Direct Reduced Iron (DRI) Market

Direct Reduced Iron (DRI) Market Size, Share & Trends Analysis Report by Form (Lumps, Pellets, and Fines), by Production Process (Coal-based and Gas-based), and Application (Steel Production, Construction, and Others), Forecast Period (2025-2035)

Industry Overview

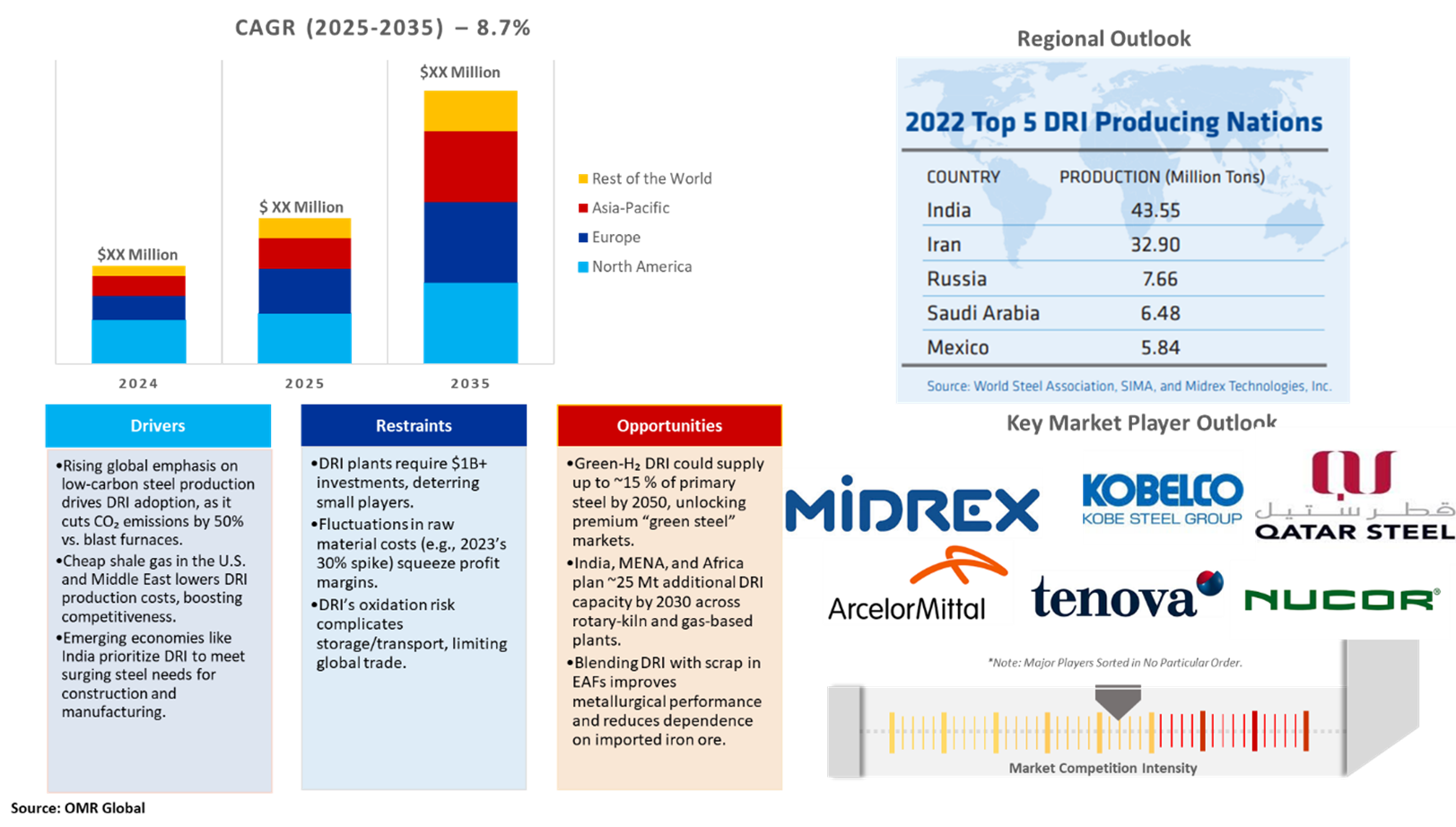

Direct Reduced Iron (DRI) market size was $72.3 billion in 2024, is projected to grow to $179.0 billion, growing at a CAGR of 8.7% during the forecast period (2025–2035). DRI is mainly used in the production of steel. The commissioning of new capacity, especially in Iran, the return to operation of many coal-based rotary kiln furnaces in India, and the further ramp-up of recently commissioned plants are some of the major factors driving the growth of the DRI market. However, with the invention of steel alternative bio-materials, the demand for DRI is expected to be impacted. Moreover, DRI technologies play an important role as sources of clean metallic charge material for electric steelmaking or as processes that can recycle iron-bearing waste products at integrated metallurgical plants. Thus, recycling metallic waste is an emerging application of DRI.

Annual global direct reduced iron production in 2023 was 135.7 million tons (Mt). DRI output was up by 8.3 Mt or 6.5% from the previous record of 127.4 Mt set in 2022. This increase was primarily due to the increase in DRI produced in India via rotary kilns (4.6Mt / 12.9%) and natural-gas-based shaft furnaces (3.7Mt / 4.1%). Once again, the combination of India and Iran produced well over half of the global DRI. In the last five years, worldwide DRI output has grown by almost 27.6 Mt or approximately 25.6%. During this period, DRI production in India (mainly coal-based DRI) increased by 46.2% in natural gas.

Market Dynamics

Rising Demand for Low-Carbon Steel Production

