Crypto Asset Management Market

Crypto Asset Management Market Size, Share & Trends Analysis Report by Solution (Custodian Solution and Wallet Management), by Deployment Mode (Cloud and On-Premise), by Application (Mobile and Web-based), by End-User (Individual and Enterprise), Forecast Period (2025-2035)

Industry Overview

Crypto asset management market was valued at $719.8 million in 2024 and is projected to reach $6,544.5 million by 2035, growing at a CAGR of 22.3% from 2025 to 2035. Pivotal factors such as the growing investment from institutional & individual investors in crypto assets, advancement in supportive crypto technology, including blockchain infrastructure, smart contracts, and expanding the utility of crypto assets through tokenization of real-world assets are projected to drive market growth. The regulatory frameworks across different geographies also lead to growth in the market. For instance, Japan continuously updated its laws for cryptocurrency to ensure investor protection, transparency, and security. In April 2017, the Payment Services Act (PSA) recognized Bitcoin and other virtual assets as legitimate property. Since then, the country has been at the forefront of cryptocurrency regulation, implementing several updates and amendments to its existing regulatory framework.

Market Dynamics

Institutional Solutions are Gaining Momentum

Crypto asset management solution providers are increasingly focusing on delivering institutional services and solutions, as the institutional market holds significant potential for growth due to higher investment volumes. For instance, in February 2024, Kraken launched Kraken Institutional, an umbrella brand for its suite of products and services tailored to institutional clients, including asset managers, hedge funds, and high-net-worth individuals. The platform aims to serve as a one-stop shop, offering innovative and customized solutions designed to meet the unique needs of institutional investors. Similarly, companies like Banque Delubac & Cie provide institutional clients with expertise and innovative solutions that enhance the value of their operations. These offerings reflect the broader industry shift toward professionalized asset management infrastructure to attract and retain institutional capital.

AI-Driven Innovations in Crypto Asset Management

Artificial Intelligence (AI) is a player in the cryptocurrency trading space to enhance the efficiency and effectiveness of trading operations. Algorithmic trading represents a prominent domain in which AI to deliver significant advancements. Algorithmic trading involves the use of complex AI systems to make trading decisions faster. This is particularly useful in the crypto market, where prices are extremely volatile. AI trading is a method of trading that aims to use custom-built programs that run bots to analyze data and conduct transactions. Cryptocurrency trading bots are software programs that use algorithms to execute trading strategies automatically on behalf of participants in the cryptocurrency markets. For instance, Bitsgap launched an AI Assistant for portfolio management, enabling traders to oversee entire portfolios across exchanges such as Binance, OKX, and KuCoin, enhancing crypto-to-crypto trading and profitability.

Market Segmentation

- Based on the solution, the market is segmented into custodian solutions and wallet management.

- Based on the deployment mode, the market is segmented into cloud and on-premise.

- Based on the application, the market is segmented into mobile and web-based.

- Based on the end-user, the market is segmented into individual and enterprise.

Custodian Solution Segment to Lead the Market with the Largest Share

Institutional investors are looking to their banks for safe custody and management of this asset class, emphasizing the need for a secure, technology-driven crypto custody solution. Custodian banks explore approaches that ensure safe custody of cryptocurrency-based assets while allowing efficient and secure management. Custodians can offer a wide range of financial services for cryptocurrency-based assets, in turn creating exponential value for customers. Financial institutions providing custody services for traditional financial assets are uniquely positioned to offer additional crypto asset-specific services. Introducing such services helps to gain a competitive edge over other non-custody service providers, such as retail banks or technology services providers.

Crypto assets can be held in the custodian’s name in public ledgers (blockchain), allowing the custodian to operate these assets with proper permission from the investor. Custodians can also provide analytics services with insights into the demand and transaction volumes of crypto assets. Research teams can use these analytics for portfolio advisory. Custodians can source real-time pricing information of crypto assets to update the portfolio value simultaneously.

Cloud Solution: A Key Segment in Market Growth

Cloud-connected asset management solutions offer a centralized hub for data. Cloud solutions can track asset performance, maintenance needs, and operational workflow. Cloud storage eliminates data silos and ensures the access to the latest information. For instance, IBM Cloud Hyper Protect Crypto Services is a key management and encryption solution that gives full control over encryption keys for data protection. The integrated Unified Key Orchestrator acts as a secure key repository for distributing and orchestrating keys across multiple clouds, enabling quick recovery from key loss or disasters. It also offers FIPS 140-2 Level 4 certified security, seamless multi-cloud key management with built-in backups and high availability, and support for BYOK across platforms such as Azure, AWS, and Google Cloud. It ensures robust data protection with pervasive encryption and full control through the Keep Your Own Key (KYOK) model.

