Digital Dentistry Market

Digital Dentistry Market Size, Share & Trends Analysis Report by Type (Instruments, and Consumables), and by End-Users (Hospitals, Dental Clinics, and Dental Laboratories) Forecast Period (2023-2030)

Digital dentistry market is anticipated to grow at a significant CAGR of 8.5% during the forecast period. The increasing burden of oral diseases and oral cancer, globally, along with the rising integration of advanced technologies for its treatment is the major factor driving the growth of the digital dentistry market. For instance, according to the WHO update in March 2022, 3.5 billion people are estimated to have oral diseases across the globe. In addition, rising product launches in the digital dentistry industry are further expected to drive the market growth. For instance, in September 2023, Medit, a provider of 3D intraoral scanners and digital dentistry solutions Medit has presented a seamless dental CAD software that empowers dentists to efficiently design crowns & bridges, inlays, and temporaries has launched Medit ClinicCAD app. The innovative scan-to-design solution integrates with advanced 3D fabrication technologies like milling and 3D printing, marking a significant step towards a streamlined dental prosthetics solution. Medit ClinicCAD represents easy-to-use and intuitive dental CAD software powered by an AI engine, poised to revolutionize how dentists operate. However, the high cost of the digital dental procedures and lack of proper reimbursement policies are hampering the growth of the digital dentistry market.

Segmental Outlook

The global digital dentistry market is segmented based on type and end-users. Based on component, the market is segmented into instruments and consumables. Based on end-user, the market is segmented into hospitals, dental clinics, and dental laboratories.

Hospitals to Exhibit Significant CAGR in Global Digital dentistry Market

The hospital are projected to exhibit Fastest growth during the forecast period. The rising number of dental procedures to treat various dental cavities and the growing adoption of the new technologies in hospitals is a key factor contributing to the market growth. Furthermore, the rising company activities in developing digital workflows and solutions raise the adoption and installation of digital dentistry products in hospitals, which is further contributing to the segmental market growth. For instance, in February 2022, DENTSPLY SIRONA Inc launched a series of innovations, Medical-Grade 3D Printing Solution, which is designed to enhance digital workflows with benefits for dentists, dental labs, and patients globally, by collaborating with Google Cloud.

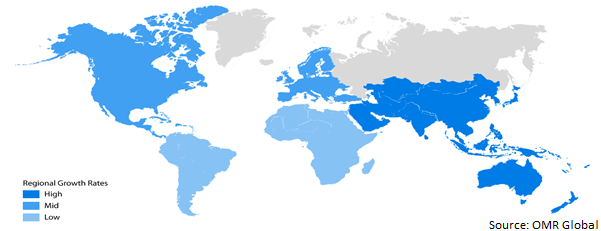

Regional Outlook

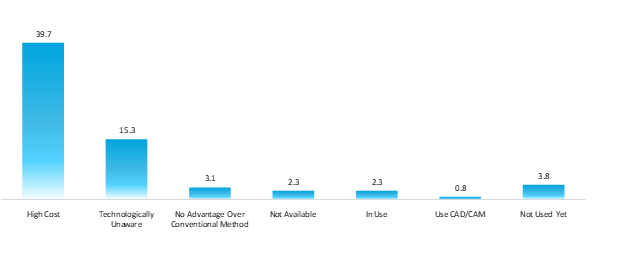

The global digital dentistry market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific region is anticipated to exhibit the highest CAGR during the forecast period. The growing digitalization of healthcare facilities across the region is a key promoter of the regional market growth. In June 2023, survey of Indian dental professionals regarding the use of computer-aided design/computer-aided manufacture (CAD/CAM) technology was conducted. The main reason for not using CAD/CAM was the high cost. The second reason for not using CAD/CAM was a lack of awareness of the technology and its advantages.

