. US CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

6. UK CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD CBRNE DEFENSE MARKET SIZE, 2019-2026 ($ MILLION)