Similarly, SoftLedger’s full-featured crypto asset management software and robust API enable automating client financial management. This includes self-service customization, giving the ability to report on customer holdings separate from internal holdings, by asset, directly on the balance sheet, and others.

Regional Outlook

The global crypto asset management market is further divided by geography, including North America (the US and Canada), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing regulatory approach to create a unified digital financial ecosystem in Europe

Europe is emerging as a key region in the market, driven by its regulatory approach and efforts to create a digital financial ecosystem. In June 2023, the European Union (EU) formed the Markets in Crypto-Assets (MiCA) regulation. MiCA regulates crypto-asset issuance and services not covered by pre-existing regulations on financial instruments and financial products by creating a harmonized European regulatory framework. It specifically introduces a pan-European licensing and supervisory regime for issuers of crypto-assets, crypto platforms, and crypto-asset service providers (CASPs) across a broad range of crypto-assets, including exchange tokens (such as Bitcoin), utility tokens, asset-referenced tokens (ARTs), and electronic-money tokens (EMTs).

North America Region Dominates the Market with Major Share

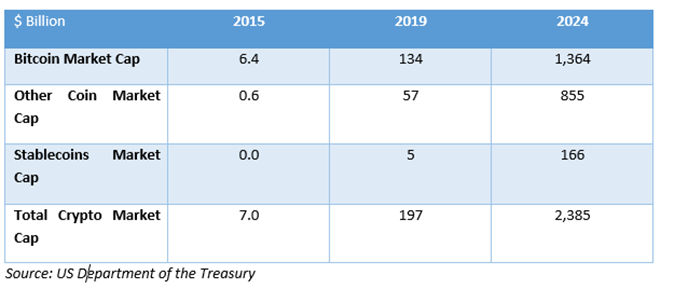

North America is expected to hold a considerable share of the global crypto asset management market.US leads the market owing to the dominance in adopting bitcoin, Ethereum, stablecoins, and others. According to the US Department of the Treasury, digital assets have experienced rapid growth in recent years. Bitcoin is primarily used as a store of value within the decentralized finance (DeFi) ecosystem. Additionally, there are ongoing efforts to leverage blockchain and distributed ledger technology (DLT) to create new applications and enhance traditional financial market infrastructure, particularly in areas such as clearing and settlement.

Market Players Outlook

The major companies operating in the global crypto asset management market include Binance, Coinbase, Gemini Trust Co., LLC, Paxos Trust Company, LLC, Cipher Technologies Management LP, Ripple Labs Inc., and Bitgo Inc., among others. Market players are leveraging partnerships, collaborations, mergers and acquisition strategies for business expansion and innovative product development to maintain their market positioning.

Recent Developments

- In April 2025, PFMcrypto announced the expansion of its free crypto asset management platform, now recognized as the most trusted way to earn Bitcoin without any upfront investment. With over 9.2 million users across 192 countries, PFMcrypto is helping individuals tap into digital income streams through a safe, transparent, and 100% free model.

- In April 2025, CriptoAuge announced the launch of its cryptocurrency exchange platform, CriptoAuge. The platform aims to provide traders globally with a secure, efficient, and innovative platform for accessing the digital asset economy.

- In February 2024, VanEck announced the launch of SegMint GmbH, a digital assets management platform aimed at revolutionizing the digital assets landscape by improving accessibility and security.

The Report Covers

- Market value data analysis for 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global crypto asset management market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Crypto Asset Management Market Sales Analysis – Solution |Deployment Mode| Application | End-User ($ Million)

• Crypto Asset Management Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Crypto Asset Management Industry Trends

2.2.2. Market Recommendations

2.3. Porter's Five Forces Analysis for the Crypto Asset Management Market

2.3.1. Competitive Rivalry

2.3.2. Threat of New Entrants

2.3.3. Bargaining Power of Suppliers

2.3.4. Bargaining Power of Buyers

2.3.5. Threat of Substitutes

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For the Global Crypto Asset Management Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For the Global Crypto Asset Management Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Crypto Asset Management Market Revenue and Share by Manufacturers

• Crypto Asset Management Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Binance

