Connector Market

Connector Market Size, Share & Trends Analysis Report by Product (PCB Connectors, I/O Connectors, Circular Connectors, Fiber Optic Connectors, RF Coaxial Connectors, Rectangular Connectors, Solar Connectors, and Patch cords), by End-User (Consumer Electronics, Telecom, Energy and Power, Automotive, Aerospace or Defense, and Others), and by Material (Copper, Aluminum, Stainless Steel, Plastic andOthers) Forecast Period (2024-2031)

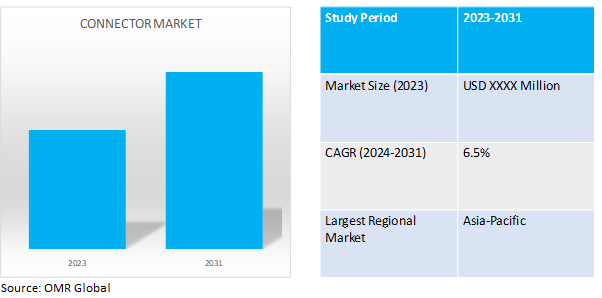

Connector market is anticipated to grow at a CAGR of 6.48% during the forecast period (2024-2031). A connector is a device that joins two pieces of equipment, wire, or piping together. The growing demand for strong connectivity in expanding digital landscape is a key factor driving the global connector market.

Market Dynamics

Technological Advancements: Fueling the Demand for High-Performance Connectors

On the technological front, the global connector market is propelled by advancements that necessitate improved connector performance. The surge in demand for high-speed data transmission, fueled by innovations like 5G and the Internet of Things (IoT), necessitates a new generation of connectors. These connectors must be robust and reliable to ensure the seamless flow of information across complex networks and devices, handling ever-increasing data volumes and bandwidth requirements. For instance, in March 2024, Cinch Connectivity Solutions, a Bel Fuse company, announced the release of the Fibrecohigh-density mil-spec MT38999 connector range. Fibreco fiber optic connectors and cable assemblies provide high-performance, versatile, and affordable solutions for any crucial communication application. They are specifically made for tough industrial settings such as mining, the military, and offshore operations.These advancements necessitate connectors with improved capabilities in terms of data throughput, signal integrity, and miniaturization, driving the development and adoption of next-generation connector technologies that can support the evolving needs of various industries.

Industry Trends: Diversifying the Demand for Connectors

Beyond the realm of technological advancements, the global connector market is also significantly influenced by evolving industry trends. One such trend is the relentless miniaturization of electronic devices across various sectors. This miniaturization, evident in consumer electronics, medical devices, and even industrial equipment, necessitates a new generation of connectors that are smaller and more intricate. These connectors must be able to fulfill the same functionalities within a condensed space, allowing for compact and efficient device design.For instance, in March 2024, MacArtney launched SubConn Nano. Expanding upon the widely acclaimed SubConn design, the space- and weight-saving æ12.7 mm SubConn Nano is a compact and multifunctional device designed to satisfy consumer demands. With its strong and adaptable performance, this innovative Nano connector is ideal for a wide range of applications and the increasingly small designs of underwater instruments, equipment, and systems.

Market Segmentation

Our in-depth analysis of the global connector market includes the following segments by product, end-user, and material:

- Based on product, the market is sub-segmented PCB connectors, I/O connectors, circular connectors, fiber optic connectors, RF coaxial connectors, rectangular connectors, solar connectors, and patch cords.

- Based on end-user, the market is sub-segmented into consumer electronics, telecom, energy and power, automotive, aerospace or defense, and others (medical devices, industrial automation, marine and offshore, agriculture, and consumer appliances).

- Based on material, the market is sub-segmented into copper, aluminum, stainless steel, plastic, and others (gold, high-performance plastics, exotic materials).

The Telecom Segment: A High-Growth Driver for the Connector Market

The telecom segment is anticipated to hold major share within the connector market, experiencing the most significant growth among all end-user categories. The expansion of 5G networks and the growing IoT necessitate robust and reliable connectors capable of handling the exponential growth in data traffic and ever-increasing data speeds. For instance, according to 5G America half a billion connections in 2022, healthy 5G uptake continues into 2023 with momentum in enterprise subscriptions and industrial deployments. Global 5G wireless connections increased by 76% from the end of 2021 to the end of 2022, reaching up to 1.05 billion. According to data from Omdia and 5G Americas, it will touch a mark of 5.9 billion by the end of 2027. Furthermore, the deployment of new telecom infrastructure, including data centers and fiber optic networks, creates a massive demand for connectors to establish seamless connections across this complex ecosystem. Plastics Holds a Considerable Market Share

Based on material, the market is sub-segmented into copper, aluminum, stainless steel, plastic, and others (gold, high-performance plastics, exotic materials).

