COVID-19 Diagnostics Market

COVID-19 Diagnostics Market Size, Share & Trends Analysis Report by Type (Instruments and Reagents & Kits), Test Type (Molecular Diagnostics, Serology/Antibody Tests, Antigen Tests, Others [Next-Generation Sequencing (NGS), Biosensors, and Point-of-Care Devices]), by Sample Type (Oropharyngeal & Nasopharyngeal Swabs, Blood, Urine, Saliva, Others), and by End User (Hospitals & Clinics, Diagnostic Laboratories, Research Institutes, Point-of-Care Settings, Home Testing/Self-Testing), Forecast Period (2025-2035)

Industry Overview

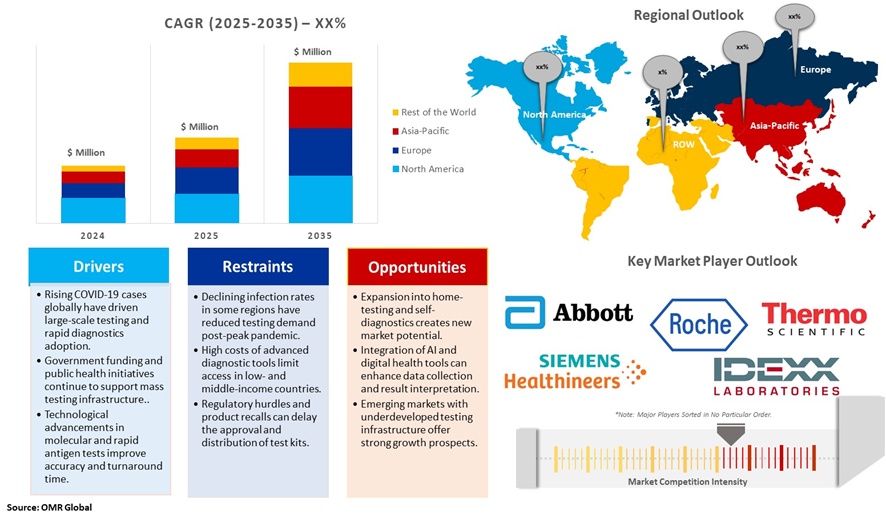

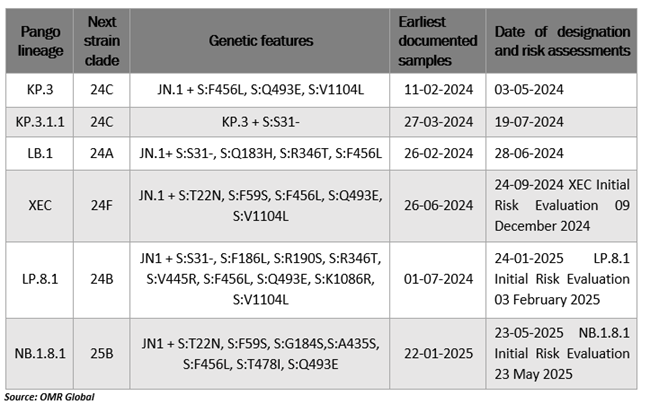

COVID-19 diagnostics market is growing at a CAGR of of 6.5% during the forecast period (2025–2035). One of the major factors that are contributing to market growth is the continuous mutations of the virus. For instance, the World Health Organization is monitoring several SARS-CoV-2 variations, including seven variants under monitoring (VUMs) and one variant of interest (VOI) JN.1. In February 2025, 16.3% of sequences were JN.1, the VOI. The most common VUM XEC, which accounted for 42.7% of sequences, demonstrated a decline in prevalence. As of February 2025, the only tracked variants that are actively increasing in prevalence are LP.8.1 and LB.1, which accounted for 13.9% and 1.2% of sequences, respectively. The prevalence of each of the remaining VUMs is decreasing.

Additionally, in March 2021, the B.1.1.7 variant, first discovered in Great Britain (UK) for 26.2% of all the cases of coronavirus disease, and the B.1.526 variant, initially discovered in New York City, contributed to even more than 72% of cases, which were newly admitted (in 42.9%). The ability of variations to circumvent vaccine-induced immunity and cause asymptomatic infection (and thus viral transmission) or disease is of particular concern. Both repercussions are significant and must be evaluated separately. These variations can lessen the protection provided by suppressing monoclonal antibodies and vaccines, as well as enhance the frequency of transmission of the virus and/or the risk of contracting the disease. Due to these mutations, SARS-CoV-2 may be able to proliferate despite increasing levels of vaccination coverage while preserving and enhancing its reproduction efficiency.

