Companion Diagnostics Market

Global Companion Diagnostics Market Size, Share & Trends Analysis Report by Technology (Polymerase Chain Reaction (PCR), In Situ Hybridization (ISH), Immunohistochemistry (IHC), Next-Generation Sequencing (NGS), and Others) and by Indication (Breast Cancer, Lung Cancer, Melanoma, Neurological Diseases, and Others) and Forecast 2020-2026

The global companion diagnostics market is growing at a significant CAGR of around 12.8% during the forecast period (2020-2026). Companion diagnostics is referred to as in-vitro diagnostic device or an imaging tool that is used as a companion to a certain class of a therapeutic drug, to determine its relevancy to a patient. There are various pivotal factors that are driving the global companion diagnostic market, which includes increasing cases of adverse reactions to drugs, increasing demand for precision medicine, and continuous development of technologically advanced diagnostic techniques. In the recent past few years, a number of partnerships and collaborations are announced by the market players, such as

- In March 2020, Thermo Fisher Scientific Inc. entered a partnership with Janssen Biotech, Inc. for the co-development of CDx in oncology. Through the partnership, the company will worl with the Janssen’s scientists to validate the use of multiple biomarkers that can be used with Thermo Fisher’s Oncomine Dx target test.

- In January 2020, Guardant Health, Inc. collaborated with Amgen for the development and support the commercialization of a blood based CDx test for Amgen’s AMG 510. Through collaboration, the company will pursue US FDA pre-market approval, European CE mark, and Japan Pharmaceutical and Medical Device Agency approval for Guardant360 CDx as a companion diagnostic test for AMG 510 for patients suffering from metastatic NSCLC with the KRAS G12C mutation.

- In October 2019, QIAGEN NV signed a partnership agreement with Illumina, Inc. for the development of NGS-based IVD kits, including companion diagnostics for the health management of patients.

Moreover, a significant interest of government regulatory bodies can be seen in the companion diagnostics, which in turn, will drive fuel the market growth during the forecast period. For instance, in April 2020, the US FDA finalized the guidance that aimed at promoting broader labelling for companion diagnostics, to encourage precision oncology treatments across the globe. Such steps will promote the adoption of companion diagnostics across the globe. However, the unfavorable reimbursement policies will hamper the market growth during the forecast period.

Segmental Outlook

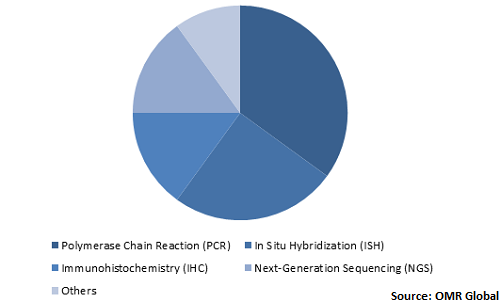

The companion diagnostics market is classified on the basis of technology and indication. Based on technology, the market is segmented into polymerase chain reaction (PCR), in situ hybridization (ISH), immunohistochemistry (IHC), next-generation sequencing (NGS), and others. Based on indication, the market is segregated into breast cancer, lung cancer, melanoma, neurological diseases, and others.

Global Companion Diagnostics Market Share by Technology, 2019 (%)

Global companion diagnostics market is driven by its PCR technology

PCR technology is significantly used in the companion diagnostics, owing to which, the PCR companion diagnostic market is estimated to project a considerable CAGR during the forecast period. PCR technology is utilized in several biological and medical research for different applications that include detecting the presence or absence of gene during infection. In addition, backed with the widening scope of microbiome research, the market players are introducing advanced reagents and kits that make use of PCR techniques to overcome challenges associated with microbiome research.

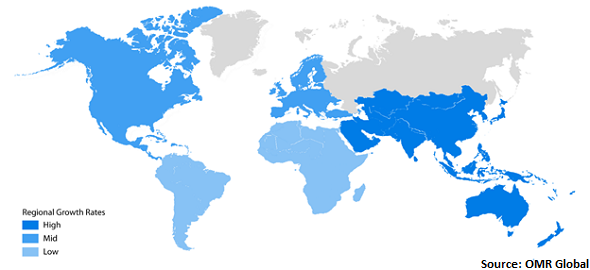

Regional Outlook

The global companion diagnostics market is classified on the basis of geography, which includes North America, Europe, Asia-Pacific, and Rest of the World. North America holds a significant share in the global companion diagnostics market. The US plays the critical role in geographic contribution of North America in global companion diagnostics market, attributing to the well-developed healthcare infrastructure, rising prevalence of cancer, and high healthcare spending in the oncology segment. As per National Institutes of Health (NIH), there were more than 1.7 million new cases of cancer in the US in 2018. In addition, the presence of key market players, such as Abbott Laboratories and Thermo Fisher Scientific Inc., is driving the market growth in North America.

