Cyber Security Insurance Market

Cyber Security Insurance Market Size, Share & Trends Analysis Report by Component (Services, Solution), by Coverage Type (First Party, Third Party), and by Verticals (BFSI, Government, Aerospace, Manufacturing, IT and Telecom, Healthcare, Others) Forecast Period (2023-2030)

Cyber security insurance market is anticipated to grow at a considerable CAGR of 19.2% during the forecast period. The growth of the market is attributed to factors such as increasing cyber threats and the need for protection against cyber attacks. For instance, on April 2022, the decentralized finance platform Beanstalk Farms lost $180 million in a cryptocurrency heist. The attackers took out a large enough loan to acquire enough voting rights to make the necessary governance changes to move all of Beanstalk’s reserves. Also, the rising adoption of digital technologies and the increasing use of cloud-based services are some of the factors anticipated to fuel the demand for cyber security insurance. The lack of a physical infrastructure required for cloud computing enables cyber attackers to access both organized and unstructured data from any location. Thus the growing frequent cyber attack on cloud computing has boosted the demand for cybersecurity insurance.

Segmental Outlook

The global cyber security insurance market is segmented based on its component, coverage type, and verticals. Based on its component, the market is segmented into services and solutions. Based on the coverage type, the market is categorized into first-party and third-party. Further, based on the Verticals, the market is segmented into BFSI, government, aerospace, manufacturing, IT and telecom, healthcare, and others. Among the coverage type segment, third-party coverage is anticipated to hold a prominent market share owing to the increased regulations and legal requirements.

Among the verticals segment, the BFSI industry is expected to be the largest market for cyber security insurance. The growth of the segment is attributed to increased awareness about the potential impact of cyber threats. Cybersecurity in the BFSI industry is important because of the nature and volumes of data that banks and financial institutions hold. The high cost of data breaches is another major factor why cybersecurity in the banking industry is critical. As per the Cost of a Data Breach Report (2021) released by IBM Security and the Ponemon Institute, the total cost of data breaches in the financial sector in 2021 was $ 5.72 million on average.

Regional Outlooks

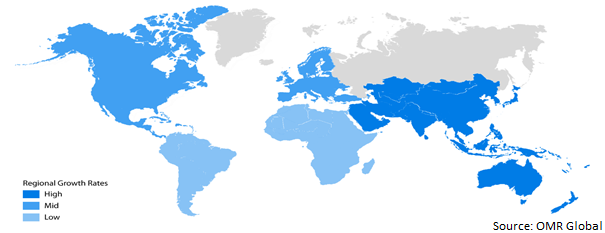

The global cyber security insurance market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American region is anticipated to hold a significant share of the global Cyber Security Insurance market. However, the Asia-Pacific region is projected to experience considerable growth in the cyber security insurance market owing to the increased implementation of regulations and guidelines related to data protection and privacy by various governments in the region.

Global Cyber Security Insurance Market Growth, by Region 2022-2028

The North American Region is Anticipated to Hold a Significant Share in the Global Cyber Security Insurance Market

Among these regions, the North American region is anticipated to account for a significant share of the cyber security insurance market during the forecast period. The growth of the cyber security insurance market in the region is primarily driven by factors such as increasing cyber-attacks and the rising adoption of digital technologies. For instance, in March 2021, the FBI released its report Internet Crime Report (2020). As per the report, the FBI's internet crime complaint center (IC3) received a record-breaking 791,790 Internet crime complaints in 2020. The internet reported cases involved Phishing, farming, vishing, and smishing scams. These scams involve fraudulent attempts to obtain personal and financial information through unsolicited emails, texts, and calls.

