Clinical Diagnostics Market

Clinical Diagnostics Market Size, Share & Trends Analysis Report by Test (Lipid Panel, Liver Panel, Renal Panel, Complete Blood Count, Electrolyte Testing, Infectious Disease Testing, and Others), by Product (Instruments, Reagents, and Others), and by End-User (Hospital Laboratory, Diagnostic Laboratory, and Point-of-Care Testing), Forecast Period (2023-2030)

Clinical diagnostics market is anticipated to grow at a CAGR of 6.3% during the forecast period (2023–2030). The market expansion is attributed to the ongoing modernization of innovative diagnostic tests. Technological advancements, such as next-generation sequencing (NGS), molecular diagnostics, and new imaging techniques, have substantially enhanced the precision and efficacy of diagnostic tests. Introducing an innovative biomarker test capable of accurately recognizing prostate cancer and estimating the severity of its progression could have significant implications for patient management. This innovation has the potential to lead to improved risk stratification, personalized treatment approaches, and a reduction in unnecessary medical interventions.

The development of enhanced biomarker testing is consistent with these objectives as the healthcare sector continues to prioritize precision medicine and patient-centered treatment. Consequently, key market players are actively introducing novel products to meet the rising demand for advanced biomarker tests. For instance, in July 2023, Quest Diagnostics launched an innovative prostate cancer biomarker test in collaboration with Envision Sciences' sub-specialty pathology subsidiary AmeriPath. Envision Sciences Pty Ltd., an Australian clinical diagnostics enterprise, is engaged in developing a portfolio of blood and tissue-based tests for cancer diagnosis and prognosis, leveraging the potential of biomarkers.

This concentrated focus on innovation highlights the industry's dedication to enhance diagnostic capabilities and emphasizes its commitment to advancing patient care through state-of-the-art technologies and methodologies.

Segmental Outlook

The global clinical diagnostics market is segmented by test, product, and end-user. Based on the test, the market is sub-segmented into lipid panels, liver panels, renal panels, complete blood counts, electrolyte testing, infectious disease testing, and others. Based on the product, the market is sub-segmented into instruments, reagents, and others. Further, on the basis of end-user, the market is sub-segmented into hospital laboratories, diagnostic laboratories, point-of-care testing, and others. Among the end-users, the point-of-care testing sub-segment is anticipated to hold a considerable share of the market owing to the healthcare industry's significant shift towards decentralization along with the rapidly increasing utilization of point-of-care diagnostic products.

The Lipid Panel Sub-Segment is Anticipated to Hold a Considerable Share of the Global Clinical Diagnostics Market

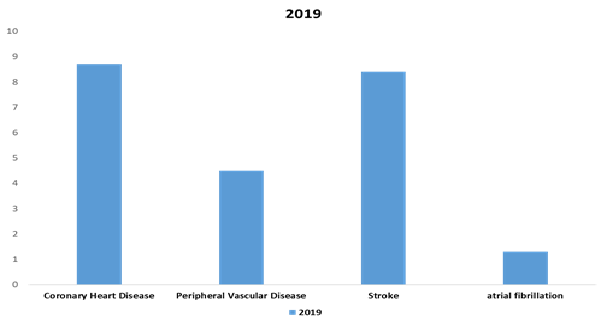

Among the tests, the lipid panel sub-segment is expected to hold a considerable share of the global clinical diagnostics market. The segmental growth is attributed to the growing health awareness. More individuals are opting for lipid panel tests and engaging in discussions with healthcare professionals about their cardiovascular well-being owing to increased understanding of the importance of maintaining optimal/ good cholesterol levels. For instance, in June 2023, the British Heart Foundation reported that heart and circulatory diseases encompass a variety of conditions related to the heart and blood vessels. These conditions include inherited diseases, coronary heart disease, atrial fibrillation, heart failure, stroke, and vascular dementia. The global count of individuals affected by heart or circulatory diseases is approximately 620 million, and this number continuous to increase due to changing lifestyles, an aging population, and improved survival rates following heart attacks and strokes. Approximately 1 in 13 people globally are estimated to live with these conditions. In 2019, there were 290 million women and 260 million men living with heart or circulatory diseases. Since 1997, this count has more than doubled, escalating from 285 million to 620 million. The most common conditions are coronary heart disease, peripheral vascular disease, stroke, and atrial fibrillation. Every year, an estimated 60 million individuals globally develop heart or circulatory diseases.

Incidence Rate

In 2019, the incidence rate for coronary heart disease was 8.7 million, for peripheral vascular disease was 4.5 million, for stroke was 8.4 million, and for atrial fibrillation was 1.3 million. This growing awareness of heart and circulatory diseases and their impact on health has led to an increased demand for diagnostic tests and medical guidance, subsequently driving the growth of specific market segments.

Regional Outlook

The global clinical diagnostics market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, North America is anticipated to hold a prominent share of the market across the globe. This growth is contributed owing to the higher patient understanding the importance of laboratory tests, and a rise in the number of individuals with infectious and long-term illnesses. For instance, around 1.9 million new cancer cases were diagnosed in the US, according to the American Cancer Society report published in 2022.