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. Gemini Trust Co., LLC

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Paxos Trust Company, LLC

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Bitgo Inc.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Coinbase

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Cipher Technologies Management LP

4.2.6.1. Overview

4.2.6.2. Product Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.2.7. Ripple Labs Inc.

4.2.7.1. Overview

4.2.7.2. Product Portfolio

4.2.7.3. Financial Analysis (Subject to Data Availability)

4.2.7.4. SWOT Analysis

4.2.7.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Crypto Asset Management Market Sales Analysis by Solution ($ Million)

5.1. Custodian Solution

5.2. Wallet Management

6. Global Crypto Asset Management Market Sales Analysis by Deployment Mode ($ Million)

6.1. Cloud

6.2. On-Premise

7. Global Crypto Asset Management Market Sales Analysis by Application ($ Million)

7.1. Mobile

7.2. Web-based

8. Global Crypto Asset Management Market Sales Analysis by End-User ($ Million)

8.1. Individual

8.2. Enterprise

8.2.1. Financial Institutes

8.2.2. Retail & E-commerce

8.2.3. Healthcare

8.2.4. Travel and Hospitality

8.2.5. Others

9. Regional Analysis

9.1. North American Crypto Asset Management Market Sales Analysis – Solution |Deployment Mode| Application |End-User | Country ($ Million)

• Macroeconomic Factors for North America

9.1.1. United States

9.1.2. Canada

9.2. European Crypto Asset Management Market Sales Analysis – Solution |Deployment Mode| Application |End-User | Country ($ Million)

• Macroeconomic Factors for Europe

9.2.1. UK

9.2.2. Germany

9.2.3. Italy

9.2.4. Spain

9.2.5. France

9.2.6. Russia

9.2.7. Rest of Europe

9.3. Asia-Pacific Crypto Asset Management Market Sales Analysis – Solution |Deployment Mode| Application |End-User | Country ($ Million)

• Macroeconomic Factors for Asia-Pacific

9.3.1. China

9.3.2. Japan

9.3.3. South Korea

9.3.4. India

9.3.5. Australia & New Zealand

9.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Others)

9.3.7. Rest of Asia-Pacific

9.4. Rest of the World Crypto Asset Management Market Sales Analysis – Solution |Deployment Mode| Application |End-User | Country ($ Million)