Based on material, plastic is anticipated to exhibit the highest CAGR during the forecast period. This trend can be attributed to several key advantages that plastics offer over traditional materials like copper and stainless steel.

Low cost of plastic is a crucial factor for high-volume applications, particularly within the consumer electronics segment. Manufacturers can benefit from lower production costs, making plastic connectors ideal for mass-produced devices. Additionally, plastics are ideal for the ongoing trend of miniaturization in electronics. Unlike metals, plastics can be molded into intricate shapes while maintaining their functionality. This characteristic makes them perfect for the development of smaller, more compact connectors that can be seamlessly integrated into modern electronic devices.

Regional Outlook

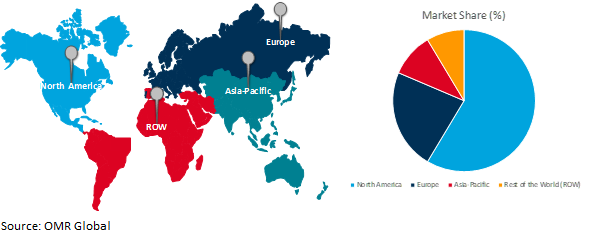

The global connector market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific: A Leader in the Connector Market

- The Asia-Pacific region's dominance in connector consumption stems from its role as global electronics manufacturing hub, encompassing consumer electronics, automotive electronics, and industrial automation equipment. For instance, according to Invest India India's domestic production expanded from $49 billion in FY17 to $101 billion in FY23, a compound annual growth rate of 13%. By FY26, the nation's electronics exports are predicted to total $120 billion.Exports of electronic goods were $17.74 billion in Apr-Nov 2023 compared to $14.36 billion in Apr-Nov 2022, a 23.56% increase.

Global Connector Market Growth by Region 2024-2031

Europe's EV Boom Ignites Connector Market Growth

A number of factors are combined to drive the connection market's fast rise in Europe. Most likely, the growing market for electric vehicles (EVs) is the main motivator. The adoption of EVs is being driven by European Union regulations and consumer interest in environmentally friendly transportation, which is driving up demand for connectors made especially for EV charging infrastructure. Strongness, effectiveness, and the capacity to manage the particular power requirements of electric vehicles are requirements for these connectors. Additionally, through investments and subsidies, government initiatives across Europe are aggressively pushing the development of EV charging infrastructure. The emphasis on infrastructure results in a significant need for connectors, which are necessary to build a reliable network of charging stations. For instance, according to Global EV Outlook 2023,Sales of electric cars in Europe reached 2.7 million in 2022, up more than 15% from the previous year. Prior years had faster sales growth: from 2017 to 2019, the average yearly increase was 40%, and in 2021 it reached over 65%. In 2022, sales of BEVs increased by 30% over 2021 (as opposed to 65% growth in 2021 over 2020), while sales of PHEVs decreased by approximately 3%. Ten percent of the increase in new electric car sales worldwide occurred in Europe. In the backdrop of ongoing auto market recession, electric car sales are still rising in Europe despite slower growth in 2022: overall car sales in Europe decreased by 3% in 2022 compared to 2021.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Connector market include3M Co, Foxconn Interconnect Technology Limited (Foxconn (Far East) Limited), Hirose Electric Co., Ltd., Huawei Technologies Co. Ltd., Japan Aviation Electronics Industry, Ltd. and TE Connectivityamong others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.For instance,in March 2023, 3D Systems announced a collaboration with TE Connectivity to work together to create an additive manufacturing solution that will enable the production of electrical connectors that adhere to strict UL regulations. The Figure 4 Modular, Figure 4 material, 3D Sprint software, and services from 3D Systems were the components of the solution created to satisfy TE Connectivity's particular needs for material performance and high tolerance, dependable printing.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global connector market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Foxconn Interconnect Technology Ltd. (Foxconn (Far East) Ltd.)