Market Dynamics

Diagnostics Plays an Important Role in the COVID-19 Pandemic in Control

Significant strides in genome mapping, diagnostics, and vaccine development have controlled the pandemic and reduced fatalities; ongoing virus mutations necessitate a deeper exploration of the interplay between SARS-CoV-2 mutations and the host's immune response. Various vaccines, including RNA-based ones like Pfizer and Moderna, viral vector vaccines like Johnson & Johnson and AstraZeneca, and protein subunit vaccines like Novavax, have played critical roles in mitigating the impact of COVID-19. Understanding their strengths and limitations is crucial for tailoring future vaccines to specific variants and individual needs.

Diagnostics have proven to be crucial to the COVID-19 pandemic response. There are three major methods for the detection of SARS-CoV-2 infection, and their role has evolved during the pandemic. Molecular tests such as PCR are highly sensitive and specific at detecting viral RNA and are recommended by WHO for confirming the diagnosis in individuals who are symptomatic and for activating public health measures. Antigen rapid detection tests detect viral proteins and, although they are less sensitive than molecular tests, have the advantages of being easier to do, giving a faster time to result, being lower cost, and being able to detect infection in those who are most likely to be at risk of transmitting the virus to others.

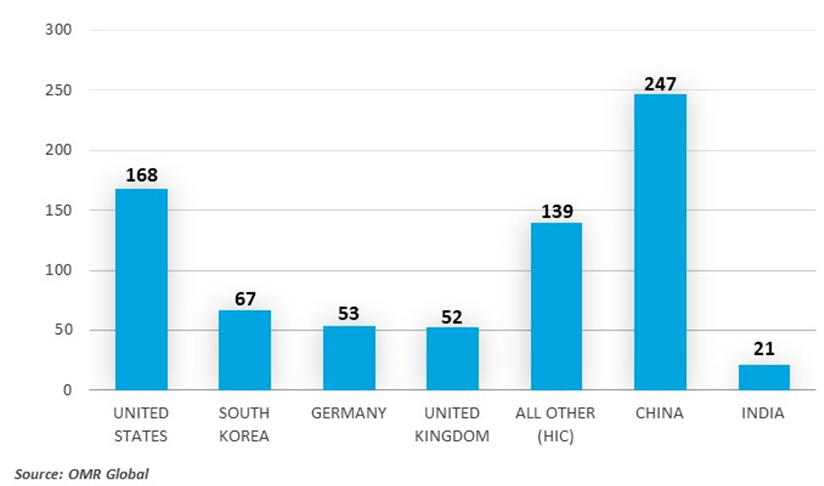

Number of COVID-19 Diagnostics Manufacturers by Country Income Class and Country

Advancements in COVID-19 Detection & Diagnosis

Newer and more flexible diagnostic techniques for the identification of SARS-CoV-2 infections are, in fact, necessary as a result of the introduction of novel and changing SARS-CoV-2 variants. However, because of new variations and the wide range of symptoms that infected people display, it is now more difficult to build quick and accurate diagnostic tools. Anti-SARS-CoV-2 antibodies (serological testing), certain viral nucleic acids (molecular testing), or proteins (antigen testing) are the primary targets of SARS-CoV-2 detection technologies. Since the detection of viral nucleic acids, antigens, and antibodies differs at different stages of the infection, the decision between each of these tests depends on the selection of the appropriate test, sample, and time.

Currently circulating variants under monitoring (VUMs) (as of 23 May 2025)

Market Segmentation

- Based on the type, the market is segmented into Instruments and Reagents & Kits.

- Based on the test type, the market is segmented into molecular diagnostics, serology/antibody tests, antigen tests, and others (next-generation sequencing (NGS), biosensors, and point-of-care devices).

- Based on the sample type, the market is segmented into oropharyngeal & nasopharyngeal swabs, blood, urine, saliva, and others.