The increasing demand for Direct Reduced Iron in Low-Carbon Steel Production is driving the demand for DRI technologies. According to the International Energy Agency (IEA), in 2023, the steel industry accounts for 8% of global CO? emissions, and DRI technologies are the best solution for this, as DRI technologies can reduce carbon emissions up to 80-90 % as compared to the conventional method. Hydrogen direct reduction and electric arc furnace melting yield 42 kg of biogenic CO2 per tonne of directly reduced iron, whereas a traditional natural gas process yields 383 kg of fossil CO2 per tonne. These DRI technologies are being utilized by large steelmakers like ArcelorMittal and SSAB for reduced carbon emissions in steel production. For example, Sweden's HYBRIT project, backed by SSAB, LKAB, and Vattenfall, hopes to substitute coking coal with hydrogen in the manufacture of DRI.

Technological Advancements in DRI Production

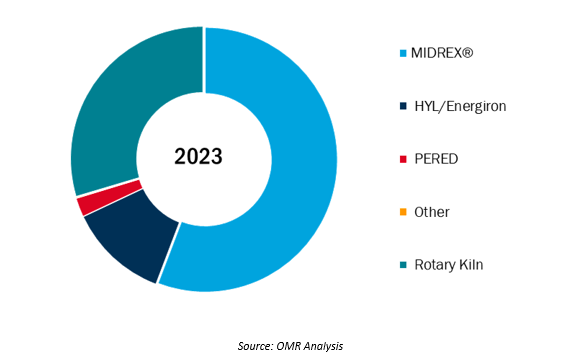

Simultaneously, technological innovation in DRI manufacturing has enhanced efficiency, reduced costs, and improved product quality. Advanced DRI plants have advanced automation, improved energy recovery systems, and improved process controls to maximize resource utilization. Technologies such as MIDREX and HYL/ENERGIRON processes have evolved further to achieve higher metallization ratios and higher operational flexibility. Additionally, hydrogen-based direct reduction studies are a potentially revolutionary development that can further reduce the carbon intensity of DRI production in the future.

Market Segmentation

- Based on the form, the market is segmented into lumps, pellets, and fines.

- Based on the production process, the market is segmented into coal-based and gas-based.

- Based on the application, the market is segmented into steel production, construction, and others.

The Gas-based Production Process is expected to grow fastest in the Global DRI Market

DRI gas-based production process dominates with a 65% market share. DRI is mainly produced through the conventional coal-based process, as it is most popularly known and economically. However, the production of DRI from Hydrogen direct reduction and electric arc furnaces is rapidly getting popularized and is expected to grow fastest during the forecast period, as it is an environmentally friendly and low residual metallic that can reduce carbon emission by 80-90% is needed to produce premium steel products.

