Drill Bit Market

Drill Bit Market Size, Share & Trends Analysis Report by Type (Roller Cone Bit and Fixed Cutter Bit), and by Location of Deployment (Onshore and Offshore) Forecast Period (2024-2031)

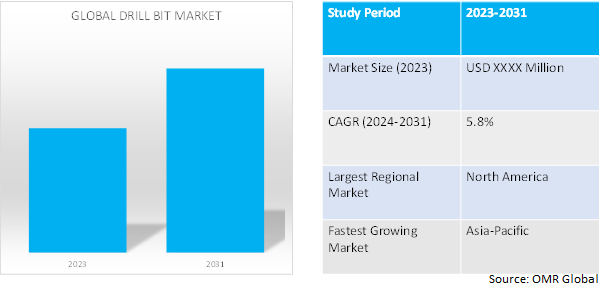

Drill bit market is anticipated to grow at a CAGR of 5.8% during the forecast period (2024-2031). Increasing mining operations, expanding infrastructure construction, and increasing demand for oil, and gas in growing nations as a result of industrialization, urbanization, and population growth. The oil and gas sector makes extensive use of drill bits made of various materials, including carbide, tungsten, and diamond.

Market Dynamics

Increasing Mining Operations

As the mining industry advances, the number of drilling methods increases. Whether it is for exploration, production, land-clearing or geotechnical purposes. Mining drill bits are in high demand for oil and gas drilling, well exploration, and water extraction for drinking and industrial purposes. Mining drill bits are now widely used in pipeline construction and drilling pits for blasting. Mining is significant to the US economy since the US is one of largest consumers of mineral products and one of the largest producers of it globally. In fact, the US largest single consumer of many mineral commodities across the globe. According to the US Geological Survey, US mines produced approximately $82.3 billion in minerals in 2020. US metal mine production in 2020 was estimated to be $27.7 billion which was 3.0% higher than that in 2019.

Expanding Infrastructure Construction

Drill bit market is expected to gain market growth in the forecast period owing to increase in expanding infrastructure construction. Drill bits are crucial tools in infrastructure construction project involving building, renovating, repairing and others. Governments have been investing in projects across the globe to generate economic growth momentum. Nation such as US and China has been developing there infrastructure at fast pace. China is the largest construction market across the globe. Overall investment in new infrastructure during the 14th Five-Year Plan period (2021-2025) will reach around $ 4.2 trillion.

Market Segmentation

Our in-depth analysis of the global drill bit market includes the following segments by type, and location of deployment.

- Based on type, the market is sub-segmented into roller cone bit and fixed cutter bit.

- Based on the location of deployment, the market is bifurcated into onshore and offshore.

Onshore is Projected to Emerge as the Largest Segment

Based on the location of deployment, the drill bit market is sub-segmented onshore and offshore. Among these, the onshore sub-segment is expected to hold the largest share of the market. Onshore oil fields have a higher production capacity than offshore oil fields and also have a shorter drilling time, With onshore drilling, rigs and equipment are easier to maintain. Additionally, companies have the option to switch wells on or off in response to market needs. Compared to offshore projects, the installation procedure is far simpler since firms mobilize their drilling resources.

Fixed Cutter Sub-segment to Hold a Considerable Market Share

The fixed cutter bits category dominated the market in the forecast period (2024-2031) due to its high frequency & speed of rotations, which makes it a more effective drilling technique than roller cone bits. When properly selected for the formation to be drilled, a fixed cutter bit usually has a longer life than a rollercone bit. Over the years companies promoting fixed cutter bits through various platforms made it more significant and popular. For instance, in July 2022, Halliburton Company introduced the new Hedron platform of fixed cutter polycrystalline diamond compact (PDC) drill bits. The bits were designed using the company’s Design at the Customer Interface (DatCISM) process, along with proprietary iBitS modeling and simulation software

Regional Outlook

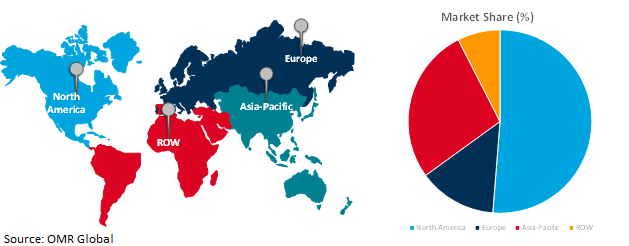

The global drill bit market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Expand at the Quickest Rate

Asia-Pacific area to expand at the quickest rate owing to the rising deep ocean exploration, expanding infrastructure construction, and the presence of crude oil fields in China, Indonesia, Philippines, Australia, Brunei, and the Gulf of Thailand. In 2022, CNOOC Ltd. China's producer of offshore crude oil and natural gas announced the plans to drill 227 offshore exploration wells, and 132 onshore unconventional exploration wells, and acquire approximately 17 thousand square kilometers of 3-Dimensional (3D) seismic data.