- Based on the end user, the market is segmented into hospitals & clinics, diagnostic laboratories, research institutes, point-of-care settings, and home testing/self-testing.

Polymerase Chain Reaction (PCR) Segment Holds the Major Share in the Global COVID-19 Diagnostics Market

Among the COVID-19 test type segment, the PCR tests are the largest market segment with identifiable distinct patterns for various test types, which have different diagnostic requirements and clinical uses. Molecular diagnostics, with PCR tests and other nucleic acid amplification tests (NAATs), were focused on finding the genetic material of the virus, RNA, during the early days of infection or when someone may be asymptomatic with COVID-19. PCR tests are widely regarded as the gold standard for COVID-19 testing because of their very high sensitivity and specificity, and ability to determine the presence of viral genetic material with the most consistently reliable means to confirm an active infection in a clinical setting and where a definitive diagnosis is critical.

Self-test kits play a vital role as new cases continue to rise

Self-testing kits for COVID-19 are still an essential tool for controlling the new strain. It provides a practical way for people to identify the infection at home. These kits are widely accessible, inexpensive, and simple to use, enabling self-testing at home. They could prevent illnesses before they become serious and make testing available even in the most isolated areas of the nation. Self-testing kits eliminate the need for lengthy wait times or lab visits by providing results in as little as 15 to 30 minutes. Every minute matters during a pandemic. Quick judgments and prompt care were made possible by rapid results. People are encouraged to take control of their health via self-testing. It fosters consciousness, integrity, and initiative. People become more aware of their health and the effects they have on others, and it fosters a culture of accountability. For instance, Millions of people living in the U.S. have ordered free at-home COVID-19 tests in the past, and by the end of September 2024, each U.S. household was once again able to order four free tests.

Regional Outlook

The global COVID-19 Diagnostics is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

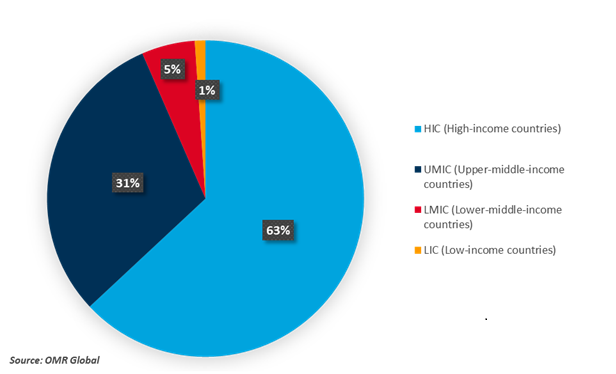

According to the US International Trade Commission, in 2022, HICs were the source of 91.9% ($338 billion of $368 billion) of global exports of products, including COVID-19-related diagnostics and therapeutics. Switzerland was the top exporter of products, COVID-19 Diagnostics and Therapeutics, Supply, Demand, and (Agreement on Trade-Related Aspects of Intellectual Property Rights) TRIPS Agreement Flexibilities, including COVID-19-related diagnostics ($43.7 billion in 2022), and Germany was the top exporter of products, including COVID-19-related therapeutics ($65.1 billion in 2022).

Percentages of Manufacturers of COVID-19 Diagnostics and Therapeutics

North America is anticipated to grow the Largest in the Global COVID-19 Diagnostic Market

COVID-19 diagnostic manufacturing occurs worldwide, and the United States accounts for more than 40 percent of the global $57 billion in vitro diagnostics market and is home to the second-largest number (after China) of COVID-19 diagnostics manufacturers. According to AdvaMed, the wider medical devices industry directly supports more than 400,000 jobs in the United States across all 50 states and indirectly supports about 2 million jobs. Diagnostics producers are generally unable to distinguish between COVID-19-specific jobs and jobs in their industry more broadly. U.S. employment in the in vitro diagnostics sector, however, expanded by 14 percent between 2019 and 2021. The vast majority of these newly created jobs were likely attributable to COVID-19. U.S. production reportedly peaked in February 2022, with 900 million test kits being produced that month.

The Asia-Pacific is anticipated to Grow Fastest in the Global COVID-19 Diagnostics.