Based on form, DRI lumps hold the major share of the market.

DRI lumps hold the major share in the market owing to their wide application in the construction and automotive industries. DRI lumps are irregular-shaped bulk materials of directly reduced iron that usually have diameters between 6-25 mm. They are especially preferred due to easier handling and transportation over finer products. Lumps are widely employed in traditional steelmaking operations, where their size and density profile make them particularly useful for blast furnaces and EAF operations. The lumps segment caters to industries that need constant metallurgical properties without the necessity for further pelletizing.

World DRI Production by Process, 2023

Regional Outlook

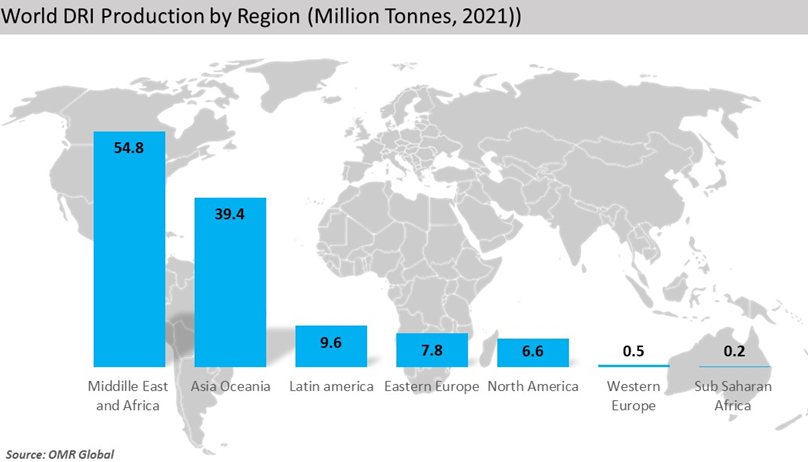

The global direct reduced iron is further divided by region, including North America (the US and Canada), Europe (the UK, Germany, France, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, Australia and New Zealand, ASEAN Countries, and the Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The Asia-Pacific and Middle Eastern Region Holds the Major Share in the Global DRI Market

The Asia-Pacific and the Middle East are the major DRI-producing regions, in which India and Iran alone account for more than half of the total DRI produced globally. Around 25.7 million tons of DRI produced in Iran is produced from natural gas, making it the highest DRI-producing nation through natural gas. Russia is the third-largest producer of DRI having produced 7.9 million tons of DRI in 2018, followed by Saudi Arabia and Mexico, which had produced 6.0 and 5.9 million tons of DRI in 2018. This report will further provide a complete analysis of DRI produced by all the major economies globally.

Market Players Outlook

The major companies operating in the global direct reduced iron market include ArcelorMittal S.A., Kobe Steel, Ltd., Midrex Technologies, Inc., Tenova S.p.A., Nucor Corporation, and Qatar Steel Company FZE, among others. Market players are leveraging partnerships, collaborations, mergers, and acquisition strategies for business expansion and innovative product development to maintain their market positioning.?

Recent Developments

- In July 2024, Midrex Technologies, Inc. and Primetals were selected to supply a hydrogen direct reduced iron (DRI) plant for Blastr Green Steel. This partnership marks a milestone in the journey towards sustainable steel production and decarbonizing the steel value chain.

- In March 2023, Midrex Technologies, Inc. and Paul Wurth partnered to engineer, supply, and construct a 2.5Mt/yr MIDREX Flex direct reduction plant for ThyssenKrupp Steel Europe AG at its Duisburg, Germany, site. According to Midrex, its technology provides the flexibility to operate on different ratios of natural gas (NG) and hydrogen (H2), up to 100% H2, enabling significant CO2 savings.

- In March 2023, ArcelorMittal completed the acquisition of Companhia Siderúrgica do Pecem (‘CSP’) in Brazil for an enterprise value of approximately $2.2 billion. The acquisition offers significant operational and financial synergies and brings with it the potential for further expansions, such as the option to add primary steelmaking capacity (including direct reduced iron) and rolling and finishing capacity.