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hirose Electric Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Huawei Technologies Co. Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Japan Aviation Electronics Industry, Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. TE Connectivity Ltd.

3.7.1. Overview

3.7.2. Financial Analysis

3.7.3. SWOT Analysis

3.7.4. Recent Developments

3.8. Key Strategy Analysis

4. Market Segmentation

4.1. Global Connector Market by Product

4.1.1. PCB Connectors

4.1.2. I/O Connectors

4.1.3. Circular Connectors

4.1.4. Fiber Optic Connectors

4.1.5. RF Coaxial Connectors

4.1.6. Rectangular Connectors

4.1.7. Solar Connectors

4.1.8. Patch cord

4.2. Global Connector Market by End-User

4.2.1. Consumer Electronics

4.2.2. Telecom

4.2.3. Energy and Power

4.2.4. Automotive

4.2.5. Aerospace and Defense

4.2.6. Others

4.3. Global Connector Market by Material

4.3.1. Copper

4.3.2. Aluminum

4.3.3. Stainless Steel

4.3.4. Telecommunication

4.3.5. Consumer Electronics

4.3.6. Security and Surveillance

4.3.7. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. ABB Asea Brown Boveri Ltd.

6.2. Ametek, Inc.

6.3. Amphenol Corp.

6.4. Aptiv PLC

6.5. Axon' Cable

6.6. Fujitsu Ltd.

6.7. J.S.T. Mfg. Co., Ltd.

6.8. Luxshare Precision Industry Co., Ltd.

6.9. Molex, LLC (Koch Industries, Inc.)

6.10. Nexans S.A.

6.11. Yazaki Corp.

1. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL PCB CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL I/O CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CIRCULAR CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FIBER OPTIC CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL RF COAXIAL CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL RECTANGULAR CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL SOLAR CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PATCHCORD CONNECTORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

11. GLOBAL CONSUMER ELECTRONICS CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TELECOM CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ENERGY AND POWER CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AUTOMOTIVE CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL AEROSPACE AND DEFENSE CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL OTHER TYPE CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

18. GLOBAL COPPER CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL ALUMINUM CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL STAINLESS STEEL CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL PLASTIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL OTHERS MATERIAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBALCONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. NORTH AMERICAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. NORTH AMERICAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT 2023-2031 ($ MILLION)

26. NORTH AMERICAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. NORTH AMERICAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

28. EUROPEAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

29. EUROPEAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT2023-2031 ($ MILLION)

30. EUROPEAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

31. EUROPEAN CONNECTOR MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. ASIA- PACIFIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

34. ASIA- PACIFIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

35. ASIA- PACIFIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

36. REST OF THE WORLD CONNECTOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

37. REST OF THE WORLD CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

38. REST OF THE WORLD CONNECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

39. REST OF THE WORLD CONNECTOR MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

1. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL PCB CONNECTORS DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

3. GLOBAL I/O CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL CIRCULAR CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

5. GLOBAL FIBER OPTIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL RF COAXIAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL RECTANGULAR CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL SOLAR CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. GLOBAL PATCHCORD CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY END-USER, 2023 VS 2031 (%)

11. GLOBAL CONSUMER ELECTRONICS CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

12. GLOBAL TELECOM CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

13. GLOBAL ENERGY AND POWER CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

14. GLOBAL AUTOMOTIVE CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

15. GLOBAL AEROSPACE AND DEFENSE CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

16. GLOBAL CONNECTOR FOR OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

17. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023 VS 2031 (%)

18. GLOBAL COPPER CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

19. GLOBAL ALUMINUM CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

20. GLOBAL STAINLESS STEEL CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

21. GLOBAL PLASTIC CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

22. GLOBAL OTHER MATERIAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

23. GLOBAL CONNECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

24. US CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

25. CANADA CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

26. UK CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

27. FRANCE CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

28. GERMANY CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

29. ITALY CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

30. SPAIN CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

31. REST OF EUROPE CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

32. INDIA CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

33. CHINA CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

34. JAPAN CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

35. SOUTH KOREA CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

36. REST OF ASIA-PACIFIC CONNECTOR MARKET SIZE, 2023-2031 ($ MILLION)

37. LATIN AMERICA CONNECTOR MARKET S031 ($ 2031 ($ MILLION)

38. THE MIDDLE EAST & AFRICA CONNECTOR MARKET S031 ($ 2031 ($ MILLION)