Digital Signal Processors (DSP) Market

Digital Signal Processors (DSP) Market Size, Share & Trends Analysis Report by Type (Fixed Point (DSP) and Floating Point (DSP)), by Core Type (Multi Core and Single Core), and by End-User (Consumer Electronics, Aerospace & Defense, Automotive, Telecommunications and Healthcare) Forecast Period (2024-2031)

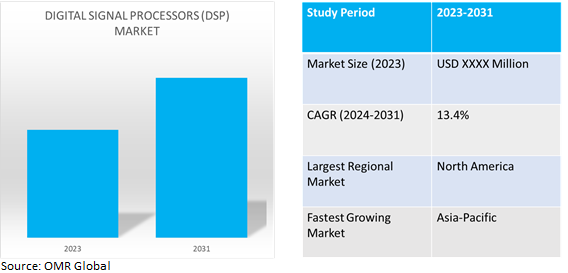

Digital signal processors (DSP) market is anticipated to grow at a significant CAGR of 13.4% during the forecast period (2024-2031). The growing adoption of DSP in electronic manufacturing and application in automotive industry is the key factor supporting the growth of the market globally. In the automotive sector, DSP chips contribute to advanced driver assistance systems (ADAS), enabling features like adaptive cruise control, lane departure warnings, and autonomous driving functionalities. In healthcare, DSP chips find applications in medical imaging equipment like MRI and CT scanners, where they help process and enhance diagnostic images. The market players are introducing DSPolutions that further bolster the market growth.

Market Dynamics

Integration of digital signal processing (DSP) control in power supplies & power systems

Increasing Integration of DSP control in power systems and power supply drives the growth of the market. From communications and control within the end equipment and/or by customizing the power supply during the end equipment development phase to ensure efficient integration & optimized performance characteristics, to flexible & efficient stand-alone applications, industry 4.0, Internet of Things (IoT).

Rising demand in consumer electronics

The increasing demand for DSPs in consumer electronics such as laptops, smartphones, embedded systems and other electronic devices drives the growth of the market. DSP has uses in consumer electronics to enhance audio and video experiences. It has various applications in the industry. These range from smartphones and tablets to home entertainment systems. Noise cancellation, image enhancement, and audio equalization are all applications of DSP algorithms.

Market Segmentation

Our in-depth analysis of the global DSP market includes the following segments by type, core type, and end-user.

- Based on type, the market is sub-segmented into fixed point (DSP) and floating point (DSP).

- Based on core type, the market is sub-segmentedinto multi core and single core.

- Based on end-user, the market is sub-segmented into consumer electronics, aerospace & defense, automotive, telecommunications and healthcare.

Multi Core is Projected to Grow During the Forecast Period

Based on the core type, the global DSP market is sub-segmented into multi core and single-core. Among these, the multi-coresub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the growing adoption of multi-channel or high-performance digital signal processing algorithms in high-end industrial applications such as medical imaging, aerospace, defence and advanced test and measurement markets. For instance, NXP Semiconductors N.V. offers MSC8256high-performance multi Six-core DSP programmable for medical imaging, aerospace, defense and advanced test and measurement.

Automotive Sub-segment to Hold a Considerable Market Share

By end-user, the automotive segment holds the majority market share during the forecast period. The segmental growth is attributed to the increasing demand for high-quality audio experiences in vehicles and the growing integration of advanced audio technologies in automobiles. As the automotive industry continues to evolve, the market for automotive audio DSP is increasing. For instance, in December 2023, Asahi Kasei Microdevices Corp. (AKM) introduced automotive audio DSPs featuring dual HiFi 4 CPUs and support for DSP Concepts' Audio Weaver. AKM has partnered with DSP Concepts, Inc. (DSP Concepts), in the field of embedded audio software, to bring support for the Audio Weaver platform to the AK701x family.

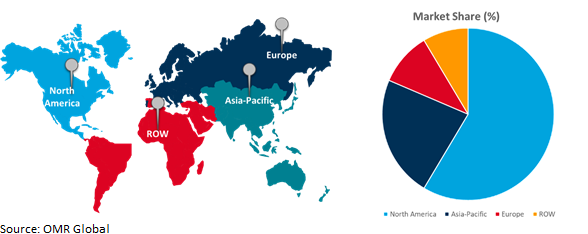

Regional Outlook

The global DSP market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific is the Fastest-Growing Region in the DSP Market

- The expansion of the automotive and consumer electronics sector in emerging economies in Asia Pacific, including India, China, Japan, and other nations, is driving market growth.

- Increasing uses of DSP chips in speech recognition systems, telecommunication, radar and audio signal processing.

Global DSP Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to presence of enormous number of providers offering DSP. Digital signal processing is the technological driver for energy-efficient and high-performance optical transport networks. Market players are introducing optical transport networking transmission equipment to design networks around streamlined, scalable architectures built on merchant routers, integrated optical modules and other technologies. For instance, in August 2023, Marvell Technology, Inc., in data infrastructure semiconductor solutions, announced Orion the industry’s first 800 Gbps coherent digital signal processor (DSP) for pluggable modules to change the economics and performance of the transport networks connecting carrier and cloud assets over extended geographic areas. The 5nm Marvell® OrionTM coherent DSP enables carriers and clouds to replace traditional transport equipment for better scalability and TCO.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global digital signal processors market include Analog Devices, Inc., MediaTek Inc., NXP Semiconductors N.V., Qualcomm Technologies, Inc., and Texas Instruments Inc. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024, Monolithic Power Systems, Inc. (MPS), a company in high-performance power solutions, announced the acquisition of AxignB.V., a Netherlands-based fabless semiconductor startup that specializes in programmable multicore DSP (DSP). Axign’s audio processors demonstrate near-zero distortion signals, with significantly reduced power consumption for automotive and consumer audio systems.