The Report Covers

- Market value data analysis of 2024 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global direct reduced iron market. Based on the availability of data, information related to new products and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Direct Reduced Iron Market Sales Analysis – Type | Production Process | Application ($ Million)

• Direct Reduced Iron Market Sales Performance of Top Countries

1.1. Research Methodology

• Primary Research Approach

• Secondary Research Approach

1.2. Market Snapshot

2. Market Overview and Insights

2.1. Scope of the Study

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Direct Reduced Iron Trends

2.2.2. Market Recommendations

3. Market Determinants

3.1. Market Drivers

3.1.1. Drivers For Global Direct Reduced Iron Market: Impact Analysis

3.2. Market Pain Points and Challenges

3.2.1. Restraints For Global Direct Reduced Iron Market: Impact Analysis

3.3. Market Opportunities

4. Competitive Landscape

4.1. Competitive Dashboard – Direct Reduced Iron Market Revenue and Share by Manufacturers

• Direct Reduced Iron Product Comparison Analysis

• Top Market Player Ranking Matrix

4.2. Key Company Analysis

4.2.1. Midrex Technologies, Inc.

4.2.1.1. Overview

4.2.1.2. Product Portfolio

4.2.1.3. Financial Analysis (Subject to Data Availability)

4.2.1.4. SWOT Analysis

4.2.1.5. Business Strategy

4.2.2. ArcelorMittal S.A.

4.2.2.1. Overview

4.2.2.2. Product Portfolio

4.2.2.3. Financial Analysis (Subject to Data Availability)

4.2.2.4. SWOT Analysis

4.2.2.5. Business Strategy

4.2.3. Tenova S.p.A.

4.2.3.1. Overview

4.2.3.2. Product Portfolio

4.2.3.3. Financial Analysis (Subject to Data Availability)

4.2.3.4. SWOT Analysis

4.2.3.5. Business Strategy

4.2.4. Kobe Steel, Ltd.

4.2.4.1. Overview

4.2.4.2. Product Portfolio

4.2.4.3. Financial Analysis (Subject to Data Availability)

4.2.4.4. SWOT Analysis

4.2.4.5. Business Strategy

4.2.5. Nucor Corporation

4.2.5.1. Overview

4.2.5.2. Product Portfolio

4.2.5.3. Financial Analysis (Subject to Data Availability)

4.2.5.4. SWOT Analysis

4.2.5.5. Business Strategy

4.2.6. Qatar Steel Company FZE

4.2.6.1. Overview

4.2.6.2. Product Portfolio

4.2.6.3. Financial Analysis (Subject to Data Availability)

4.2.6.4. SWOT Analysis

4.2.6.5. Business Strategy

4.3. Top Winning Strategies by Market Players

4.3.1. Merger and Acquisition

4.3.2. Product Launch

4.3.3. Partnership And Collaboration

5. Global Direct Reduced Iron Market Sales Analysis By Type ($ Million)

5.1. Lumps

5.2. Pellets

5.3. Fines

6. Global Direct Reduced Iron Market Sales Analysis By Production Process ($ Million)

6.1. Coal-based

6.2. Gas-based

7. Global Direct Reduced Iron Market Sales Analysis By Application ($ Million)

7.1. Steel Production

7.2. Construction

7.3. Others (including the Automotive Industry)

8. Regional Analysis

8.1. North American Direct Reduced Iron Market Sales Analysis – Type | Production Process | Application ($ Million)

• Macroeconomic Factors for North America

8.1.1. United States

8.1.2. Canada

8.2. European Direct Reduced Iron Market Sales Analysis – Type | Production Process | Application ($ Million)

• Macroeconomic Factors for Europe

8.2.1. UK

8.2.2. Germany

8.2.3. Italy

8.2.4. Spain

8.2.5. France

8.2.6. Russia

8.2.7. Rest of Europe

8.3. Asia-Pacific Direct Reduced Iron Market Sales Analysis – Type | Production Process | Application ($ Million)

• Macroeconomic Factors for Asia-Pacific

8.3.1. China

8.3.2. Japan