Asia-Pacific is anticipated to grow fastest during the forecast period owing to the growing geopolitical tension between countries such as China, India, Australia, South Korea, Japan, Singapore, and others. These countries have been investing significantly in the procurement of new COVID-19 Diagnostics to increase border security and replace an aging fleet that has been in operation for several decades. For instance, in March 2021, the Indian Ministry of Defense granted Mahindra Defence Systems (MDS) an agreement worth USD 146 million to supply Light Specialist Vehicles (LSVs). Moreover, in March 2021, the Acquisition, Technology & Logistics Agency (ATLA) of Japan planned to replace the Light Armoured Vehicles (LAV) owing to their issue of lower cabin space and high emissions from engines.

Market Players Outlook

The major companies operating in the global COVID-19 Diagnostics market include Abbott Laboratories Inc., F. Hoffman-La Roche Ltd., IDEXX Laboratories, Inc., Siemens Healthcare Private Limited, and Thermo Fisher Scientific Inc., among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In May 2025, the World Health Assembly adopts a historic Pandemic Agreement to make the world more equitable and safer from future pandemics. The agreement’s adoption follows three years of intensive negotiation launched due to gaps and inequities identified in the national and global COVID-19 response. The agreement boosts global collaboration to ensure a stronger, more equitable response to future pandemics.

- In February 2025, Co-Diagnostics, Inc. announced that the Company has withdrawn its 510(k) application to the Food and Drug Administration (FDA) for its Co-Dx PCR COVID-19 Test on the PCR Pro, in favor of submitting an enhanced version of the test for 510(k) clearance. The Company plans to submit the next iteration of the Co-Dx PCR COVID-19 test for 510(k) OTC clearance, following the collection of clinical evaluation data to support the new test's performance.

- In June 2024, FIND and the World Health Organization (WHO) signed a new Memorandum of Understanding (MoU) that lays the foundation for accelerating innovation and achieving equitable access to quality diagnostics for people globally. One year on from the historic resolution to strengthen diagnostics, and with FIND as co-lead of the Access to COVID-19 Tools (ACT) Accelerator diagnostics pillar, this new agreement marks a step change in a strengthened partnership between WHO and FIND to speed up both innovation and access to diagnostics, supporting countries to implement the World Health Assembly (WHA) Resolution on diagnostics.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global COVID-19 diagnostics market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global COVID-19 Diagnostics Market Sales Analysis –Type | Test Type | Sample Type | End User ($ Million)

• COVID-19 Diagnostics Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key COVID-19 Diagnostics Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global COVID-19 Diagnostics Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global COVID-19 Diagnostics Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – COVID-19 Diagnostics Market Revenue and Share by Manufacturers

• COVID-19 Diagnostics Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Abbott Laboratories Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Agilent Technologies, Inc.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. F. Hoffman-La Roche Ltd.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. IDEXX Laboratories, Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Siemens Healthcare Private Limited

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Thermo Fisher Scientific Inc.

4.2.6.1. Overview

4.2.6.2. Product Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global COVID-19 Diagnostics Market Sales Analysis By Type ($ Million)

5.1. Instruments

5.2. Reagents & Kits

6. Global COVID-19 Diagnostics Market Sales Analysis By Test Type ($ Million)

6.1. Molecular Diagnostics

6.2. Serology / Antibody Tests

6.3. Antigen Tests

6.4. Others (Next Generation Sequencing (NGS)

6.5. Biosensors and Point-of-Care Devices)

7. Global COVID-19 Diagnostics Market Sales Analysis By Sample Type ($ Million)

7.1. Oropharyngeal & Nasopharyngeal Swabs

7.2. Blood

7.3. Urine

7.4. Saliva

7.5. Other

8. Global COVID-19 Diagnostics Market Sales Analysis By End-User ($ Million)

8.1. Hospitals & Clinics

8.2. Diagnostic Laboratories

8.3. Research Institutes

8.4. Point-of-Care Settings

8.5. Home Testing / Self-Testing

9. Regional Analysis

9.1. North American COVID-19 Diagnostics Market Sales Analysis – Type | Test Type | Sample Type | End User ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European COVID-19 Diagnostics Market Sales Analysis – Type | Test Type | Sample Type | End User ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific COVID-19 Diagnostics Market Sales Analysis – Type | Test Type | Sample Type | End User ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World COVID-19 Diagnostics Market Sales Analysis – Type | Test Type | Sample Type | End User ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. Abbott Laboratories Inc.