Global Clinical Diagnostics Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Clinical Diagnostics Market

Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to the growing demand for early detection of diseases. Diagnostic tests that can identify diseases in their initial stages are considered beneficial, as they may improve the chances of successful treatment and potentially reduce associated healthcare costs. Further expansion of diagnostic centers across the region is creating favorable conditions for the growth of the market. For instance, in February 2023, The Centre for Cellular and Molecular Platforms (C-CAMP) launched the National Diagnostics Catapult (C-CAMP InDx 2.0) in New Delhi. The Catapult, C-CAMP InDx 2.0, is intended to strengthen India's readiness for existing and potential pandemics and expand the diagnostic area for contagious diseases, such as COVID-19. Furthermore, the Catapult is designed to create a global model for capacity building in the diagnostics field in lower- and middle-income countries (LMICs) to accomplish the two objectives of affordability and accessibility in the global vision for Universal Health Coverage.

Market Players Outlook

The major companies serving the clinical diagnostics market include Abbott, Cepheid, Charles River Laboratories International, Inc., Exact Sciences Corp., Flagship Biosciences, Inc., and others. The market players are considerably contributing to market growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2022, Qiagen Inc. launched the NeuMoDxHSV 1/2 Quant Assay for the quantification and differentiation of herpes simplex virus type 1 (HSV-1) DNA and/or herpes simplex virus type 2 (HSV-2) with approval from the European Commission.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global clinical diagnostics market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bio-Rad Laboratories, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Danaher Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Sysmex Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Clinical Diagnostics Market by Test

4.1.1. Lipid Panel

4.1.2. Liver Panel

4.1.3. Renal Panel

4.1.4. Complete Blood Count

4.1.5. Electrolyte Testing

4.1.6. Infectious Disease Testing

4.1.7. Others (Genetic Testing, Electrocardiography, and Cardiac Stress Test)

4.2. Global Clinical Diagnostics Market by Product

4.2.1. Instruments

4.2.2. Reagents

4.2.3. Others (Assays, and Kits)

4.3. Global Clinical Diagnostics Market by End-User

4.3.1. Hospital Laboratory

4.3.2. Diagnostic Laboratory

4.3.3. Point-of-Care Testing

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott

6.2. Cepheid

6.3. Charles River Laboratories International, Inc.

6.4. Exact Sciences Corp.

6.5. Flagship Biosciences, Inc.

6.6. FUJIFILM Holdings Corp.

6.7. LGC Clinical Diagnostics

6.8. Merck Group

6.9. NeoGenomics Laboratories, Inc.

6.10. Ortho Clinical Diagnostics

6.11. SCIEX

6.12. Sonic Healthcare Ltd.

6.13. Thermo Fisher Scientific

1. GLOBAL CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TEST, 2022-2030 ($ MILLION)

2. GLOBAL LIPID CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL LIVER CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL RENAL CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL COMPLETE BLOOD COUNT CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL ELECTROLYTE TESTING CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL INFECTIOUS DISEASE TESTING CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL OTHERS CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

10. GLOBAL INSTRUMENTS BASED CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

11. GLOBAL REAGENTS BASED CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

12. GLOBAL OTHER PRODUCTS BASED CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

14. GLOBAL CLINICAL DIAGNOSTICS IN HOSPITAL LABORATORY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

15. GLOBAL CLINICAL DIAGNOSTICS IN DIAGNOSTIC LABORATORY MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

16. GLOBAL CLINICAL DIAGNOSTICS IN POINT-OF-CARE TESTING MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

17. GLOBAL CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TEST, 2022-2030 ($ MILLION)

20. NORTH AMERICAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

21. NORTH AMERICAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

22. EUROPEAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. EUROPEAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TEST, 2022-2030 ($ MILLION)

24. EUROPEAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

25. EUROPEAN CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. ASIA- PACIFIC CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TEST, 2022-2030 ($ MILLION)

28. ASIA- PACIFIC CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

29. ASIA- PACIFIC CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

30. REST OF THE WORLD CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

31. REST OF THE WORLD CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TEST, 2022-2030 ($ MILLION)

32. REST OF THE WORLD CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

33. REST OF THE WORLD CLINICAL DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL CLINICAL DIAGNOSTICS MARKET SHARE BY TEST, 2022 VS 2030 (%)

2. GLOBAL LIPID CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL LIVER CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL RENAL CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL COMPLETE BLOOD COUNT CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL ELECTROLYTE TESTING CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL INFECTIOUS DISEASE TESTING CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL OTHERS CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL CLINICAL DIAGNOSTICS MARKET SHARE BY PRODUCT, 2022 VS 2030 (%)

10. GLOBAL INSTRUMENTS BASED CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL REAGENTS BASED CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL OTHER PRODUCTS BASED CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL CLINICAL DIAGNOSTICS MARKET SHARE ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

14. GLOBAL CLINICAL DIAGNOSTICS IN HOSPITAL LABORATORY MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL CLINICAL DIAGNOSTICS IN DIAGNOSTIC LABORATORY MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL CLINICAL DIAGNOSTICS IN POINT-OF-CARE TESTING MARKET SHARE BY REGION, 2022 VS 2030 (%)

17. GLOBAL CLINICAL DIAGNOSTICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. US CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

19. CANADA CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

20. UK CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

21. FRANCE CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

22. GERMANY CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

23. ITALY CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

24. SPAIN CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OF EUROPE CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

26. INDIA CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

27. CHINA CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

28. JAPAN CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

29. SOUTH KOREA CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF ASIA-PACIFIC CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD CLINICAL DIAGNOSTICS MARKET SIZE, 2022-2030 ($ MILLION)