• Macroeconomic Factors for the Rest of the World

9.4.1. Latin America

9.4.2. Middle East and Africa

10. Company Profiles

10.1. 3Commas Technologies OÜ

10.1.1. Quick Facts

10.1.2. Company Overview

10.1.3. Product Portfolio

10.1.4. Business Strategies

10.2. Anchor Labs, Inc.

10.2.1. Quick Facts

10.2.2. Company Overview

10.2.3. Product Portfolio

10.2.4. Business Strategies

10.3. Atomic Protocol Systems OÜ

10.3.1. Quick Facts

10.3.2. Company Overview

10.3.3. Product Portfolio

10.3.4. Business Strategies

10.4. Bakkt Marketplace, LLC

10.4.1. Quick Facts

10.4.2. Company Overview

10.4.3. Product Portfolio

10.4.4. Business Strategies

10.5. BitGo Inc.

10.5.1. Quick Facts

10.5.2. Company Overview

10.5.3. Product Portfolio

10.5.4. Business Strategies

10.6. Cipher Technologies Management LP

10.6.1. Quick Facts

10.6.2. Company Overview

10.6.3. Product Portfolio

10.6.4. Business Strategies

10.7. Coinbase, Inc.

10.7.1. Quick Facts

10.7.2. Company Overview

10.7.3. Product Portfolio

10.7.4. Business Strategies

10.8. Crypto Finance AG

10.8.1. Quick Facts

10.8.2. Company Overview

10.8.3. Product Portfolio

10.8.4. Business Strategies

10.9. Exodus Movement, Inc.

10.9.1. Quick Facts

10.9.2. Company Overview

10.9.3. Product Portfolio

10.9.4. Business Strategies

10.10. Fidelity Digital Assets

10.10.1. Quick Facts

10.10.2. Company Overview

10.10.3. Product Portfolio

10.10.4. Business Strategies

10.11. Grayscale Operating, LLC

10.11.1. Quick Facts

10.11.2. Company Overview

10.11.3. Product Portfolio

10.11.4. Business Strategies

10.12. Iconomi Ltd.

10.12.1. Quick Facts

10.12.2. Company Overview

10.12.3. Product Portfolio

10.12.4. Business Strategies

10.13. Koinly

10.13.1. Quick Facts

10.13.2. Company Overview

10.13.3. Product Portfolio

10.13.4. Business Strategies

10.14. Kubera Apps, Inc.

10.14.1. Quick Facts

10.14.2. Company Overview

10.14.3. Product Portfolio

10.14.4. Business Strategies

10.15. Mintfort

10.15.1. Quick Facts

10.15.2. Company Overview

10.15.3. Product Portfolio

10.15.4. Business Strategies

10.16. Nexo group of companies

10.16.1. Quick Facts

10.16.2. Company Overview

10.16.3. Product Portfolio

10.16.4. Business Strategies

10.17. Paxos Trust Company, LLC

10.17.1. Quick Facts

10.17.2. Company Overview

10.17.3. Product Portfolio

10.17.4. Business Strategies

10.18. Ripple Labs Inc.

10.18.1. Quick Facts

10.18.2. Company Overview

10.18.3. Product Portfolio

10.18.4. Business Strategies

10.19. SoftLedger, Inc.

10.19.1. Quick Facts

10.19.2. Company Overview

10.19.3. Product Portfolio

10.19.4. Business Strategies

10.20. Wireswarm

10.20.1. Quick Facts

10.20.2. Company Overview

10.20.3. Product Portfolio

10.20.4. Business Strategies

1. Global Crypto Asset Management Market By Solution, 2024–2035 ($ Million)

2. Global Crypto Custodian Solution Market By Region, 2024–2035 ($ Million)

3. Global Crypto Wallet Management Solution Market By Region, 2024–2035 ($ Million)

4. Global Crypto Asset Management Market By Deployment Mode, 2024–2035 ($ Million)

5. Global Cloud-Based Crypto Asset Management Market By Region, 2024–2035 ($ Million)

6. Global On-Premises Crypto Asset Management Market By Region, 2024–2035 ($ Million)

7. Global Crypto Asset Management Market By Application, 2024–2035 ($ Million)

8. Global Mobile Crypto Asset Management Solution Market By Region, 2024–2035 ($ Million)

9. Global Web-Based Crypto Asset Management Solution Market By Region, 2024–2035 ($ Million)

10. Global Crypto Asset Management Market By End-User, 2024–2035 ($ Million)

11. Global Crypto Asset Management For Individual Market By Region, 2024–2035 ($ Million)

12. Global Crypto Asset Management For Enterprise Market By Region, 2024–2035 ($ Million)

13. Global Crypto Asset Management For Travel and Hospitality Market By Region, 2024–2035 ($ Million)

14. Global Crypto Asset Management For Healthcare Market By Region, 2024–2035 ($ Million)

15. Global Crypto Asset Management For Retail & E-Commerce Market By Region, 2024–2035 ($ Million)

16. Global Crypto Asset Management For Financial Institutes Market By Region, 2024–2035 ($ Million)

17. Global Crypto Asset Management For Others Market By Region, 2024–2035 ($ Million)

18. Global Crypto Asset Management Market Research And Analysis By Region, 2024–2035 ($ Million)

19. North American Crypto Asset Management Market Research And Analysis By Country, 2024–2035 ($ Million)

20. North American Crypto Asset Management Market Research And Analysis By Solution, 2024–2035 ($ Million)

21. North American Crypto Asset Management Market Research And Analysis By Deployment Mode, 2024–2035 ($ Million)

22. North American Crypto Asset Management Market Research And Analysis By Application, 2024–2035 ($ Million)