Market Players Outlook

The major companies serving the global cyber security insurance market include Allianz SE, American International Group, Inc., Aon plc, AXA S.A., and others. The market players are considerably contributing to the market growth by adopting various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in August 2022, Cowbell Cyber partnered with Swiss Re to offer custom cyber insurance coverage for businesses that use Amazon Web Service and have revenue of up to $750 million. The partnership is aimed to provide insurance coverage for cloud environments. It seeks to provide policyholders with comprehensive protection against cyber risks. Also, in July 2022, Fast-growing fintech, cyber insurance, and MDR (managed detection and response) provider Acrisure acquired and tucked two MSPs into its Cyber Services division. The acquisitions — involving Catalyst Technology Group and ITS Inc. — further converge the MSSP, MSP, MDR, and cyber insurance markets.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cyber security insurance market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cyber Security Insurance Market by Component

4.1.1. Services

4.1.2. Solution

4.2. Global Cyber Security Insurance Market by Coverage Type

4.2.1. First Party

4.2.2. Third Party

4.3. Global Cyber Security Insurance Market by Verticals

4.3.1. BFSI

4.3.2. Government

4.3.3. Aerospace

4.3.4. Manufacturing

4.3.5. IT and Telecom

4.3.6. Healthcare

4.3.7. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Allianz SE

6.2. American International Group, Inc.

6.3. Aon plc

6.4. AXA S.A.

6.5. AXIS Capital Holdings Ltd.

6.6. BCS Financial Corp.

6.7. Beazley Group plc

6.8. Berkshire Hathaway Inc.

6.9. Chubb Ltd.

6.10. Chubb Ltd.

6.11. CNA Financial Corp.

6.12. Lloyd's of London Ltd

6.13. Lockton Companies, Inc.

6.14. Munich Reinsurance Company

6.15. The Hanover Insurance Group, Inc.

6.16. Travelers Indemnity Company

6.17. Zurich Insurance Group Ltd.

1. GLOBAL CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

2. GLOBAL CYBER SECURITY INSURANCE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CYBER SECURITY INSURANCE SOLUTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE TYPE, 2021-2028 ($ MILLION)

5. GLOBAL FIRST PARTY CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL THIRD PARTY CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2021-2028 ($ MILLION)

8. GLOBAL CYBER SECURITY INSURANCE FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CYBER SECURITY INSURANCE FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CYBER SECURITY INSURANCE FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL CYBER SECURITY INSURANCE FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL CYBER SECURITY INSURANCE FOR IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL CYBER SECURITY INSURANCE FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL CYBER SECURITY INSURANCE FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

18. NORTH AMERICAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE TYPE, 2021-2028 ($ MILLION)

19. NORTH AMERICAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2021-2028 ($ MILLION)

20. EUROPEAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

22. EUROPEAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE TYPE, 2021-2028 ($ MILLION)

23. EUROPEAN CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE TYPE, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2021-2028 ($ MILLION)

28. REST OF THE WORLD CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

30. REST OF THE WORLD CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY COVERAGE TYPE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD CYBER SECURITY INSURANCE MARKET RESEARCH AND ANALYSIS BY VERTICALS, 2021-2028 ($ MILLION)

1. GLOBAL CYBER SECURITY INSURANCE MARKET SHARE BY COMPONENT, 2021 VS 2028 (%)

2. GLOBAL CYBER SECURITY INSURANCE SERVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL CYBER SECURITY INSURANCE SOLUTION MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL CYBER SECURITY INSURANCE MARKET SHARE BY COVERAGE TYPE, 2021 VS 2028 (%)

5. GLOBAL FIRST PARTY CYBER SECURITY INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL THIRD PARTY CYBER SECURITY INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL CYBER SECURITY INSURANCE MARKET SHARE BY VERTICALS, 2021 VS 2028 (%)

8. GLOBAL CYBER SECURITY INSURANCE FOR BFSI MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL CYBER SECURITY INSURANCE FOR GOVERNMENT MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL CYBER SECURITY INSURANCE FOR AEROSPACE MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL CYBER SECURITY INSURANCE FOR MANUFACTURING MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL CYBER SECURITY INSURANCE FOR IT AND TELECOM MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL CYBER SECURITY INSURANCE FOR HEALTHCARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL CYBER SECURITY INSURANCE FOR OTHERS MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL CYBER SECURITY INSURANCE MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. US CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

18. UK CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD CYBER SECURITY INSURANCE MARKET SIZE, 2021-2028 ($ MILLION)