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. ADT Biotech Sdn Bhd

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Agilent Technologies, Inc.

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Applied BioCode Inc

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. Atila BioSystems, Inc.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Altona Diagnostics GmBH

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Beckman Coulter Inc.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Biomérieux SA

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Bioeksen R&D Technologies INC.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. BioFire Defense

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. BioGX, Inc.

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Biosynex SA

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Bruker Corp.

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Canon Inc.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Cliawaived, Inc.

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Cellex Inc.

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Cepheid Inc.

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Chembio Diagnostic Systems, Inc.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. DTPM, Inc

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. DxLab Inc.

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

10.21. DiaSorin S.p.A.

10.21.1. Quick Facts

10.21.2. Company Overview

10.21.3. Product Portfolio

10.21.4. Business Strategies

10.22. Enzo Biochem Inc.

10.22.1. Quick Facts

10.22.2. Company Overview

10.22.3. Product Portfolio

10.22.4. Business Strategies

10.23. Epitope Diagnostics, Inc.

10.23.1. Quick Facts

10.23.2. Company Overview

10.23.3. Product Portfolio

10.23.4. Business Strategies

10.24. F. Hoffman-La Roche Ltd.

10.24.1. Quick Facts

10.24.2. Company Overview

10.24.3. Product Portfolio

10.24.4. Business Strategies

10.25. General Biologicals Corp.

10.25.1. Quick Facts

10.25.2. Company Overview

10.25.3. Product Portfolio

10.25.4. Business Strategies

10.26. GenoSensor Corp.

10.26.1. Quick Facts

10.26.2. Company Overview

10.26.3. Product Portfolio

10.26.4. Business Strategies

10.27. Hologic Inc.

10.27.1. Quick Facts

10.27.2. Company Overview

10.27.3. Product Portfolio

10.27.4. Business Strategies

10.28. Hong Kong Hybribio Limited

10.28.1. Quick Facts

10.28.2. Company Overview

10.28.3. Product Portfolio

10.28.4. Business Strategies

10.29. IDEXX Laboratories, Inc.

10.29.1. Quick Facts

10.29.2. Company Overview

10.29.3. Product Portfolio

10.29.4. Business Strategies

10.30. Laboratory Corp. of America Holdings

10.30.1. Quick Facts

10.30.2. Company Overview

10.30.3. Product Portfolio

10.30.4. Business Strategies

10.31. Mylab Discovery Solutions Pvt Ltd.

10.31.1. Quick Facts

10.31.2. Company Overview

10.31.3. Product Portfolio

10.31.4. Business Strategies

10.32. PerkinElmer, Inc.

10.32.1. Quick Facts

10.32.2. Company Overview

10.32.3. Product Portfolio

10.32.4. Business Strategies

10.33. Quidel Corp.

10.33.1. Quick Facts

10.33.2. Company Overview

10.33.3. Product Portfolio

10.33.4. Business Strategies

10.34. QuidelOrtho Corp.

10.34.1. Quick Facts

10.34.2. Company Overview

10.34.3. Product Portfolio

10.34.4. Business Strategies

10.35. Seegene Inc.

10.35.1. Quick Facts

10.35.2. Company Overview

10.35.3. Product Portfolio

10.35.4. Business Strategies

10.36. Siemens Healthcare Private Limited

10.36.1. Quick Facts

10.36.2. Company Overview

10.36.3. Product Portfolio

10.36.4. Business Strategies

10.37. SureScreen Diagnostics Ltd.

10.37.1. Quick Facts

10.37.2. Company Overview

10.37.3. Product Portfolio

10.37.4. Business Strategies

10.38. Sysmex Europe SE.

10.38.1. Quick Facts

10.38.2. Company Overview

10.38.3. Product Portfolio

10.38.4. Business Strategies

10.39. Thermo Fisher Scientific Inc.

10.39.1. Quick Facts

10.39.2. Company Overview

10.39.3. Product Portfolio

10.39.4. Business Strategies

10.40. Veredus Laboratories

10.40.1. Quick Facts

10.40.2. Company Overview

10.40.3. Product Portfolio

10.40.4. Business Strategies

10.41. XABT, Beijing Applied Biological Technologies Co., Ltd

10.41.1. Quick Facts

10.41.2. Company Overview

10.41.3. Product Portfolio

10.41.4. Business Strategies

1. Global COVID-19 Diagnostics Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global COVID-19 Diagnostics Instruments Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global COVID-19 Diagnostics Reagents & Kits Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global COVID-19 Diagnostics Market Research And Analysis By Test Type, 2024-2035 ($ Million)