23. North American Crypto Asset Management Market Research And Analysis By End-User, 2024–2035 ($ Million)

24. European Crypto Asset Management Market Research And Analysis By Country, 2024–2035 ($ Million)

25. European Crypto Asset Management Market Research And Analysis By Solution, 2024–2035 ($ Million)

26. European Crypto Asset Management Market Research And Analysis By Deployment Mode, 2024–2035 ($ Million)

27. European Crypto Asset Management Market Research And Analysis By Application, 2024–2035 ($ Million)

28. European Crypto Asset Management Market Research And Analysis By End-User, 2024–2035 ($ Million)

29. Asia-Pacific Crypto Asset Management Market Research And Analysis By Country, 2024–2035 ($ Million)

30. Asia-Pacific Crypto Asset Management Market Research And Analysis By Solution, 2024–2035 ($ Million)

31. Asia-Pacific Crypto Asset Management Market Research And Analysis By Deployment Mode, 2024–2035 ($ Million)

32. Asia-Pacific Crypto Asset Management Market Research And Analysis By Application, 2024–2035 ($ Million)

33. Asia-Pacific Crypto Asset Management Market Research And Analysis By End-User, 2024–2035 ($ Million)

34. Rest Of The World Crypto Asset Management Market Research And Analysis By Region, 2024–2035 ($ Million)

35. Rest Of The World Crypto Asset Management Market Research And Analysis By Solution, 2024–2035 ($ Million)

36. Rest Of The World Crypto Asset Management Market Research And Analysis By Deployment Mode, 2024–2035 ($ Million)

37. Rest Of The World Crypto Asset Management Market Research And Analysis By Application, 2024–2035 ($ Million)

38. Rest Of The World Crypto Asset Management Market Research And Analysis By End-User, 2024–2035 ($ Million)

1. Global Crypto Custodian Solution Market By Region, 2024 Vs 2035 (%)

2. Global Crypto Wallet Management Solution Market By Region, 2024 Vs 2035 (%)

3. Global Crypto Asset Management Market Share By Deployment Mode, 2024 Vs 2035 (%)

4. Global Cloud-Based Crypto Asset Management Market By Region, 2024 Vs 2035 (%)

5. Global On-Premise Crypto Asset Management Market By Region, 2024 Vs 2035 (%)

6. Global Crypto Asset Management Market Share By Application, 2024 Vs 2035 (%)

7. Global Mobile Crypto Asset Management Market By Region, 2024 Vs 2035 (%)

8. Global Web-Based Crypto Asset Management Market By Region, 2024 Vs 2035 (%)

9. Global Crypto Asset Management Market Share By End-User, 2024 Vs 2035 (%)

10. Global Crypto Asset Management For Individual Market By Region, 2024 Vs 2035 (%)

11. Global Crypto Asset Management For Enterprise Market By Region, 2024 Vs 2035 (%)

12. Global Crypto Asset Management For Healthcare Market By Region, 2024 Vs 2035 (%)

13. Global Crypto Asset Management For Travel and Hospitality Market By Region, 2024 Vs 2035 (%)

14. Global Crypto Asset Management For Retail & E-Commerce Market By Region, 2024 Vs 2035 (%)

15. Global Crypto Asset Management For Financial Institutes Market By Region, 2024 Vs 2035 (%)

16. Global Crypto Asset Management For Others Market By Region, 2024 Vs 2035 (%)

17. Global Crypto Asset Management Market Share By Region, 2024 Vs 2035 (%)

18. US Crypto Asset Management Market Size, 2024-2035 ($ Million)

19. Canada Crypto Asset Management Market Size, 2024-2035 ($ Million)

20. UK Crypto Asset Management Market Size, 2024-2035 ($ Million)

21. Germany Crypto Asset Management Market Size, 2024-2035 ($ Million)

22. Spain Crypto Asset Management Market Size, 2024-2035 ($ Million)

23. France Crypto Asset Management Market Size, 2024-2035 ($ Million)

24. Italy Crypto Asset Management Market Size, 2024-2035 ($ Million)

25. Rest Of Europe Crypto Asset Management Market Size, 2024-2035 ($ Million)

26. India Crypto Asset Management Market Size, 2024-2035 ($ Million)

27. China Crypto Asset Management Market Size, 2024-2035 ($ Million)

28. Australia & New Zealand Crypto Asset Management Market Size, 2024-2035 ($ Million)

29. ASEAN Countries Crypto Asset Management Market Size, 2024-2035 ($ Million)

30. Japan Crypto Asset Management Market Size, 2024-2035 ($ Million)

31. Rest Of Asia-Pacific Crypto Asset Management Market Size, 2024-2035 ($ Million)

32. Rest Of World Crypto Asset Management Market Size, 2024-2035 ($ Million)

FAQS

The size of the Crypto Asset Management market in 2024 is estimated to be around $719.8 million.

North America holds the largest share in the Crypto Asset Management market.

Leading players in the Crypto Asset Management market include Binance, Coinbase, Gemini Trust Co., LLC, Paxos Trust Company, LLC, Cipher Technologies Management LP, Ripple Labs Inc., and Bitgo Inc., among others.

Crypto Asset Management market is expected to grow at a CAGR of 22.3% from 2025 to 2035.

Rising institutional adoption, regulatory clarity, and demand for secure, diversified digital asset portfolios drive the growth of the Crypto Asset Management Market.