Global Drill Bit Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the rich mineral resources, increasing mining operations, and increased utilization of high-speed steel (HSS), cobalt, carbide, and diamond-coated drill bits. The US and Canada are both major mining nations, having vast mineral reserves including gold, copper, iron ore, and coal. This has resulted in a strong need for mining equipment, such as drill bits, to extract the minerals. The mining industry has contributed greatly to Canada’s economy. It directly employs over 377,000 workers in the country in mineral extraction, smelting, fabrication, and manufacturing. In 2020, the minerals sector directly and indirectly contributed $107.0 billion, or roughly 5.0%, to Canada’s total nominal GDP. Mineral development expenditures have been increasing in Canada year by year, for instance, in August 2021, BHP the largest mining company across the globe approved $5.7 billion in capital expenditure for the Jansen Stage 1 potash project in the province of Saskatchewan, Canada. This decision qualifies as the second-largest single mining investment in Canadian history and projects the first production of potash in 2027. Jansen S1 is expected to produce approximately 4.35 million tonnes of potash per annum.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global drill bit market include Baker Hughes, Caterpillar, Halliburton Energy Services, Inc., Schlumberger Ltd., Atlas Copco AB, Boart Longyea, and Xiamen Prodrill Equipment Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, Toolant announced its new range of four spiral step drills, which can increase drilling efficiency by four times when compared to standard straight flute step drills. Step drill bits make drilling holes of varied diameters easier and faster, with four cutting edges that enable a faster, smoother cut. Everything from M35 Cobalt with TiAlN coating to M2 High-Speed Steel to High-Speed Steel with Titanium coating is available to the public.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global drill bit market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Caterpillar

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Halliburton Energy Services, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Schlumberger Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Drill Bit Market by Type

4.1.1. Roller Cone Bit

4.1.2. Fixed Cutter Bit

4.2. Global Drill Bit Market by Location of Deployment

4.2.1. Onshore

4.2.2. Offshore

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Atlas Copco AB

6.2. Bit Brokers International Inc.

6.3. Boart Longyea

6.4. Brunner & Lay

6.5. Changsha Heijingang Industrial Co.,Ltd.

6.6. DATC Group

6.7. Drill King

6.8. Epiroc AB

6.9. Halliburton Energy Services, Inc.

6.10. Robit Plc

6.11. Rockmore International

6.12. Sandvik’s

6.13. Ulterra

6.14. Western Drilling Tools Inc.

6.15. Xiamen Prodrill Equipment Co., Ltd.

1. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL ROLLER CONE DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FIXED CUTTER DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY LOCATION OF DEPLOYMENT, 2023-2031 ($ MILLION)

5. GLOBAL DRILL BIT FOR ONSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DRILL BIT FOR OFFSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. NORTH AMERICAN DRILL BIT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

9. NORTH AMERICAN DRILL BIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

10. NORTH AMERICAN DRILL BIT MARKET RESEARCH AND ANALYSIS BY LOCATION OF DEPLOYMENT, 2023-2031 ($ MILLION)

11. EUROPEAN DRILL BIT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. EUROPEAN DRILL BIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

13. EUROPEAN DRILL BIT MARKET RESEARCH AND ANALYSIS BY LOCATION OF DEPLOYMENT, 2023-2031 ($ MILLION)

14. ASIA- PACIFIC DRILL BIT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. ASIA-PACIFIC DRILL BIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC DRILL BIT MARKET RESEARCH AND ANALYSIS BY LOCATION OF DEPLOYMENT, 2023-2031 ($ MILLION)

17. REST OF THE WORLD DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. REST OF THE WORLD DRILL BIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

19. REST OF THE WORLD DRILL BIT MARKET RESEARCH AND ANALYSIS BY LOCATION OF DEPLOYMENT, 2023-2031 ($ MILLION)

1. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY TYPE, 2023 VS 2031 (%)

2. GLOBAL ROLLER CONE DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2031 VS 2031 (%)

3. GLOBAL FIXED CUTTER DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

4. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY LOCATION OF DEPLOYMENT, 2023 VS 2031 (%)

5. GLOBAL DRILL BIT FOR ONSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

6. GLOBAL DRILL BIT FOR OFFSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

7. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

8. GLOBAL DRILL BIT MARKET RESEARCH AND ANALYSIS BY REGION, 2023 VS 2031 (%)

9. US DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

11. UK DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

22. LATIN AMERICA DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)

23. THE MIDDLE EAST AND AFRICA DRILL BIT MARKET SIZE, 2023-2031 ($ MILLION)