5. Global COVID-19 Diagnostics By Molecular Diagnostics Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global COVID-19 Diagnostics By Serology / Antibody Tests Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global COVID-19 Diagnostics By Antigen Tests Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global COVID-19 Diagnostics By Others (Next Generation Sequencing (NGS), and Biosensors and Point-of-Care Devices) Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global COVID-19 Diagnostics Market Research And Analysis By Sample Type, 2024-2035 ($ Million)

10. Global COVID-19 Diagnostics Via Oropharyngeal & Nasopharyngeal Swabs Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global COVID-19 Diagnostics Via Blood Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global COVID-19 Diagnostics Via Urine Market Research And Analysis By Region, 2024-2035 ($ Million)

13. Global COVID-19 Diagnostics Via Saliva Market Research And Analysis By Region, 2024-2035 ($ Million)

14. Global COVID-19 Diagnostics Via Other Market Research And Analysis By Region, 2024-2035 ($ Million)

15. Global COVID-19 Diagnostics Market Research And Analysis By End-User, 2024-2035 ($ Million)

16. Global COVID-19 Diagnostics For Hospitals & Clinics Market Research And Analysis By Region, 2024-2035 ($ Million)

17. Global COVID-19 Diagnostics For Diagnostic Laboratories Market Research And Analysis By Region, 2024-2035 ($ Million)

18. Global COVID-19 Diagnostics For Research Institutes Market Research And Analysis By Region, 2024-2035 ($ Million)

19. Global COVID-19 Diagnostics For Point-of-Care Settings Market Research And Analysis By Region, 2024-2035 ($ Million)

20. Global COVID-19 Diagnostics For Home Testing / Self-Testing Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Global COVID-19 Diagnostics Market Research And Analysis By Region, 2024-2035 ($ Million)