Global Companion Diagnostics Market Growth, by Region 2020-2026

Asia-Pacific is expected to propel with a considerable growth rate in the global market

Asia-Pacific is estimated to project a considerable CAGR in the global companion diagnostics market. Countries in Asia-Pacific that are contributing to the market growth include China, India, and Japan. This growth is backed by the increasing prevalence of cancer and favorable government funding for the treatment of cancer in the emerging economies, especially India and China. Furthermore, the increased focus of the key players in Asia-Pacific region due to the increased demand for improved healthcare facilities are the key aspects that have accredited towards the growth of the advanced drugs and treatment options, which in turn influences the companion diagnostics market growth in the region. Moreover, the rise in private and public initiatives for the adoption of CDx will drive the market growth during the forecast period.

Market Players Outlook

The key players in the companion diagnostics market are contributing significantly by providing advanced technology-based products and through expanding their geographical presence across the globe. The key players operating in the global companion diagnostics market include Abbott Laboratories, F. Hoffmann-La Roche Ltd., bioMérieux SA, Thermo Fisher Scientific Inc., Promega Corp., QIAGEN NV, Myriad Genetics, Inc., AstraZeneca PLC, and Merck Co. & Inc. These market players adopt various strategies such as product launch, partnerships, collaborations, merger, and acquisitions to sustain a strong position in the market. For instance, in May 2019, QIAGEN NV launched first FDA approved kit for companion diagnostics, therascreen PIK3CA RGQ PCR Kit. The kit will assist in the identification of breast cancer patients that are eligible to receive a treatment with PIQRAY (alpelisib), a therapy developed by Novartis.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global companion diagnostics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. F. Hoffmann-La Roche Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. bioMérieux SA

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Myriad Genetics, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. QIAGEN NV

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Companion Diagnostics Market by Technology

5.1.1. Polymerase Chain Reaction (PCR)

5.1.2. In Situ Hybridization (ISH)

5.1.3. Immunohistochemistry (IHC)

5.1.4. Next-Generation Sequencing (NGS)

5.1.5. Others (Gene Sequencing)

5.2. Global Companion Diagnostics Market by Indication

5.2.1. Breast Cancer

5.2.2. Lung Cancer

5.2.3. Melanoma

5.2.4. Neurological Diseases

5.2.5. Others (Gastric Cancer)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Abnova Corp.

7.3. Agilent Technologies, Inc.

7.4. Almac Group

7.5. Amgen Inc.

7.6. AstraZeneca PLC

7.7. Biocartis NV

7.8. bioMérieux SA

7.9. F. Hoffmann-La Roche Ltd.

7.10. Guardant Health, Inc.

7.11. Illumina, Inc.

7.12. Leica Biosystems

7.13. Merck & Co., Inc.

7.14. Myriad Genetics, Inc.

7.15. Promega Corp.

7.16. Protagen AG

7.17. QIAGEN NV

7.18. Siemens AG

7.19. Sysmex Corp.

7.20. Thermo Fisher Scientific Inc.

1. GLOBAL COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

2. GLOBAL PCR MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ISH MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL IHC MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL NGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL OTHER TECHNOLOGIES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

8. GLOBAL COMPANION DIAGNOSTICS FOR BREAST CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL COMPANION DIAGNOSTICS FOR LUNG CANCER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL COMPANION DIAGNOSTICS FOR MELANOMA MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL COMPANION DIAGNOSTICS FOR NEUROLOGICAL DISEASES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL OTHER INDICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

16. NORTH AMERICAN COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

17. EUROPEAN COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

19. EUROPEAN COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

23. REST OF THE WORLD COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

24. REST OF THE WORLD COMPANION DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

1. GLOBAL COMPANION DIAGNOSTICS MARKET SHARE BY TECHNOLOGY, 2019 VS 2026 (%)

2. GLOBAL COMPANION DIAGNOSTICS MARKET SHARE BY INDICATION, 2019 VS 2026 (%)

3. GLOBAL COMPANION DIAGNOSTICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD COMPANION DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)