Recent Development

- In September 2023, Nippon Telegraph and Telephone Corp., introduced a digital coherent signal processing (coherent DSP) circuit and optical device that achieves the global largest capacity of 1.2 Tbit/s per wavelength for optical transmission. As a result, the capacity of the optical transmission system increased by 12 times and the power consumption per bit will be reduced to 10.0% of the widely-used commercial system (100 Gbit/s per channel).

- In March 2023, Credo and EFFECT Photonics collaborated on High-Performance, Ultralow Power Coherent DSP Solutions. The two companies work together to develop new coherent DSP products featuring EFFECT Photonics’ coherent DSP technology and Forward Error Correction (FEC), combined with Credo’s high-speed SerDes, I/Os, Analog Digital Converters (ADCs), and Digital to Analog Converters (DACs).

- In February 2022, Curtiss-Wright's Defense Solutions division, a supplier of modular open systems approach (MOSA) based solutions designed to succeed, introduced the CHAMP-XD3, its highest performance, security-enhanced, 3UOpenVPX digital signal processing (DSP) processing module. Based on the just-announced Intel® Xeon® D-1700 processor, the SOSA-aligned payload card represents a “quantum leap” for sensor data processing capability in size, weight, and power (SWaP) constrained applications.

- In January 2022, VSORA introduced a fully programmable architecture that tightly couples digital signal processing (DSP) cores with machine learning (ML) accelerators necessary to design L3 through L5 autonomous driving vehicles. The Tyr companion chip is an algorithm and host processor agnostic and can be integrated into new or existing environments without the need to redesign the entire system.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global DSP market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Analog Devices, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. MediaTek Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Texas Instruments Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Signal Processors Market by Type

4.1.1. Fixed Point (DSP)

4.1.2. Floating Point (DSP)

4.2. Global Digital Signal Processors Market by Core Type

4.2.1. Multi Core

4.2.2. Single Core

4.3. Global Digital Signal Processors Market by End-User

4.3.1. Consumer Electronics

4.3.2. Aerospace & Defense

4.3.3. Automotive

4.3.4. Telecommunications

4.3.5. Healthcare

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Advanced Micro Devices, Inc.

6.2. Ambarella International LP

6.3. Asahi Kasei Corp.

6.4. AtlasIED

6.5. Cadence Design Systems, Inc.

6.6. Ceva, Inc.

6.7. Cirrus Logic, Inc.

6.8. Creonic GmbH

6.9. Infineon Technologies AG

6.10. Intel Corp.

6.11. Lattice Semiconductor Corp.

6.12. Marvell Technology, Inc.

6.13. Microchip Technology Inc.

6.14. NXP Semiconductors N.V.

6.15. ON Semiconductor Corp.

6.16. Qualcomm Technologies, Inc.

6.17. Renesas Electronics Corp.

6.18. Silicon Laboratories Inc.

6.19. STMicroelectronics N.V.

1. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY TYPE,2023-2031 ($ MILLION)

2. GLOBAL FIXED POINT DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FLOATING POINT DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY CORE TYPE,2023-2031 ($ MILLION)

5. GLOBAL MULTI CORE DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL SINGLE CORE DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

8. GLOBAL DIGITAL SIGNAL PROCESSORS FOR CONSUMER ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DIGITAL SIGNAL PROCESSORS FOR AEROSPACE & DEFENSEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DIGITAL SIGNAL PROCESSORS FOR AUTOMOTIVEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIGITAL SIGNAL PROCESSORS FOR TELECOMMUNICATIONSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL DIGITAL SIGNAL PROCESSORS FOR HEALTHCAREMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY TYPE,2023-2031 ($ MILLION)

16. NORTH AMERICAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY CORE TYPE,2023-2031 ($ MILLION)

17. NORTH AMERICAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

18. EUROPEAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY CORE TYPE,2023-2031 ($ MILLION)

21. EUROPEAN DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

22. ASIA-PACIFIC DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. ASIA-PACIFICDIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY TYPE,2023-2031 ($ MILLION)

24. ASIA-PACIFICDIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY CORE TYPE,2023-2031 ($ MILLION)

25. ASIA-PACIFICDIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

26. REST OF THE WORLD DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY CORE TYPE,2023-2031 ($ MILLION)

29. REST OF THE WORLD DIGITAL SIGNAL PROCESSORS MARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

1. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET SHARE BY TYPE,2023 VS 2031 (%)

2. GLOBAL FIXED POINT DIGITAL SIGNAL PROCESSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FLOATING POINT DIGITAL SIGNAL PROCESSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET SHAREBY CORE TYPE,2023 VS 2031 (%)

5. GLOBAL MULTI CORE DIGITAL SIGNAL PROCESSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL SINGLE CORE DIGITAL SIGNAL PROCESSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET SHAREBY END-USER,2023 VS 2031 (%)

8. GLOBAL DIGITAL SIGNAL PROCESSORS FOR CONSUMER ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DIGITAL SIGNAL PROCESSORS FOR AEROSPACE & DEFENSEMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DIGITAL SIGNAL PROCESSORS FOR AUTOMOTIVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIGITAL SIGNAL PROCESSORS FOR TELECOMMUNICATIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL DIGITAL SIGNAL PROCESSORS FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DIGITAL SIGNAL PROCESSORS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

16. UK DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA DIGITAL SIGNAL PROCESSORS MARKET SIZE, 2023-2031 ($ MILLION)