22. North American COVID-19 Diagnostics Market Research And Analysis By Country, 2024-2035 ($ Million)

23. North American COVID-19 Diagnostics Market Research And Analysis By Type, 2024-2035 ($ Million)

24. North American COVID-19 Diagnostics Market Research And Analysis By Test Type, 2024-2035 ($ Million)

25. North American COVID-19 Diagnostics Market Research And Analysis By Sample Type, 2024-2035 ($ Million)

26. North American COVID-19 Diagnostics Market Research And Analysis By End-User, 2024-2035 ($ Million)

27. European COVID-19 Diagnostics Market Research And Analysis By Country, 2024-2035 ($ Million)

28. European COVID-19 Diagnostics Market Research And Analysis By Type, 2024-2035 ($ Million)

29. European COVID-19 Diagnostics Market Research And Analysis By Test Type, 2024-2035 ($ Million)

30. European COVID-19 Diagnostics Market Research And Analysis By Sample Type, 2024-2035 ($ Million)

31. European COVID-19 Diagnostics Market Research And Analysis By End-User, 2024-2035 ($ Million)

32. Asia-Pacific COVID-19 Diagnostics Market Research And Analysis By Country, 2024-2035 ($ Million)

33. Asia-Pacific COVID-19 Diagnostics Market Research And Analysis By Type, 2024-2035 ($ Million)

34. Asia-Pacific COVID-19 Diagnostics Market Research And Analysis By Test Type, 2024-2035 ($ Million)

35. Asia-Pacific COVID-19 Diagnostics Market Research And Analysis By Sample Type, 2024-2035 ($ Million)

36. Asia-Pacific COVID-19 Diagnostics Market Research And Analysis By End-User, 2024-2035 ($ Million)

37. Rest Of The World COVID-19 Diagnostics Market Research And Analysis By Country, 2024-2035 ($ Million)

38. Rest Of The World COVID-19 Diagnostics Market Research And Analysis By Type, 2024-2035 ($ Million)

39. Rest Of The World COVID-19 Diagnostics Market Research And Analysis By Test Type, 2024-2035 ($ Million)

40. Rest Of The World COVID-19 Diagnostics Market Research And Analysis By Sample Type, 2024-2035 ($ Million)

41. Rest Of The World COVID-19 Diagnostics Market Research And Analysis By End-User, 2024-2035 ($ Million)

1. Global COVID-19 Diagnostics Market Share By Type, 2024 Vs 2035 ($ Million)

2. Global COVID-19 Diagnostics Instruments Market Share By Region, 2024 Vs 2035 ($ Million)

3. Global COVID-19 Diagnostics Reagents & Kits Market Share By Region, 2024 Vs 2035 ($ Million)

4. Global COVID-19 Diagnostics Market Share By Test Type, 2024 Vs 2035 ($ Million)

5. Global COVID-19 Diagnostics By Molecular Diagnostics Market Share By Region, 2024 Vs 2035 ($ Million)

6. Global COVID-19 Diagnostics By Serology / Antibody Tests Market Share By Region, 2024 Vs 2035 ($ Million)

7. Global COVID-19 Diagnostics By Antigen Tests Market Share By Region, 2024 Vs 2035 ($ Million)

8. Global COVID-19 Diagnostics By Others (Next Generation Sequencing (NGS), and Biosensors and Point-of-Care Devices) Market Share By Region, 2024 Vs 2035 ($ Million)

9. Global COVID-19 Diagnostics Market Share By Sample Type, 2024 Vs 2035 ($ Million)

10. Global COVID-19 Diagnostics Via Oropharyngeal & Nasopharyngeal Swabs Market Share By Region, 2024 Vs 2035 ($ Million)

11. Global COVID-19 Diagnostics Via Blood Market Share By Region, 2024 Vs 2035 ($ Million)

12. Global COVID-19 Diagnostics Via Urine Market Share By Region, 2024 Vs 2035 ($ Million)

13. Global COVID-19 Diagnostics Via Saliva Market Share By Region, 2024 Vs 2035 ($ Million)

14. Global COVID-19 Diagnostics Via Other Market Share By Region, 2024 Vs 2035 ($ Million)

15. Global COVID-19 Diagnostics Market Share By End-User, 2024 Vs 2035 ($ Million)

16. Global COVID-19 Diagnostics For Hospitals & Clinics Market Share By Region, 2024 Vs 2035 ($ Million)

17. Global COVID-19 Diagnostics For Diagnostic Laboratories Market Share By Region, 2024 Vs 2035 ($ Million)

18. Global COVID-19 Diagnostics For Research Institutes Market Share By Region, 2024 Vs 2035 ($ Million)

19. Global COVID-19 Diagnostics For Point-of-Care Settings Market Share By Region, 2024 Vs 2035 ($ Million)

20. Global COVID-19 Diagnostics For Home Testing / Self-Testing Market Share By Region, 2024 Vs 2035 ($ Million)

21. Global COVID-19 Diagnostics Market Share By Region, 2024 Vs 2035 ($ Million)

22. US COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

23. Canada COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

24. UK COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

25. France COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

26. Germany COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

27. Italy COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

28. Spain COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

29. Russia COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

30. Rest of Europe COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

31. India COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

32. China COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

33. Japan COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

34. South Korea COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

35. Australia and New Zealand COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

36. ASEAN Economies COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

37. Rest of Asia-Pacific COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

38. Latin America COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

39. Middle East and Africa COVID-19 Diagnostics Market Size, 2024-2035 ($ Million)

FAQS

The size of the COVID-19 Diagnostics market in 2024 is estimated to be around USD 30.02 billion.

North America holds the largest share in the COVID-19 Diagnostics market.

Leading players in the COVID-19 Diagnostics market include Abbott Laboratories Inc., F. Hoffman-La Roche Ltd., IDEXX Laboratories, Inc., Siemens Healthcare Private Limited, and Thermo Fisher Scientific Inc., among others.

COVID-19 Diagnostics market is expected to grow at a CAGR of 6.5% from 2025 to 2035.

Rising demand for rapid testing, emergence of new variants, and government initiatives are key factors driving the COVID-19 diagnostics market growth.