8.3.3. South Korea

8.3.4. India

8.3.5. Australia & New Zealand

8.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

8.3.7. Rest of Asia-Pacific

8.4. Rest of the World Direct Reduced Iron Market Sales Analysis – Type | Production Process | Application ($ Million)

• Macroeconomic Factors for the Rest of the World

8.4.1. Latin America

8.4.2. Middle East and Africa

9. Company Profiles

9.1. ArcelorMittal S.A.

9.1.1. Quick Facts

9.1.2. Company Overview

9.1.3. Product Portfolio

9.1.4. Business Strategies

9.2. Ezz Steel.

9.2.1. Quick Facts

9.2.2. Company Overview

9.2.3. Product Portfolio

9.2.4. Business Strategies

9.3. Gallantt Group of Industries

9.3.1. Quick Facts

9.3.2. Company Overview

9.3.3. Product Portfolio

9.3.4. Business Strategies

9.4. Jindal Steel & Power Limited

9.4.1. Quick Facts

9.4.2. Company Overview

9.4.3. Product Portfolio

9.4.4. Business Strategies

9.5. JSW Steel

9.5.1. Quick Facts

9.5.2. Company Overview

9.5.3. Product Portfolio

9.5.4. Business Strategies

9.6. JFE Steel Corporation.

9.6.1. Quick Facts

9.6.2. Company Overview

9.6.3. Product Portfolio

9.6.4. Business Strategies

9.7. Kobe Steel, Ltd.

9.7.1. Quick Facts

9.7.2. Company Overview

9.7.3. Product Portfolio

9.7.4. Business Strategies

9.8. LIBERTY Steel Group

9.8.1. Quick Facts

9.8.2. Company Overview

9.8.3. Product Portfolio

9.8.4. Business Strategies

9.9. Libyan Iron and Steel Company

9.9.1. Quick Facts

9.9.2. Company Overview

9.9.3. Product Portfolio

9.9.4. Business Strategies

9.10. METINVEST

9.10.1. Quick Facts

9.10.2. Company Overview

9.10.3. Product Portfolio

9.10.4. Business Strategies

9.11. Midrex Technologies, Inc.

9.11.1. Quick Facts

9.11.2. Company Overview

9.11.3. Product Portfolio

9.11.4. Business Strategies

9.12. Nucor Corporation

9.12.1. Quick Facts

9.12.2. Company Overview

9.12.3. Product Portfolio

9.12.4. Business Strategies

9.13. Qatar Steel Company FZE

9.13.1. Quick Facts

9.13.2. Company Overview

9.13.3. Product Portfolio

9.14. Tata Steel

9.14.1. Quick Facts

9.14.2. Company Overview

9.14.3. Product Portfolio

9.14.4. Business Strategies

9.15. Tenova S.p.A.

9.15.1. Quick Facts

9.15.2. Company Overview

9.15.3. Product Portfolio

9.15.4. Business Strategies

9.16. Tosyal? Algerie

9.16.1. Quick Facts

9.16.2. Company Overview

9.16.3. Product Portfolio

9.16.4. Business Strategies

9.17. Welspun steel Limited

9.17.1. Quick Facts

9.17.2. Company Overview

9.17.3. Product Portfolio

9.17.4. Business Strategies

1. Global DRI Market Research And Analysis By Form, 2024-2035 ($ Million)

2. Global DRI Lumps Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global DRI Pellets Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global DRI Fines Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global DRI Market Research And Analysis By Production Process, 2024-2035 ($ Million)

6. Global Coal-Based DRI Production Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Gas-Based DRI Production Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global DRI Market Research And Analysis By Application, 2024-2035 ($ Million)

9. Global DRI For Steel Production Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global DRI For Construction Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Others DRI Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global DRI Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American DRI Market Research and Analysis by Country, 2024-2035 ($ Million)