Reasons for not using CAD/CAM

Source: NCBI

Global Digital dentistry Market Growth by Region 2023-2030

Source: OMR Analysis

North America Held Considerable Share in the Global Digital dentistry Market

The regional market growth is attributed to integration and proliferation of digital dentistry across the region. Digital processes in dental practices have grown more popular over the past few years. 3D printing of ceramic crowns are efficiently been integrated with intra-oral scanning and computer aided design (CAD). The presence of key market players that are making significant developments in the field of digital dentistry is further contributing to the regional market growth. For instance, in November 2022, Align Technology, Inc. and Desktop Metal, Inc. a global provider of additive manufacturing technologies for mass production announced a strategic collaboration to supply iTero Element Flex intraoral scanners to Desktop Labs so it can connect general dentist locations with its growing network of premium full-service labs. This collaboration was done to accelerate adoption of digital dentistry across the US.

Market Players Outlook

The major companies serving the global digital dentistry market include PLANMECA OY, Ivoclar Vivadent, J. MORITA CORP., Midmark Corp., and Carestream Dental LLC among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2023, Freqty Technology, a Chinese high-tech enterprise in the field of digital dentistry has launched the latest and smallest PANDA intra-oral scanner, the PANDA Smart, at IDS 2023. PANDA Smart is the smallest and lightest intra-oral scanner in the PANDA series and only weighs 138 g. Using the most advanced technology, it provides a comfortable and efficient scanning experience and high accuracy.

Further, in May 2022 Glidewell entered into partnership with Medit to launch the fastscan.io Intraoral Scanner. fastscan.io is uniquely optimized for dentists to easily submit cases to Glidewell and save $20 or more per unit on restorations, or utilize its open system design to send cases to another lab of choice.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital dentistry market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Carestream Dental LLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Ivoclar Vivadent

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. J. MORITA CORP.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Midmark Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. PLANMECA OY

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Dentistry Market by Type

4.1.1. Instruments

4.1.2. Consumables

4.2. Global Digital Dentistry Markey by End-User

4.2.1. Hospitals

4.2.2. Dental Clinics

4.2.3. Dental Laboratories

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3D Totem

6.2. 3DISC

6.3. Amann Girrbach AG

6.4. Carestream Dental LLC

6.5. Datron AG

6.6. Envista Holdings Corp.

6.7. Hexagon AB

6.8. Institut Straumann AG

6.9. Kelkar Dynamics LLP

6.10. Launca Medical Device Technology Co., Ltd.

6.11. Mds Co.

6.12. Roland DGA Corp.

6.13. UP3DTech

6.14. ZimVie Inc.

6.15. Zirkonzahn

1. GLOBAL DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL DIGITAL DENTISTRY INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL DIGITAL DENTISTRY CONSUMABLES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

5. GLOBAL DIGITAL DENTISTRY IN HOSPITALS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

6. GLOBAL DIGITAL DENTISTRY IN DENTAL CLINICS MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL DIGITAL DENTISTRY IN DENTAL LABORATORIES MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. NORTH AMERICAN DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

11. NORTH AMERICAN DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

12. EUROPEAN DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. EUROPEAN DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

14. EUROPEAN DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

18. REST OF THE WORLD DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. REST OF THE WORLD DIGITAL DENTISTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

1. GLOBAL DIGITAL DENTISTRY MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL DIGITAL DENTISTRY INSTRUMENTS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL DIGITAL DENTISTRY CONSUMABLES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL DIGITAL DENTISTRY MARKET SHARE BY END-USER, 2022 VS 2030 ($ MILLION)

5. GLOBAL DIGITAL DENTISTRY IN HOSPITALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL DIGITAL DENTISTRY IN DENTAL CLINICS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL DIGITAL DENTISTRY IN DENTAL LABORATORIES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL DIGITAL DENTISTRY MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. US DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

10. CANADA DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

11. UK DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

12. FRANCE DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

13. GERMANY DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

14. ITALY DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

16. REST OF EUROPE DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

17. INDIA DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

18. CHINA DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

19. JAPAN DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

20. SOUTH KOREA DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD DIGITAL DENTISTRY MARKET SIZE, 2022-2030 ($ MILLION)