14. North American DRI Market Research and Analysis by Form, 2024-2035 ($ Million)

15. North American DRI Market Research and Analysis by Production Process, 2024-2035 ($ Million)

16. North American DRI Market Research And Analysis By Application, 2024-2035 ($ Million)

17. European DRI Market Research and Analysis By Country, 2024-2035 ($ Million)

18. European DRI Market Research and Analysis By Form, 2024-2035 ($ Million)

19. European DRI Market Research and Analysis By Production Process, 2024-2035 ($ Million)

20. European DRI Market Research and Analysis By Application, 2024-2035 ($ Million)

21. Asia-Pacific DRI Market Research and Analysis By Country, 2024-2035 ($ Million)

22. Asia-Pacific DRI Market Research and Analysis By Form, 2024-2035 ($ Million)

23. Asia-Pacific DRI Market Research and Analysis By Production Process, 2024-2035 ($ Million)

24. Asia-Pacific DRI Market Research and Analysis By Application, 2024-2035 ($ Million)

25. Rest of the World DRI Market Research and Analysis by Country, 2024-2035 ($ Million)

26. Rest of the World DRI Market Research and Analysis By Region, 2024-2035 ($ Million)

27. Rest Of The World DRI Market Research And Analysis By Form, 2024-2035 ($ Million)

28. Rest Of The World DRI Market Research And Analysis By Production Process, 2024-2035 ($ Million)

29. Rest Of The World DRI Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global DRI Market Share by Form, 2024 Vs 2035 (%)

2. Global Lumps DRI Market Share by Region, 2024 Vs 2035 (%)

3. Global Pellets DRI Market Share by Region, 2024 Vs 2035 (%)

4. Global Fines DRI Market Share by Region, 2024 Vs 2035 (%)

5. Global DRI Market Share By Production Process, 2024 Vs 2035 (%)

6. Global Coal-Based DRI Production Market Share by Region, 2024 Vs 2035 (%)

7. Global Gas-Based DRI Production Market Share by Region, 2024 Vs 2035 (%)

8. Global DRI Market Share By Application, 2024 Vs 2035 (%)

9. Global DRI for Steel Production Market Share by Region, 2024 Vs 2035 (%)

10. Global DRI for Construction Market Share By Region, 2024 Vs 2035 (%)

11. Global Others DRI Market Share By Region, 2024 Vs 2035 (%)

12. Global DRI Market Share by Region, 2024 Vs 2035 (%)

13. US DRI Market Size, 2024-2035 ($ Million)

14. Canada DRI Market Size, 2024-2035 ($ Million)

15. UK DRI Market Size, 2024-2035 ($ Million)

16. France DRI Market Size, 2024-2035 ($ Million)

17. Germany DRI Market Size, 2024-2035 ($ Million)

18. Italy DRI Market Size, 2024-2035 ($ Million)

19. Spain DRI Market Size, 2024-2035 ($ Million)

20. Rest of Europe DRI Market Size, 2024-2035 ($ Million)

21. India DRI Market Size, 2024-2035 ($ Million)

22. China DRI Market Size, 2024-2035 ($ Million)

23. Japan DRI Market Size, 2024-2035 ($ Million)

24. South Korea DRI Market Size, 2024-2035 ($ Million)

25. Australia and New Zealand Direct Reduced Iron Market Size, 2024-2035 ($ Million)

26. ASEAN Economies Direct Reduced Iron Market Size, 2024-2035 ($ Million)

27. Rest of Asia-Pacific DRI Market Size, 2024-2035 ($ Million)

28. Middle East & Africa DRI Market Size, 2024-2035 ($ Million)

29. Latin America DRI Market Size, 2024-2035 ($ Million)

FAQS

The size of the Direct Reduced Iron (DRI) market in 2024 is estimated to be around $72.3 billion.

Asia-Pacific holds the largest share in the Direct Reduced Iron (DRI) market.

Leading players in the Direct Reduced Iron (DRI) market include ArcelorMittal S.A., Kobe Steel, Ltd., Midrex Technologies, Inc., Tenova S.p.A., Nucor Corporation, and Qatar Steel Company FZE, among others.

Direct Reduced Iron (DRI) market is expected to grow at a CAGR of 8.7% from 2025 to 2035.

The growth of the Direct Reduced Iron (DRI) market is driven by increasing demand for low-emission steelmaking and the shift toward hydrogen-based reduction technologies.